Netherlands Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), Price Category (Mass, Premium), Sales Channel (Retail Offline, Retail Online)

- FMCG

- Dec 2025

- VI0632

- 125

-

Netherlands Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

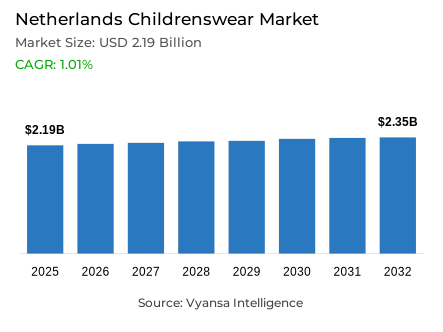

- Childrenswear in Netherlands is estimated at USD 2.19 billion.

- The market size is expected to grow to USD 2.35 billion by 2032.

- Market to register a cagr of around 1.01% during 2026-32.

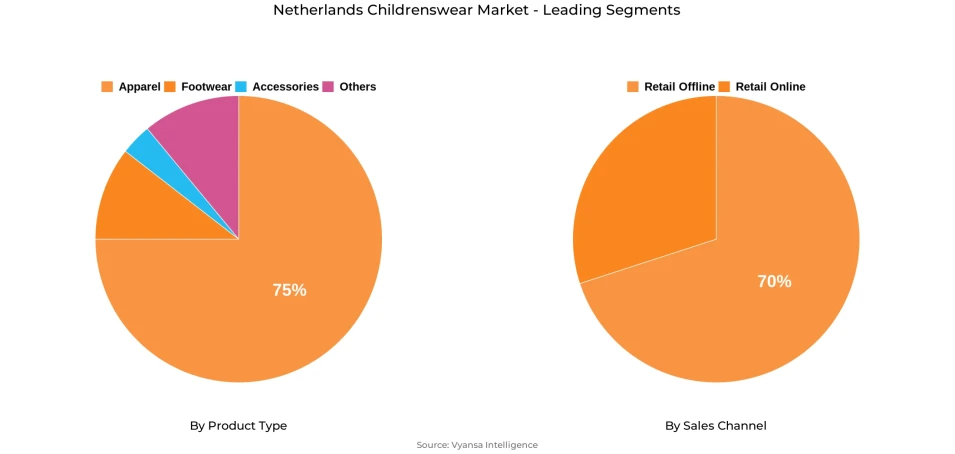

- Product Type Shares

- Apparel grabbed market share of 75%.

- Competition

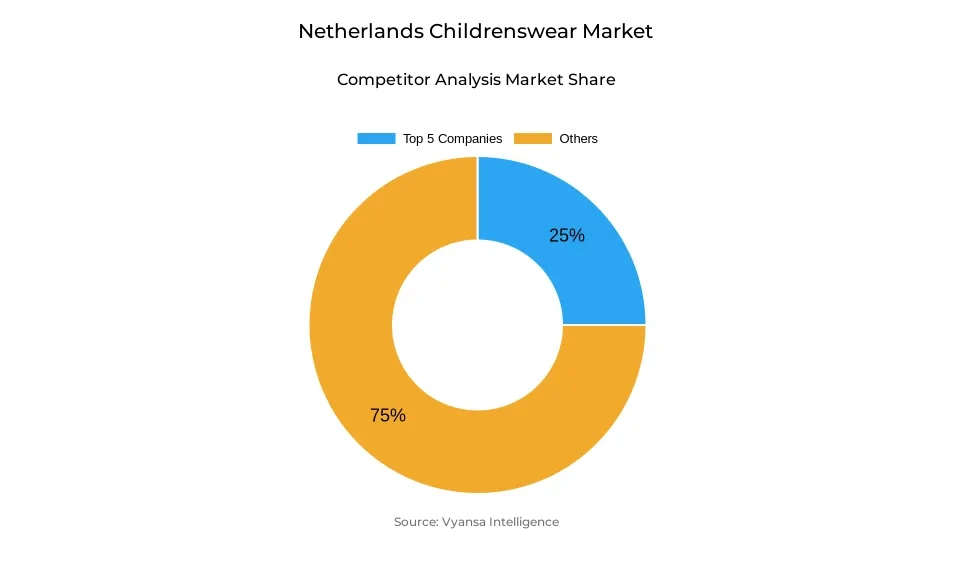

- More than 20 companies are actively engaged in producing childrenswear in Netherlands.

- Top 5 companies acquired around 25% of the market share.

- Cars Jeans & Casuals BV, Columbia Sportswear Netherlands BV, Vingino Jeans BV, Primark Netherlands BV, Hema BV etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 70% of the market.

Netherlands Childrenswear Market Outlook

The Netherlands childrenswear market estimated value of USD 2.19 billion in 2025 and is expected to touch USD 2.35 billion by 2032, growing at a CAGR of approximately 1.01% during 2026–2032. Since inflationary pressures have recently eased, parents are more open to trading up to higher-quality, design-oriented products. Trends toward fashion, such as the "mini-me" concept, in which children's wear is designed similar to adult styles, fuel demand for upscale apparel. Clothing remains at the heart of sales, accounting for 75% of total market share, being both fashionable and durable. Parents increasingly want practicality and aesthetics, which will further cement the position of fashionable yet functional childrenswear.

At the same time, price sensitivity has remained strong, driving end userss to the discounters like Zeeman, Wibra, and C&A that have managed to balance low prices with a degree of fashionability. Retail offline still dominates the market, with a 70% market share, reflecting the density of physical stores across the country. But e-commerce has grown steadily as families go online in search of value, convenience, and more choice. Online marketplaces such as Zalando, Bol.com, and Kidsbrandstore.nl have become important channels to buy children's apparel, driving both reach and visibility for brands.

Sustainability has become a defining feature of the childrenswear market in the Netherlands. Parents are increasingly attracted to eco-friendly and ethically produced clothes, which is why both local and international brands have been eager to introduce organic cotton, recycled fibres, and certified sustainable fabrics. Players like Hema, Nixnut, Donsje, and Gray Label are using this trend as an opportunity to reinforce their brand image with environmentally aware end userss. Social media plays a significant role in telling the story of sustainability and informing purchasing decisions.

Looking ahead, social media marketing and influencer engagement will play key roles in driving demand. International fashion houses like Moncler, Balenciaga, and Ralph Lauren will further expand their presence by offering child-oriented series of high-end collections that combine design, quality, and aspirational appeal. Yet, for independent store-based retailers, the growing penetration of online sales may imply cost pressures. Future market growth, therefore, will depend on innovations in design and sustainability combined with omnichannel retailing for further advancement in the childrenswear market.

Netherlands Childrenswear Market Growth DriverGrowing Focus on Sustainable and High-Quality Apparel

The Netherlands childrenswear market is on its way up due to the increasing priority that parents give to sustainability, quality, and ethical production. Eco-friendly materials such as organic cotton and recycled fibers are increasingly prominent purchase factors, reflecting strong national awareness of environmental responsibility. The Netherlands ranked in the top five EU countries for textile recycling rates in 2024 according to Eurostat, indicating their leading position in sustainable apparel practices. At the same time, improved household income levels underpin this increasing demand for higher-quality garments: household disposable income went up by 2.5% in 2024, according to Statistics Netherlands – CBS, which allows parents to invest in more value-added garments combining functionality and design.

This shift is further reinforced by sustainability initiatives supported by the government, which encourage responsible production and transparent sourcing. Parents show a marked preference for brands reflecting this value, hence driving interest in certified sustainable collections. Companies consequently focusing on eco-conscious materials and ethical manufacturing strengthen their market presence, helping redefine long-term growth in the childrenswear market of the Netherlands.

Netherlands Childrenswear Market ChallengeInflationary Pressures and Cost-Driven Purchases

Inflation, which is on the rise, continues to squeeze household finances in the Netherlands and affects overall spending on childrenswear. High retail prices make many families switch to value-oriented buying habits, with the focus on affordability rather than brand loyalty. end users inflation reached 3.1% in 2024, while household consumption growth slowed to 0.6%, with end userss being very cautious in their expenditure due to the sustained living cost increases. These financial pressures have intensified competition across budget and mid-range segments as parents look for value-for-money deals that balance cost and quality.

Especially for smaller independent brands, the struggle to maintain profit margins is on as operational expenses rise and pricing flexibility is limited. With households continuing to manage their budgets tightly, the challenge remains how to hold onto sales volume without letting profitability suffer. For retailers, the key issue during this inflationary period remains how to balance affordability with quality and sustainability.

Netherlands Childrenswear Market TrendFashion-driven appeal to global brand expansion

Fashion-conscious parenting is gradually becoming a defining trend in the Netherlands' childrenswear market, with parents being increasingly attracted to "mini-me" styles reflecting modern design aesthetics. This growing penchant for stylish, coordinating looks has made the factor of style rise in children's clothing purchases. Children below 14 years constitute 16% of the total population of the country, according to the World Bank, thereby forming a sizeable and trend-sensitive end users segment. International influences are also reshaping the market, with apparel imports up 4.5% in 2024, according to UN Comtrade, reflecting increased activity from global brands.

Designer labels like Moncler and Balenciaga are expanding their premium kids' lines, while mainstream brands inject high-end inspiration at more accessible price levels. This design-led evolution is fostering stronger fashion identity within childrenswear, balancing comfort and functionality with aspirational appeal. Given that parents increasingly see apparel as one aspect of family style, brands offering distinctive, design-forward collections can be expected to capture greater market share over the next several years.

Netherlands Childrenswear Market OpportunitySocial Media Engagement and Digital Branding

Social media and digital branding have started to emerge as major enablers of growth in the childrenswear market of the Netherlands. With 97% of households in the country having access to the internet in 2024, according to Statistics Netherlands – CBS, online platforms like Instagram and TikTok are becoming crucial for brand engagement and storytelling. More than 80% of Netherlands parents use social media every week, according to the Eurostat ICT Survey, which allows apparel brands to reach a highly connected and active audience directly. Companies can communicate their sustainability efforts and show new collections with influencer partnerships, live content, and user-generated campaigns.

This growing digital engagement helps niche and established players alike to increase visibility, strengthen customer loyalty, and offer more personalized shopping experiences. As digitalization further advances, the integration of social commerce and online marketing will become highly instrumental in extending reach and molding brand perception. The strong growth of digital connectivity will continue to be the leading opportunity for long-term growth in the market in the Netherlands.

Netherlands Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Footwear

- Accessories

- Others

The segment with highest market share under By product type is apparel holds about 75% of the market share in the Netherlands childrenswear market. Apparel is the leading category because growing children need garment replacements on many occasions, either due to practical needs or because of fashion sense. Parents in the Netherlands replace clothes very often as sizes change rapidly, but they are also interested in high-quality, comfortable, and sustainable materials. Brands offering cotton and organic apparel remain more popular in accordance with the growing awareness of the Netherlands towards ethical consumption. Fashionable yet functional designs appeal to both parents and children, which supports a steady market performance.

Likewise, in the Netherlands, where weather conditions fluctuate over the year, people pay much attention to easy-to-wash garments. Whereas parents link it back to durability and comfort, playfulness and appeal are added by colorful and playful designs. A combination of all the factors-need, varieties in design, and sustainability-makes up the dominance of apparel in the children's wear segment.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share underr Sales Channel is Retail offline holding approximately 70% of the Netherlands childrenswear market. Parents still prefer brick-and-mortar stores because of the satisfaction they get in trying, touching, and fitting before buying. Department stores, supermarkets, and specialist stores continue to enjoy heavy footfall due to their varied collections, seasonal discounts, and quality assurance.

Further, physical shopping after the pandemic has perpetuated this preference for convenience and assurance among families. Furthermore, retail offline benefits from the possibilities of providing personalized customer service and immediate product availability. Parents often rely on in-store recommendations, promotions, and visual displays to make purchase decisions. While online shopping is fast gaining acceptance, especially among young parents, the more 'hands-on' experience and dependability of offline channels keep them at the forefront of childrenswear retailing in the Netherlands.

Top Companies in Netherlands Childrenswear Market

The top companies operating in the market include Cars Jeans & Casuals BV, Columbia Sportswear Netherlands BV, Vingino Jeans BV, Primark Netherlands BV, Hema BV, C&A Nederland CV, Zeeman textielSupers BV, Cool Cat Fashion BV, Hennes & Mauritz (H&M) Nederlands BV, Roadget Business Pte Ltd, etc., are the top players operating in the Netherlands childrenswear market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Netherland Childrenswear Market Policies, Regulations, and Standards

4. Netherland Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Netherland Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Netherland Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Netherland Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Netherland Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Primark Netherlands BV

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Hema BV

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.C&A Nederland CV

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Zeeman textielSupers BV

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Cool Cat Fashion BV

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Cars Jeans & Casuals BV

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Columbia Sportswear Netherlands BV

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Vingino Jeans BV

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Hennes & Mauritz (H&M) Nederlands BV

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Roadget Business Pte Ltd

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.