Saudi Arabia Large Cooking Appliance Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Built-in Large Cooking Appliance, Freestanding Large Cooking Appliance), By Application (Household, Commercial), By Sales Channel (Retail Channels, Non-Retail Channels)

- FMCG

- Oct 2025

- VI0045

- 120

-

Saudi Arabia Large Cooking Appliance Market Statistics, 2025

- Market Size Statistics

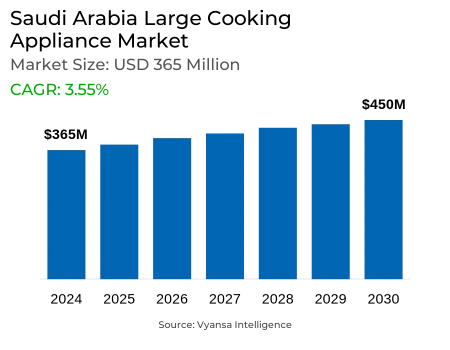

- Large Cooking Appliance in Saudi Arabia is estimated at $ 365 Million.

- The market size is expected to grow to $ 450 Million by 2030.

- Market to register a CAGR of around 3.55% during 2025-30.

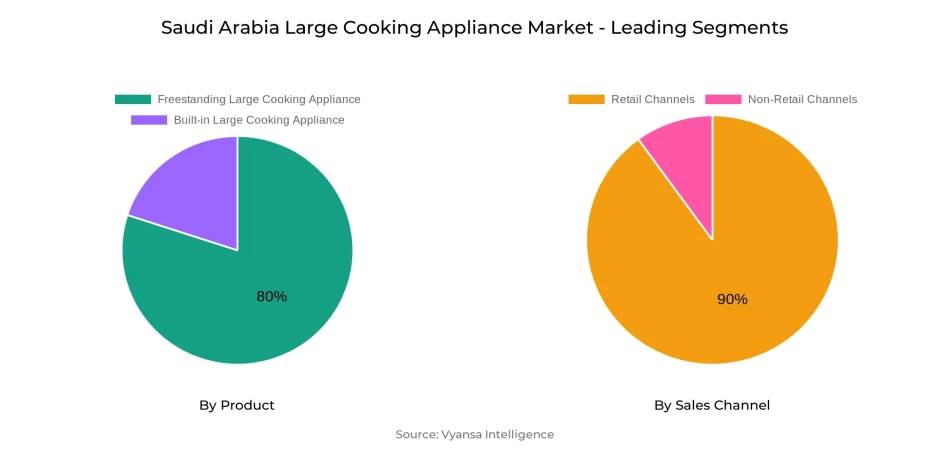

- Product Shares

- Freestanding Large Cooking Appliances grabbed market share of 80%.

- Freestanding Large Cooking Appliances to witness a volume CAGR of around 2.89%.

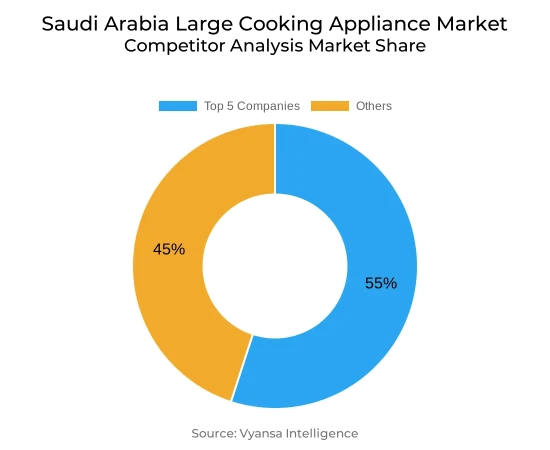

- Competition

- More than 10 companies are actively engaged in producing Large Cooking Appliance in Saudi Arabia.

- Top 5 companies acquired 55% of the market share.

- Abdul Latif Jameel Electronics & Air Conditioning Co, Al Babtain Trading Co Inc, United Matbouli Group, Zagzoog Home Appliance, Abdul Mohsin Al Swailem Est etc., are few of the top companies.

- Sales Channel

- Retail Channels grabbed 90% of the market.

Saudi Arabia Large Cooking Appliance Market Outlook

Saudi Arabia large cooking appliance market will see stable growth from 2025 to 2030, driven by continued urbanisation, increasing disposable incomes, and governmental action under Vision 2030. With growing homeownership, particularly among youth buyers, demand for trendy and built-in appliances will increasingly rise. Cookers will be the most in-demand appliance because of strong traditional cooking habits such as stewing and grilling, which will make them a must-have in Saudi households. Despite international trends towards smart appliances, numerous consumers continue to favor traditional models because they are affordable and comforting.

International brands will be overriding in the Saudi Arabia market since local production is still limited. Imports from countries like Italy, South Korea, Germany, Turkey & China will be crucial for supply achievement. Chinese brands provide low-cost options, while European and Korean brands target premium and technology-driven segments. This import dependence can be risky because of price volatility and changes in exchange rates. To manage these risks, companies are focusing on forming strong local partnerships to better understand customer needs and ensure smooth product availability.

Replacement purchases are also increasing as customers seek more energy-efficient and technologically advanced models. Although conventional cookers continue to reign supreme, smart ovens and comparable devices are becoming increasingly popular for their convenience factor and energy savings. Energy efficiency will be an increasingly significant driver of purchasing decisions, particularly with incentives from the government for lower energy use.

While small smart devices such as air fryers and multi-cookers are picking up interest, they are largely viewed as accessories not substitutes for big cooking appliances. The Saudi market will remain interested in traditional ovens and cookers, particularly for sizeable meals for big families, to ensure that they are a central fixture of domestic kitchens until 2030.

Saudi Arabia Large Cooking Appliance Market Growth Driver

The market will continue to grow steadily in the years to come, bolstered by fast-paced urbanisation and an increase in households. As the Saudi government targets 70% homeownership by 2030 as part of Vision 2030, demand for major cooking appliances is bound to increase. Economic reform and housing programs are set to increase consumers' spending, while energy efficiency is becoming a prime focus for consumers and the government, with new incentives promoting the adoption of energy-efficient appliances.

Many customers would consider investing in newer, more efficient models that save money on electricity costs and contribute to environmental objectives. Some obstacles still exist. Dependence on imports makes the market susceptible to exchange rate fluctuations. Besides, old cooking culture can constrain adoption of modern appliances, particularly among older generations or within more conservative households.

Saudi Arabia Large Cooking Appliance Market Challenge

Consumer demand is changing at a fast pace towards appliances that are easy to use, multifunctional, and convenient for meal preparation. Consequently, consumers are increasingly looking for smart appliances that can keep up with the current digital shift and changing consumer behavior. This has caused demand to surge for compact cooking appliances such as multi-cookers, air fryers, and instant pots.

Though these products are unlikely to replace large cooking appliances completely, they are becoming more and more widely used in conjunction with standard cookers to maximize kitchen efficiency and save time. This trend might, though, limit the growth prospects for large cooking appliances, as some shoppers might opt for these cheaper, more convenient options rather than purchasing new ovens or cookers.

Saudi Arabia Large Cooking Appliance Market Opportunity

Since most big cooking appliances in Saudi Arabia are imported, companies are investing in establishing strong local partnerships to better gauge the needs of consumers in terms of affordability, quality, and innovation. Since local manufacturing is limited, businesses have to foretell demands accurately and maintain a secure supply chain. Heavy dependence on imports may produce price pressures and delay shelf availability, thus necessitating local distributor partnerships. These distributors know the sensitivity of local prices and facilitate rapid movement of products from customers to retailers.

Apart from facilitating convenient distribution, marketing efforts also need to appeal to Saudi consumers. Companies can implement targeted campaigns showcasing how their appliances facilitate cooking of favorite dishes among Saudis. By promoting features that make or improve traditional cooking easier, companies can establish a stronger bond with Saudi customers and increase their product attractiveness in a competitive environment.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 365 Million |

| USD Value 2030 | $ 450 Million |

| CAGR 2025-2030 | 3.55% |

| Largest Category | Freestanding Large Cooking Appliances segment leads with 80% market share |

| Top Drivers | Urbanisation & Government Reforms to Drive Continued Growth |

| Top Challenges | Rising Preference for Small Cooking Appliances Hindering Market Expansion |

| Top Opportunities | Strengthening Local Partnerships to Improve Market Reach |

| Key Players | Abdul Latif Jameel Electronics & Air Conditioning Co, Al Babtain Trading Co Inc, United Matbouli Group, Zagzoog Home Appliance, Abdul Mohsin Al Swailem Est, Ibrahim Shaker Co Ltd, United Electronics Co, Alessa Industries Co, Awad Badi Nahas Trading Co Ltd, LG Electronics and Others. |

Saudi Arabia Large Cooking Appliance Market Segmentation Analysis

The most prevalent segment in the Saudi Arabia Large Cooking Appliances Market by market share is freestanding large cooking appliances, especially cookers. They remain the market leaders because of their universal usage for traditional cooking techniques like stewing, pressure cooking, and roasting, which are still very popular in the nation. Owing to familiarity and affordability, Saudi consumers continue to opt for traditional models despite the international trend towards smart appliances. Cookers are deemed necessary in all homes and are perceived as efficient and practical for daily cooking.

Saudi consumers in selecting cookers also place high importance on brand reputation and equate global names such as GE, La Germania, Glemgas, and Hotpoint-Ariston with quality and fashionable looks. Limited local brand presence further enhances these international players' positions. Price is also an important factor in decision-making, with competitive pricing favoring brands. Since most of the appliances are imported, however, price remains heavily dependent on supply fluctuations in the international market.

Top Companies in Saudi Arabia Large Cooking Appliance Market

The top companies operating in the market include Abdul Latif Jameel Electronics & Air Conditioning Co, Al Babtain Trading Co Inc, United Matbouli Group, Zagzoog Home Appliance, Abdul Mohsin Al Swailem Est, Ibrahim Shaker Co Ltd, United Electronics Co, Alessa Industries Co, Awad Badi Nahas Trading Co Ltd, LG Electronics, etc., are the top players operating in the Saudi Arabia Large Cooking Appliance Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Saudi Arabia Large Cooking Appliance Market Policies, Regulations, and Standards

4. Saudi Arabia Large Cooking Appliance Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Saudi Arabia Large Cooking Appliance Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Unit Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Built-in Large Cooking Appliance- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Built-in Hobs- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1.1. Gas- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1.2. Induction- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1.3. Mixed- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1.4. Standard Electric- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1.5. Vitroceramic- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Ovens- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2.1. Smart- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2.2. Non-Smart- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.3. Built-in Cooker Hoods- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Freestanding Large Cooking Appliance- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.1. Freestanding Cooker Hoods- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.2. Cookers- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Application

5.2.2.1. Household- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Commercial- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Channels- Market Insights and Forecast 2020-2030, USD Million

5.2.3.1.1. Retail Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.3.1.2. Retail E-Commerce- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Non-Retail Channels- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2.1. Builder Merchants and Construction- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Saudi Arabia Built-in Large Cooking Appliance Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Unit Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Application- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Saudi Arabia Freestanding Large Cooking Appliance Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Unit Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Application- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Zagzoog Home Appliance

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Abdul Mohsin Al Swailem Est

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Ibrahim Shaker Co Ltd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.United Electronics Co

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Alessa Industries Co

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Abdul Latif Jameel Electronics & Air Conditioning Co

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Al Babtain Trading Co Inc

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.United Matbouli Group

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Awad Badi Nahas Trading Co Ltd

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. LG Electronics

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Application |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.