South Korea Baby and Child-Specific Products Market Report: Trends, Growth and Forecast (2026-2032)

By Product (Hair Care, Skin Care, Sun Care, Toiletries, Baby Wipes, Diapers, Medicated), By Category (Premium, Mass), By Sales Channel (Retail Online, Retail Offline)

|

Major Players

|

South Korea Baby and Child-Specific Products Market Statistics and Insights, 2026

- Market Size Statistics

- Baby and child-specific products in South Korea is estimated at USD 480 million in 2025.

- The market size is expected to grow to USD 515 million by 2032.

- Market to register a cagr of around 1.01% during 2026-32.

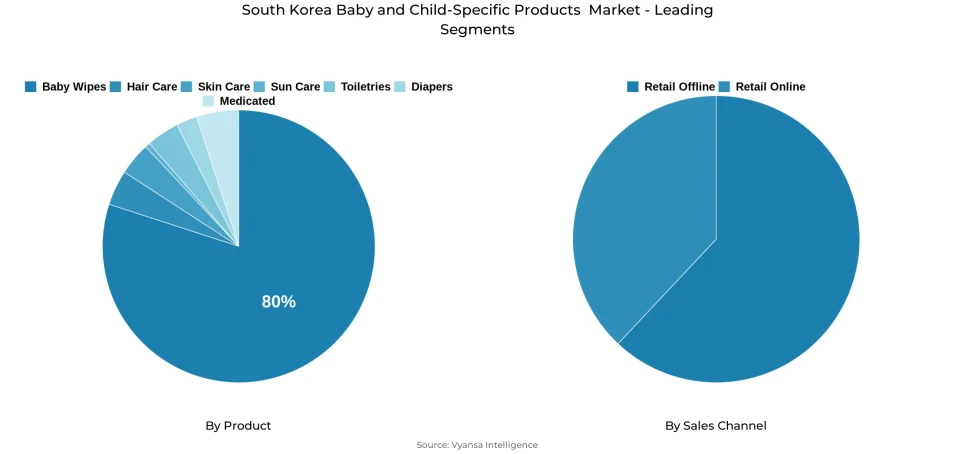

- Product Shares

- Baby wipes grabbed market share of 80%.

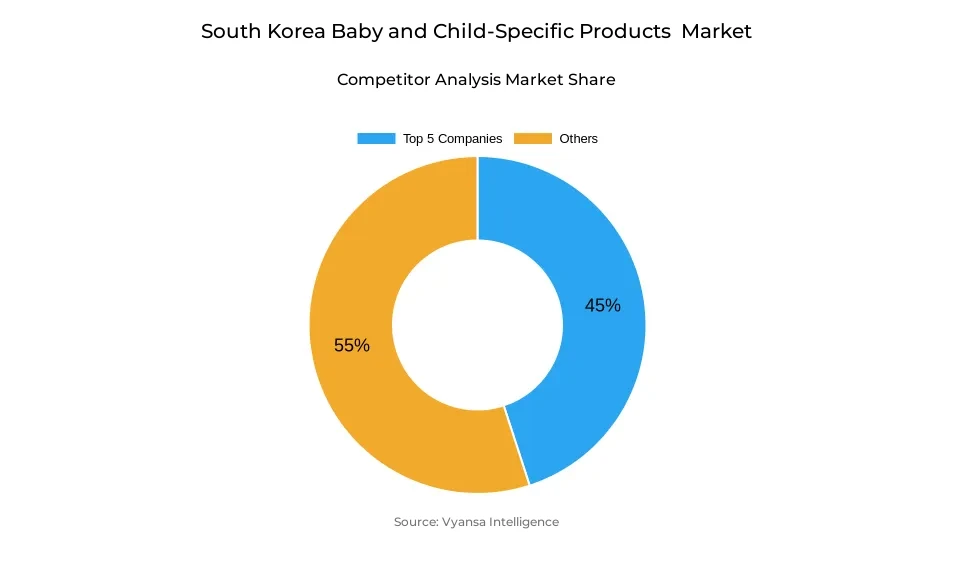

- Competition

- More than 20 companies are actively engaged in producing baby and child-specific products in South Korea.

- Top 5 companies acquired around 45% of the market share.

- Soonsu Korea Co Ltd; LG Household & Health Care Ltd; Dakor Co Ltd; Yuhan Kimberly Co Ltd; AJ Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline continues to dominate the market.

South Korea Baby and Child-Specific Products Market Outlook

South Korea baby and child-specific products market will grow to about USD 515 million by 2032, compared to USD 480 million in 2025, which is a compounded annual growth rate of approximately 1.01% in the forecast period. The country is witnessing a drop in birth rate, but the sector is expected to continue growing steadily, mainly due to the demand of baby and child-specific skincare. Parents are buying more specific products to certain areas of the body such as the face, trunk and buttocks which leads to increased utilization and value sales. However, baby wipes, which control about 80% of the market, will probably continue to be a drag on the overall performance because of environmental issues and decreased use with a shrinking child population.

The market is still dominated by retail offline channels, where department stores and health and personal-care retailers are performing well in terms of sales. Although retail online already contributes a significant portion of overall revenue, its pace has slowed down as the channel nears saturation. Physical retailing is gaining momentum with parents going to stores more often to see new products and offers, particularly at baby fairs where they can get special offers and can directly interact with brands and end users.

It is assumed that local manufacturers will continue to hold a leading role, as they have a profound knowledge of end user preferences and experience in product development. Companies like Yuhan Kimberly and LG Household and Health Care have been able to stay on top of the pack due to their large product lines and strong multichannel distribution, thus guaranteeing easy access. Their focus on safe, family-friendly, and dermatologically tested formulations contribute to the development of loyalty among the careful Korean parents.

Nevertheless, the increasing popularity of dermocosmetics poses a threat to the expansion of categories. Most parents are resorting to general-use, science-based skincare products that target sensitive skin, which are considered to be safe to both adults and children. This change may limit the potential of baby-specific brands, but those that can differentiate with specific skin solutions and reputable local positioning will probably maintain consistent demand until 2032.

South Korea Baby and Child-Specific Products Market Growth Driver

Expanding Product Range and Market Entrants

The development of baby and child-specific products in South Korea is driven by the rising demand of specific body parts products to a large extent. Parents are more and more inclined to use special products on the face, body, and buttocks of infants and children, which leads to an increase in the number of products bought per end user. This need prompts businesses to be creative and expand their products, especially in skincare that is dynamic in growth.

New entrants into the market are also being witnessed by different sectors, such as children apparel brands that are introducing family-safe skincare lines. The presence of well-established brands with a large distribution network, like those that sell baby wipes and creams online and offline, also contributes to the growth of the market. A combination of these factors still leads to steady growth in retail value despite the demographic issues like low birth rate.

South Korea Baby and Child-Specific Products Market Challenge

Declining Baby Wipes Sales and Product Substitution

The market is challenged because the biggest category, baby wipes, is under a constant decline because of environmental issues and less usage by end users. Increased sensitivity to sustainability makes most households restrict the use of disposable wipes, which directly affects the overall category performance. Furthermore, the declining number of children under a specific age also limits the potential sales increase in this segment.

The other significant threat is the threat of substitution by general-use dermocosmetics. With the increasing number of children with sensitive skin and parents who want to find a solution that is proven and effective, they are more likely to resort to family-safe dermocosmetics instead of baby-specific products. These substitutes, which are seen as scientifically supported and safe, shift the demand out of the traditional baby and child-specific products, which negatively affects the long-term growth potential of the category.

Unlock Market Intelligence

Explore the market potential with our data-driven report

South Korea Baby and Child-Specific Products Market Trend

Rising Demand for Specialized and Seasonal Products

A prominent trend shaping the market is the rising demand for specialized and seasonal baby care products, as parents increasingly select formulations tailored to specific body parts and adapt their choices to seasonal needs, such as soothing products in summer and moisturizing products in winter. The effect of this behavior is that end users will buy more than one all-in-one solution, which will lead to higher usage of the products.

Meanwhile, retail retail online remains the leader in sales because end users enjoy the comfort of shopping baby care with household products. However, the offline channels like department stores and health and personal-care retailers are proving to be stronger than ever, slowly recovering market share through a wider selection of baby brands and increased customer interaction after the pandemic.

South Korea Baby and Child-Specific Products Market Opportunity

Expanding Niche Segments and Local Brand Strength

The future has great prospects in creating products that can be applied to particular parts of the body like the hips, the head or the region around the mouth. Treatment of nappy rash is one of the categories that will experience the highest growth due to the increased use of specialized care products. Brands that respond to these niche needs are able to differentiate and gain a bigger portion of the changing market.

It is anticipated that local firms will continue to dominate because they have a better grasp of end user behavior and ingredient preferences that Korean parents prefer. In addition, baby fairs and other direct-to-end user activities provide the best opportunities to local players to increase brand awareness and turn new customers into loyal customers. These channels are expected to be even greater market growth drivers in the future.

Unlock Market Intelligence

Explore the market potential with our data-driven report

South Korea Baby and Child-Specific Products Market Segmentation Analysis

By Product

- Hair Care

- Skin Care

- Sun Care

- Toiletries

- Baby Wipes

- Diapers

- Medicated

The segment with the highest share under Product Type in the South Korea Baby and Child-Specific Products Market is Baby Wipes, holding around 80% of the market. Baby wipes remain the largest category due to their versatility and frequent use, not only for infants but also for cleaning tasks in daily life. end users increasingly value convenience, especially in single-person households, and prefer products that are easy to use and dispose of.

Despite their high share, baby wipes are expected to see declining value sales over the forecast period due to environmental concerns and the shrinking population aged 0–11. Meanwhile, baby and child-specific skin care is projected to see steady growth as parents increasingly purchase targeted products for different parts of the body. Seasonal purchases, along with new product launches from local brands, will support overall category value.

By Sales Channel

- Retail Online

- Retail Offline

The segment with the highest share under Sales Channel in the South Korea Baby and Child-Specific Products Market is Retail Offline, which continues to dominate the market. Retail offline channels, including department stores, health and personal care stores, and hypermarkets, are preferred by parents seeking product variety, trusted brands, and immediate availability. Department stores and specialist retailers are showing strong growth as they expand their baby and child-specific product assortments, attracting parents looking for specialized items.

Retail offline benefits from in-store promotions, brand visibility, and events such as baby fairs, which encourage trial and repeat purchases. While retail online accounts for the majority of overall sales, retail offline remains central to the market due to its role in end user education, personalized service, and immediate product access, ensuring steady demand across the forecast period.

List of Companies Covered in South Korea Baby and Child-Specific Products Market

The companies listed below are highly influential in the South Korea baby and child-specific products market, with a significant market share and a strong impact on industry developments.

- Soonsu Korea Co Ltd

- LG Household & Health Care Ltd

- Dakor Co Ltd

- Yuhan Kimberly Co Ltd

- AJ Co Ltd

- Neopharm Co Ltd

- KleanNara Co Ltd

- First Touch Co Ltd, The

- Zero To Seven Inc

- Abovonature Co Ltd

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. South Korea Baby and Child-Specific Product Market Policies, Regulations, and Standards

4. South Korea Baby and Child-Specific Product Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. South Korea Baby and Child-Specific Product Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Hair Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Skin Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Sun Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Toiletries- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Baby Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Diapers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Medicated- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. South Korea Baby and Child-Specific Hair Care Product Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. South Korea Baby and Child-Specific Skin Care Product Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. South Korea Baby and Child-Specific Sun Care Product Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. South Korea Baby and Child-Specific Toiletries Product Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. South Korea Baby and Child-Specific Baby Wipes Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. South Korea Baby and Child-Specific Diapers Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. South Korea Baby and Child-Specific Medicated Product Market Statistics, 2022-2032F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Yuhan Kimberly Co Ltd

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. AJ Co Ltd

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Neopharm Co Ltd

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. KleanNara Co Ltd

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. First Touch Co Ltd, The

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Soonsu Korea Co Ltd

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. LG Household & Health Care Ltd

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Dakor Co Ltd

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Zero To Seven Inc

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Abovonature Co Ltd

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.