Saudi Arabia Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), Price Category (Mass, Premium), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Dec 2025

- VI0655

- 110

-

Saudi Arabia Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

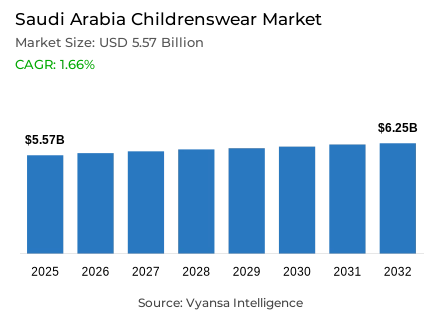

- Childrenswear in Saudi Arabia is estimated at USD 5.57 billion.

- The market size is expected to grow to USD 6.25 billion by 2032.

- Market to register a cagr of around 1.66% during 2026-32.

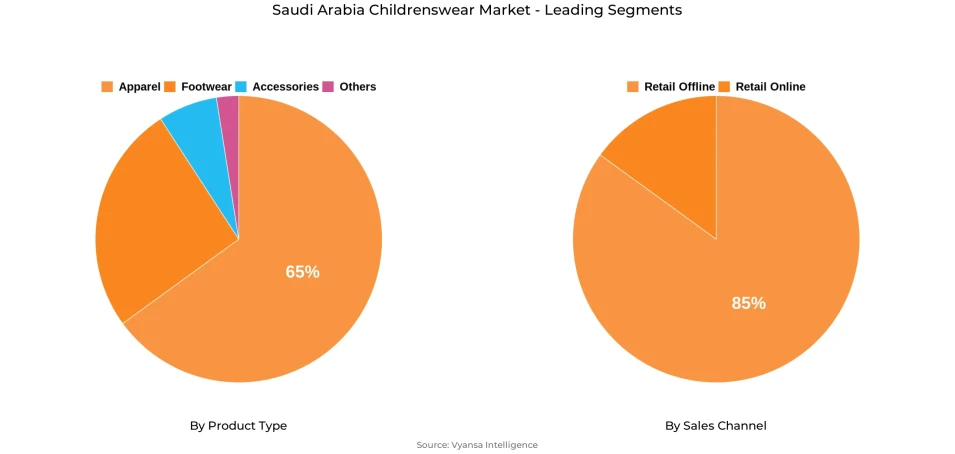

- Product Type Shares

- Apparel grabbed market share of 65%.

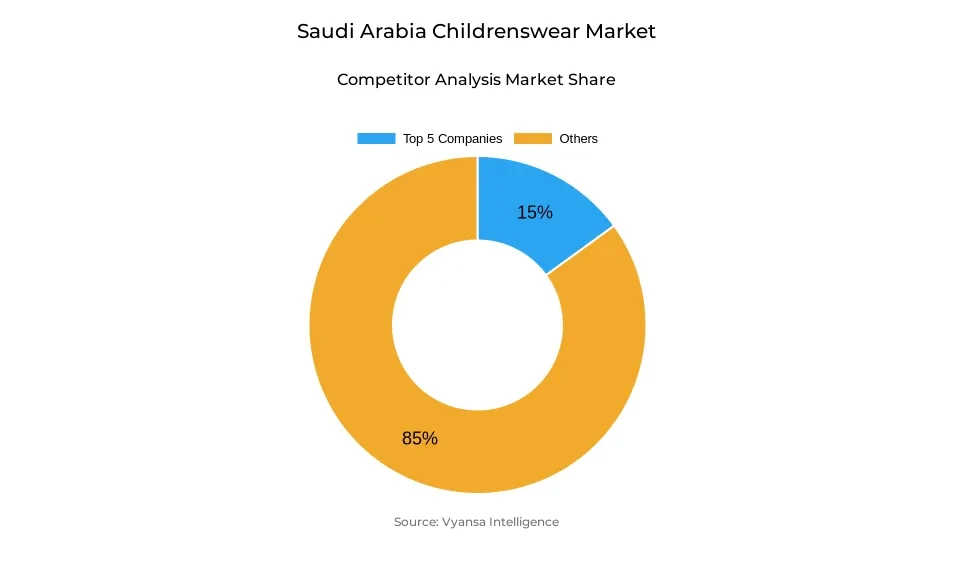

- Competition

- More than 10 companies are actively engaged in producing childrenswear in Saudi Arabia.

- Top 5 companies acquired around 15% of the market share.

- Al Othaim Group; Nike Inc; PVH Corp; Al Bandar Trading Co; Cenomi Retail etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Saudi Arabia Childrenswear Market Outlook

The Saudi Arabia childrenswear market was valued at approximately USD 5.57 billion in 2025 and is anticipated to reach USD 6.25 billion by 2032, growing at a CAGR of about 1.66% during 2026-2032. This rise can be largely attributed to the young population of the country, as approximately one-quarter of it falls in the age category ranging from 0-14 years. The apparel segment accounts for approximately 65% market share, reflecting high demand for both traditional and modern attire suited to social and religious events.

Also, the continuous economic diversification in Saudi Arabia and its Vision 2030 have reshaped the lifestyles of families by engaging them in sports and outdoor activities. This has enhanced demand for casual and activewear and forced local and global brands to expand their offerings. Retail offline channels account for 85% of total sales, supported by the trend of in-store experiences and brands like Al Bandar Trading Co., Zara, and H&M that maintain end users trust through product quality and physical accessibility.

Tourism and entertainment investments are also likely to further drive the market. Initiatives include developments like Riyadh’s Sports Boulevard, THE Mukaab, and events such as Riyadh Season and Jeddah Season, which create occasions for people to buy more apparel, especially for family outings and leisure activities. The country’s growing emphasis on family-friendly experiences, along with rising disposable incomes, will continue to create strong retail opportunities.

Sustainability is gradually but surely featuring as an important consideration across the Saudi childrenswear landscape. In fact, through initiatives like the Saudi Green Initiative, more and more parents are embracing eco-friendly materials, recycling, and the reuse of clothes. The popularity of swap shops and online resale platforms shows both the practical and ethical switch in the trend of purchasing habits, setting the stage for a more sustainable value-driven childrenswear market.

Saudi Arabia Childrenswear Market Growth DriverGovernment Focus on Sports and Economic Growth Boosts Market Demand

Saudi Arabia childrenswear market is in full swing, thanks to the government's many initiatives under Vision 2030 to engage youth, encourage participation in sports, and ensure family welfare. Considering that about 25% of the national population comprises children aged 0-14 years, as per the estimates of the General Authority for Statistics, 2024, the country's youthful demography continues to support strong apparel demand. Initiatives such as Summer Camps and investment in sports infrastructure are facilitating physical activities among children, hence increasing demand for active wear and versatile clothing. Increasing growth in the non-oil sector further strengthens household purchasing capacity and supports broad apparel consumption.

Improving economic conditions are reinforcing the market's long-term outlook: household disposable income recorded growth of 9.3% in 2024, according to the Saudi Central Bank, while on a year-on-year basis, the non-oil sector grew by 4.4%, contributing to increased spending on quality and diverse apparel options. In tandem, these structural and cultural factors are creating a market environment in which functionality and fashion both hold growing importance among Saudi families.

Saudi Arabia Childrenswear Market TrendSustainable and Ethical Fashion Gains Traction Among Families

The growing focus on sustainability and ethics is fast changing the Saudi Arabia childrenswear market. Greater environmental awareness, aided by such national programs as the Saudi Green Initiative, is encouraging companies to use eco-friendly materials, such as organic cotton and recycled fibers. Parents are increasingly selective about purchases based on their environmental impact, valuing durability and responsible sourcing within children's products. Further hastening the pace of this shift were renewed efforts by organizations like Kiswa and the Fashion Commission to encourage reuse and recycling of clothes.

The movement toward sustainability is taking tangible shape, as the textile recycling volume increased by 12% in 2024, according to the National Center for Waste Management (MWAN), and the number of public participations in the sustainability programs increased by 15% year on year, according to the Ministry of Environment, Water, and Agriculture. These initiatives are setting a path for a more circular and ethically conscious childrenswear market, which would align with the long-term environmental objectives of Saudi Arabia.

Saudi Arabia Childrenswear Market OpportunitySecond-Hand and Circular Fashion Platforms Offer Growth Potential

Expanding second-hand and circular fashion initiatives are expected to open up significant opportunities in Saudi Arabia's childrenswear market. As children grow out of their clothes, resale and swap platforms are becoming practical options for families who want both affordability and sustainability. Programmes led by Kiswa and MWAN have formalized the recycling and reuse frameworks; public "swap shop" events introduced through Fashion Futures spur responsible consumption. The addition of these initiatives on digital platforms is further increasing access across urban households.

Growing awareness about sustainability is being translated into measurable shifts in purchase behavior. According to the Saudi Ministry of Commerce, online resale transactions in apparel grew 17% in 2024, and the Saudi Fashion Commission reported a 20% increase in end users awareness about sustainable fashion practices. This dynamic landscape shows how environmental responsibility and economic opportunity are increasingly intertwined, placing circular fashion as a mainstream growth driver in the childrenswear segment.

Saudi Arabia Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Footwear

- Accessories

- Others

The segment with highest market share under By product type, is apparel, which held about 65% of the Saudi Arabia childrenswear market. This segment leads the market mainly because of the Kingdom's young population and the strong cultural imperative of dressing children smartly for all major family occasions, religious events, and social functions. Parents are increasingly inclined toward purchasing fashionable, comfortable, and high-quality apparel that represents both traditional and modern fashion preferences.

Sports-inspired wear is gaining popularity, while simultaneously being aided by the changes in Vision 2030, by way of encouraging active lifestyles among children. Besides, the increasing power of international fashion trends and greater availability of high-end and affordable options have turned apparel into an increasingly attractive category across all income groups. International brands like Nike and Zara, along with local labels, are serving a range of fashion requirements-from everyday wear to occasion-specific clothing-thereby making apparel retain its lead position in the childrenswear market in Saudi Arabia.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel is retail offline occupies the largest market share, with around 85% of the Saudi Arabia childrenswear market. Even though e-commerce has grown rapidly, physical retail remains dominated because parents prefer to check fabric quality, size, and fit before buying children's clothes. Shopping in stores is also a deeply ingrained part of Saudi culture, often combined with family outings and mall visits. Leading retailers like Al Bandar Trading Co tap into this preference through wide networks of stores and frequent promotional campaigns that attract regular traffic in-store.

Retail offline continues to gain from its strong trust factor and personalized service experience, especially in premium and formal wear categories. A large number of parents still find in-store shopping more reliable and enjoyable, especially when buying for special occasions or fast-growing children. As retailers modernize stores and improve the shopping experience, retail offline is expected to maintain its leading position in the Saudi Arabia childrenswear market during the forecast period.

List of Companies Covered in Saudi Arabia Childrenswear Market

The companies listed below are highly influential in the Saudi Arabia childrenswear market, with a significant market share and a strong impact on industry developments.

- Al Othaim Group

- Nike Inc

- PVH Corp

- Al Bandar Trading Co

- Cenomi Retail

- M H Alshaya Co

- BMA International FZE

- Xiyin E Commerce FZE Pvt Ltd

- Beside Group

- AlShiaka Thobes

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Saudi Arabia Childrenswear Market Policies, Regulations, and Standards

4. Saudi Arabia Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Saudi Arabia Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Saudi Arabia Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Saudi Arabia Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Saudi Arabia Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Al Bandar Trading Co

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Cenomi Retail

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.M H Alshaya Co

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.BMA International FZE

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Xiyin E Commerce FZE Pvt Ltd

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Al Othaim Group

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Nike Inc

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.PVH Corp

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Beside Group

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. AlShiaka Thobes

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.