South Korea Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), Price Category (Mass, Premium), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Dec 2025

- VI0666

- 120

-

South Korea Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

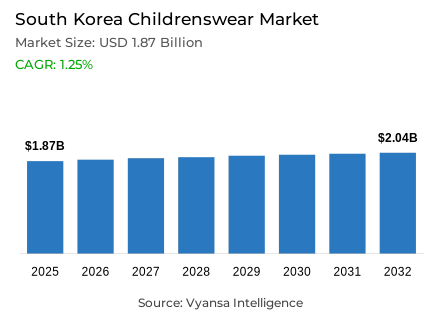

- Childrenswear in South Korea is estimated at USD 1.87 billion.

- The market size is expected to grow to USD 2.04 billion by 2032.

- Market to register a cagr of around 1.25% during 2026-32.

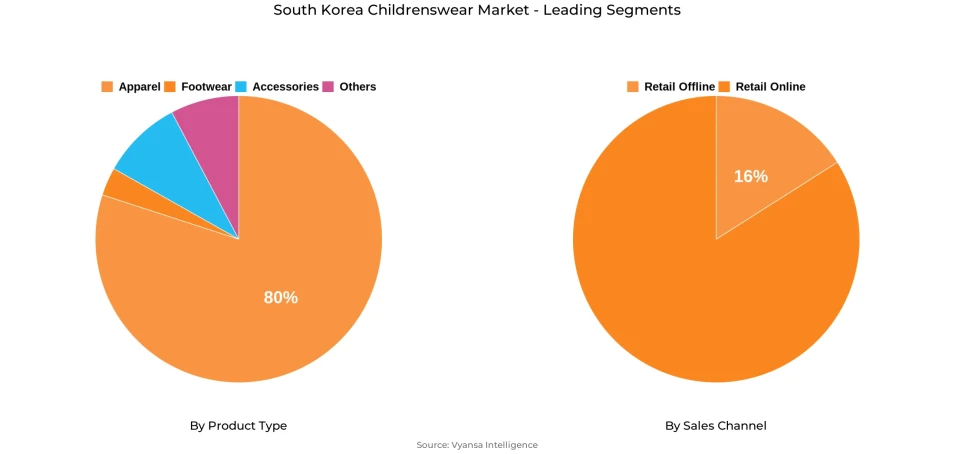

- Product Type Shares

- Apparel grabbed market share of 80%.

- Competition

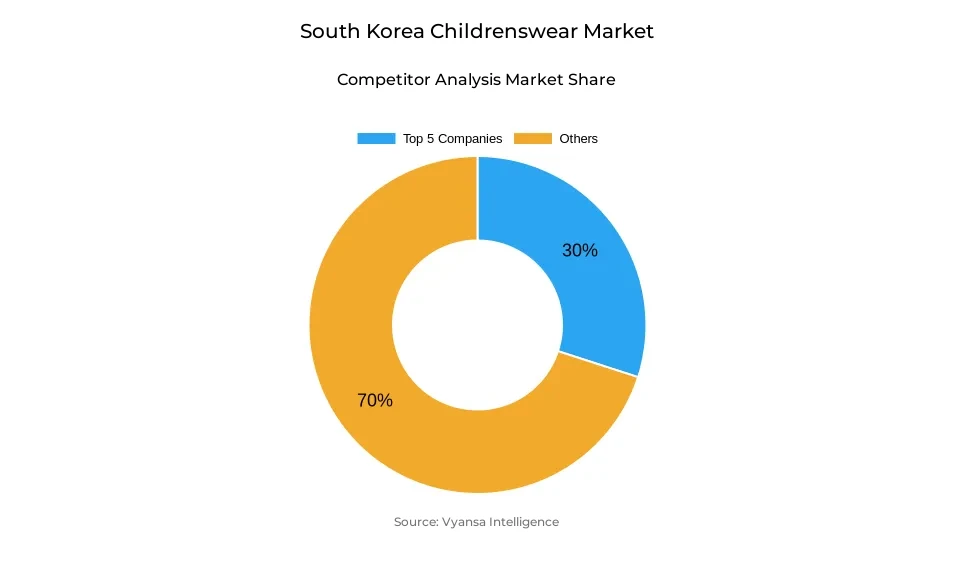

- More than 20 companies are actively engaged in producing childrenswear in South Korea.

- Top 5 companies acquired around 30% of the market share.

- Frl Korea Co Ltd; E-Land World Co Ltd; Fila Korea Ltd; Suhyang Networks Co Ltd; Hansaedreams Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

South Korea Childrenswear Market Outlook

The South Korea childrenswear market was valued at approximately USD 1.87 billion in 2025 and is set to reach approximately USD 2.04 billion by 2032, growing at a CAGR of around 1.25% from 2026 to 2032. The market still shows the effects of South Korea's low birth rate, whereby high unit prices and premiumisation counterbalance low volume growth. Department stores have managed to sustain sales owing to parents' willingness to spend on expensive clothing for their children, which is facilitated by the "Very Important Baby (VIB)" trend. Large department stores like Hyundai, Shinsegae, and Lotte Department Stores have developed displays of luxury brands such as Baby Dior, Burberry, and Moncler Enfant, as many affluent parents prefer high-end, unique designs.

Apparel dominates the childrenswear market, accounting for about 80% of total sales. Within this segment, both luxury brands and sportswear names such as Nike Kids, adidas Kids, and The North Face Kids have captured a strong following, benefiting from the athleisure trend which continues unabated. However, children-targeted brands such as Blue Dog and Mink Mew reflect weaker performance, with a few pulling out of retail spaces due to sluggish sales. Meanwhile, the second-hand market, facilitated by platforms such as Carrot Market, continues to thrive, with parents reselling outgrown premium apparel-a cost-effective choice that has partly offset demand for new products.

Another factor at play is the increasing polarisation of the market, wherein premium and economy brands are expanding in opposite directions. The premium and luxury brands keep their loyal base of well-off families intact, while affordable brands such as Moimoln and Curlysue reach price-sensitive end end userss through e-commerce and hypermarkets. Meanwhile, online-first brands like Limitedoudou and Apricot Studios gain rapid growth by adopting pre-order models for lower inventory costs, thus offering competitive pricing.

While 'retail offline' remains the most important and dominant sales channel-through which nearly all activity within the market is recorded-digital transformation is becoming increasingly complementary. Wholesale centers such as the Namdaemun Market in Seoul are moving to live commerce and online websites to maintain sales. Furthermore, even designer wear for children targeting teenagers has attracted a new niche of women seeking smaller sizes at lower prices, hence further diversifying the category.

South Korea Childrenswear Market Growth DriverIncreasing Premiumization Driven by the ‘VIB' Trend

The Very Important Baby trend forms a major role in shaping South Korea's childrenswear market, with ever-increasing time and money being dedicated to high-end and luxury children's wear by parents and grandparents alike. Spending per child has greatly increased due to fewer children per household, which has driven the expansion of luxury sections in major department stores such as Hyundai and Shinsegae. Sales of luxury children's products have significantly outpaced other categories, highlighting the growing preference for exclusivity and quality. This reflects not only emotional investment but also the social value placed on premium goods within South Korean culture.

According to Statistics Korea (KOSTAT), the percentage of children under 15 years old in 2024 was only 12.5% of the total population, which shows that the lesser base of children is concentrating spending power. Furthermore, the World Bank estimated that South Korea's per capita GDP reached USD 33,745 in 2024, underlining how powerful family purchasing power has become. All these factors work together to reinforce the dominance of luxury brands, with the likes of Baby Dior, Burberry, and Moncler Enfant continuing to see sustained growth in metropolitan areas.

South Korea Childrenswear Market ChallengeDeclining Birth Rate Limits Volume Growth

The main barrier to the further development of the childrenswear market in South Korea is the country's continuing low birth rate, which limits retail volume growth despite an increase in expenditure per child. This demographic contraction decreases the number of potential end users directly and creates structural obstacles to the long-term expansion of the market. In 2023, the country's fertility rate dropped to 0.72, which is the lowest in the world, while the number of babies born dropped to only 230,000-also a record low. This steep plunge in births further weakened the overall demand base for children's apparel.

At the same time, the growth of resale sites like Carrot Market has raised the bar, where parents have increasingly chosen almost new designer products at lower prices. Already saturated with brands, this twofold squeeze of declining demographics and expanding secondhand options limits the growth potential. Consequently, market players must innovate or focus on their value differentiation to maintain competitiveness in an increasingly mature and competitive environment.

South Korea Childrenswear Market TrendSports and Luxury Convergence Redefines Children's Fashion

Another clear trend that is changing the face of childrenswear in South Korea is the blending of luxury design and sportswear elements. Parents today want a balance of fashion, comfort, and functionality; thus, brands like MLB Kids by F&F Co. Ltd, Nike Kids, and The North Face Kids are thriving by successfully bringing active wear and streetwear influences together. This mirrors general national choices, wherein contemporary identity is aligned with practicality and youth culture.

According to the Ministry of Culture, Sports and Tourism (MCST), sports participation among children aged 6–14 increased by 5.8% in 2024, reflecting a growing lifestyle focus on activity and wellness. Meanwhile, the World Trade Organization (WTO) showed that apparel exports from South Korea surged by 8.2% in 2024, further solidifying the country's position as a hotbed of fashion innovation. Combined, these factors are pushing demand for sports-inspired luxury collections, which have now emerged as a vital crossroads of performance, durability, and aspirational fashion for kids.

South Korea Childrenswear Market OpportunityGrowth in Second-Hand and Circular Fashion

This rapid rise of second-hand fashion presents a strong opportunity for sustainable growth in South Korea childrenswear market. Such platforms as Carrot Market and Danggeun Market have been widely adopted, reflecting the increasing acceptance of resale culture. Carrot Market had in excess of 35 million registered users at the end of 2024, from the statistics provided by MCIT, showing how digital resale ecosystems become mainstream, especially in children's apparel, which is outgrown so fast. Parents consider such places affordable, convenient, and environmentally responsible.

In addition, ME Korea estimated that textile recycling increased by 17% in 2024, and this reflects national progress toward circular economy objectives. This trend is supported by a growing environmental consciousness among younger parents who increasingly prioritize sustainable consumption. The reselling of high-end children's clothes bridges affordability with aspiration and opens up opportunity for the brands to collaborate on eco-friendly projects. With this in mind, a growing second-hand ecosystem may support not only sustainability goals but also new growth avenues within the childrenswear market

South Korea Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Footwear

- Accessories

- Others

The segment with highest market share under Product Type is Apparel, accounting for about 80% of the South Korea childrenswear market. This could be due to the 'Very Important Baby (VIB)' trend, whereby parents and grandparents increasingly realize the importance of high-quality, premium, or luxury clothing for children. As the birth rate continues to decline, families try to invest more in each child, boosting demand for branded and designer apparel.

Department stores like Hyundai and Shinsegae have added sections of luxury to include high-end labels for children such as Baby Dior, Fendi Kids, and Moncler Enfant, to further strengthen the leading position of apparel in the market. Additionally, apparel continues to benefit from fashion-conscious parents who seek comfortable, good-looking, and exclusive products for their children. This is further supported by an increase in demand for sporty clothes that is further fueled by brands such as Nike Kids and The North Face Kids. Along with a developing resale culture for designer kids' wear, the segment of apparel continues to be the main growth driver in South Korea's childrenswear market.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel is retail offline has the largest market share and currently dominates the majority in the South Korea childrenswear market. Department stores are at the center, where the demand for premium and luxury childrenswear is met with exclusive in-store experiences and brand sections. Major retailers such as Hyundai Department Store and Lotte Department Store have added more luxury brands like Burberry Kids and Fendi Kids to their product portfolios, making offline retail the favored avenue for high-income households seeking premium quality and assurance of authenticity.

Retail Online and second-hand platforms such as Carrot Market have seen rapid growth, but it is the offline stores that maintain dominance, due to the South Korean end userss' preference for physical product evaluation, premium store service, and immediate availability. Limited-edition collections, seasonal launches, and pop-up stores make offline shopping an experience that continues to attract parents and keeps retail offline as the leading channel in the childrenswear market of South Korea.

List of Companies Covered in South Korea Childrenswear Market

The companies listed below are highly influential in the South Korea childrenswear market, with a significant market share and a strong impact on industry developments.

- Frl Korea Co Ltd

- E-Land World Co Ltd

- Fila Korea Ltd

- Suhyang Networks Co Ltd

- Hansaedreams Co Ltd

- F&F Co Ltd

- Agabang & Co Ltd

- Moncler SpA

- North Face Inc

- H&M Hennes & Mauritz AB

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. South Korea Childrenswear Market Policies, Regulations, and Standards

4. South Korea Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. South Korea Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. South Korea Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. South Korea Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. South Korea Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Suhyang Networks Co Ltd

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Hansaedreams Co Ltd

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.F&F Co Ltd

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Agabang & Co Ltd

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Moncler SpA

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Frl Korea Co Ltd

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.E-Land World Co Ltd

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Fila Korea Ltd

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.North Face Inc, The

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. H&M Hennes & Mauritz AB

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.