Spain Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0546

- 125

-

Spain Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

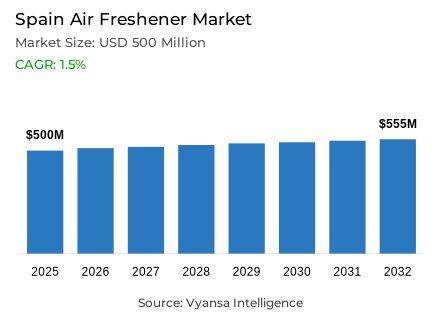

- Air Freshener Market in Spain is estimated at $ 500 Million.

- The market size is expected to grow to $ 555 Million by 2032.

- Market to register a CAGR of around 1.5% during 2026-32.

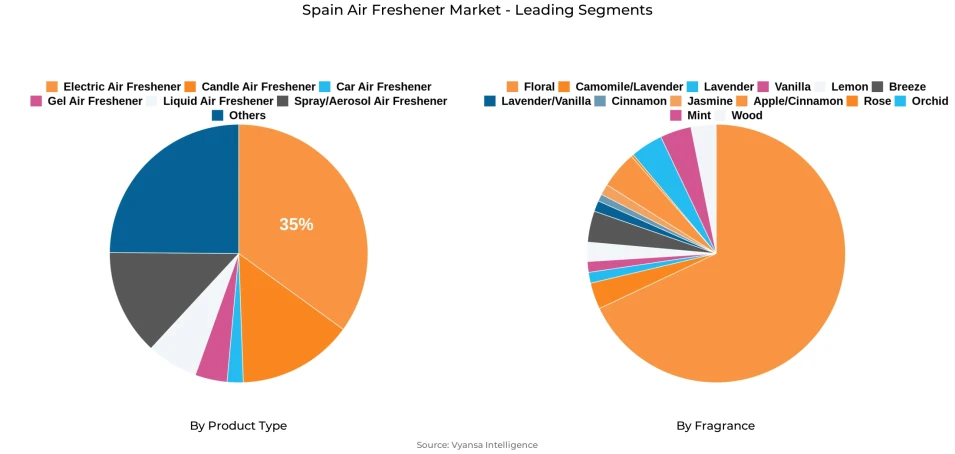

- Product Type Shares

- Electric Air Freshener grabbed market share of 35%.

- Competition

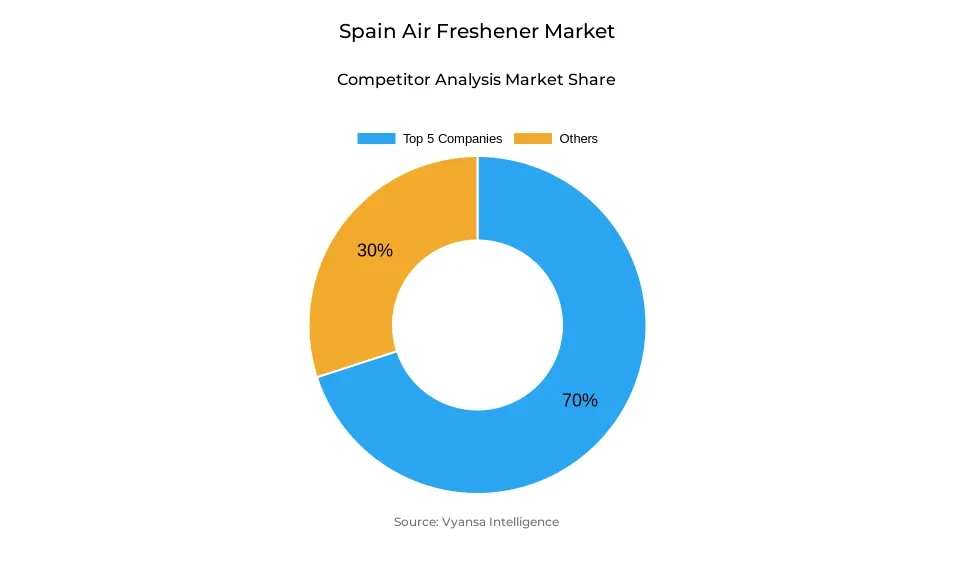

- More than 10 companies are actively engaged in producing Air Freshener Market in Spain.

- Top 5 companies acquired around 70% of the market share.

- Hugworld International, Henkel Ibérica SA, Ceras Rouras SA, Mercadona SA, Reckitt Benckiser España SL etc., are few of the top companies.

- Fragrance

- Floral continues to dominate the market.

Spain Air Freshener Market Outlook

The Spain air freshener market is pegged at $500 million in 2025 and is expected to touch $555 million by 2032. Over a dozen companies are actively manufacturing air fresheners, with the market share of the top five players at about 70%. Spray and aerosol air fresheners continue as the biggest sector, fueled by cost-effectiveness and extensive distribution, while candle and electric air fresheners are becoming the most rapidly growing sectors. Candle air fresheners, specifically, have advantages due to their double benefit as decorative products and wellness promoters, attracting end users looking for products that improve atmosphere and provide a calming home setting.

Floral scents are still reigning supreme in the market, boosted by end users' demand for natural and aromatherapy-based fragrances. Essential oils and plant-sourced aromas, for example, lavender, vanilla, and citronella, are gaining ground with their association with wellness, mental health, and eco-living. Design, scent, and packaging premiumisation are likely to fuel growth further, as candle holders, reed diffusers, and refillable formats become popular among green end users.

Private labels are still very dominant, and especially in the spray/aerosol category where they hold more than 60% of market share. Their aggressive pricing, extensive distribution, and prominent presence on e-commerce websites will make their dominance even stronger. Electric air fresheners will also gain due to private label growth with cost-saving and refillable products that attract price-sensitive end users.

E-commerce is expected to account for an expanding portion of the air fresheners market, particularly for premium and lifestyle-oriented products such as candles and liquid air sprays. With end users increasingly linking air fresheners to wellness and home design, demand for novel formats, soothing fragrances, and environmentally friendly packaging will grow, continuing to drive steady market growth during the forecast period.

Spain Air Freshener Market Growth Driver

Greater Emphasis on Sustainability

Growing emphasis on sustainability in packaging and product design is increasingly shaping developments in the air freshener category. End users are becoming more environmentally conscious about the household products and their impact on the environment, prompting manufacturers to embrace green materials and refill packaging. Brands are embracing recycled packaging, biodegradable scents, and renewable raw materials, which resonate with eco-conscious end users and foster repeat business.

This movement towards sustainability also impacts product innovation, as businesses create non-aerosol sprays, liquid air fresheners with refills, and reusable candle jars. By positioning with end users demands for eco-responsibility, manufacturers can build brand loyalty and enable future market growth. The emphasis on sustainability places air fresheners products not only as functional products but as environmentally sustainable lifestyle options.

Spain Air Freshener Market Trend

Increasing Premiumisation Across Fragrances and Packaging

Air fresheners are increasingly being offered with premium fragrances and upscale packaging, reflecting evolving consumer preferences. end users are increasingly expressing preference for refined, high-end fragrances and classy packaging that enhances the appearance and ambiance of their homes. Companies are reacting by introducing exclusive scents like rosemary, sage, and citronella, as well as the customary lavender and vanilla, to meet the end users' aspirations for luxury and wellness-promoting products.

This premiumisation is not confined to the development of the scent, but also extends to product design and presentation. Brands are pushing towards higher-quality materials like porcelain holders for candle air fresheners and design-pleasing reed diffusers. Such premium elements upgrade air fresheners products from utilitarian staples to lifestyle products, supporting the category's move toward creating luxury home ambience and individual well-being.

Spain Air Freshener Market Opportunity

Broadening Role of E-Commerce and Hybrid Product Positioning

Greater focus on Retail online channels and the positioning of air fresheners as lifestyle products is set to influence market expansion. Retail Online are becoming increasingly important to sell premium and decorative air fresheners, particularly candle and liquid variants, which are increasingly being purchased consciously as opposed to routine grocery store visits. Supermarkets and hypermarkets are also developing their webstores, providing greater brand reach and ease for end users buying online.

As end users further equate air fresheners with comfort, relaxation, and health, products will evolve from their traditional home care roles into lifestyle expressions. Such an evolution, with online accessibility and new novel fragrances and sustainable packaging, will propel future growth. The industry is poised to see more intensity of activity on the part of established and private labels alike through digital sales growth.

Spain Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

The segment with highest market share under product type is Electric Air Fresheners and holds approximately 35% of Spain market share. Electric air fresheners are popular because they are convenient, have longer-lasting scents, and feature novel designs that appeal to end users' interests in wellness and ambience building. While spray/aerosol versions continue to be popular, electric air fresheners are gaining traction among end users who seek higher-end, lifestyle-based items that enhance home decoration and create a relaxing atmosphere.

During the forecast period, electric air fresheners will keep expanding, guided by developments in battery-operated and refillable products. end users are increasingly attracted to aromatherapy-based, natural, and stress-reducing fragrances, and this segment is poised to be appealing to brands that emphasize mental wellness, luxury fragrances, and eco-friendly packaging solutions.

By Fragrance

- Camomile/Lavender

- Lavender

- Floral

- Vanilla

- Lemon

- Breeze

- Lavender/Vanilla

- Cinnamon

- Jasmine

- Apple/Cinnamon

- Rose

- Orchid

- Mint

- Wood

The segment with highest market share under sales channel category belongs to the Retail Offline, which continues to lead with around 60% of the market share. Hypermarkets and supermarkets are the top distribution channels, offering end users simple access to a broad selection of air fresheners products ranging from low-cost private labels to high-end electric and candle-based air fresheners. Promotions, loyalty, and visibility in-store are crucial drivers of offline retail supremacy.

During the forecast period, retail offline channels will continue to lead, underpinned by ongoing end users preference for shopping in-store for home care. Although online sales are expanding, especially for premium and lifestyle-focused air fresheners products, most routine purchases will still be made through conventional retail channels, keeping Retail Offline as the leading sales channel in Spain.

Top Companies in Spain Air Freshener Market

The top companies operating in the market include Hugworld International, Henkel Ibérica SA, Ceras Rouras SA, Mercadona SA, Reckitt Benckiser España SL, Centros Comerciales Carrefour SA, Procter & Gamble España SA, Johnson Wax Española SA, Dia SA, Humex SA, etc., are the top players operating in the Spain Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Spain Air Freshener Market Policies, Regulations, and Standards

4. Spain Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Spain Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Spain Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Spain Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Spain Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Spain Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Spain Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Spain Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Mercadona SA

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Reckitt Benckiser España SL

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Centros Comerciales Carrefour SA

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Procter & Gamble España SA

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Johnson Wax Española SA

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Hugworld International Distributions SL

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Henkel Ibérica SA

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Ceras Rouras SA

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Dia SA

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Humex SA

12.1.10.1. Business Description

12.1.10.2. Product Portfolio

12.1.10.3. Collaborations & Alliances

12.1.10.4. Recent Developments

12.1.10.5. Financial Details

12.1.10.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.