Nigeria Baby and Child-Specific Products Market Report: Trends, Growth and Forecast (2026-2032)

By Product (Hair Care, Skin Care, Sun Care, Toiletries, Baby Wipes, Diapers, Medicated), By Category (Premium, Mass), By Sales Channel (Retail Online, Retail Offline)

|

Major Players

|

Nigeria Baby and Child-Specific Products Market Statistics and Insights, 2026

- Market Size Statistics

- Baby and child-specific products in Nigeria is estimated at USD 60 million in 2025.

- The market size is expected to grow to USD 80 million by 2032.

- Market to register a cagr of around 4.2% during 2026-32.

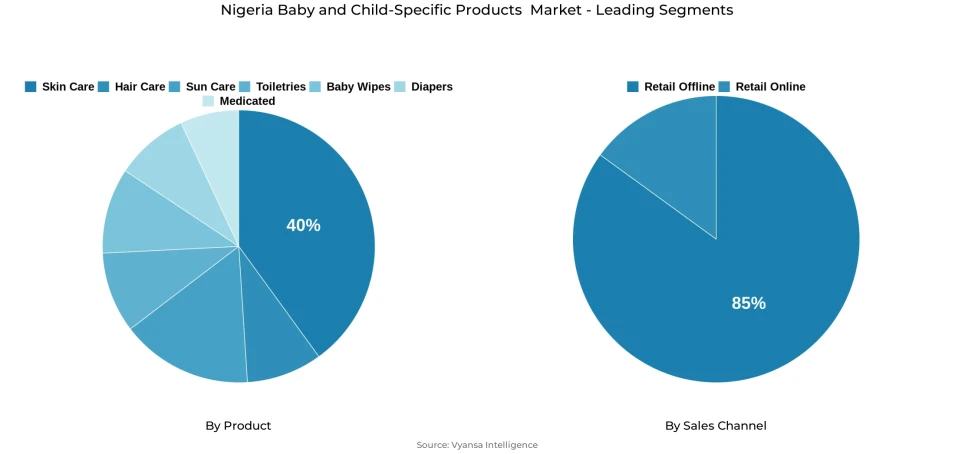

- Product Shares

- Skin care grabbed market share of 40%.

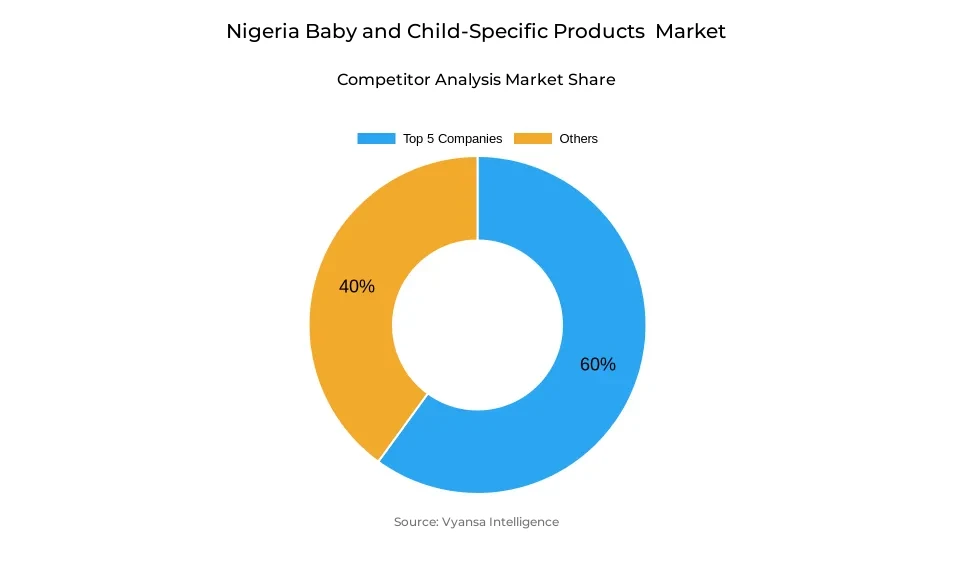

- Competition

- More than 20 companies are actively engaged in producing baby and child-specific products in Nigeria.

- Top 5 companies acquired around 60% of the market share.

- UNZA Holdings Bhd; Angel Commodity Products Nigeria Ltd; Mallinson Group; Johnson & Johnson Inc; PZ Cussons Nigeria Plc etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Nigeria Baby and Child-Specific Products Market Outlook

The Nigeria Baby and Child-Specific Products Market with a current market value around USD 60 million in 2025 is expected to realize USD 80 million market value in 2032, which is a compound annual growth rate (CAGR) of about 4.2% within the forecast period of 2026-2032. Progressive economic growth and growing disposable income will be the key drivers of market expansion trends and will result in a slow consumer shift in unpackaged traditional products such as shea butter and black soap to branded, packaged product lines. With the purchasing power rehabilitation, the end-user segments will be more inclined to purchase products that are reliably based on dermatologically validated products that provide convenience and guarantee quality delivery.

Skin care, which currently control 40% of the overall market share are poised to continue playing a major growth category as the awareness of infant dermal health grows. The demographics of the end-users indicate increasing inclination towards the use of natural ingredient-based formulations and the domestic market players, Amal Botanicals and Adunni Organics, are on the forefront when it comes to innovation in this segment. The use of culturally recognizable ingredients such as coconut oil and shea butter is the reason that still creates a significant buzz among the parental customers who need gentler and naturally-derived ingredients in their application as pediatric skin care.

Moreover, the dynamics of population growth, in specific the population segment 0-2 years old (infant population) and the 3-7 years old (early childhood population) will also be more supportive in terms of market growth due to the trends of urbanization acceleration. The population of urban end-users is preferring more and more the packaged products which are ready to use with time and effort optimization as compared to the traditional ones.

The supermarkets have retained their dominance in the sale channel environment enjoying better product availability and increased visibility. The continued growth of the modern retail system in the urban areas will help to get easier access to high and sub-premium segments of goods, which will underlie the long-term degenerative dynamics of the baby and child-specific products market in Nigeria.

Nigeria Baby and Child-Specific Products Market Growth DriverGrowing Baby Population and Urbanization Drives Market Expansion

The increasing infant and child population in Nigeria, which is being supported by the increasing rates of urbanization, is creating the creation of baby and child specific products, which is a sustainable demand. Recent developments are showing that urban families with infants and young children are starting to use packaged product solutions due to the factors of convenience and hygiene, especially in the urban setting where the demographics of the parents are compressed with regard to time. The growing number of women in the workforce is also creating an appeal among economically active women towards ready-to-use, branded products that help make child care routines easier.

The urban household segments present a growing openness to contemporary baby and child-specific products and their guaranteed quality with the ease of usage. Due to these family units not being dependent on traditional unpackaged alternatives, the pressure of demand keeps perking up within the toiletries, skin care, and hair care products segments. The systemic expansion of the consumer reach by brands through the progressive infiltration of the supermarket formats and the modern retail infrastructure further increases the availability of products and allows the brands to spread their reach to the end user in a systematic manner.

Nigeria Baby and Child-Specific Products Market ChallengeWeak Economy and Currency Depreciation Restrains Growth

The main obstacle that limits the growth of market is related to the economic instability and significant depreciation of the currency that dominate Nigeria. The local currency has been severely depreciated leading to sharp rises in production as well as importation expenses forcing manufacturers to adopt high levels of price increases. This increasing price trend has undermined its affordability and consumer buying capacity among the target customers.

It is in the midst of the high inflation that many households are cutting on spending on packaged products and returning to the traditional options like the black soap and shea butter. The availability and continuity of branded product offering is also being affected by restrictions imposed on imports and accessibility to foreign exchange. These macroeconomic off-puts are still putting pressure on the producers and end user, keeping market growth rate mild even with a huge and growing population base of pediatric end user.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Nigeria Baby and Child-Specific Products Market TrendRising Preference for Natural and Multi-Purpose Products

The Nigerian end user exhibit strong behavioral change towards baby products and child specific products which are developed with natural and organic ingredient profiles. Cosmetic and care products with coconut oil, shea butter and similar mild ingredients are gaining popularity among parents, with less risky and more dermatologically-compatible options becoming their choice of products to use with children. A brand movement in its domestic form such as Kids and More and Amal Botanicals are on the forefront of this trend by incorporating concepts of traditional natural care into modern and packaged products.

Another new trend is the increasing demand of multi-purpose products with the aim of use by a larger population group- including infants, children, adolescents and adults. These are mild products with a family wide application, which provide the convenience with natural efficacy. This shift in the trend indicates the increased consciousness of end user in terms of safety attributes of products and the desire to consume formulations that are value-optimized.

Nigeria Baby and Child-Specific Products Market OpportunityExpanding Middle-Class and Demand for Premium Offerings

Improving macroeconomic stability and the steady expansion of the middle-class population are set to open up meaningful growth opportunities for the market. With the restoration of purchasing power, more consumer groups are expected to shift their focus on consumption of alternative products of traditional products to high quality and better performance features packed products in premium and sub-premium categories. Brands that focus on the use of natural ingredient compositions, in specific, coconut oil and shea butter will be in a good position to tap into this rising demand trend.

Domestic and multinational manufacturers will find a chance to launch new and value added product lines such as bath foams and organic cream formulations, that will target the current urban segment of the family market. As the stability of progressive income increase and the diversification of the modern retail channel infrastructure, commercial businesses can consolidate the market positioning by means of differentiated and superior baby-care solutions orchestrated to improve the changing consumer preference trends.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Nigeria Baby and Child-Specific Products Market Segmentation Analysis

By Product

- Hair Care

- Skin Care

- Sun Care

- Toiletries

- Baby Wipes

- Diapers

- Medicated

Skin care constitute the dominant segment within the product categorization of the Nigeria Baby and Child-Specific Products Market, commanding approximately 40% of total market share. This leadership position is underpinned by the fundamental role of skin care in maintaining infant hygiene protocols and preventing dermal irritation, dryness, and associated skin-related complications. Notwithstanding competitive pressure from unpackaged alternatives including shea butter and black soap, escalating parental awareness regarding hygiene imperatives and the benefits of dermatologically validated products continues to sustain robust demand for packaged baby skin care merchandise.

The ascending popularity of natural and organic formulation approaches has further reinforced this segment's market position. Domestic brand entities such as Amal Botanicals and Adunni Organics are successfully appealing to parental demographics through product offerings enriched with culturally familiar ingredients including coconut oil and shea butter, thereby aligning with traditional preferences while ensuring safety assurance and usage convenience. This evolutionary trend is progressively driving elevated acceptance of branded baby skin care products within the Nigerian market context.

By Sales Channel

- Retail Online

- Retail Offline

Retail offline channels maintain dominant positioning within the sales channel segmentation of the Nigeria Baby and Child-Specific Products Market, continuing around 85% of market share. Small-scale local grocery establishments remain the primary distribution channel, leveraging their residential proximity and affordability positioning for low-income household demographics. These retail points predominantly stock essential baby toiletries and represent the most accessible procurement option for routine daily purchases.

However, supermarket formats are experiencing progressive importance elevation as modern retail infrastructure expands across urban centers. Offering substantially broader product assortment within the baby and child-specific category, supermarkets provide enhanced convenience and visibility for both premium and mass-market brand portfolios. As supermarket network expansion continues in residential proximity zones, these formats are gradually reshaping consumer purchasing patterns through targeted service delivery to middle- and upper-income consumer segments who demonstrate preference for trusted, packaged products within organized retail environments.

List of Companies Covered in Nigeria Baby and Child-Specific Products Market

The companies listed below are highly influential in the Nigeria baby and child-specific products market, with a significant market share and a strong impact on industry developments.

- UNZA Holdings Bhd

- Angel Commodity Products Nigeria Ltd

- Mallinson Group

- Johnson & Johnson Inc

- PZ Cussons Nigeria Plc

- Unilever Nigeria Plc

- Wemy Industries Ltd

- Megachem Nigeria Ltd

- Bordar Group

- Hayat Kimya Nigeria Ltd

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Nigeria Baby and Child-Specific Product Market Policies, Regulations, and Standards

4. Nigeria Baby and Child-Specific Product Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Nigeria Baby and Child-Specific Product Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product

5.2.1.1. Hair Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Skin Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Sun Care- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Toiletries- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Baby Wipes- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Diapers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Medicated- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Category

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Sales Channel

5.2.3.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Nigeria Baby and Child-Specific Hair Care Product Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Nigeria Baby and Child-Specific Skin Care Product Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Nigeria Baby and Child-Specific Sun Care Product Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Nigeria Baby and Child-Specific Toiletries Product Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Nigeria Baby and Child-Specific Baby Wipes Market Statistics, 2022-2032F

10.1.Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2.Market Segmentation & Growth Outlook

10.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Nigeria Baby and Child-Specific Diapers Market Statistics, 2022-2032F

11.1.Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2.Market Segmentation & Growth Outlook

11.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Nigeria Baby and Child-Specific Medicated Product Market Statistics, 2022-2032F

12.1.Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2.Market Segmentation & Growth Outlook

12.2.1. By Category- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

13. Competitive Outlook

13.1.Company Profiles

13.1.1. Johnson & Johnson Inc

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. PZ Cussons Nigeria Plc

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Unilever Nigeria Plc

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. Wemy Industries Ltd

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Megachem Nigeria Ltd

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. UNZA Holdings Bhd

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Angel Commodity Products Nigeria Ltd

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Mallinson Group

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Bordar Group

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Hayat Kimya Nigeria Ltd

13.1.10.1. Business Description

13.1.10.2. Product Portfolio

13.1.10.3. Collaborations & Alliances

13.1.10.4. Recent Developments

13.1.10.5. Financial Details

13.1.10.6. Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.