Southeast Asia Water & Wastewater Pump Market Report: Trends, Growth and Forecast (2026-2032)

Pump Type (Centrifugal Pumps (End Suction, Split Case, Vertical (Turbine, Axial Pump, Mixed Flow Pump), Submersible Pump), Positive Displacement Pumps (Progressing Cavity, Diaphragm, Gear Pump, Others)), Application (Water, Wastewater), End User (Industrial Water & Wastewater, Municipal Water & Wastewater), Country (Philippines, Singapore, Indonesia, Malaysia, Thailand, Vietnam, Cambodia, Myanmar, Rest of Southeast Asia)

- Energy & Power

- Jan 2026

- VI0716

- 165

-

Southeast Asia Water & Wastewater Pump Market Statistics and Insights, 2026

- Market Size Statistics

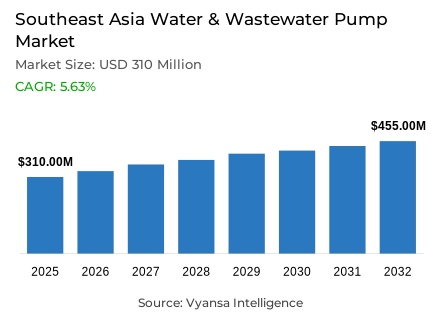

- Southeast Asia water & wastewater pump market is estimated at USD 310 million in 2025.

- The market size is expected to grow to USD 455 million by 2032.

- Market to register a cagr of around 5.63% during 2026-32.

- Pump Type Shares

- Centrifugal pumps grabbed market share of 90%.

- Competition

- More than 10 companies are actively engaged in producing water & wastewater pump in Southeast Asia.

- Top 5 companies acquired the maximum share of the market.

- Xylem Inc.; KSB SE & Co. KGaA; Kirloskar Brothers Limited (KBL); Flowserve Corporation; Ebara Corporation etc., are few of the top companies.

- End User

- Municipal Water & Wastewater grabbed 65% of the market.

- Country

- Indonesia leads with a 30% share of the Southeast Asia market.

Southeast Asia Water & Wastewater Pump Market Outlook

The South East Asia Water & Wastewater Pump Market, at USD 310 Million in 2025, is likely to grow to USD 455 Million in 2032 with a CAGR of approximately 5.63%. Urbanization in the region is putting tremendous stress on the current water and wastewater infrastructure, especially in Indonesia and Vietnam, where most wastewater goes untreated despite high drinking water access. This has generated a pressing demand for upgraded pumping equipment and increased treatment plant capacity to provide secure water service and environmental adequacy.

Market expansion is being pushed by government-led programs, as Indonesia will invest USD 20 billion in water and energy projects up to 2023, and Vietnam spends around USD 150 million per year on wastewater development. The programs are targeting the replacement of old pumps and the installation of high-performance pumping stations. However, municipal networks continue to experience issues like varying maintenance practices, equipment degradation from untreated flows, and operational inefficiencies, while industrial estates tend to exhibit greater adherence to centralized systems.

Technological adoption is also aiding market growth as utilities and industrial operators deploy IoT-enabled monitoring and cloud-based analytics for predictive maintenance and operational optimization. Increasing energy prices, expected to increase 4.3% per year from now until 2030, are driving the deployment of energy-efficient pumps, which can save power by 10–20%. Smart technologies are improving equipment reliability, reducing downtime, and allowing more sustainable operation in the urban and industrial segments.

Centrifugal pumps account for a 90% market share because of their adaptability in serving variable head and flow demands, while municipal water and wastewater utilities hold the largest end-user segment with 65% demand. Indonesia is the regional market leader with a 30% share, followed by Vietnam and Thailand, as a result of urbanization, industrial expansion, and continued infrastructure upgrading. These considerations have the region poised for consistent expansion in water and wastewater pumping solutions through 2032.

Southeast Asia Water & Wastewater Pump Market Growth DriverRapid Urbanization Accelerates Infrastructure Expansion

Rising urban populations throughout Southeast Asia are putting pressure on current water networks, forcing officials to increase pumping and treatment facilities. Although 92.64% of Indonesia's inhabitants have access to drinking water, only 1% of urban wastewater is treated, revealing extreme collection and pumping shortfalls municipalities must quickly fill. Vietnam also reflects comparable disparities—70% of urban residences are connected to sewerage systems, but only 12.5% of wastewater is treated across the country, highlighting the necessity for increased pumping capacity to avoid network overloads and service outages.

Government-funded programs are directing substantial investments into upgrading aging systems. Indonesia has committed USD 20 billion for energy and water programs by 2023, while Vietnam allocates around USD 150 million each year—about 0.45% of GDP—to its wastewater industry. These investments focus on replacing old pumps and construction of high-efficiency pumping stations to improve urban service coverage and resilience in operations.

Southeast Asia Water & Wastewater Pump Market ChallengeLimited Treatment Coverage Creates Operational Constraints

Inadequate wastewater treatment capacity still troubles utilities that cause pumping equipment to run less than optimally. In Vietnam, treatment is given to just 10% of the collected wastewater with 60% of homes connected to sewerage networks, which means untreated flows cause increased equipment degradation. Industrial parks show improvement—89% of Vietnam's 280 operational parks are equipped with centralized systems—but municipal networks are far behind and produce uneven urban-industrial sector development.

Maintenance and operating practices continue to be uneven across the region. Most wastewater treatment plants underperform because of varying flow rates, poor technical training, and cost-saving pressures that slow pump maintenance. Thailand also lists similar inefficiencies, where despite continued infrastructure development, wastewater coverage is short. These deficits strengthen the call to standardize maintenance models and invest in more robust, energy-efficient pumping technologies in public utilities.

Southeast Asia Water & Wastewater Pump Market TrendIoT-Driven Advancements Enhance Pump Performance

Increased use of IoT-based monitoring systems is reshaping water and wastewater operations in Southeast Asia. Utilities and industrial operators now utilize remote monitoring using smart sensors to provide predictive maintenance and reduce unscheduled downtime. The systems provide real-time monitoring of motor vibration, pressure, and flow rates, facilitating prompt response to abnormalities that might otherwise halt operations. Increased energy usage—expected to expand 4.3% per year through 2030—also drives end users to implement energy-efficient pumps, which lower the cost of power by 10–20%.

Cloud-based analytics and automation platforms are increasingly used to optimize pumping operations. Utilities are using these technologies to remotely improve performance, responding to skilled labor shortages and operational inefficiencies. Pump manufacturers are answering at the same time with innovative designs that respond to changing emission requirements and sustainability goals, ensuring their equipment is compliant with regional climates for resiliency and long-term infrastructure reliability.

Southeast Asia Water & Wastewater Pump Market OpportunityRural Expansion Unlocks New Market Prospects

Emerging rural demand presents huge growth opportunities for pump makers and service companies. Although urban cities in Southeast Asia have better water access rates, rural areas have only about 60% of safely managed drinking water, demanding robust demand for decentralized and modular pumping technology. These small, simple-to-install technologies solve infrastructure gaps in outlying communities, where traditional systems experience logistical and economic challenges.

Government initiatives are actually addressing these gaps in services. Indonesia's PAMSIMAS program encourages community-based water supply systems that need compact pump sets, and public-private partnerships allow for quicker deployment of skid-mounted pumps. Regional development strategies now address the 15% of populations without piped connections, underscoring the growing role for private financing in bringing sustainable water and wastewater infrastructure to off-grid communities.

Southeast Asia Water & Wastewater Pump Market Country Analysis

By Country

- Philippines

- Singapore

- Indonesia

- Malaysia

- Thailand

- Vietnam

- Cambodia

- Myanmar

- Rest of Southeast Asia

Indonesia dominates the local market, with about 30% of all pump installations, backed by its 280 active industrial park zones and strong infrastructure spending of USD 20 billion up to 2023. With a respectable 92.64% coverage of drinking water, however, only 1% of urban wastewater is treated, so huge expansion of pumping stations and collection networks is needed for untapped flows. These circumstances position Indonesia in the spotlight for continued system upgrades and public spending.

Vietnam and Thailand are next in line, fueled by concurrent urbanization and industrialization trends. Vietnam boasts 49 centralized municipal wastewater treatment plants servicing Class IV municipalities and 250 industrial parks using centralized pumping technology. Thailand's 6% average yearly manufacturing growth maintains constant demand for pumping solutions that drive water reuse and management projects, making the two countries pivotal players in market growth within the region.

Southeast Asia Water & Wastewater Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pumps

- Positive Displacement Pumps

Centrifugal pumps lead the South East Asia Water & Wastewater Pump Market, contributing to around 90% of the total installations. Their operation under variable head and flow conditions makes them a choice in most municipal treatment plants as well as industrial locations. Centrifugal pumps are especially apt for large-scale water distribution and wastewater collection, where uninterrupted reliability and operational efficiency are crucial to uninterruptible service delivery.

Conversely, other pumps all share only some market share for serving specialized applications. These types are chiefly used for extraction from deep well or abrasive handling of fluids, in which case centrifugal models might be ill suited. Nevertheless, advances in technology concerning materials and efficiency are slowly widening their niche uses, particularly in situations that demand high flow control accuracy as well as lessened maintenance intervals.

By End User

- Industrial Water & Wastewater

- Municipal Water & Wastewater

Industrial wastewater and water usage comprise the most rapidly growing application area, with a CAGR of approximately 8.19%. Sustained growth in industries like food and beverage, chemicals, and mining increases the demand for high-grade pumps that are designed to handle corrosive or high-temperature fluids. Increasingly stringent effluent discharge regulations are also encouraging industrial operators to fit energy-efficient and robust systems for ensuring compliance without excess cost escalation.

Various Market Players in Southeast Asia Water & Wastewater Pump Market

The companies mentioned below are highly active in the Southeast Asia water & wastewater pump market, occupying a considerable portion of the market and shaping industry progress.

- Xylem Inc.

- KSB SE & Co. KGaA

- Kirloskar Brothers Limited (KBL)

- Flowserve Corporation

- Ebara Corporation

- WILO SE

- Sulzer Limited

- Grundfos Holding A/S

- Franklin Electric

- Pentair PLC

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Southeast Asia Water & Wastewater Pump Market Policies, Regulations, and Standards

4. Southeast Asia Water & Wastewater Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Southeast Asia Water & Wastewater Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Progressing Cavity- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Diaphragm- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Application

5.2.2.1. Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By End User

5.2.3.1. Industrial Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Municipal Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Country

5.2.4.1. Philippines

5.2.4.2. Singapore

5.2.4.3. Indonesia

5.2.4.4. Malaysia

5.2.4.5. Thailand

5.2.4.6. Vietnam

5.2.4.7. Cambodia

5.2.4.8. Myanmar

5.2.4.9. Rest of Southeast Asia

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Philippines Water & Wastewater Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Singapore Water & Wastewater Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Indonesia Water & Wastewater Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Malaysia Water & Wastewater Pump Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

10. Thailand Water & Wastewater Pump Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By End User- Market Insights and Forecast 2022-2032, USD Million

11. Vietnam Water & Wastewater Pump Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By End User- Market Insights and Forecast 2022-2032, USD Million

12. Cambodia Water & Wastewater Pump Market Statistics, 2022-2032F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By End User- Market Insights and Forecast 2022-2032, USD Million

13. Myanmar Water & Wastewater Pump Market Statistics, 2022-2032F

13.1. Market Size & Growth Outlook

13.1.1. By Revenues in US$ Million

13.2. Market Segmentation & Growth Outlook

13.2.1. By Pump Type- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Application- Market Insights and Forecast 2022-2032, USD Million

13.2.3. By End User- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1. Company Profiles

14.1.1. Flowserve Corporation

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. Ebara Corporation

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. WILO SE

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. Sulzer Limited

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. Grundfos Holding A/S

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. Xylem Inc.

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By Application |

|

| By End User |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.