Philippines Baby and Child-Specific Products Market Report: Trends, Growth and Forecast (2026-2032)

Product (Hair Care, Skin Care, Sun Care, Toiletries, Baby Wipes, Diapers, Medicated), Category (Premium, Mass), Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0630

- 125

-

Philippines Baby and Child-Specific Products Market Statistics and Insights, 2026

- Market Size Statistics

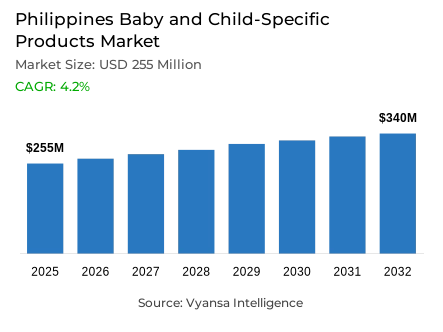

- Baby and child-specific products in Philippines is estimated at USD 255 million.

- The market size is expected to grow to USD 340 million by 2032.

- Market to register a cagr of around 4.2% during 2026-32.

- Product Shares

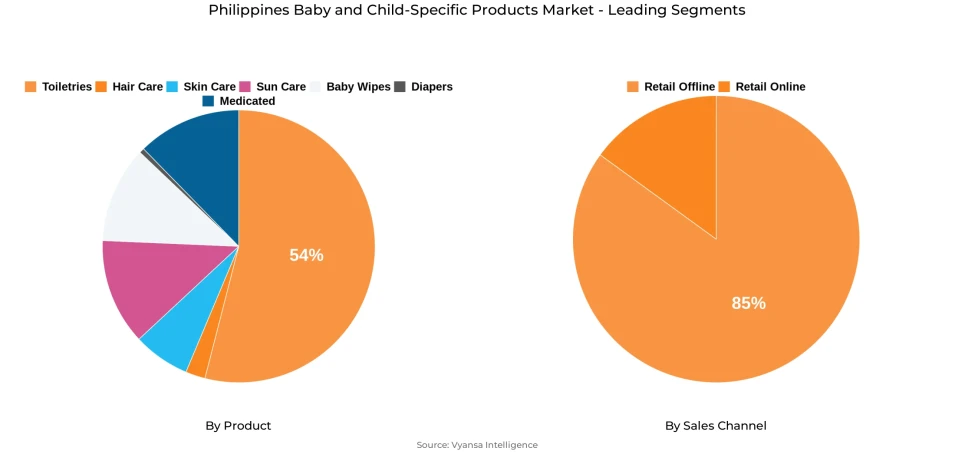

- Toiletries grabbed market share of 54%.

- Competition

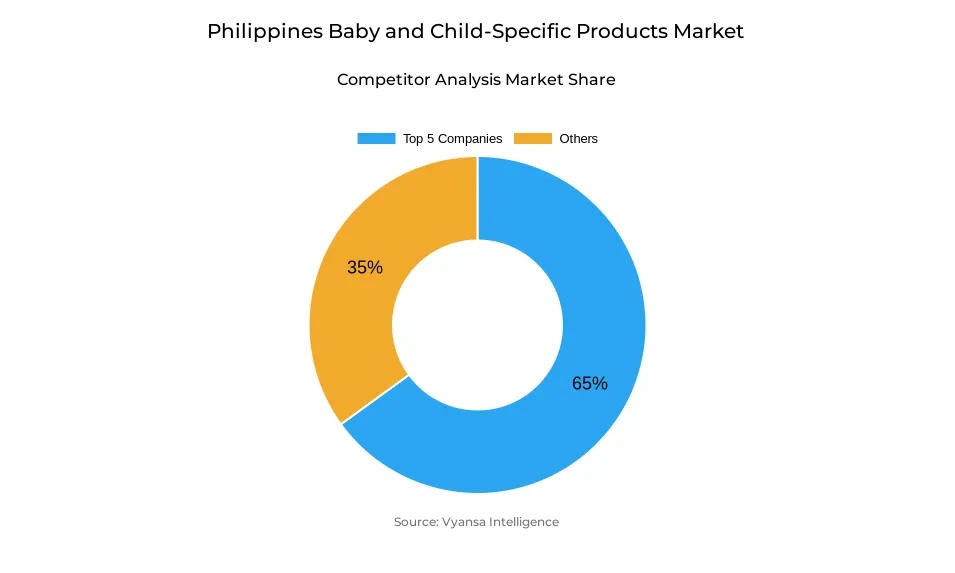

- More than 20 companies are actively engaged in producing baby and child-specific products in Philippines.

- Top 5 companies acquired around 65% of the market share.

- Colgate-Palmolive Philippines Inc, Beiersdorf Philippines Inc, Sanofi-Aventis Philippines Inc, Johnson & Johnson (Philippines) Inc, Unilever Philippines Inc etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Philippines Baby and Child-Specific Products Market Outlook

The Philippines baby and child-specific products market is estimated at $255 million in 2025 and is projected to reach $340 million by 2032, registering a CAGR of around 4.2% during 2026–32. The market continues to benefit from the country strong family orientation, which supports relatively high birth rates. Baby and child-specific toiletries, holding a 54% market share, remain the largest category as parents focus on maintaining hygiene, freshness, and rash-free skin for their children, particularly in the country’s tropical climate. Rising parental health awareness is also driving demand for safe, gentle, and natural products that are suitable for babies’ sensitive skin.

Retail offline dominate with about 85%, with supermarkets at the forefront, leveraging convenience and variety. Beauty specialist stores and pharmacies are also emerging as alternatives, providing professional consultations, their own promotions, and expanded range of premium products. Retail Retail Online is developing at steady trajectory, with the impetus of online marketplace platforms such as Lazada's LazMom and Shopee's Mom's Club, better promotions, and services with a convenience focus, although the share remains less than retail offline.

Johnson & Johnson will remain the leader in the Philippines, benefiting from high brand loyalty as well as consumer perception of safety and reliability. Dermocosmetics and natural brands, like Cetaphil Baby, will rise as parents are increasingly gravitating toward hypoallergenic, organic, and dermatologist-tested products. These brands are also increasing access through offline and online channels and formats that encourage trial (e.g., travel-size, sample), while helping the consumer feel confident in the quality.

While opportunities for growth are there in multi-functional products and organic offerings, parents are increasingly looking for products that can save time, offer convenience, and provide health benefits, especially for first-time parents. Specialist retailers are likely to expand both offline and online with a greater choice of premium and natural baby products. Continued marketing, promotions, and education of product benefits will also further support category growth and encourage end users to invest more in the health and wellbeing of their children.

Philippines Baby and Child-Specific Products Market Growth Driver

Cultural Emphasis on Child Care

The cultural long-standing emphasis on family and child well-being contributes to the consumption of baby and child-related products in the Philippines. Filipino parents, whom are challenged by family traditions and/or religious beliefs, make hygiene and cleanliness a daily part of their child's routine. Mothers routinely ensure care for their children by keeping children fresh and clean to avoid rashes throughout the day. This behavior exacerbated by the country's tropical climate wherein the use of mild and gentle formula personal care products, and frequent baths were typical protocols to managing perspiration and sensitive skin.

This cultural emphasis creates lasting relationships and loyalties to the baby care brands that have been used, even to subsequent generations. Despite variations of baby care products recently entering the category, parents are still intentional about safe, effective, and gentle products for their baby children. Overall, family and related hygiene protocols continue to drive the growth and consumption of products developed and produced for the child and baby market.

Philippines Baby and Child-Specific Products Market Trend

Shift to Organic and Natural Baby Products

The shift toward organic and natural products for baby care is quite powerful, fueled by the growing awareness of Philippines parents regarding product safety and ingredient transparency. Parents are becoming more aware of exposing their children's sensitive skin to chemicals and artificial additives, and they have adapted every day to using products containing natural oils, vitamins, and plant extracts. This is in line with a broader trend towards healthy living and gentle skincare that resonates with parents' values of safety and gentleness.

Brands are also reformulating to offer less product with artificial ingredients, and again, a nod to natural ingredients such as milk, rice, almond, and calendula oils. This even extends to packaging and sustainability as priorities consistent with parents' preferences for greener and eco-friendly options. As the organic and natural baby category continues to grow, changing expectations will continue to improve trust and loyalty for Philippines families.

Philippines Baby and Child-Specific Products Market Opportunity

Increasing demand for multifunctional baby care products

The demand for multi-functional products in baby care is thus expected to create significant growth opportunities in the Philippines over the coming years. With increasing living costs, Philippines parents will continuously search for products that can offer them multiple benefits at once, whether in a combined shampoo and body wash formula or a lotion offering hydration and protection. These versatile solutions help families save time and money while being as high quality and gentle for children's daily needs as their premium counterparts.

The manufacturers that innovate and develop efficient, all-in-one products stand to gain a competitive advantage. This focus on convenience, value, and effectiveness will drive brands toward expanding their portfolios and introducing smart formulations relevant for modern family lifestyles. This increasing trend for multifunctional products will create new opportunities for differentiation, which ensures further market growth with increased end users involvement in the coming years.

Philippines Baby and Child-Specific Products Market Segmentation Analysis

By Product

- Hair Care

- Skin Care

- Sun Care

- Toiletries

- Baby Wipes

- Diapers

- Medicated

The segment with highest market share under Product is Toiletries, with about 54% of market share. This category is significant because it represents everyday personal hygiene essentials, such as washes, lotions, powders, and oils. Parents, especially, mothers are more concerned with keeping babies and children clean, comfortable, and rash-free, particularly given the tropical climate and warmer temperatures in the Philippines.

There are other emerging demands for product formulations in this category, such as hypo-allergenic, gentle, or organic. Multi-functional product innovations as well as foaming pump dispensers, and scented oils have increased convenience and care. These designed qualities allow parents to make repeat purchases. Brands that instill confidence through safety, natural ingredient, and high efficacy claims continue to build end user trust and maintain their products as a prominent category in the market.

By Sales Channel

- Retail Online

- Retail Offline

The segment with highest market share under sales channel is offline retail remains the most trusted and predominantly used channel to purchase baby- and child-specific products, with a share of around 85%. Supermarkets play a key role in this channel, as they primarily serve as a source of convenience in purchasing baby care and grocery items.

Health and beauty specialist retailers, for example Watsons, also serve an important role, as they can educate and offer loyalty programs and other promotions that can be valuable to mothers of baby- or child-specific products. Pharmacies are increasingly important for skin and sun care products, while specialist baby retailers carry a broader range of premium and organic offerings. Overall, Offline Retail and its sub-segments are the most trusted and utilized channels to purchase baby- and child-specific products in the Philippines.

Top Companies in Philippines Baby and Child-Specific Products Market

The top companies operating in the market include Colgate-Palmolive Philippines Inc, Beiersdorf Philippines Inc, Sanofi-Aventis Philippines Inc, Johnson & Johnson (Philippines) Inc, Unilever Philippines Inc, Tupperware Brands Philippines Inc, Galderma Philippines Inc, Personal Collection Direct Selling Inc, Minton Multiresources Inc, Pigeon Corp, etc., are the top players operating in the Philippines baby and child-specific products market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Philippines Baby and Child-Specific Product Market Policies, Regulations, and Standards

4. Philippines Baby and Child-Specific Product Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Philippines Baby and Child-Specific Product Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Hair Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Skin Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Sun Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Toiletries- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Baby Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Diapers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Medicated- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Category

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Philippines Baby and Child-Specific Hair Care Product Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Philippines Baby and Child-Specific Skin Care Product Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Philippines Baby and Child-Specific Sun Care Product Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Philippines Baby and Child-Specific Toiletries Product Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Philippines Baby and Child-Specific Baby Wipes Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Philippines Baby and Child-Specific Diapers Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Philippines Baby and Child-Specific Medicated Product Market Statistics, 2022-2032F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. Johnson & Johnson (Philippines) Inc

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Unilever Philippines Inc

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Tupperware Brands Philippines Inc

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Galderma Philippines Inc

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Personal Collection Direct Selling Inc

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Colgate-Palmolive Philippines Inc

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Beiersdorf Philippines Inc

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Sanofi-Aventis Philippines Inc

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Minton Multiresources Inc

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Pigeon Corp

13.1.10.1.Business Description

13.1.10.2.Product Portfolio

13.1.10.3.Collaborations & Alliances

13.1.10.4.Recent Developments

13.1.10.5.Financial Details

13.1.10.6.Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.