Nigeria Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), Price Category (Mass, Premium), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Dec 2025

- VI0637

- 125

-

Nigeria Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

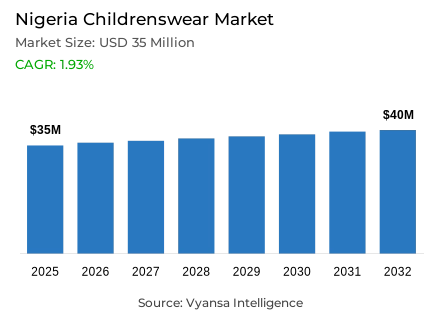

- Childrenswear in Nigeria is estimated at USD 35 million.

- The market size is expected to grow to USD 40 million by 2032.

- Market to register a cagr of around 1.93% during 2026-32.

- Product Type Shares

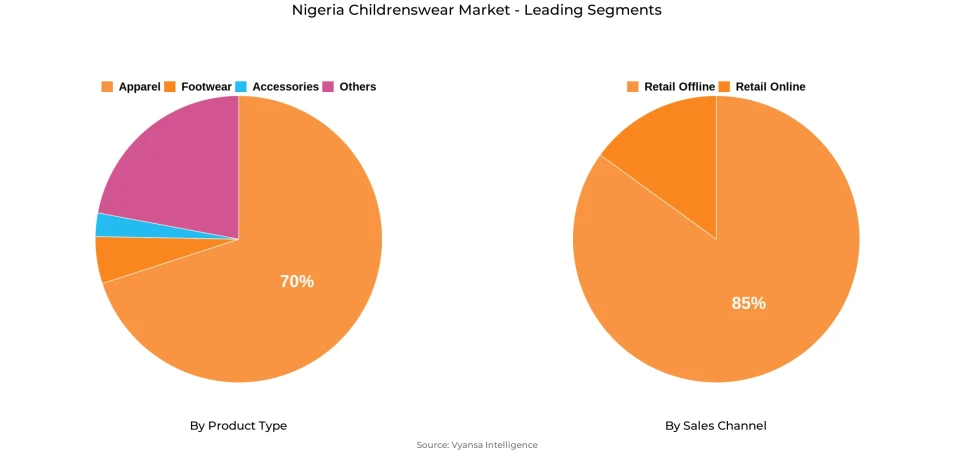

- Apparel grabbed market share of 70%.

- Competition

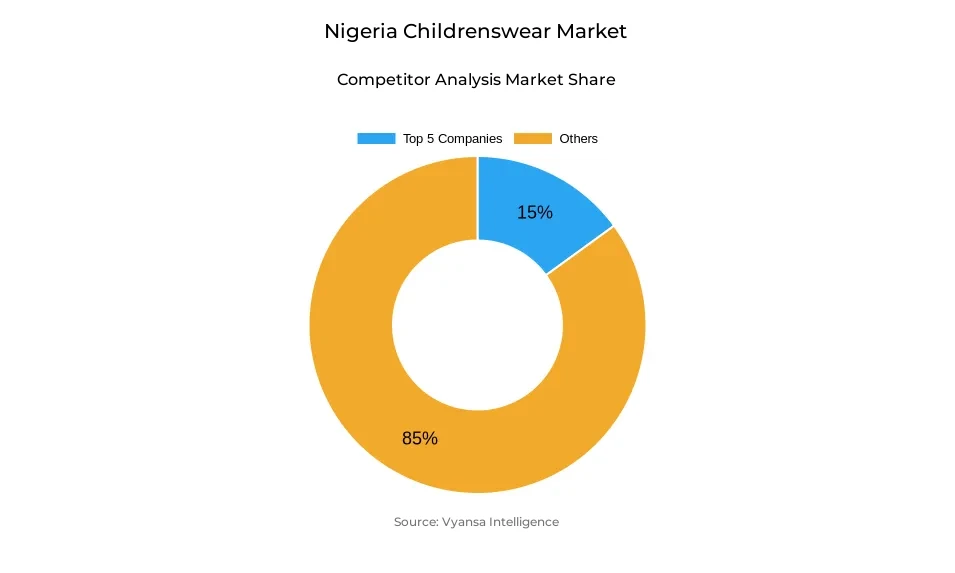

- More than 10 companies are actively engaged in producing childrenswear in Nigeria.

- Top 5 companies acquired around 15% of the market share.

- Roadget Business Pte Ltd, RedTag Group, Skechers USA Inc, Gatimo Nigeria Ltd, Gerson & Gerson, Inc etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Nigeria Childrenswear Market Outlook

The Nigeria childrenswear market is likely to witness a moderate growth from USD 35 million in 2025 to USD 40 million by 2032, reflecting a CAGR of around 1.93% during 2026–2032. After facing a sharp decline due to inflation and currency depreciation, the gradual economic recovery and improved end users purchasing power are likely to restore demand. More households with dual incomes are expected to drive consumption, with spending on new clothes, especially for social and festive occasions, with the economy stabilizing. The country's rising children population and accelerating urbanization will further support the demand as urban families show greater preference for formal retail and branded apparel.

The dominant Apparel segment retains around 70% of the total market share, with a continued high demand for both everyday and occasion wear for both boys and girls. Although strong demand is still pervasive across all income classes due to affordability, middle and premium local brands like Ruff n Tumble and Kidz Country have managed to establish themselves among middle- and high-income families who value higher quality and design. Meanwhile, the emergence of more affordable Asian brands such as Shein and Defacto further expands access to low-cost children's apparel across income groups.

By sales channel, Retail Offline dominates at approximately 85% of market share, with in-store shopping remaining favored among Nigerian families. Traditional retailers, department stores, and small boutiques will continue to be very important, particularly at the start of holidays and back-to-school seasons. However, social commerce and e-commerce are increasingly developing, with social platforms like Jumia, Konga, and brand-operated online stores such as Kiddies Wearhouse extending their reach outside of major cities.

Going forward, the combination of a large young population, social media-driven marketing, and the growing presence of local brands will strengthen the market's foundation. The trend toward digital shopping and greater product availability across the price segments will ensure that the market expands steadily, though gradually.

Nigeria Childrenswear Market Growth DriverGrowth in the population of children and increased urbanization are driving demand in the market.

Driving the demand for childrenswear in Nigeria are the increasing child population and the fast-growing urbanization process. As the number of children increases and families move gradually from rural to urban areas, the need for new outfits, especially for parties and special occasions, has continued to increase. More urban parents will be inclined to purchase new clothes, assisted by higher incomes and better access to apparel. The baby and toddler segment continues to be a strong contributor due to the need for hygiene and comfort for younger children.

This demographic expansion forms a consistent base for market growth even in economic volatility. According to UNICEF, 43% of Nigeria's total population comprises the age group 0–14 years, while the urban population share will reach 55% by 2025, projections by the National Bureau of Statistics show. Together, these factors strengthen the long-term demand outlook for childrenswear in Nigeria.

Nigeria Childrenswear Market ChallengeHigh Inflation and Currency Depreciation Undermine Spending Power

Childrenswear in Nigeria is still beset by persistent inflation and the sharp depreciation of the naira, which have raised the costs of importing and economic production, thus increasing retail prices and reducing affordability. Many households are therefore having to prioritize essential goods over children's clothing, leading to a reduction in the overall expenditure on children's wear, especially within low-income earners. The market is also characterized by limited access to imported materials and quality fabrics, reducing product diversity and competitiveness.

The increase in operational expenses led to the exit of some international brands, making the market fragmented with small local players dominating. According to the International Monetary Fund (IMF), the average annual inflation rate of Nigeria was at 33.4% in 2024. Central Bank of Nigeria (CBN) reported a 45% depreciation of Naira against the US Dollar in 2024. This persistent instability is becoming one of the major obstacles toward the market growth of the entire nation.

Nigeria Childrenswear Market TrendShift to Locally Designed and Produced Apparel

A very important fashion trend in the Nigerian childrenswear market is the increasing demand for locally designed and produced apparel. With ongoing economic challenges, this segment has emerged as a popular choice, offering affordable and good-quality clothing representative of Nigerian culture and modern fashion sentiments. Most local producers are combining traditional and modern designs, thus being able to cater to a wide category of end-users. This has also been aided by the exit of many international retailers from the country.

This shift is about a broader sense of national pride and appreciation for homegrown craftsmanship. Local production reduces reliance on imports and mitigates risks against foreign exchange fluctuations. The National Bureau of Statistics reports that local textile and garment manufacturing output rose 5.1% in 2024, while the UNDP reported 58% of Nigerian end userss now prefer domestic brands for affordability and accessibility.

Nigeria Childrenswear Market OpportunitySocial Media Engagement New Avenues for Market Growth

Social media engagement is expected to create strong growth opportunities for Nigeria's childrenswear market in the coming years. As small and mid-sized producers have relatively limited access to traditional advertising and face high retail costs, digital platforms are being increasingly relied on to reach end users directly. Social media provides cost-effective marketing, fast brand visibility, and personalized interaction with end userss. Young parents and urban dwellers are especially responsive to online content, which drives discovery and purchase of children's apparel.

This digital transformation supports the development of social commerce in such a way that platforms like Instagram and Facebook can be used for marketing and sales. It can be expected that, with increased internet penetration, local apparel brands will make better use of the channels to connect with their audience: according to the NCC, active internet users reached 163 million in 2024, and UNICEF reported that 69% of parents aged 25–35 engage with children’s product content online.

Nigeria Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Footwear

- Accessories

- Others

The segment with highest market share under By product type, is apparels, contributing approximately 70% to the Nigeria childrenswear market. A staple purchase in every family, parents prefer to buy new clothes for their children, especially for social visits and school functions. Therefore, it continues to find a place despite reduced household budgets due to inflationary pressures, as it is essential and requires frequent replacement with the child's growing age.

In the case of apparel, baby and toddler wear is more resilient than older children's wear, since parents can be less likely to use second-hand alternatives for infants. Increasingly available and affordable local brands, as well as a greater presence of mid-priced and premium options, have also contributed to category value growth. The combination of everyday demand and evolving fashion preferences ensures apparel maintains its dominance within Nigeria's childrenswear market.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel, the retail offline segment captured about 85% of the market share in the Nigeria childrenswear market. Physical stores, such as independent apparel specialists and supermarkets, remain an avenue of purchase that is convenient and accessible. Parents generally show trust in buying from these places regarding product quality.

Most of the time, parents prefer in-person purchases to assess size, material, and comfort, especially for essential categories like baby and toddler wear. Supermarkets and local stores dominate due to their wide availability, promotional campaigns, and seasonal offers. It is expected that, while online retail and social media-based commerce will continue to grow, offline retail will remain the backbone of sales in kids' wear in Nigeria during the forecast period. Wide reach, particularly among end userss, is guaranteed to keep this channel dominant.

Top Companies in Nigeria Childrenswear Market

The top companies operating in the market include Roadget Business Pte Ltd, RedTag Group, Skechers USA Inc, Gatimo Nigeria Ltd, Gerson & Gerson, Inc, adidas Group, Puma AG, Pricewise Stores Nigeria Ltd, Kidz Country, Defacto Perakende Tic AS, etc., are the top players operating in the Nigeria childrenswear market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Nigeria Childrenswear Market Policies, Regulations, and Standards

4. Nigeria Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Nigeria Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Nigeria Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Nigeria Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Nigeria Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Gatimo Nigeria Ltd

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Gerson & Gerson, Inc

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.adidas Group

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Puma AG

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Pricewise Stores Nigeria Ltd

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Roadget Business Pte Ltd

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.RedTag Group

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Skechers USA Inc

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Kidz Country

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Defacto Perakende Tic AS

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.