Norway Baby and Child-Specific Products Market Report: Trends, Growth and Forecast (2026-2032)

By Product (Hair Care, Skin Care, Sun Care, Toiletries, Baby Wipes, Diapers, Medicated), By Category (Premium, Mass), By Sales Channel (Retail Online, Retail Offline)

|

Major Players

|

Norway Baby and Child-Specific Products Market Statistics and Insights, 2026

- Market Size Statistics

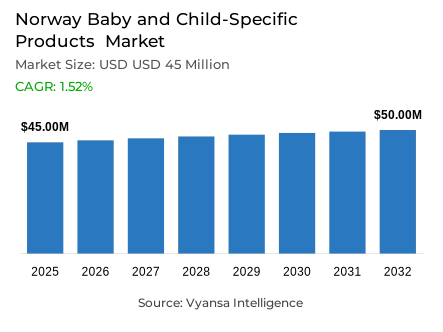

- Baby and child-specific products in Norway is estimated at USD 45 million in 2025.

- The market size is expected to grow to USD 50 million by 2032.

- Market to register a cagr of around 1.52% during 2026-32.

- Product Shares

- Baby wipes grabbed market share of 55%.

- Competition

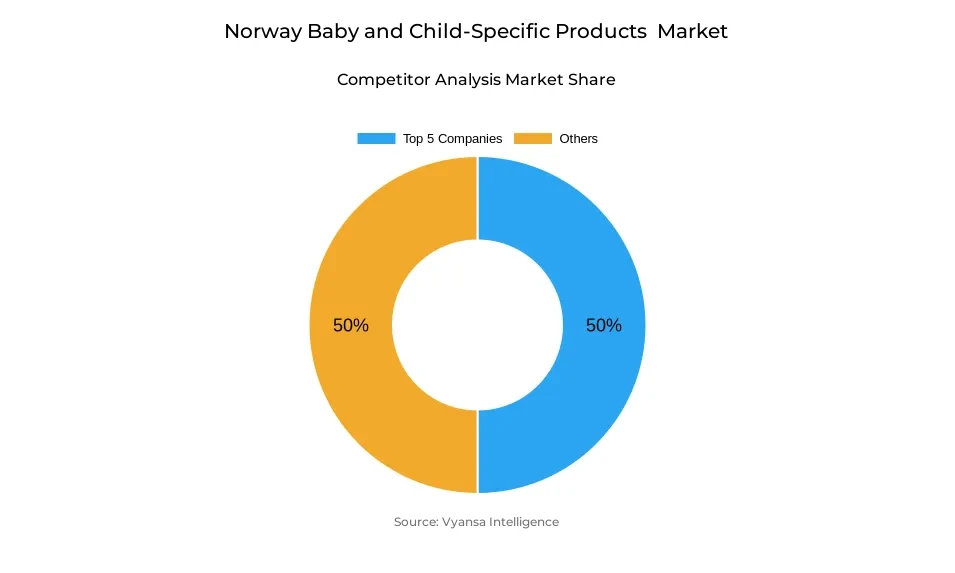

- More than 20 companies are actively engaged in producing baby and child-specific products in Norway.

- Top 5 companies acquired around 50% of the market share.

- ACO Hud Norge AS; L'Oréal Norge AS; Apotek 1 Norge AS; Essity AS; Norgesgruppen ASA etc., are few of the top companies.

- Sales Channel

- Retail offline continues to dominate the market.

Norway Baby and Child-Specific Products Market Outlook

Norway Baby and child-specific products market is projected to be around USD 45 million in 2025 and reach around USD 50 million by 2032, with a moderate CAGR of approximately 1.52% from 2026 to 2032. The growth of this market also represents Norway’s affection for simplicity and a less-is-more approach when caring for a new-born infant. Baby wipes lead sales at a projected 55%, and other products like skincare and haircare products have restricted growth as a result of end user conservatism and recommendations by health organizations to use less of these products.

The retail offlineing channels are still the key sales channels in the retailing scenario of the Norwegian market. The pharmacies are becoming equally important as trusted distribution channels for dermatologically tested and certified sun care products. Norwegian parents are linking pharmacies to safe products and expertise, which strengthens their preference for the same. Online pharmacies like Apotera and Farmasiet are gaining popularity among the younger generation of parents who are attracted to convenience and professional information about the products.

The forthcoming period is also expected to see steady but modest growth, which will be impacted by declining birth rates and deep-seated end user preferences that do not promote the excessive use of products. The premium trend will continue to remain channel- and product-specific, such as in sun care products, which emphasize protection and efficacy justifying their price points. Well-established pharmacy and grocery brands such as Neutral, Dr Greve, and La Roche-Posay will continue to enjoy high end user loyalty, especially among parents who value their children’s safety and satisfaction expressed through dermatological approval.

Although the pace of innovation will hold back, some progress can only just begin in mineral-based sun products and barrier protective creams. Some brands promoting microbiome-friendly or fortifying properties might start slowly taking hold in the market for cautious yet health-concerned parents. Nonetheless, the market will witness stable growth in terms of value.

Norway Baby and Child-Specific Products Market Growth DriverStrong Parental Preference for Safety and Simplicity

Strong end-user emphasis on safety, simplicity, and formally certified standards is shaping demand across Norway’s baby and child-specific products market. The healthcare sector has been promoting the ideology of doing things the "cleaner way," using as few products as possible, with just one being sufficient, which is often just water. This ideology has led people to trust brands like Neutral, Dr Greve, and Natusan, which are known for their reliable hypoallergenic products that are scent-free.

By prioritizing safety and certification, brands are able to maintain a loyal clientele within the market. The focus continues to be on quality and gentleness as opposed to diversity, thereby enabling established brands within the market to maintain a steady flow of end users in a slow-growing market.

Norway Baby and Child-Specific Products Market ChallengeCultural Minimalism Restricting Product Expansion

Norway possesses an entrenched "less is more" mentality when it comes to hygiene, and this is deemed to pose one of the biggest market development challenges. Parents are advised to avoid using multiple baby care products and adhere to "less is more" by following health guidelines to limit baby care products, thereby hindering diversification of products, as well as their frequency of use.

Due to the prevalence of simplicity and trust in end user values, it becomes difficult even for niche or organic brands to scale. The conservative usage pattern hampers innovation and restricts development in the category.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Norway Baby and Child-Specific Products Market TrendPreference for Multi-Purpose and Fragrance-Free Formulations

A prominent trend shaping the market in Norway is the rising preference for multi-purpose, unscented, and hypoallergenic products. Norway parents find it convenient to have multi-purpose products that can take care of many baby needs while meeting the standards required in the area of allergy and dermatology. Products such as multi-purpose ones from the brand “Neutral” and “Dr. Greve” are in high demand in place of specially designed baby products.

This ongoing usage of simple and uncomplicated alternatives represents a social attitude towards efficiency and safety in childcare. The trend ensures a consistent stream of end user confidence in well-known brands, with end users overlooking the limited innovation and range of offerings in the market.

Norway Baby and Child-Specific Products Market OpportunityFunctional Segmentation Offering Scope for Differentiation

An opportunity emerges in adopting functional benefits–based segmentation as a strategic foundation for steady development in Norway’s baby and child-related market. The development of specific products for particular situations such as eczema, nappy rash, or cradle cap would help create differentiation in terms of the safety and minimalism offered by parents in Norway.

It will be easier for pharmacy brands and brands with credentials from dermatologists to tailor to this strategy. By giving the right certifications and benefits for use, the brands can live up to the conservative expectations of the customers in Norway and reach untapped potential for expansion.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Norway Baby and Child-Specific Products Market Segmentation Analysis

By Product

- Hair Care

- Skin Care

- Sun Care

- Toiletries

- Baby Wipes

- Diapers

- Medicated

The segment with the highest share under Product Type in the Norway Baby and Child-Specific Products Market is Baby Wipes, holding around 55% of the market. This dominance is due to the essential role of wipes in daily infant hygiene and their convenience for on-the-go use. Norwegian parents, who follow minimalist parenting norms, rely on a small number of trusted products, making wipes a core staple that consistently drives sales.

Although innovation across the category is limited, baby wipes continue to benefit from product improvements such as gentle formulations, dermatological testing, and hypoallergenic materials. Trusted brands like Neutral and Dr Greve maintain strong end user loyalty, reinforcing the segment’s leadership. The focus on safety and efficacy ensures continued demand, with minimal impact from niche or premium offerings in the broader baby and child-specific product landscape.

By Sales Channel

- Retail Online

- Retail Offline

The segment with the highest share under Sales Channel in the Norway Baby and Child-Specific Products Market is Retail Offline, which continues to dominate the market. Grocery stores remain the mainstay for purchasing baby and child-specific products due to convenience, accessibility, and the availability of trusted brands. Parents value the ability to see and choose products in-store, especially for essential daily items like wipes and sun care.

Pharmacies are gradually gaining ground, particularly for premium or medically endorsed products, but retail offline remains central to the market. Supermarkets and grocery chains offer wide assortments that meet the minimalist preferences of Norwegian parents, combining convenience with assurance of product safety. This ensures that the majority of purchases continue to occur through traditional retail outlets, maintaining offline dominance over other channels.

List of Companies Covered in Norway Baby and Child-Specific Products Market

The companies listed below are highly influential in the Norway baby and child-specific products market, with a significant market share and a strong impact on industry developments.

- ACO Hud Norge AS

- L'Oréal Norge AS

- Apotek 1 Norge AS

- Essity AS

- Norgesgruppen ASA

- Johnson & Johnson Consumer Nordic

- Procter & Gamble Norge AS

- Unilever Norge AS

- Orion Pharma AS

- Orkla Care AS

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Norway Baby and Child-Specific Product Market Policies, Regulations, and Standards

4. Norway Baby and Child-Specific Product Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Norway Baby and Child-Specific Product Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product

5.2.1.1. Hair Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Skin Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Sun Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Toiletries- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Baby Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Diapers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Medicated- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Category

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Norway Baby and Child-Specific Hair Care Product Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Norway Baby and Child-Specific Skin Care Product Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Norway Baby and Child-Specific Sun Care Product Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Norway Baby and Child-Specific Toiletries Product Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Norway Baby and Child-Specific Baby Wipes Market Statistics, 2022-2032F

10.1.Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2.Market Segmentation & Growth Outlook

10.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Norway Baby and Child-Specific Diapers Market Statistics, 2022-2032F

11.1.Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2.Market Segmentation & Growth Outlook

11.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Norway Baby and Child-Specific Medicated Product Market Statistics, 2022-2032F

12.1.Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2.Market Segmentation & Growth Outlook

12.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1.Company Profiles

13.1.1. Essity AS

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Norgesgruppen ASA

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Johnson & Johnson Consumer Nordic

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Procter & Gamble Norge AS

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Unilever Norge AS

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. ACO Hud Norge AS

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. L'Oréal Norge AS

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Apotek 1 Norge AS

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Orion Pharma AS

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Orkla Care AS

13.1.10.1. Business Description

13.1.10.2. Product Portfolio

13.1.10.3. Collaborations & Alliances

13.1.10.4. Recent Developments

13.1.10.5. Financial Details

13.1.10.6. Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.