Philippines Wearable Electronics Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Activity Wearables, Smart Wearables), By Application (Healthcare, Entertainment, Industrial, Others), By Sales Channel (Offline, Online)

|

Major Players

|

Philippines Wearable Electronics Market Statistics, 2025

- Market Size Statistics

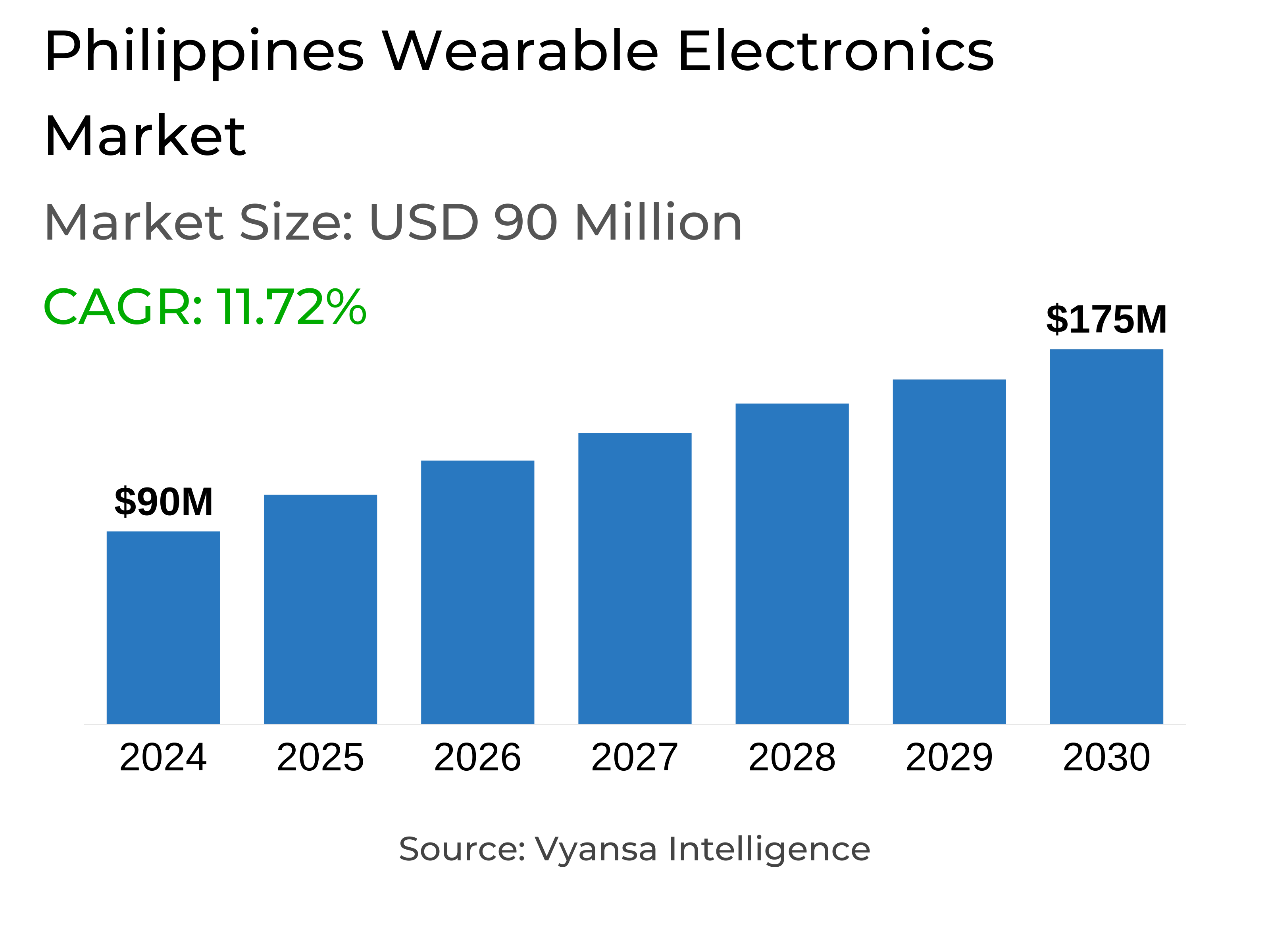

- Wearable Electronics in Philippines is estimated at $ 90 Million.

- The market size is expected to grow to $ 175 Million by 2030.

- Market to register a CAGR of around 11.72% during 2025-30.

- Product Shares

- Smart Wearables grabbed market share of 70%.

- Smart Wearables to witness a volume CAGR of around 10.43%.

- Competition

- More than 5 companies are actively engaged in producing Wearable Electronics in Philippines.

- Top 5 companies acquired 80% of the market share.

- Fossil Group Inc, Fitbit Inc, Alphabet Inc., Huawei Technologies, Xiaomi Corp etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 65% of the market.

Philippines Wearable Electronics Market Outlook

Philippines wearable electronics market will expand steadily between 2025 and 2030, spurred by growing health consciousness among consumers, particularly post-COVID-19 pandemic. Filipinos are increasingly concerned with monitoring their body and mind, thus boosting demand for wearables with functionalities such as heart rate monitoring, sleep tracking, and guided breathing. Activities like the World Mental Health Day by PMHA have further boosted this trend. Consequently, both high-end smartwatches and low-end activity bands are gaining increased popularity.

Low-cost activity wearables like Xiaomi Band and Huawei Band are still doing well because of their affordability and the basic health-tracking functions. Price-conscious Filipino consumers tend to go for these bands as their initial wearable, considering that they provide a lot of the features of pricier devices. Meanwhile, smart wearables continue to be the most vibrant category with sophisticated features like call management, social media, and emergency alert. Such products as the Apple Watch also provide forward-looking capabilities like car crash detection and ovulation tracking, which appeal to more technology-oriented consumers.

Nevertheless, economic sensitivity is a challenge. The premium pricing of the cost of living has been making consumers wary, although the demand for high-end smartwatches has been good. Companies such as Huawei and RealMe are luring consumers by providing smartwatches with basic features at more affordable prices. Sales have also been boosted through promotions on channels such as Lazada and Shopee with discounts and making flagship devices more available. Official retailers of companies such as Apple and Huawei are leveraging these platforms to drive greater reach and brand loyalty.

There are still challenges to overall growth, however. Contactless payment through smartwatches remains constrained by weak POS infrastructure, a large unbanked population, and cultural bias towards cash. These factors can limit the uptake of smartwatch payment capabilities, although health-centric features continue to drive market growth.

Philippines Wearable Electronics Market Challenge

Even with the growth of digital payment habits, contactless payments via smart watches are likely to meet major obstacles in the near future. One of the primary challenges lies in the absence of infrastructure, particularly in smaller towns and rural areas where the use of contactless-enabled Point of Sale (POS) is not a common practice. Although big cities have advanced to some extent, smaller merchants usually lack access to the required technology to accommodate such payments.

Furthermore, cash is still favored culturally in the Philippines. Many people are still unbanked, and it is hard for most people to access smart watch payment functions. Both security issues and a lack of awareness regarding these technologies hinder their use. For this reason, even top players such as Apple and Samsung have not had much success in the region with their NFC smart watches.

Philippines Wearable Electronics Market Opportunity

The increased emphasis on wellness and health is prompting businesses to incorporate sophisticated health-tracking capabilities into wearables. The trend can easily be seen in the Philippines, where consumer demand for personal health has picked up, particularly following the COVID-19 pandemic. Devices featuring capabilities such as blood oxygen tracking, ECG, and UV radiation exposure are increasingly being sought out as individuals become more health-aware.

Leading brands such as Apple and Fitbit are launching wearables capable of performing ECG tests and measuring blood oxygen, which is appealing to consumers wanting precise health information. Such advanced functionality is not only desirable for fitness users but also for individuals with certain health conditions who can monitor key signs on a regular basis. With increasing consumers looking for smart solutions to manage their health, this trend offers good potential for the Philippines Wearable Electronics Market in 2025–30.

Unlock Market Intelligence

Explore the market potential with our data-driven report

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 90 Million |

| USD Value 2030 | $ 175 Million |

| CAGR 2025-2030 | 11.72% |

| Largest Category | Smart Wearables segment leads with 70% market share |

| Top Challenges | Limited Adoption of Contactless Payments via Smart Watches |

| Top Opportunities | Rising Integration of Health-Monitoring Features to Boost Adoption |

| Key Players | Fossil Group Inc, Fitbit Inc, Alphabet Inc., Huawei Technologies, Xiaomi Corp, Apple Inc, Samsung Electronics, Garmin (Asia) Corp and Others. |

Unlock Market Intelligence

Explore the market potential with our data-driven report

Philippines Wearable Electronics Market Segmentation Analysis

The most popular segment in the Philippines Wearable Electronics Market for 2025–30 is smart wearables. Smart wearables dominate in retail volume because they offer many functions other than mere tracking. Smartwatches enable individuals to make and receive calls and messages, synchronize notifications, set reminders, establish alarms, and even function independently of a smartphone. With extra features and functionality such as emergency calls, ovulation tracking, and car collision detection, smart wearables are perceived to be worth more money. Their high cross-platform compatibility with smartphones and social media continues to fuel demand.

At the same time, activity wearables like the Xiaomi Band and Huawei Band are on the rise, particularly for price-conscious Filipino buyers. These types of products offer core health monitoring such as steps, sleep, and oxygen saturation at a low price. Most first-time buyers opt for these budget products, generating robust sales. Yet, even with this expansion, smart wearables continue to be the most dynamic and sought-after category.

Top Companies in Philippines Wearable Electronics Market

The top companies operating in the market include Fossil Group Inc, Fitbit Inc, Alphabet Inc., Huawei Technologies, Xiaomi Corp, Apple Inc, Samsung Electronics, Garmin (Asia) Corp, etc., are the top players operating in the Philippines Wearable Electronics Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Philippines Wearable Electronics Market Policies, Regulations, and Standards

4. Philippines Wearable Electronics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Philippines Wearable Electronics Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Unit Sold (Thousand Units)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Activity Wearables- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Activity Bands- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Activity Watch- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2.1. Analogue- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2.2. Digital- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Smart Wearables- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.1. Eye Wear- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.2. Body Wear- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Application

5.2.2.1. Healthcare- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Entertainment- Market Insights and Forecast 2020-2030, USD Million

5.2.2.3. Industrial- Market Insights and Forecast 2020-2030, USD Million

5.2.2.4. Others- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Sales Channel

5.2.3.1. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Philippines Activity Wearable Electronics Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Unit Sold (Thousand Units)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Application- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Philippines Smart Wearable Electronics Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Unit Sold (Thousand Units)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Application- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Huawei Technologies

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Xiaomi Corp

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Apple Inc

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Samsung Electronics

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Garmin (Asia) Corp

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Fossil Group Inc

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Fitbit Inc

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Alphabet Inc.

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Company 9

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Company 10

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Application |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.