Poland Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), Price Category (Mass, Premium), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Dec 2025

- VI0648

- 130

-

Poland Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

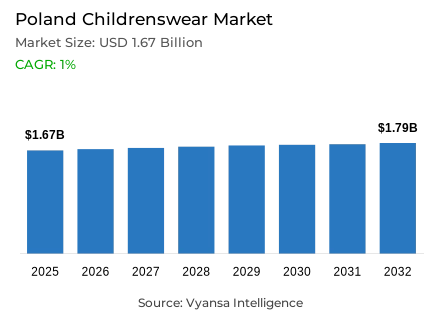

- Childrenswear in Poland is estimated at USD 1.67 billion.

- The market size is expected to grow to USD 1.79 billion by 2032.

- Market to register a cagr of around 1% during 2026-32.

- Product Type Shares

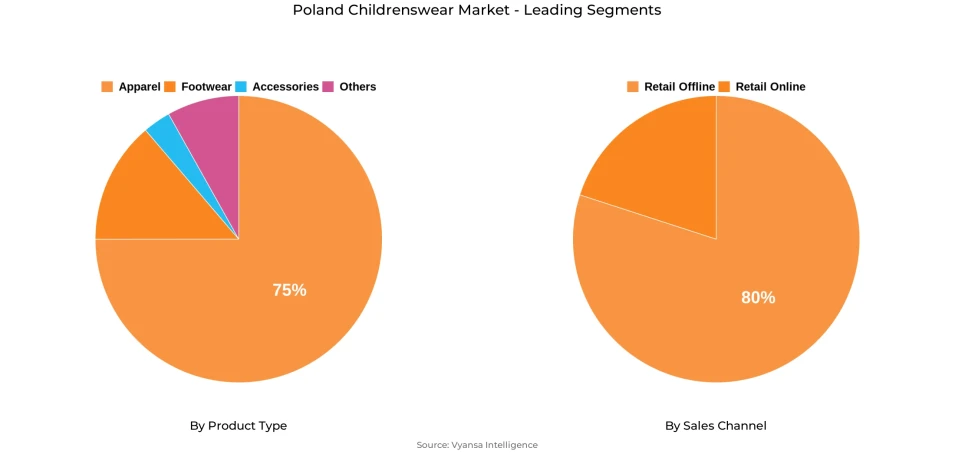

- Apparel grabbed market share of 75%.

- Competition

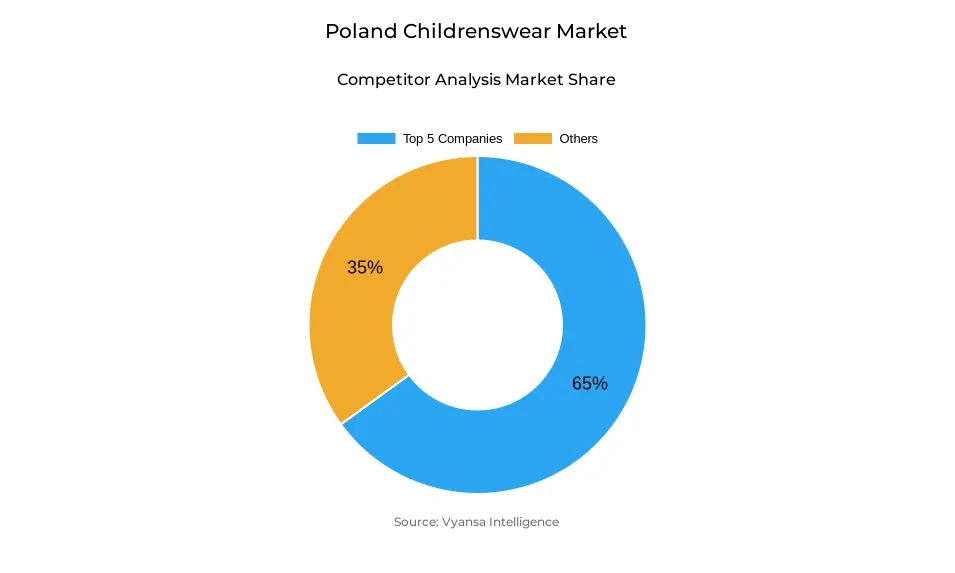

- More than 20 companies are actively engaged in producing childrenswear in Poland.

- Top 5 companies acquired around 65% of the market share.

- Komex SA; CDRL SA; C&A Polska Sp zoo; Pepco Poland Sp zoo; LPP SA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

Poland Childrenswear Market Outlook

The Poland childrenswear market is valued at approximately USD 1.67 billion in 2025 and is projected to reach USD 1.79 billion by 2032, growing at a CAGR of about 1% during 2026-2032. The growth of this market is supported by an increase in disposable incomes, government subsidies like the 800+ child benefit, and increased premiumization of clothing. While Poland’s birthrate continues to fall, parents are spending more per child, often opting for branded or organic garments that guarantee comfort and safety. The rise in demand for this category has driven apparel to hold nearly 75% of the total market share, indicating a core product category within childrenswear.

The market is seeing growing empowerment among children, who are increasingly influencing purchase decisions. Popular characters from TV and online platforms are shaping preferences, prompting brands like Pepco to expand licensed product lines. Parents, while mindful of budgets, still seek fashionable and character-themed designs, supporting the performance of established value retailers. Despite inflationary pressures, retail offline channels remain dominant, accounting for about 80% of market share, as Poland families continue to prefer in-store experiences where they can assess quality firsthand.

Another emerging feature of the market outlook is sustainability. Families are turning to second-hand clothes and resale platforms as affordable alternatives that are also greener. Parents are more open to buying previously owned apparel, a cultural shift from passing clothes down in families to organized resale. This is likely to augment and not replace traditional retail channels.

However, over the longer term, the declines seen in Poland child population will constrain overall volume growth. In order for brands to maintain profitability, the focus will likely be on premiumisation, sustainable materials, and character-driven designs. Ongoing government support, coupled with increasing value awareness among parents, should keep the market stable and ensure steady, if modest, growth over the forecast period.

Poland Childrenswear Market Growth Driver

Government Family Support Stimulates Spending on Childrenswear

Backed by the government's continued focus on welfare policies for its families, Poland childrenswear market is seeing steady growth. A major reason has been the 800+ child benefit program, greatly increasing disposable household income to spend on necessities like clothes for children. Families with increased financial security are considering higher-quality clothes, focusing on aspects such as safety, comfort, and design. This not only increases short-term consumption but also consolidates confidence in family-oriented spending.

Government backing through subsidies also remains consistent, meaning families are cushioned against inflationary pressures and continue to support demand for both premium and mid-range apparel. According to the data presented by the Statistics Poland, average household disposable income increased by 11.2% in 2024. Meanwhile, the Ministry of Family and Social Policy reported that more than PLN 62 billion was allocated under the 800+ child benefit scheme. Strong domestic consumption is underpinned by these supportive measures, which act as a key growth driver for the market.

Poland Childrenswear Market Trend

Children's Media Influence Drives Demand for Licensed Apparel

An emerging trend that is shaping Poland's childrenswear market is the fact that digital media now influence children's apparel choice. Exposure to online content has led them to now have more say in family purchasing decisions. The preferences are shifting towards licensed merchandise with characters from YouTube, streaming platforms, and animated series, as parents increasingly support their children in making independent fashion choices. This had prompted brands to expand collections that connect emotionally with young audiences.

The growing demand for character-themed apparel underscores how digital culture is transforming consumption patterns and marketing approaches. According to UNICEF Poland, 82% of children aged 5-14 engage with online media daily, while the Poland Economic Institute (PIE) estimates that licensed apparel represented 27% of total children’s clothing sales in 2024. These figures demonstrate how media exposure continues to redefine design priorities and brand strategies across the childrenswear segment.

Poland Childrenswear Market Opportunity

Increasing Popularity of Second-Hand Clothing Fosters Sustainable Growth

Growing acceptance of second-hand apparel is expected to create strong opportunities for sustainable growth in the childrenswear market in Poland. Indeed, parents increasingly embrace resale options due not only to their affordability but also to their practicality and environmental benefits. Online and offline resale platforms are increasingly developing from informal exchanges to structured retail channels that could offer quality assurance and development pertaining to circular fashion. This closely aligns with the wider sustainability goals and waste reduction directives in the EU.

Younger parents, especially, are increasingly aware of eco-friendly fashion consumption. According to Eurostat, second-hand apparel trade in Poland grew by 9.5% year-on-year in 2024, while the EEA states that reused textiles can reduce emissions by up to 40% compared with new production of the same material. This shift toward sustainable consumption creates opportunities for brands and digital resale platforms in building innovative, environmentally conscious business models in the childrenswear space.

Poland Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Footwear

- Accessories

- Others

The segment with highest market share under Product Type is apparel covering about 75% of the Poland childrenswear market. Apparel continues to dominate as parents prioritize buying comfortable, durable, and good-looking apparel for their children. Increasing disposable income and supportive government benefits such as the "800+" child subsidy have further strengthened this segment, with a rising preference for high-end and organic clothing.

Parents are more willing to invest in high-quality apparel, viewing it as an essential and long-lasting purchase. Children's increasing influence on the decision-making process in clothing purchases has also influenced this segment, with demand particularly evident for licensed characters popularized through media and cartoons. This trend has inspired companies to expand their product range and designs in tune with the latest fashion trends. In general, apparel is still the mainstay of children's wear demand in Poland, supported by a mix of practicality, fashion appeal, and rising household spending power.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel Retail offline, captures about 80% market share under the Sales Channel. In-store purchase is still preferred by parents due to various factors such as the ability to judge quality, fit, and comfort of the clothes before actual purchase. Key discount chains like Pepco are well-established in this format, and their wide network of stores and low prices have helped attract the price-conscious family. Such trust in physical stores remains stronger than ever, especially among those parents who give ample importance to the assurance of tangible quality for their clothes.

Despite the consistent double-digit growth of online channels, retail offline is in a leading position thanks to its convenience and accessibility, added to by frequent in-store promotions. The hands-on shopping experience, together with the widespread presence of brands across urban and rural regions, further cements its leading position. With brands continuing to expand their physical presence and adding affordable yet stylish collections, retail offline will remain the key distribution channel for childrenswear in Poland over the coming years.

List of Companies Covered in Poland Childrenswear Market

The companies listed below are highly influential in the Poland childrenswear market, with a significant market share and a strong impact on industry developments.

- Komex SA

- CDRL SA

- C&A Polska Sp zoo

- Pepco Poland Sp zoo

- LPP SA

- H&M Hennes & Mauritz Sp zoo

- Smyk SA

- Zara Polska Sp zoo

- adidas Poland Sp zoo

- Decathlon Sp zoo

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Poland Childrenswear Market Policies, Regulations, and Standards

4. Poland Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Poland Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Poland Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Poland Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Poland Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Pepco Poland Sp zoo

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.LPP SA

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.H&M Hennes & Mauritz Sp zoo

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Smyk SA

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Zara Polska Sp zoo

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Komex SA

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.CDRL SA

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.C&A Polska Sp zoo

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.adidas Poland Sp zoo

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Decathlon Sp zoo

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.