Philippines Consumer Lending Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Outstanding Balance, Gross Lending), By Loan Type (Personal Loans, Unsecured Personal Loans, Secured Personal Loans, Auto Loans, Mortgages / Home Loans, Credit Card Loans, Student Loans), By Interest Rate Type (Fixed Interest Rate Loans, Floating / Variable Interest Rate Loans), By Payment Method (Direct Deposit (Salary Transfers, Government Benefits, Tax Refunds), Debit Card, Credit Card, Mobile Wallet / UPI, Cheque), By Borrower Type (Individual Borrowers, Joint Borrowers), By Distribution Channel (Bank Branches, Online / Digital Lending Platforms, Non-Banking Financial Institutions (NBFCs)), By Collateral Type (Secured Loans (Vehicle Collateral, Property Collateral), Unsecured Loans), By Age Group (Youth (up to 24 years), Young Adults (25-34 years), Adults (35-54 years), Pre-Retirement (55-64 years), Seniors (65+ years))

- ICT

- Feb 2026

- VI0899

- 120

-

Philippines Consumer Lending Market Statistics and Insights, 2026

- Market Size Statistics

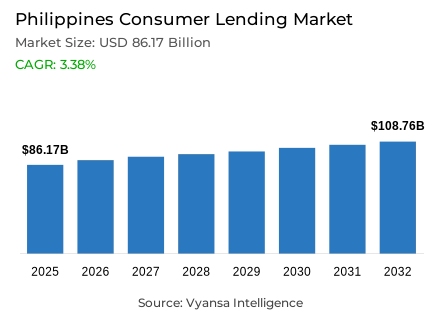

- Consumer lending in Philippines outstanding balance is estimated at USD 86.17 billion and gross lending is estimated at USD 53.68 billion in 2025.

- An outstanding balance market size is expected to grow to USD 108.76 billion and gross lending USD 74.8 billion by 2032.

- Market to register an outstanding balance cagr of around 3.38% and gross lending cagr of around 4.85% during 2026-32.

- Loan Type Shares

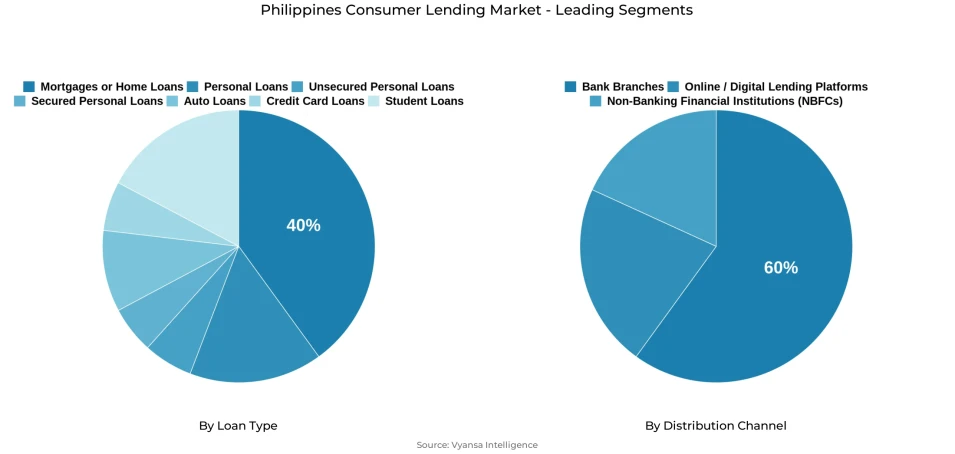

- Mortgages / home loans grabbed market share of 40%.

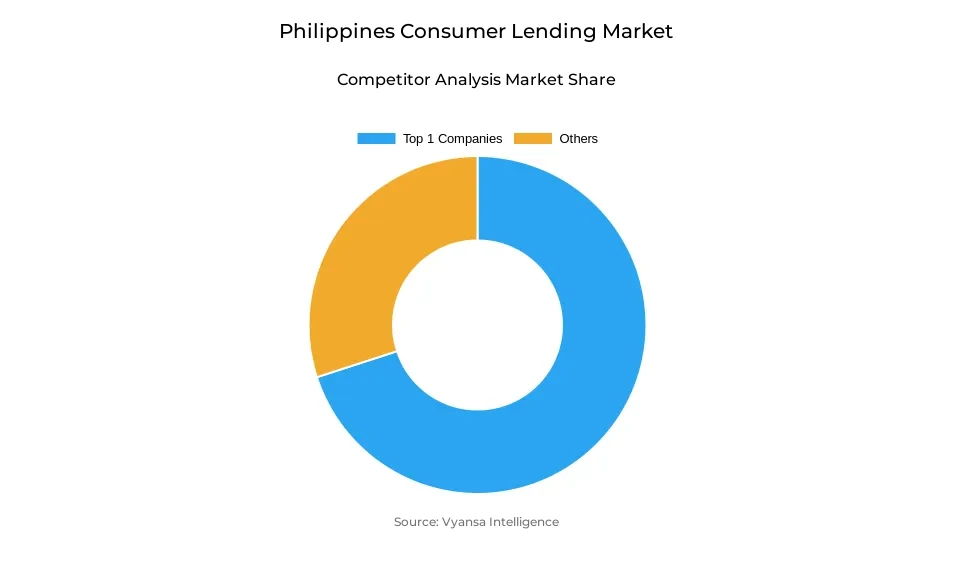

- Competition

- Consumer lending in Philippines is currently being catered to by more than 15 companies.

- Top 10 companies acquired the maximum share of the market.

- EastWest Banking Corp; Security Bank Corp; Philippine National Bank (PNB); BDO Unibank Inc; Bank of the Philippine Islands (BPI) etc., are few of the top companies.

- Distribution Channel

- Bank branches grabbed 60% of the market.

Philippines Consumer Lending Market Outlook

The Philippine consumer lending market is forecast to grow at a moderate pace over the forcat period, due to a strengthening economy and increased access to lending. The volume outstanding will be on the rise, from a value of USD 86.17 billion in 2025 to USD 108.76 billion by 2032, growing at a CAGR of 3.38%. Gross lending is forecast to grow even further, from USD 53.68 billion to USD 74.8 billion, at a CAGR of 4.85%, due to strong demand for automobile, personal, and credit card lending. A stabilized workforce and keeping inflation low has encouraged more Filipinos to take on debt for consumption upgrades and investments.

Digital transformation will be an important factor in lending expansion. The availability of digital lending platforms such as GCash, Maya, BillEase, and TendoPay will be of great importance and facilitate lending, especially catering to the young who have not previously availed themselves of any financial services. Digital lending firms will continue to gain traction with the use of micro-lending, BNPL, and AI-enabled loan approval facilities. Legacy banks, including BPI and UnionBank, will continue to enhance their digital platforms to compete effectively, hence increasing financial inclusion.

Home and mortgage lending is also set to retain its position as one of the main drivers of the sector due to the availability of affordable housing finance programs through Pag-IBIG and the increasing interests in owning homes amid the escalating cost of building the same. Mortgage lending will also retain the highest proportion of the loan type sector during the forecasted period, accounting for 40% of the sector.

Bank branches are expected to remain the most prominent distribution channels, with a 60% market share due to the trust and confidence reposed in conventional banks when it comes to home and car loans, even with the growth of online lending. Overall, the consumer lending market of the Philippines is expected to be boosted by the increasing financial literacy and the facilitation by the government.

Philippines Consumer Lending Market Growth DriverImproving Economic Indicators Strengthening Lending Confidence

The overall improvement in economic performance boosted consumer lending sentiments in the Philippines in 2024. The Philippine Statistics Authority declared that it had registered an unemployment rate at only 3.1% in December last year, the lowest in two decades since 2005. Moreover, inflation has declined in Q1 2024 to only 3.3% from the original statement of 3.9%, thereby providing better conditions for consumers to take credit with ease.

Increased affordability factors in the lending products of our choice led to increased borrowings by households. Credit card, automobile, and consumer lending increased as people took advantage of the favorable economic conditions. The favorable economic conditions were driven by the low unemployment rate of 3.1% and tame inflation rates of 3.3%, which maintained favorable consumer sentiment in the year 2024.

Philippines Consumer Lending Market ChallengeLow Financial Literacy and Dependence on Informal Credit

Limited financial literacy continues to constrain the expansion of formal consumer lending in the Philippines, even though its exact scale is difficult to quantify. World Bank 25% financial literacy cannot be verified from recent updates, as previous 2015 World Bank figures indicated 59% of Filipinos in the country are planners of their expenditure, significantly different from the claimed 25% financial literacy. Whatever the extent of the problem, it leads to overdependence on alternative sources of funds, including loans from relatives and online lending schemes, because transparency and clear objectives are non-existent in these modes of raising funds, placing their clients under high potential financial risk.

This makes the challenge restrict the effectiveness of digital lending innovation despite the swift expansion of BNPL and microloans. Many still remain wary of tapping into formal lending services due to lack of understanding of lending procedures and fears of hidden charges. Without concrete baseline information about the prevalence of financial illiteracy, policymakers cannot target interventions effectively. Indicative financial illiteracy figures can be misleading in shaping interventions and can overestimate or underestimate the true extent of the knowledge gap that restricts formal lending services.

Philippines Consumer Lending Market TrendRapid Expansion of Digital Lending Platforms

The consumer credit landscape in the Philippines is undergoing structural change, driven by the rapid expansion of digital lending. BillEase, GCash, Maya Bank, and other online lenders have been able to provide considerable easy access to short-term loans and BNPL services, especially to the unbanked. But the connectivity rate statistics are to be made correct the mobile phone penetration rate was 99.3% as of early 2024, and internet penetration was 73.6%, which helps support the development of the digital lending market. Online lenders rely on AI-powered credit scoring and automatic approvals, making lending much more convenient than traditional banking.

The BNPL and microloans offer solutions for the increasing demands from the general public for flexible and palatable credit terms that suit the current demands. The platforms show a lot of potential in catering to the needs of the younger generation who opt for clearer repayment terms, compared to the revolving payments that usually come with credit cards. The digital payment service in the country reached a staggering 57.4% in terms of monthly retail payments in volume and also accounted for 59% in terms of transaction value in the year 2024, reaching above the targeted performance level of 52–54%.

Philippines Consumer Lending Market OpportunityExpanding Demand for Affordable Housing Through Pag-IBIG

Affordable housing finance is a significant opportunity due to strong demand as well as government-supported loan programs. Pag-IBIG Fund is described as the most prominent housing financier within the Philippines, as it provides attractive terms of interest, greater amounts of money to be repaid, as well as affordable prices during increased building costs to enable middle-class individuals to buy housing. It is not possible to confirm the exact 2023 data PHP126.04 Billion released money, affecting 96,848 members because it is not available in open government records, even though Pag-IBIG is identified as the major driver of affordable housing finance.

The initiatives of the government in enhancing accessibility in the provision of housing continue to support this. Since the number of Filipinos is working towards obtaining long-term stability in their homes, the entry of financial institutions offering additional home financing choices will be a welcome support within the framework of Pag-IBIG. Although program performance is not ascertained due to a lack of verification of specific program numbers, program demand in affordable housing is a very promising expansion choice.

Philippines Consumer Lending Market Segmentation Analysis

By Loan Type

- Personal Loans

- Unsecured Personal Loans

- Secured Personal Loans

- Auto Loans

- Mortgages / Home Loans

- Credit Card Loans

- Student Loans

The segment with the highest share under the Loan Type is Mortgages / Home Loans, which dominated the market with a share of 40%. This is aided by the increasing demand for affordable housing and the significant part played by Pag-IBIG Fund in offering home loans for this purpose. The attractive rates of interest and repayment terms of Pag-IBIG continue to make homeownership possible for both local and foreign Filipino workers, and as such, mortgage products lead the market through the forecast period.

Increasing property prices and the growth of government-backed home loan programs mean that home loans are poised to continue their steady expansion. Although consumer loans such as auto loans, consumer durables, and credit card loans are expected to be significant in the future, mortgage loans are expected to lead as their term and quantum are substantial. Digitalization in the lending process will also increase the accessibility of mortgage loans and help it lead in the year 2032

By Distribution Channel

- Bank Branches

- Online / Digital Lending Platforms

- Non-Banking Financial Institutions (NBFCs)

The segment with the largest market share under the Distribution Channel is Bank Branches, which contributed 60% to the total market. More than ever, the conventional bank stands as the channel of choice in large loan amounts, particularly home loans, as well as personal structurer loans, where physical validation of loan qualification undergoes immense respect from the public. Against the consistent adoption of digital, the Filipino remains set on legitimate banks in large financial undertakings.

During the forcastperiod, bank branches will continue dominating as they offer not only personal advisory services, along with enhanced online platforms that will simplify loan processing. Even though online lending providers, such as GCash, Maya, and BillEase, will offer greater access to small loan amounts and microloans offered on a BNPL terms basis, high-value lending will still be conducted by banks.

List of Companies Covered in Philippines Consumer Lending Market

The companies associated with the Philippines consumer lending market are outlined below.

- EastWest Banking Corp

- Security Bank Corp

- Philippine National Bank (PNB)

- BDO Unibank Inc

- Bank of the Philippine Islands (BPI)

- Metropolitan Bank & Trust Co (Metrobank / MBTC)

- Union Bank of the Philippines Inc

- Rizal Commercial Banking Corp (RCBC)

- CIMB Bank Philippines Inc

- G-Xchange Inc (GCash – GCredit & GLoan)

Competitive Landscape

The Philippines consumer lending market is increasingly competitive, led by a mix of traditional banks, digital banks, fintech platforms, and government-backed institutions. Established banks such as BPI and UnionBank maintain strong positions by expanding digital lending and credit card services. Digital players like GCash, BillEase, Maya Bank, and TendoPay are rapidly gaining share through mobile-first platforms, BNPL services, and fast approval processes that appeal to younger and underserved borrowers. Government-backed Pag-IBIG Fund remains a key player in housing finance, supporting affordable home ownership. Strong regulatory oversight by the BSP and SEC has also reshaped competition, favouring licensed, transparent lenders while pushing out unregulated and predatory digital lending platforms.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Philippines Consumer Lending Market Policies, Regulations, and Standards

4. Philippines Consumer Lending Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Philippines Consumer Lending Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Outstanding Balance- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Gross Lending- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Loan Type

5.2.2.1. Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Unsecured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Secured Personal Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Auto Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Mortgages / Home Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Credit Card Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Student Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Interest Rate Type

5.2.3.1. Fixed Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Floating / Variable Interest Rate Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Payment Method

5.2.4.1. Direct Deposit- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.1. Salary Transfers- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.2. Government Benefits- Market Insights and Forecast 2022-2032, USD Million

5.2.4.1.3. Tax Refunds- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Debit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Credit Card- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Mobile Wallet / UPI- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Cheque- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Borrower Type

5.2.5.1. Individual Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Joint Borrowers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Distribution Channel

5.2.6.1. Bank Branches- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Online / Digital Lending Platforms- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Non-Banking Financial Institutions (NBFCs)- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Collateral Type

5.2.7.1. Secured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.1. Vehicle Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.1.2. Property Collateral- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Unsecured Loans- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Age Group

5.2.8.1. Youth (up to 24 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Young Adults (25-34 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.3. Adults (35-54 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.4. Pre-Retirement (55-64 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.8.5. Seniors (65+ years)- Market Insights and Forecast 2022-2032, USD Million

5.2.9.By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. Philippines Outstanding Balance Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7. Philippines Gross Lending Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Loan Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Interest Rate Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Payment Method- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Borrower Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Distribution Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Collateral Type- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.BDO Unibank Inc

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Bank of the Philippine Islands (BPI)

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Metrobank (MBTC)

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Union Bank of the Philippines

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Rizal Commercial Banking Corp (RCBC)

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Security Bank Corp

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.EastWest Banking Corp

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Philippine National Bank (PNB)

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.GCash / G-Xchange (GCredit & GLoan)

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Maya Bank

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Loan Type |

|

| By Interest Rate Type |

|

| By Payment Method |

|

| By Borrower Type |

|

| By Distribution Channel |

|

| By Collateral Type |

|

| By Age Group |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.