North America Water Pump Market Report: Trends, Growth and Forecast (2026-2032)

By Pump Type (Centrifugal Pump (Overhung Pumps (Vertical Line, Horizontal End Suction), Split Case Pumps (Single/Two Stage, Multi Stage), Vertical Pumps (Turbine, Axial, Mixed Flow), Submersible Pumps (Solid Handling, Non-Solid Handling)), Positive Displacement Pump (Diaphragm Pumps, Piston Pumps, Gear Pumps, Lobe Pumps, Progressive Cavity Pumps, Screw Pumps, Vane Pumps, Peristaltic Pumps, Others)), By End User (Oil & Gas, Power, Residential, Agriculture & Irrigation, Commercial Building, HVAC, Chemical, Water & Wastewater, Food & Beverage, Others), By Country (US, Canada, Mexico, Rest of North America)

- Energy & Power

- Oct 2025

- VI0517

- 154

-

North America Water Pump Market Statistics and Insights, 2026

- Market Size Statistics

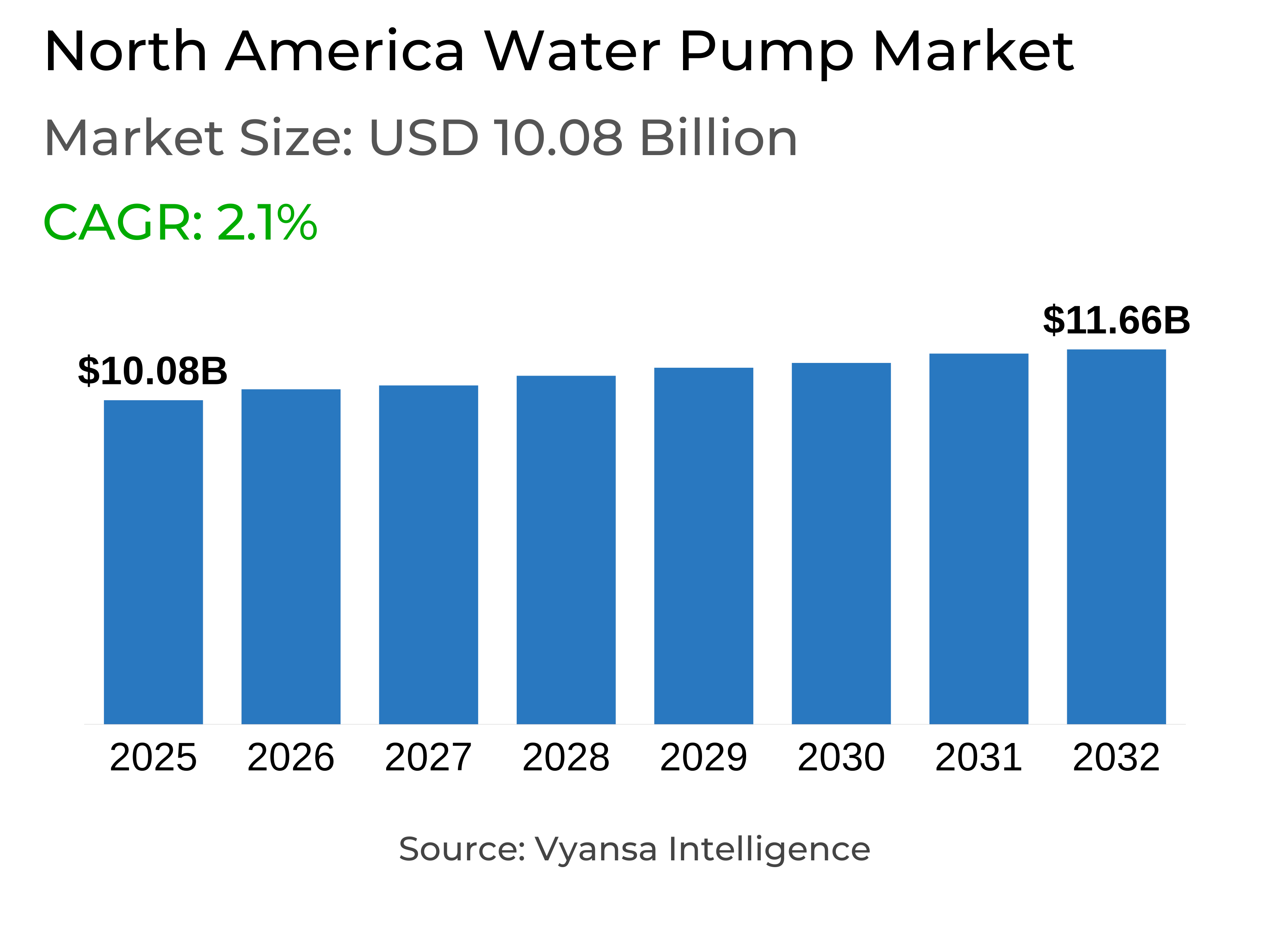

- North America Water Pump Market is estimated at $ 10.08 Billion.

- The market size is expected to grow to $ 11.66 Billion by 2032.

- Market to register a CAGR of around 2.1% during 2026-32.

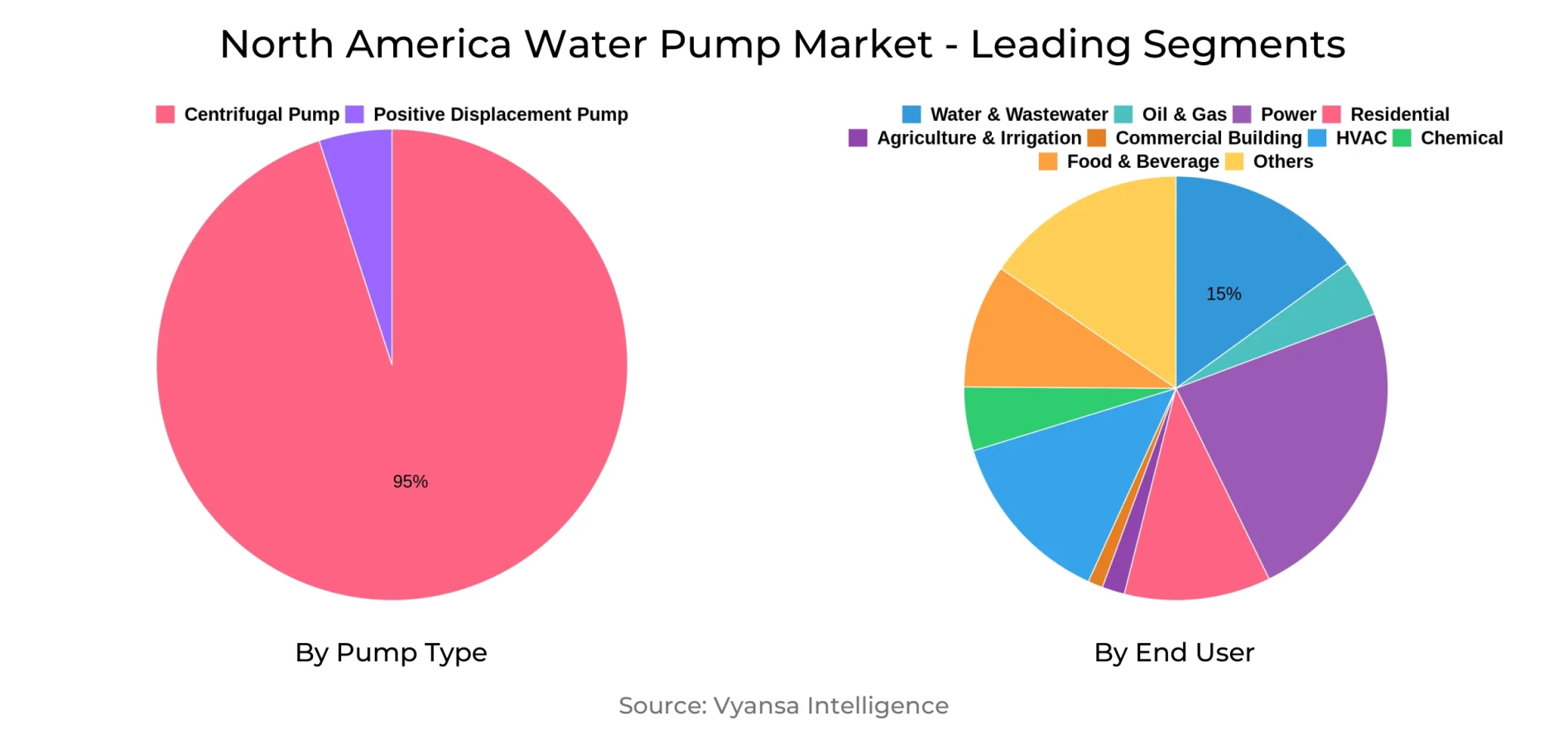

- Pump Type Shares

- Centrifugal Pump grabbed market share of 95%.

- Competition

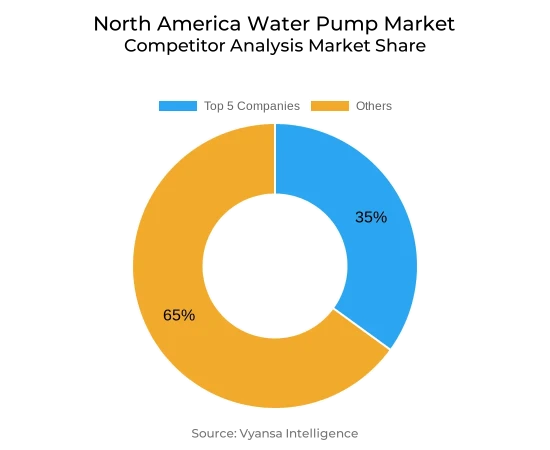

- More than 10 companies are actively engaged in producing Water Pump in North America.

- Top 5 companies acquired 35% of the market share.

- ITT, IDEX, Dover, Flowserve, Sulzer AG etc., are few of the top companies.

- End User

- Water & Wastewater grabbed 15% of the market.

- Country

- US leads with a 90% share of the North America Market.

North America Water Pump Market Outlook

The North America Water Pump Market, worth USD 10.08 billion in 2025, is expected to grow to USD 11.66 billion by 2032, led by high investment in replacing old infrastructure and stricter environmental regulations. Governments in the region, especially in the U.S., are investing heavily—more than USD 50 billion under the Bipartisan Infrastructure Law—to replace old water systems and upgrade wastewater treatment. These programs are prompting utilities and industries to embrace advanced, energy-saving pumping technologies that provide reliability, sustainability, and EPA-compliance.

Technological innovations are redefining the market scenario, with digital and IoT-capable centrifugal pumps being widely adopted. Such solutions facilitate real-time monitoring, predictive maintenance, and up to 20% energy savings to enable utilities to reduce expenditure and achieve sustainability targets. Centrifugal pumps own the market with 95% share because of their efficiency, ease of design, and ability to integrate with smart technologies, and variable-frequency drives add that extra layer of energy optimization.

The water and sewerage utility industry is still the largest end-use segment, contributing 15% to overall installations. Such utilities use sturdy pumping systems for sewage activities, treatment, and distribution to provide continuous urban services. The agricultural irrigation industry, growing at a 4.38% CAGR, represents upcoming opportunities through modernization efforts and government-supported funding schemes encouraging water conservation.

Over 10 players are present in the North America Water Pump Market, with the leading five holding approximately 35% market share. The U.S. dominates regional demand with mega-sized municipal and industrial projects, whereas Canada is aiming at building resilience in remote and rural networks through energy-efficient and connected pump solutions.

North America Water Pump Market Growth Driver

Growing Investments and Regulatory Support Propel Market Expansion

Growing investments in replacement of old water infrastructure and tougher environmental regulations are the major drivers in the North America Water Pump Market. Municipal utilities are under increasing pressure to replace systems aged more than 50 years, backed by U.S. federal funds through the Bipartisan Infrastructure Law, which earmarks more than USD 50 billion for water and wastewater work. Industrial applications like oil & gas and agriculture also drive demand further, as energy-saving centrifugal pumps maintain consistent performance in irrigation, hydraulic fracturing, and fluid-handling applications. The upgrades to infrastructure are essential for ensuring water supply continuity and fulfilling the demands of growing urban and industrial areas.

Concurrently, straining EPA regulations on water quality and sustainability drive up take of smart, IoT-connected pumps. Real-time monitoring capabilities can lower energy usage by as much as 20%, allowing utilities to achieve regulatory deadlines while reducing operating expenses. Incorporation of innovative technologies reflects the increased focus on advanced pump systems to maximize efficiency, dependability, and environmental conformity in North America's water infrastructure.

North America Water Pump Market Challenge

Aging Infrastructure and Integration Hurdles Limit Adoption

The aging infrastructure of water remains a major concern for North American utilities. More than half of municipal pipes were laid prior to 1970, leading to constant leaks, breakage, and huge repair expenses, with USD 240,000 American water main breaks occurring on average each year and costing USD 13 billion in 2022 alone. Ensuring business continuity while handling these old systems generates operational stress for municipal and industrial operators alike.

In addition, adoption of new pump technologies is still a sophisticated process for existing systems. Most facilities are not equipped with the digital infrastructure required for IoT-supported monitoring, which hinders adoption and slows down efficiency improvements. High front-end retrofitting costs of USD 1.2 million per plant strain municipal budgets further. These issues call for long-term investment planning and updating infrastructure to ensure the full potential of energy-efficient and digitally integrated pumping solutions.

North America Water Pump Market Trend

Digitalization and Energy Efficiency Drive Technological Adoption

North American utilities are growing more supportive of sustainability and digitalization, with IoT-connected centrifugal pumps now accounting for more than 30% of new installations, compared to 12% in 2020. Such intelligent systems include real-time information on flow, pressure, and energy consumption, facilitating predictive maintenance, lowering unplanned downtime by 40%, and enhancing operational reliability. With such technology integrated, utilities can maximize resources while staying compliant with strict environmental and performance requirements.

At the same time, companies are releasing variable-frequency drives (VFDs) for pump speed and energy control to provide as much as 25% more energy efficiency than fixed-speed pumps. This reflects efforts like the U.S. Department of Energy's WaterAMR program, with a focus on energy efficiency and sustainability. A combination of intelligent monitoring and optimized operational control is redefining the selection criteria for pumps, leading to digital and energy-efficient solutions as the core drivers of market growth.

North America Water Pump Market Opportunity

Agricultural Irrigation Expansion Creates Market Opportunities

The North America Water Pump Market offers high prospects in the agricultural irrigation segment, growing at a 4.38% CAGR, higher than municipal and industrial usage. At present, regional pumps are only penetrating 15% of agriculture, which means high opportunities for further penetration. Upgrades to irrigation infrastructure and government incentives favor use of energy-efficient pumps to enhance water management and farm productivity.

Products like the USDA's Rural Utilities Service grants also provide added impetus to pump upgrades in farming environments, generating demand for more advanced centrifugal pump types. Companies that adapt product lines to meet this expanding market opportunity can leverage funding incentives as well as sustainable agriculture programs. By meeting the unique needs of the farm market, pump suppliers can secure lasting marketplace visibility while assisting in effective and responsible water management.

North America Water Pump Market Country Analysis

United States leads the North America Water Pump Market, commanding 90% of the region's installations. Robust demand is driven by extensive municipal programs, vast oil & gas activity, and funding at the state and federal levels for smart, energy-saving pump deployment. Mature infrastructure and regulatory climate in the country support the adoption of sophisticated pumping technology across various end-user markets.

Canada, though a smaller fraction of the market, is prioritizing the modernization of remote and rural water infrastructure to enhance the resilience of the infrastructure. Federal investments such as CAD 2 billion from the Canada Water Agency finance the installation of energy-efficient and digitally enabled pumps in northern towns. Focused upgrades in these areas boost the reliability of the services and offer long-term growth opportunities for pump makers that specialize in sustainable infrastructure solutions.

North America Water Pump Market Segmentation Analysis

By Pump Type

- Centrifugal Pump

- Positive Displacement Pump

Centrifugal pumps possess the most market share in the Pump Type category with 95% of installations. Their basic configuration, ease of maintenance, and compatibility for high-volume operations make them a popular option for municipal water supply, irrigation, and industrial fluid-handling systems. Their capability to accommodate large-scale operations with little downtime further supports their universal usage.

Additionally, centrifugal pumps are easily compatible with variable-frequency drives and IoT monitoring systems to increase energy efficiency and control operation. With North American industries and utilities focusing on sustainability and digital monitoring, the centrifugal pump technology continues to be the prevailing technology, featuring reliability, efficiency, and compatibility with new smart systems to fulfill changing infrastructure requirements.

By End User

- Oil & Gas

- Power

- Residential

- Agriculture & Irrigation

- Commercial Building

- HVAC

- Chemical

- Water & Wastewater

- Food & Beverage

- Others

Water & Wastewater utilities have the greatest market share among end users, with 15% of all pump installations. Municipal operators depend on specialty pumps to operate treatment, distribution, and sewer systems, providing constant service to city dwellers. The fact that these pumps play such a crucial role in public infrastructure makes them remain the market leaders.

Yet the most rapidly growing sector is Agriculture & Irrigation, growing at a 4.38% CAGR. It is driven by the upgrading of irrigation equipment and government subsidies for energy-saving equipment. This movement toward sustainable water use indicates changing priorities among end users and offers opportunities for pump producers to address high-growth segments while continuing support for conventional municipal applications.

Top Companies in North America Water Pump Market

The top companies operating in the market include ITT, IDEX, Dover, Flowserve, Sulzer AG, KSB, Xylem, Grundfos, Ebara, SPX Flow, Others (Kirloskar, Wilo, etc.), etc., are the top players operating in the North America Water Pump Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. North America Water Pump Market Policies, Regulations, and Standards

4. North America Water Pump Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. North America Water Pump Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.1.2.By Units Sold in Million Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Pump Type

5.2.1.1. Centrifugal Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Overhung Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.1. Vertical Line- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1.2. Horizontal End Suction- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Split Case Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.1. Single/Two Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2.2. Multi Stage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Vertical Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.1. Turbine- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.2. Axial- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3.3. Mixed Flow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Submersible Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.1. Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4.2. Non-Solid Handling- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Positive Displacement Pump- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Diaphragm Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Piston Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Gear Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Lobe Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Progressive Cavity Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.6. Screw Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.7. Vane Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.8. Peristaltic Pumps- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.9. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By End User

5.2.2.1. Oil & Gas- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Power- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Residential- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Agriculture & Irrigation- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Commercial Building- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. HVAC- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Chemical- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Water & Wastewater- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Food & Beverage- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Country

5.2.3.1. US

5.2.3.2. Canada

5.2.3.3. Mexico

5.2.3.4. Rest of North America

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. US Water Pump Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.1.2.By Units Sold in Million Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Canada Water Pump Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.1.2.By Units Sold in Million Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Mexico Water Pump Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.1.2.By Units Sold in Million Units

8.2. Market Segmentation & Growth Outlook

8.2.1.By Pump Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Flowserve

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Sulzer AG

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.KSB

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Xylem

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Grundfos

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.ITT

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.IDEX

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Dover

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Ebara

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. SPX Flow

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

9.1.11. Others (Kirloskar, Wilo, etc.)

9.1.11.1. Business Description

9.1.11.2. Product Portfolio

9.1.11.3. Collaborations & Alliances

9.1.11.4. Recent Developments

9.1.11.5. Financial Details

9.1.11.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Pump Type |

|

| By End User |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.