Philippines Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

Category (Costume Jewellery, Fine Jewellery), Type (Earrings, Neckwear, Rings, Wristwear, Other), Collection (Diamond, Non-Diamond), Material Type (Gold, Platinum, Metal Combination, Silver), Sales Channel (Retail Offline, Retail Online), End User (Men, Women)

|

Major Players

|

Philippines Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

- Jewellery in Philippines is estimated at USD 680 million in 2025.

- The market size is expected to grow to USD 785 million by 2032.

- Market to register a cagr of around 2.07% during 2026-32.

- Category Shares

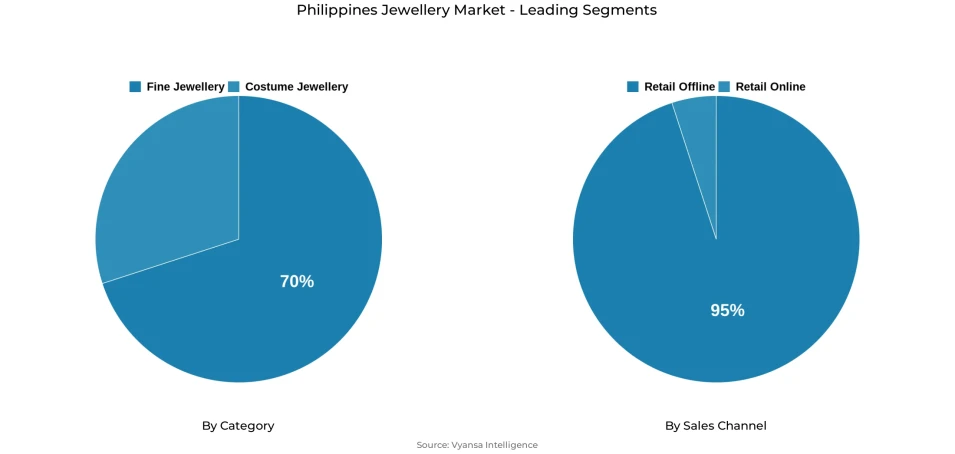

- Fine jewellery grabbed market share of 70%.

- Competition

- More than 15 companies are actively engaged in producing jewellery in Philippines.

- Top 5 companies acquired around 5% of the market share.

- Forever Agape & Glory Inc; Philippe Charriol International Ltd; Hermès International SCA; Tiffany & Co; Cie Financière Richemont SA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 95% of the market.

Philippines Jewellery Market Outlook

It Philippine jewellery market is estimated to grow steadily over the forcast period due to the changing end user preferences and the increased financial awareness. The market is expected to grow by an average of 2.07% per year to USD 680 million in 2025, and USD 785 million in 2032. The trends of affordability, including the rising popularity of lab-grown diamonds, and the cultural importance of fine jewellery within Philippine families will continue to influence demand.

The main driver will be fine jewellery, which has a dominant 70% market share. The purchase activity is likely to be maintained by cultural traditions, especially in the Philippine Chinese communities, where ceremonies like the Ting-hun strengthen the symbolic meaning of jewellery sets. With families focusing on high-quality jewellery to use at weddings and other significant occasions in their lives, jewellery houses are projected to launch bigger collections, customizable jewellery, and unique designs to meet this growing demand.

The next stage of market development will also be affected by digital engagement. The growing financial awareness of Philippine end users is giving them more confidence to buy fine jewellery via retail online platforms. Pawnshops and brands that use TikTok live selling, influencer-led appraisals, and secure retail online platforms are increasing accessibility and trust. These tendencies are likely to reinforce the online ecosystem, but offline retail will remain dominant with a 95% share, as mall-based authorized retailers will ensure authenticity and certification.

In the future, the mining market might see suggested fiscal changes that will stimulate more local investment in the production of raw materials. A streamlined mining regime would make it more competitive, cheaper to the miners and increase domestic supply, which would indirectly benefit jewellery makers. Together with the maintained cultural relevance, the increased digital presence, and the increased demand of ethical alternatives like lab-grown diamonds, the Philippine jewellery market is set to experience a stable and sustainable growth.

Philippines Jewellery Market Growth DriverRising Demand for Lab-Grown Diamonds Driven by Environmental & Cost Concerns

The growing use of lab-grown diamonds in the Philippines is being driven by environmental awareness and affordability. The Philippine Statistics Authority reports that 71% of adults in the Philippines are concerned about environmental degradation and resource extraction. In the meantime, according to the DENR, metal mining has been the source of 30% of all environmental complaints lodged in 2023, which supports the end user desire to have ethical alternatives. These issues make lab-grown diamonds attractive to younger end users who are more concerned about sustainability.

Demand is further strengthened by financial considerations. According to the Bangko Sentral ng Pilipinas, inflation of jewellery and other related items increased by 4.9% in 2024, pushing end users into the affordable luxury category. Brands like Pandora, Swarovski, Lucce, and Golcondia have lab-grown diamonds that offer affordable prices and high-quality certification, which promotes quick category growth.

Philippines Jewellery Market ChallengeFast-Changing Style Trends Driven by K-Pop & Maximalist Fashion

The changing style preferences are a major challenge to jewellery brands and they change very fast. According to the Philippine Statistics Authority, 59% of Philippine millennials are trendsetters of foreign pop-culture, such as Korean and Japanese fashion. Also, according to the Digital 2023 Report by DICT, 83% of Philippines aged 16 to 34 years use social media on a daily basis, which increases the speed at which jewellery trends spread. These forces create high but unstable demand of maximalist costume jewellery that is highly dependent on K-pop and P-pop idols.

Global pop culture fashion cycles can change rapidly and brands may struggle to keep up. As the maximalist designs of Tala and other local brands are flourishing, the demand needs to be sustained with high turnover of products, increased design expenses, and marketing efforts. This volatility is a threat to smaller players who have low production agility.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Philippines Jewellery Market TrendGrowing Use of Pawnshops & retail online for Fine Jewellery Access

The jewellery retail landscape is increasingly being reshaped by the rise of pawnshops and retail online platforms as alternative entry points for end users. According to Bangko Sentral ng Pilipinas, pawnshop transactions grew 18% in 2023 with more than 13,000 registered pawnshops across the country, indicating the rising end user interest in pre-owned jewellery. Moreover, the data provided by Philippine Statistics Authority shows that 42% of Philippines bought goods via retail online stores in 2024, nearly twice as many as before the pandemic. These changes make fine jewellery more affordable with reduced prices, live selling, and certified second-hand jewellery.

Big chains like Villarica and Cebuana Lhuillier use Tik Tok and influencer marketing to stimulate appraisal and purchase behavior, and online jewellery stores are increasingly using livestream promotions and discounts. With the growing popularity of digital purchasing, both low-end and high-end customers are integrating retail online platforms and pawnshops into their fine jewellery discovery journey.

Philippines Jewellery Market OpportunityCultural Significance of Fine Jewellery in Filipino Chinese Traditions

The cultural practices, particularly in the Philippine Chinese families, offer a good growth potential to the fine jewellery. Philippine Statistics Authority estimates that the Philippine Chinese population is about 1.3 to 1.5% of the population with much more per-capita expenditure on wedding and ceremony goods. Also, according to Philippine Statistics Authority household expenditure, wedding-related spending grew 11.2% in 2023, which stimulated the demand of symbolic fine jewellery. Rituals like the Ting-hun where the grooms offer fine jewellery sets strengthen the cultural need to have high-quality jewellery.

With the changing of these traditions, families are demanding bigger sets, custom designs, and quality materials. This opens up prospects of jewellery houses to increase bespoke, high-end collections, and culturally-themed sets to high-income families. As jewellery (especially fine jewellery) is an essential part of pre-wedding traditions, the category is likely to grow over the long term.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Philippines Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

Fine Jewellery represents the dominant segment under category classification, capturing 70% of the Philippines jewellery market. Fine jewellery maintains its leadership due to its cultural significance, especially among Philippine Chinese communities where traditions such as the Ting-hun ceremony require high-quality, symbolic pieces. This cultural importance ensures consistent demand for gold, diamonds, and premium sets used in weddings and other milestone events. The rising popularity of lab-grown diamonds has further strengthened the category by offering more affordable yet elegant options for younger end users.

From 2026 to 2032, fine jewellery is expected to retain its dominance as end users increasingly seek meaningful and high-value purchases. Greater financial literacy, improved retail transparency, and stronger availability of certified jewellery, both in malls and through reputable retail online channels, will support continued growth. Customisable designs, larger sets, and sustainable alternatives will further attract both traditional and modern buyers, reinforcing the category's long-term strength.

By Sales Channel

- Retail Offline

- Retail Online

Retail Offline channels constitute the dominant segment under sales channel classification, capturing 95% of the Philippines jewellery market. Shopping malls remain the primary purchasing environment due to strict regulations that ensure product authenticity, giving end users confidence when buying high-value items. Pawnshops and authorised jewellery retailers also play a major role, with pawnshops becoming increasingly influential through social media engagement and promotional live-selling activities.

Over the forcast period, reatil offline is expected to maintain its dominance, supported by cultural habits, trust-based purchasing, and the tactile nature of jewellery shopping where end users prefer to inspect items in person. While retail online channels are growing, especially for lab-grown and fashion pieces, fine jewellery purchases will continue to rely heavily on physical stores for verification, certification, and after-sales services. This continued reliance ensures retail offline remains the leading channel throughout the forecast period.

List of Companies Covered in Philippines Jewellery Market

The companies listed below are highly influential in the Philippines jewellery market, with a significant market share and a strong impact on industry developments.

- Forever Agape & Glory Inc

- Philippe Charriol International Ltd

- Hermès International SCA

- Tiffany & Co

- Cie Financière Richemont SA

- Pandora A/S

- LVMH Moët Hennessy Louis Vuitton SA

- H&M Hennes & Mauritz Inc

- Kering SA

- Avon Philippines Inc

Competitive Landscape

Lab-grown diamond specialists such as Lucce and Golcondia strengthened their position in the Philippines in 2025, capitalising on growing consumer interest in ethical, sustainable, and affordable alternatives to mined diamonds. Global brands like Pandora and Swarovski also expanded their influence through accessible lab-grown collections that resonate strongly with younger buyers. In the costume jewellery space, maximalist and K-pop-inspired designs fuelled growth for local brands such as Tala, which appealed to millennials and the LGBTQ+ community seeking expressive, statement pieces. Pawnshop chains including Villarica and Cebuana Lhuillier reshaped fine jewellery engagement by leveraging TikTok influencers and live appraisals, while fine jewellery retailers increased their presence on retail online platforms through live-selling and discount-driven campaigns. This mix of global brands, local designers, and digitally active retailers contributed to a highly dynamic and diversified competitive environment.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Philippines Jewellery Market Policies, Regulations, and Standards

4. Philippines Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Philippines Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Philippines Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Philippines Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Tiffany & Co

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Richemont SA, Cie Financière

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Pandora A/S

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.LVMH Moët Hennessy Louis Vuitton SA

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.H&M Hennes & Mauritz Inc

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Forever Agape & Glory Inc

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Philippe Charriol International Ltd

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Hermès International SCA

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Kering SA

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Avon Philippines Inc

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.