Philippines Skin Care Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Body Care, Facial Care, Hand Care, Skin Care Sets/Kits), By Category (Premium, Mass), By Gender (Men, Women, Unisex), By End User (Adults, Teenagers, Children), By Packaging (Tubes, Bottles, Jars, Others), By Sales Channel (Online, Offline)

- FMCG

- Jan 2026

- VI0121

- 112

-

Philippines Skin Care Market Statistics, 2025

- Market Size Statistics

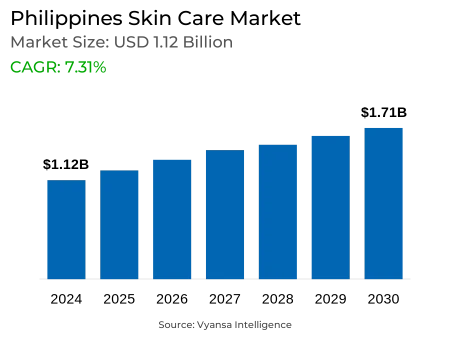

- Skin Care in Philippines is estimated at $ 1.12 Billion.

- The market size is expected to grow to $ 1.71 Billion by 2030.

- Market to register a CAGR of around 7.31% during 2025-30.

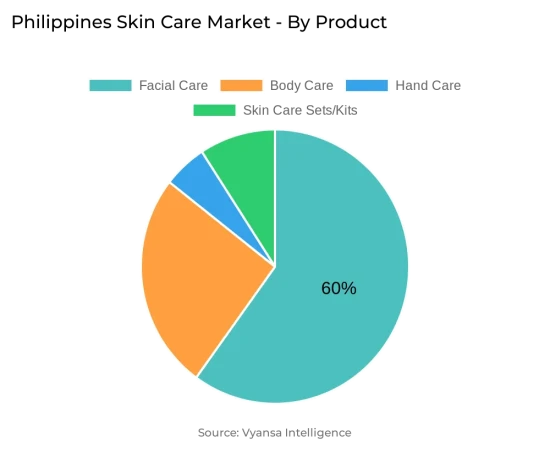

- Product Shares

- Facial Care grabbed market share of 60%.

- Competition

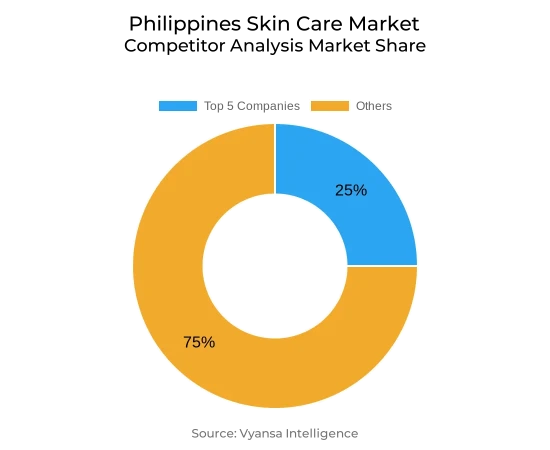

- More than 20 companies are actively engaged in producing Skin Care in Philippines.

- Top 5 companies acquired 25% of the market share.

- Avon Cosmetics Inc, UL Skin Sciences Inc, Intelligent Skin Care Inc, Procter & Gamble Philippines Inc, Unilever Philippines Inc etc., are few of the top companies.

- Sales Channel

- Retail Offline grabbed 85% of the market.

Philippines Skin Care Market Outlook

Philippines skin care market is anticipated to see steady growth between 2025 and 2030 on the back of rising consumer emphasis on personal looks and growth in social and active lifestyles. With Filipinos spending more time outdoors and socially interacting, concern about skin conditions like acne, dullness, and dryness has increased, causing greater use of facial as well as body care products. New formulations and focused solutions are also increasingly motivating consumers to utilize skin care in greater quantities.

Multinational corporations will continue to hold market leadership because of strong brand recall, extensive distribution channels, and ongoing investment in product development. Brands like Olay, Pond's, Garnier, and Cetaphil have established high consumer trust due to product innovation and successful promotional campaigns. Dermocosmetics will also continue to be popular because they are known for leaving noticeable improvements in skin health and endorsement by dermatologists.

Distribution channels like specialist health and beauty stores and online platforms are set to dominate future growth. The online platforms provide a vast product range, ease of access, with digital engagement tools such as games and tailored quizzes. As affiliate marketing continues to increase, online sales are also set to increase further.

Sustainability will dictate innovation in the future with brands introducing greener and refillable packaging. Counterfeit product issues could rise as packaging reduces. Nevertheless, increased awareness of ethical behavior and environmental considerations will compel brands to embrace transparent labeling and sustainable practices to serve customer expectations.

Philippines Skin Care Market Growth Driver

A better economic situation and rising disposable incomes are inducing Filipino consumers to spend more on skin care products. As both men and women focus increasingly on their personal appearance, more complicated skin care regimens are being adopted. Consumers are also being increasingly concerned with the need for protecting and caring for their skin, which is causing steady growth in demand for sophisticated products.

Global brands usually select the Philippines as the first country to pilot test their new products, with the English-speaking population easily explaining product benefits and conducting feedback gathering. Unilever, for example, launched its new innovative Pond's New York Bright Brilliance line in Watsons stores in the country. While Thailand is still the Southeast Asian manufacturing center, the Philippines is a prime market for launching and developing beauty innovations because of its responsive and well-informed clientele.

Philippines Skin Care Market Trend

While social media use remains strong in the Philippines, brands are keen to leverage digital content trends to drive skin care sales. Top formats such as "Get Ready With Me," "Story Time," and "Get Unready With Me" are being employed by influencers and regular users to demonstrate their skin care routines and interact with audiences. These trend-jacking measures, as per a survey, will become even larger a part of digital marketing campaigns with add-ons like a purchase link or educational content for skin care products.

As Filipino shoppers become more knowledge-based and purposeful in buying, their web searches are changing. Rather than broad generic product names such as moisturisers, they now contain specific ingredients and even levels of concentrations. Brands are thus set to take on clearer and more descriptive labelling in response to this trend, allowing quicker and more precise decision-making for shoppers seeking purpose-specific skin care solutions.

Philippines Skin Care Market Opportunity

The increasing consciousness about sustainability among Filipino consumers is also pushing brands to think creatively and innovate with sustainable solutions. Several players are now launching refillable packs made from recycled material to help minimize waste and provide cost-saving options. Sunnies Face Dream Cream, for example, is launched in refillable form as a pod made completely of post-consumer recycled plastic. This response is set to persist throughout 2025-30 as sustainability remains the major area of focus for consumers as well as brands.

Secondly, ethical branding is also becoming a significant differentiator. Businesses are associating their image with causes to gain consumer trust, like Avon's backing of breast cancer awareness through its charity foundation. It does pose potential risks of counterfeit, though, in an attempt to reduce packaging, like La Roche Posay's elimination of cardboard. The reduced visibility of packaging could potentially complicate it for consumers to identify the actual versus fake product, particularly in a market where parallel imports are common.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 1.12 Billion |

| USD Value 2030 | $ 1.71 Billion |

| CAGR 2025-2030 | 7.31% |

| Largest Category | Facial Care segment leads with 60% market share |

| Top Drivers | Rising Incomes and Skin Health Awareness Fueling Market Growth |

| Top Trends | Rising Influence of Social Media Trends on Consumer Buying Behaviour |

| Top Opportunities | Growing Emphasis on Sustainability Driving Innovation and Ethical Branding |

| Key Players | Avon Cosmetics Inc, UL Skin Sciences Inc, Intelligent Skin Care Inc, Procter & Gamble Philippines Inc, Unilever Philippines Inc, Splash Corp, Beiersdorf Philippines Inc, L'Oréal Philippines Inc, Genson Distribution Inc, Do Day Dream Co Ltd and Others. |

Philippines Skin Care Market Segmentation Analysis

The highest market share under the sales channel is in the Retail Offline segment, led mainly by the growing number of health and beauty specialist stores throughout the Philippines. These specialist stores are still the preferred point to buy skin care products due to their widening product offerings and availability of brand-exclusive products. Most skin care firms are placing their bets in these stores by launching appealing and creative fixtures that lead customers to the proper products. Filipino customers value the convenience and in-store service that these experts provide, which continues to drive the category's robust expansion.

Yet, Retail E-commerce is fast gaining momentum, boosted by rising digitalisation in the nation. Leading platforms such as Shopee and Lazada collaborated with international skin care brands to provide a broader range online. Consumers are guided by interactive tools like surveys and mini-games to determine the right product, while affiliate marketing keeps expanding. As per a survey, affiliates now get additional commissions for achieving certain targets, further propelling online skin care sales.

Top Companies in Philippines Skin Care Market

The top companies operating in the market include Avon Cosmetics Inc, UL Skin Sciences Inc, Intelligent Skin Care Inc, Procter & Gamble Philippines Inc, Unilever Philippines Inc, Splash Corp, Beiersdorf Philippines Inc, L'Oréal Philippines Inc, Genson Distribution Inc, Do Day Dream Co Ltd, etc., are the top players operating in the Philippines Skin Care Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Philippines Skin Care Market Policies, Regulations, and Standards

4. Philippines Skin Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Philippines Skin Care Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Firming Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. General Purpose Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Facial Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.1. Acne Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.2. Face Masks- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3. Facial Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.1. Liquid- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.2. Cream- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.3. Gel- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.4. Bar Cleansers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.3.5. Facial Cleansing Wipes- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4. Moisturisers and Treatments- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.1. Basic Moisturisers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.4.2. Anti-Agers- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.5. Lip Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2.6. Toners- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Hand Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Skin Care Sets/Kits- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Women- Market Insights and Forecast 2020-2030, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By End User

5.2.4.1. Adults- Market Insights and Forecast 2020-2030, USD Million

5.2.4.2. Teenagers- Market Insights and Forecast 2020-2030, USD Million

5.2.4.3. Children- Market Insights and Forecast 2020-2030, USD Million

5.2.5.By Packaging

5.2.5.1. Tubes- Market Insights and Forecast 2020-2030, USD Million

5.2.5.2. Bottles- Market Insights and Forecast 2020-2030, USD Million

5.2.5.3. Jars- Market Insights and Forecast 2020-2030, USD Million

5.2.5.4. Others- Market Insights and Forecast 2020-2030, USD Million

5.2.6.By Sales Channel

5.2.6.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.6.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Philippines Body Care Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

6.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

6.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Philippines Facial Care Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Category- Market Insights and Forecast 2020-2030, USD Million

7.2.3.By Gender- Market Insights and Forecast 2020-2030, USD Million

7.2.4.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.5.By Packaging- Market Insights and Forecast 2020-2030, USD Million

7.2.6.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Philippines Hand Care Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

8.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

8.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. Philippines Skin Care Sets/Kits Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Gender- Market Insights and Forecast 2020-2030, USD Million

9.2.3.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.4.By Packaging- Market Insights and Forecast 2020-2030, USD Million

9.2.5.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Procter & Gamble Philippines Inc

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Unilever Philippines Inc

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Splash Corp

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Beiersdorf Philippines Inc

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. L'Oréal Philippines Inc

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Avon Cosmetics Inc

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. UL Skin Sciences Inc

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Intelligent Skin Care Inc

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Genson Distribution Inc

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Do Day Dream Co Ltd

10.1.10.1.Business Description

10.1.10.2.Product Portfolio

10.1.10.3.Collaborations & Alliances

10.1.10.4.Recent Developments

10.1.10.5.Financial Details

10.1.10.6.Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Gender |

|

| By End User |

|

| By Packaging |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.