Netherlands Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Costume Jewellery, Fine Jewellery), By Type (Earrings, Neckwear, Rings, Wristwear, Other), By Collection (Diamond, Non-Diamond), By Material Type (Gold, Platinum, Metal Combination, Silver), By Sales Channel (Retail Offline, Retail Online), By End User (Men, Women)

|

Major Players

|

Netherlands Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

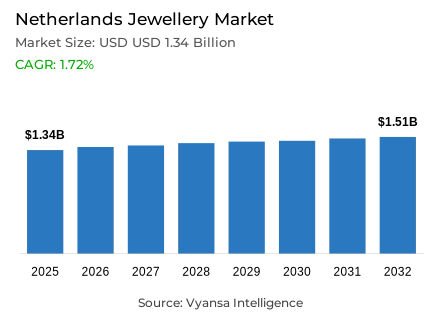

- Jewellery market in Netherlands is estimated at USD 1.34 billion in 2025.

- The market size is expected to grow to USD 1.51 billion by 2032.

- Market to register a cagr of around 1.72% during 2026-32.

- Category Shares

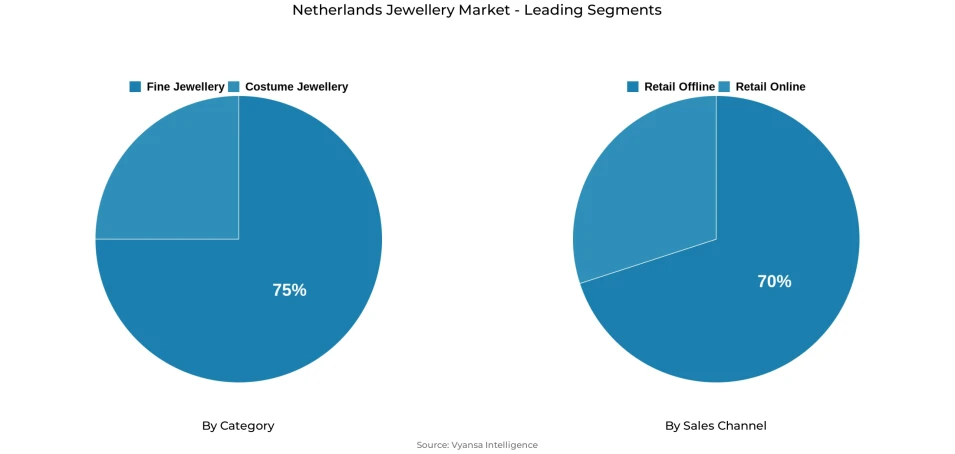

- Fine jewellery grabbed market share of 75%.

- Competition

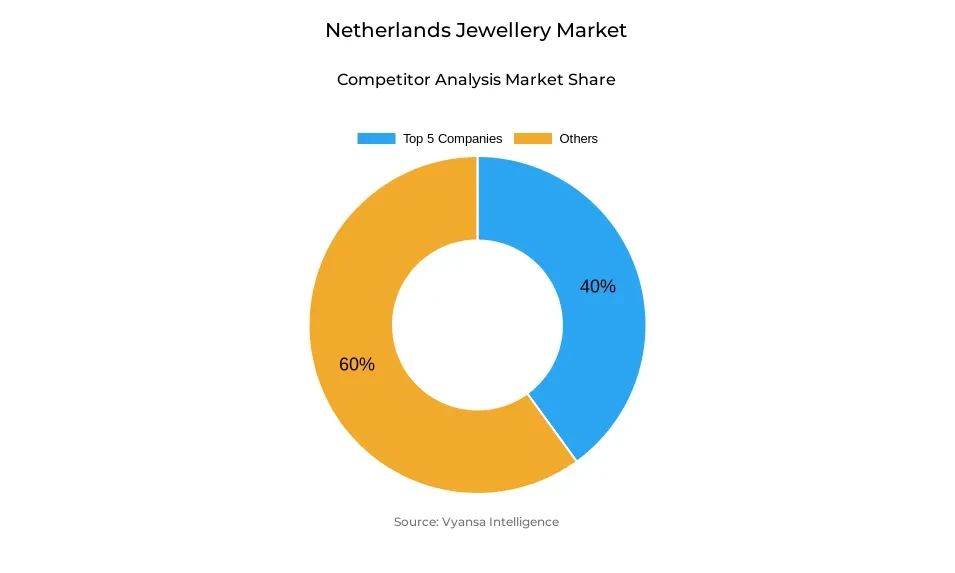

- More than 20 companies are actively engaged in producing jewellery market in Netherlands.

- Top 5 companies acquired around 40% of the market share.

- Vroemen Trading BV; Pandora Jewelry BV; Hennes & Mauritz (H&M) Nederlands BV; Lucardi BV; IBB Amsterdam BV etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Netherlands Jewellery Market Outlook

The Netherlands jewellery market is estimated to be US $1.34 billion in 2025, which is expected to grow to US $1.51 billion in 2032, with a compound annual growth rate of about 1.72% in 2026-2032. The expansion will be supported by the long-term interest in fine and costume jewellery, and the changing end user behaviour influenced by the trends in affordability, sustainability, and personal style. The most popular category is still fine jewellery, which constitutes 75% of the market, due to the strong tourist flows and demand of high-quality jewellery. Domestic end users, in their turn, are more restrained in their luxury spending, which makes brands diversify their products with affordable and trend-driven designs.

Costume jewellery will continue to pick up as more people are drawn to new materials, artisanal styles, and low-end lines. Social media trends are driving younger end users to demand expressive and sustainable items. Meanwhile, males and children are becoming important end user segments, forcing retailers to introduce specific campaigns and special collections. The brands that manage to combine the design attractiveness with the affordability will probably enjoy this growing demographic base.

Distribution will still be dominated by retail offline channels that control 70% of the market however, the trend towards online purchasing will gain momentum. The retail online channels will grow as the existing retailers will implement more robust omnichannel strategies, using artificial intelligence and end user profiling to personalise recommendations and optimise inventory planning. This change can put smaller independents at a disadvantage, and bigger brands can improve their digital touchpoints to keep up with changing purchase experiences.

Affordable jewellery lines, lab-grown diamonds, and handmade collections will be important in influencing end user decisions throughout the forecast period. The combination of design-led innovation, sustainability, and digital engagement will guarantee the consistent market growth until 2032.

Netherlands Jewellery Market Growth Driver

Tourism-Led Growth Supporting Fine Jewellery Demand

Tourism recovery has played a significant role in driving the strong performance of the fine jewellery market in the Netherlands. CBS Netherlands reports that in 2023, the country registered 22.7 million international overnight stays, compared to 18.9 million in 2022. According to UNWTO, European tourism flows exceeded 95% of pre-pandemic levels in 2024, and Germany, Spain, Italy, China, and India were strong visitors. This influx increased expenditure on high-end categories, which directly contributed to the sale of fine jewellery, which increased 7% in 2024.

Although domestic buyers were more cautious about discretionary spending, international buyers still bought high-end items, which kept the value growth. The rise of high-end tourists stimulated manufacturers and retailers to develop new collections, improve merchandising, and invest in high-end positioning. With tourism still strong, the fine jewellery is still enjoying the benefits at a disproportionate rate relative to the mass-market segments.

Netherlands Jewellery Market Challenge

Rising Precious Metal Costs and Consumer Caution

The increasing material prices and the reserved end user expenditure are significant limitations to jewellery development. According to Eurostat, gold prices in the EU were at an average of EUR 57 per gram in 2024, compared to EUR 48 in 2023, and silver prices increased by 12% per year. These rises drive the cost of production up, restricting affordability in fine jewellery at a time when end users are under wider cost-of-living pressures. Besides, the netherlands inflation stood at 3.5% in 2023, which constrained the household budgets into early 2024.

This price pressure diminishes domestic demand on luxury, decelerating retail growth even with favorable tourism-related demand. With households focusing on necessities, jewellery with higher prices faces weaker local demand, limiting the ability of high-end brands to grow in volume. Retailers should thus consider sound pricing policies and material diversification to counter the effects of increasing input prices.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Netherlands Jewellery Market Trend

Growing Appeal of Men’s Jewellery as a Fashion Segment

Men jewellery is becoming a major trend that is redefining the Netherlands jewellery market. According to the European Commission, 2024 end user Trends Report, 42% of European men aged 18 to 44 years have bought at least one fashion accessory within the last year, indicating an increase in interest in personal styling. In the Netherlands in particular, CBS notes that the expenditure of men on apparel and accessories grew 6.8% in 2023, which supports the demand in the related categories like bracelets, necklaces, and rings.

This end user change is evident in the fast development of Netherlands brands like Pig and Hen, which grew retail presence beyond an Amsterdam flagship to new destinations like The Hague in 2024. The growth of the segment is also justified by the growth of marketing focus, partnerships with influencers, and collections aimed at younger men. The segment will keep on creating category-level momentum as more Netherlands males adopt jewellery as a fashion statement.

Netherlands Jewellery Market Opportunity

Shift Toward Affordable and Lab-Grown Jewellery

The need to have affordable and sustainable jewellery, especially lab-grown diamonds, is a significant opportunity. According to Eurostat, the EU market of lab-grown diamonds grew by 18% in 2023 due to its affordability and growing end user interest in ethical products. In the meantime, CBS Netherlands emphasizes that 54% of Netherlands customers are willing to buy sustainable or ethically produced goods, including jewellery products. Such tastes lead to the demand of lab-grown diamonds, moissanite, and high-quality substitutes like Sateurs.

Simultaneously, the increase in the price of gold and silver stimulates the growth of interest in cheaper materials. This helps to grow the number of accessible luxury brands like Franky Amsterdam and Vedder and Vedder that are not concerned with expensive materials but with design-based collections. As the category has lab-grown stones that provide high brilliance and versatility at much lower retail prices, the category is poised to grow rapidly throughout the forecast period.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Netherlands Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

Fine Jewellery represents the dominant segment under category classification, capturing 75% of the Netherlands jewellery market. Fine jewellery continues to dominate due to strong demand from tourists and sustained interest in premium pieces. International visitors from Europe and Asia have supported growth, especially in major cities such as Amsterdam and Rotterdam. Although domestic spending has softened due to cautious end user behaviour, fine jewellery remains attractive thanks to its long-term value and the rising popularity of lab-grown diamonds, moissanite, and innovative alternatives like Satéur.

Over the period 2026–2032, fine jewellery is expected to maintain its lead as retailers introduce more affordable luxury ranges and sustainable materials. Growing male and children's jewellery segments, combined with high-quality craftsmanship from Netherlands brands, will help diversify demand. Innovation in design, rising social media influence, and increased attention to personal style will further strengthen the segment's appeal across wider end user groups.

By Sales Channel

- Retail Offline

- Retail Online

Retail Offline channels constitute the dominant segment under sales channel classification, capturing 70% of the Netherlands jewellery market. Jewellery specialist retailers hold the largest share, supported by their strong physical presence, trusted service, and the ability to offer personalised shopping experiences. End users continue to value in-store consultations, especially for fine jewellery purchases that require expert guidance. Specialty stores, chained retailers, and boutique brands collectively reinforce the strength of the offline channel.

During the forcastperiod, retail offline will remain dominant, although growth will be slower as retail online channels expand. Chained retailers are expected to strengthen their omnichannel strategies, integrating AI-driven customer profiling, personalised offers, and improved stock management. While online shopping will continue gaining relevance, the offline channel will stay essential for discovery, verification, and premium purchases, ensuring its leading position through the forecast period.

List of Companies Covered in Netherlands Jewellery Market

The companies listed below are highly influential in the Netherlands jewellery market market, with a significant market share and a strong impact on industry developments.

- Vroemen Trading BV

- Pandora Jewelry BV

- Hennes & Mauritz (H&M) Nederlands BV

- Lucardi BV

- IBB Amsterdam BV

- Imas BV

- Koninklijke JPC BV

- L Kasius Sieraden BV

- Swarovski AG

- C&A Nederland CV

Competitive Landscape

The Netherlands jewellery market in 2025 remained highly competitive, shaped by a mix of global brands, established local players, and rapidly growing niche designers. Fine jewellery benefited from strong tourist spending, while domestic brands such as Pig & Hen, Zinzi, and Franky Amsterdam strengthened their positions through expanded retail footprints, social-media-driven visibility, and locally crafted designs. Costume jewellery players gained traction by appealing to younger consumers seeking stylish, affordable pieces, while handmade and artisanal brands like Vedder & Vedder continued to thrive through personalised designs and strong influencer partnerships. At the same time, the rise of lab-grown diamonds and alternatives such as moissanite and Satéur intensified competition within fine jewellery. As retail retail online expanded, both chained and independent retailers adapted through omnichannel strategies, contributing to a dynamic and increasingly diversified competitive landscape.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Netherlands Jewellery Market Policies, Regulations, and Standards

4. Netherlands Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Netherlands Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Netherlands Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Netherlands Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Lucardi BV

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.IBB Amsterdam BV

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Imas BV

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Koninklijke JPC BV

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.L Kasius Sieraden BV

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Vroemen Trading BV

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Pandora Jewelry BV

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Hennes & Mauritz (H&M) Nederlands BV

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Swarovski AG

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. C&A Nederland CV

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.