Morocco Bottled Water Market Report: Trends, Growth and Forecast (2026-2032)

By Type of Water (Carbonated Bottled Water, Flavoured Bottled Water, Functional Bottled Water, Still Bottled Water), By Sub Types (Purified (Desalinated, Atmospheric Generated, Others), Mineral, Other (Spring, Alkaline, Other)), By Packaging Material (Flexible Packaging (Aluminium, Pouches), Glass, Rigid Plastic (PET Bottles, Thin Wall Plastic Containers, Others)), By Price Category (Budget, Economy, Premium), By Pack Size (100 ml, 125 ml, 200 ml, 250 ml, 330 ml, 370 ml, 450 ml, 500 ml, 591 ml, 750 ml, 1,000 ml, 1,500 ml, 4,000 ml, 5,000 ml, Others), By Sales Channel (On Trade (Restaurants, Hotels, Cafes, Others), Off Trade (Grocery Retailers (Convenience Retail, Supermarkets, Hypermarkets, Small Local Grocer), Non-Grocery Retailers (General Merchandise Stores, Health and Beauty Specialists), Vending, E-commerce))

|

Major Players

|

Morocco Bottled Water Market Statistics and Insights, 2026

- Market Size Statistics

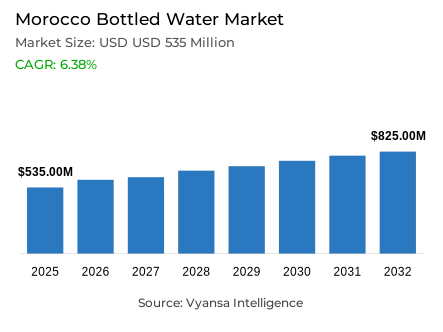

- Bottled water in Morocco is estimated at USD 535 million in 2025.

- The market size is expected to grow to USD 825 million by 2032.

- Market to register a cagr of around 6.38% during 2026-32.

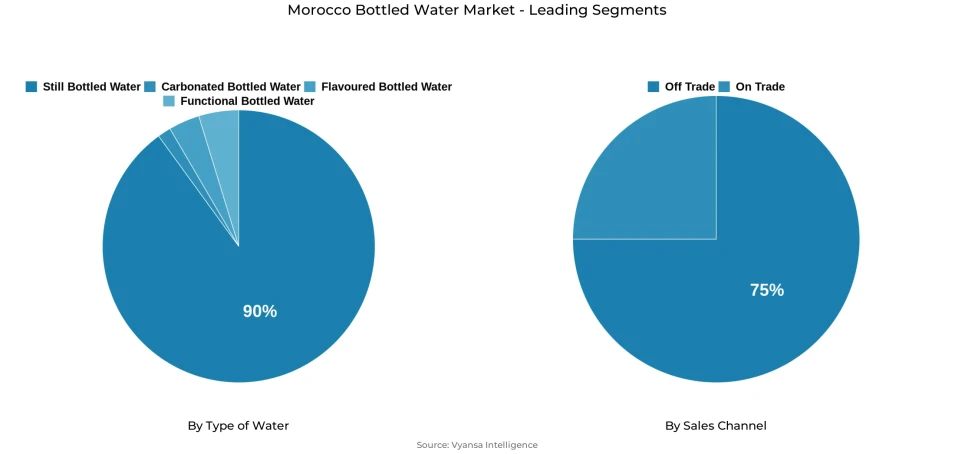

- Type of Water Shares

- Still bottled water grabbed market share of 90%.

- Competition

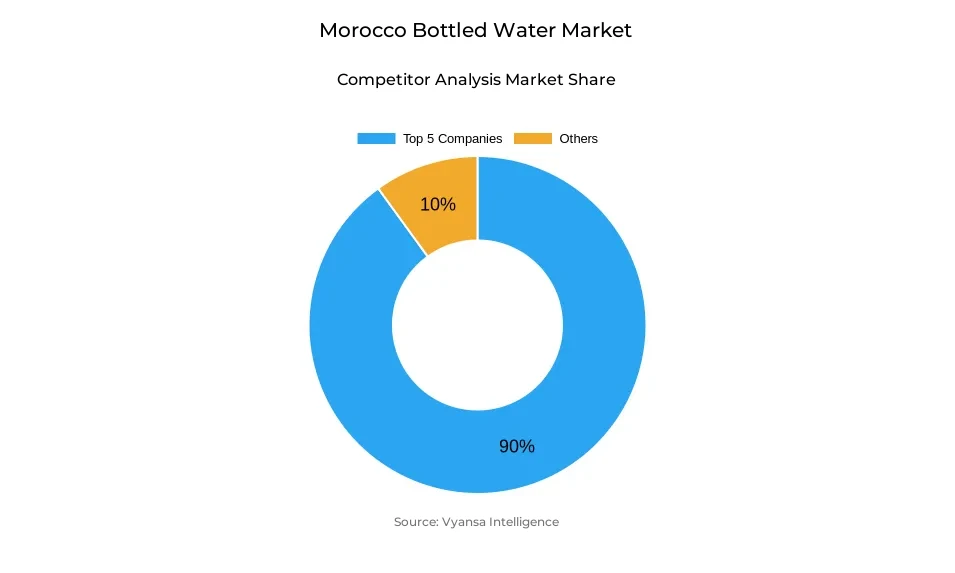

- Bottled water in Morocco is currently being catered to by more than 10 companies.

- Top 5 companies acquired around 90% of the market share.

- Water Mineral Chefchaouen Sarl; Distribution Casino France SAS; Coca-Cola Morocco; Les Eaux Minérales d'Oulmès; Sotherma SA etc., are few of the top companies.

- Sales Channel

- Off trade grabbed 75% of the market.

Morocco Bottled Water Market Outlook

The Morocco bottled water market is estimated at USD 535 million in 2025 and is expected to be USD 825 million in 2032 with a CAGR of approximately 6.38% in 2026-32. This consistent growth indicates the shift of bottled water as a luxury item to a necessity. Continuous heat stress, extended drought periods, and structural water shortage remain to support routine consumption in households and workplaces. In such circumstances, bottled water will continue to be a reliable source of hydration, and it will sustain strong demand even in times of economic stress.

Health-led behaviour among end users reinforces environmental stress. Bottled water is considered safer and cleaner than tap water and healthier than sugary drinks. The reliance is especially high in urban households where the issues of water taste and reliability are more acute. Nevertheless, the category is dominated by bottled water that has a market share of 90% due to its universal applicability in terms of age, meals, and occasions of use. Its connection with purity and daily hydration makes it the structural foundation of market volumes.

The increase in the use of in-home water purification systems, particularly by middle-income and price-sensitive households, is one of the factors that moderate growth. The expensive cost of living promotes the comparison between the regular buying of bottled water and filtration systems that are placed as cost-efficient and environmentally friendly. This trend constrains at-home volume growth but does not replace the role of bottled water in mobility, travel and emergency where convenience and trust are paramount.

The recovery of tourism and urbanisation offer significant growth support up to 2032. The inflows of tourists enhance out-of-home consumption, and the urban lifestyles augment daily hydration requirements. Approximately 75% of all sales are made through off-trade channels, which are led by supermarkets, discounters, and small local grocers that make the products accessible and regularly replenished. All these combine to give a positive and stable market outlook in spite of substitution pressures.

Morocco Bottled Water Market Growth DriverClimate Stress and Health-Led Hydration Needs

The constant heat stress, extended drought periods, and structural water shortage remain to support the daily consumption of bottled water throughout the Morocco bottled water market. Morocco is one of the most water-stressed countries in the world, and the per-capita availability of freshwater is decreasing because of the decrease in rainfall and the increase in average temperatures. According to the World Bank Climate Change Knowledge Portal (2024), climatic pressure is increasing the burden on national water systems, which further supports the idea that bottled water is a stable source of hydration at home and in the workplace. In this case, bottled water is gradually becoming less of a luxury item and more of a necessity item among all income brackets, particularly in long hot seasons.

This dynamic is further supported by health-led behaviour, with end users becoming more concerned with hydration, purity, and safety. Bottled water is commonly viewed as a healthier and cleaner alternative to tap water and a healthier choice compared to sugary soft drinks. Reliance is especially high in urban households, where issues of water taste and reliability are more acute. Climate exposure and health awareness together form structurally resilient demand fundamentals that facilitate long-term consumption of bottled water in the country.

Morocco Bottled Water Market ChallengeCost Substitution Pressures from Household Filtration Solutions

The growing use of in-home water purification systems is a structural limitation to the growth of bottled water volumes. Price-sensitive and middle-income households are increasingly weighing the cost of buying bottled water on a recurring basis against a one-time or periodic expenditure on filtration systems that promise them long-term savings. The high cost of living and the pressure of inflation have continued to hasten this cost-benefit analysis, especially among the large families that consume a lot of water per day. Consequently, bottled water faces substitution risk for routine home consumption, although it is still considered to be safe.

An increased awareness of domestic treatment technologies further transforms behaviour patterns. Water purifiers are being sold as a dependable, convenient, and environmentally friendly option, making them a potential substitute to daily hydration. Although bottled water remains strong enough to be mobile, travel, and emergency-ready, a portion of at-home demand is gradually being taken over by filtration systems. This change puts an upper limit on the growth of off-trade volumes, particularly in urban centres where the availability of appliances and awareness rates are the greatest.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Morocco Bottled Water Market TrendPremium Formats and Sustainability-Led Differentiation

Packaging-based and sustainability-based premiumisation has become one of the defining consumption pattern in the Morocco bottled water market. With the growth of environmental consciousness and perceived health advantages, urban and higher-income end users are moving towards glass bottles, aluminium cans, and recycled PET formats. Sustainable packaging is one of the priorities of the United Nations Environment Programme (2023) in the global food and beverage systems, which supports the competitive advantages of recyclability and minimized lifecycle impact. The packaging decision is becoming more of a quality, purity, and responsibility indicator than a containment indicator.

This change redefines the competition by shifting the brand positioning out of price-based approaches. Premium packaging helps to increase the unit values and meet the changing environmental demands, especially among younger urban populations. With the growing visibility of sustainability credentials at the point of sale, brands are increasingly investing in material innovation, lightweighting, and recycling stories. The outcome is a market in which differentiation is motivated by packaging ethics and aesthetics as much as by water source or mineral composition.

Morocco Bottled Water Market OpportunityTourism Momentum and Urban Lifestyles Expand Consumption Occasions

Tourism recovery is a structural growth driver of bottled water consumption in Morocco. According to official statistics, in 2024, Morocco received about 17.4 million international tourists, the highest number in the country, which significantly increases the on-trade demand in hotels, restaurants, cafes, and travel hubs. Bottled water is usually a default purchase by visitors as they tend to use it as a safe and convenient alternative during the traveling process. This reliance offers a stable consumption base that is not subject to local affordability pressures.

Urbanisation also increases the headroom of demand by transforming the everyday way of life and drinking patterns. According to World Bank urban development indicators (2023), more than 65 percent of the Moroccan population currently lives in cities, which contributes to the increased consumption of packaged beverages per-capita. Crowded living conditions, extended commuting, and out-of-home activity strengthen the use of bottled water in various occasions. The combination of tourism intensity and urban concentration generates long-term structural opportunities amidst substitution pressures at home.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Morocco Bottled Water Market Segmentation Analysis

By Type of Water

- Carbonated Bottled Water

- Flavoured Bottled Water

- Functional Bottled Water

- Still Bottled Water

Still Bottled Water holds the highest share within the Type of Water segmentation, accounting for approximately 90% of the Morocco bottled water market. This dominance reflects its deep association with safety, purity, and everyday hydration, particularly amid drought conditions and ongoing concerns around tap water quality. Still water serves as the primary household hydration source across urban and semi-urban areas, reinforcing its role as a staple rather than an occasional purchase.

End users consistently perceive still spring and mineral water as more trustworthy and versatile than alternative formats. Its compatibility with all age groups, meals, and usage occasions supports resilient demand across income brackets. While flavoured, functional, and premium variants continue to gain shelf visibility, their role remains supplementary. Still bottled water therefore remains the structural backbone of category volumes, providing stability against both economic pressure and emerging substitutes.

By Sales Channel

- On Trade

- Restaurants

- Hotels

- Cafes

- Others

- Off Trade

- Grocery Retailers

- Convenience Retail

- Supermarkets

- Hypermarkets

- Small Local Grocer

- Non-Grocery Retailers

- General Merchandise Stores

- Health and Beauty Specialists

- Vending

- E-commerce

- Grocery Retailers

Off-trade channels account for approximately 75% of total sales within the Morocco bottled water market, reflecting the category’s integration into routine household purchasing. Supermarkets, discounters, and especially small local grocers collectively underpin this dominance by ensuring wide geographic coverage and frequent replenishment opportunities. Off-trade retail supports bulk purchases and price comparisons, making it the preferred channel for daily hydration needs across income segments.

Small local grocers play a critical last-mile role, particularly outside major metropolitan centres, where proximity and convenience drive frequent purchases. Discounters further strengthen off-trade leadership through aggressive pricing strategies and network expansion, appealing to cost-conscious end users. This retail structure ensures bottled water remains accessible and affordable despite economic pressure, reinforcing off-trade channels as the primary volume engine of the market.

List of Companies Covered in Morocco Bottled Water Market

The companies listed below are highly influential in the Morocco bottled water market, with a significant market share and a strong impact on industry developments.

- Water Mineral Chefchaouen Sarl

- Distribution Casino France SAS

- Coca-Cola Morocco

- Les Eaux Minérales d'Oulmès

- Sotherma SA

- Groupe des Brasseries du Maroc SA

- Eaux Minérales Al Karama

- Lodep Sarl

- Eau Minérale d'Evian SA

Competitive Landscape

Morocco’s bottled water market in 2025 remains highly consolidated, led by Les Eaux Minérales d’Oulmès, which retains leadership through its trusted flagship brands Sidi Ali and Oulmès, extensive nationwide distribution, and ongoing packaging innovation such as rPET and premium glass formats. The company has also strengthened its position through Aquafina, which recorded strong growth by leveraging PepsiCo’s distribution capabilities, competitive pricing, and broad promotional activity targeting middle-income households. Lodep Sarl emerged as the most dynamic player, achieving double-digit volume growth driven by Mondariz, particularly in still natural mineral water. While local players continue to dominate, the success of Aquafina signals rising competitive pressure from multinational brands, despite high import levies limiting foreign entry.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Morocco Bottled Water Market Policies, Regulations, and Standards

4. Morocco Bottled Water Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Morocco Bottled Water Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Volume (Million Litres)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type of Water

5.2.1.1. Carbonated Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Flavoured Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Functional Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Still Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sub Types

5.2.2.1. Purified- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.1. Desalinated- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.2. Atmospheric Generated- Market Insights and Forecast 2022-2032, USD Million

5.2.2.1.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mineral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Other (Spring, Alkaline, Other) - Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Packaging Material

5.2.3.1. Flexible Packaging- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. Aluminium- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. Pouches- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Glass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Rigid Plastic- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3.1. PET Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3.2. Thin Wall Plastic Containers- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3.3. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Price Category

5.2.4.1. Budget- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Economy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Pack Size

5.2.5.1. 100 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. 125 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. 200 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. 250 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. 330 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.6. 370 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.7. 450 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.8. 500 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.9. 591 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.10. 750 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.11. 1,000 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.12. 1,500 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.13. 4,000 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.14. 5,000 ml- Market Insights and Forecast 2022-2032, USD Million

5.2.5.15. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Sales Channel

5.2.6.1. On Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.1. Restaurants- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.2. Hotels- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.3. Cafes- Market Insights and Forecast 2022-2032, USD Million

5.2.6.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Off Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.1. Grocery Retailers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.1.1. Convenience Retail- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.1.2. Supermarkets- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.1.3. Hypermarkets- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.1.4. Small Local Grocer- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.2. Non-Grocery Retailers- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.2.1. General Merchandise Stores- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.2.2. Health and Beauty Specialists- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.3. Vending- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2.4. E-commerce- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Morocco Carbonated Bottled Water Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Volume (Million Litres)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Sub Types- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Pack Size- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Morocco Flavoured Bottled Water Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Volume (Million Litres)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Sub Types- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Pack Size- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Morocco Functional Bottled Water Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Volume (Million Litres)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Sub Types- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Pack Size- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Morocco Still Bottled Water Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Volume (Million Litres)

9.2. Market Segmentation & Growth Outlook

9.2.1.By Sub Types- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Pack Size- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Les Eaux Minérales d'Oulmès

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Sotherma SA

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Groupe des Brasseries du Maroc SA

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Eaux Minérales Al Karama

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Lodep Sarl

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Water Mineral Chefchaouen Sarl

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Distribution Casino France SAS

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Coca-Cola Morocco

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Eau Minérale d'Evian SA

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type of Water |

|

| By Sub Types |

|

| By Packaging Material |

|

| By Price Category |

|

| By Pack Size |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.