Mexico Off the Road (OTR) Tire Market Report: Trends, Growth and Forecast (2026-2032)

By Equipment Type (Earthmoving Equipment (Excavator, Grader, Loader, Bulldozer, Road Roller, Others), Material Handling Equipment (Forklifts, Cranes), Agriculture Equipment (Tractor, Grain Harvester, Others)), By Demand Type (OEM, Aftermarket), By Sales Channel (Direct Sales, Multi Brand Stores & Exclusive Outlets, Online), By Tire Type (Radial, Bias), By Tire Size (Tire Size 1, Tire Size 2, Tire Size 3, Tire Size 4, Tire Size 5), By End User (Construction, Industry, Mining, Agriculture, Ports), By Price Category (Budget, Economy, Premium)

- Mobility

- Jan 2026

- VI0727

- 120

-

Mexico Off the Road (OTR) Tire Market Statistics and Insights, 2026

- Market Size Statistics

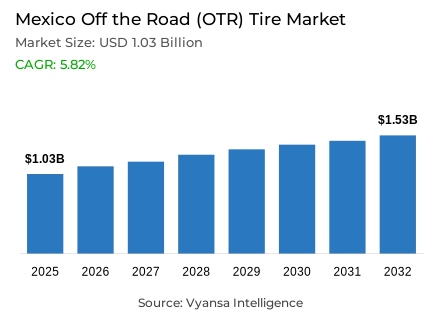

- Mexico off the road (OTR) tire market is estimated at USD 1.03 billion in 2025.

- The market size is expected to grow to USD 1.53 billion by 2032.

- Market to register a cagr of around 5.82% during 2026-32.

- Equipment Type Shares

- Earthmoving Equipment grabbed market share of 60% in terms of units sold.

- Competition

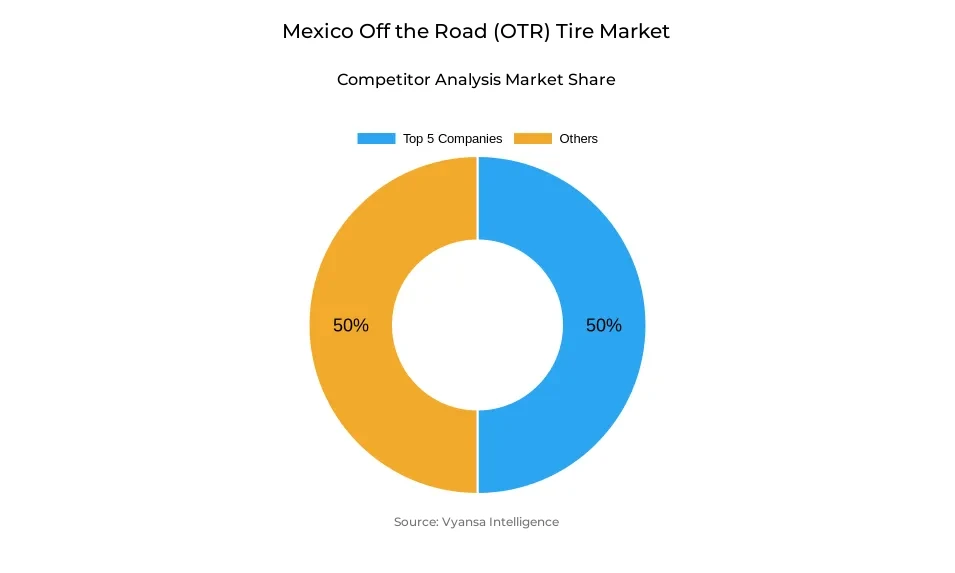

- Mexico off the road (OTR) tire market is currently being catered to by more than 25 companies.

- Top 5 companies acquired around 50% of the market share.

- Michelin; Triangle; Trelleborg; Yokohama; Galaxy etc., are few of the top companies.

- End User

- Construction grabbed 50% of the market in terms of units sold.

- Faster Growing End User Segment

- Mining segment to register 2.98% CAGR during 2026-32.

Mexico Off the Road (OTR) Tire Market Outlook

The Mexico OTR tire market reached a value of USD 1.03 billion in 2025 and is projected to hit USD 1.53 billion by 2032. This steady growth reflects the expansion of national production of heavy machinery, particularly in mining and agriculture. According to Instituto Nacional de Estadística y Geografía (INEGI), the production of construction machinery rose by 6.2% in 2024, driving up demand for high-capacity tires.

During 2025-2032, the expansion of infrastructure projects under the National Infrastructure Plan 2020-2035 is expected to boost the OTR equipment use in construction and mining. According to the Ministry of Finance and Public Credit (SHCP), public and private investments exceeded USD 60 billion in 2024, reinforcing demand for durable and specialized tires.

Further, the market growth is also tied to increased exports of agricultural and construction machinery, which rose 8% year-on-year, according to the Ministry of Economy. This dynamism creates opportunities for global manufacturers seeking to expand local capacity and lower logistics costs.

Demand for radial OTR tires which are more durable and efficient, is gradually replacing bias models. According to Bridgestone and Michelin Mexico, the adoption of heat-resistant and high-traction compounds has improved operational performance by up to 15%, strengthening the market’s competitiveness.

Mexico Off the Road (OTR) Tire Market Growth Driver

Expansion of Mega Infrastructure Projects Fuels OTR Tire Demand

The rapid expansion of large-scale public and private infrastructure projects are driving the market growth . According to the Mexican Chamber of the Construction market (CMIC), over 500 roads, rail, and energy projects are underway, totaling investments above USD 70 billion between 2024 and 2030.

These projects rely heavily on heavy-duty machinery such as bulldozers, excavators, and front loaders, etc., that require high-resistance OTR tires. According to Caterpillar Mexico, the 12% rise in earthmoving equipment usage during 2024 directly boosted demand for premium tires with reinforced compounds.

Additionally, the entry of international manufacturers such as BKT and Trelleborg has expanded access to specialized tires for extreme conditions. BKT reports that its cut- and wear-resistant tire lines extended tire life by up to 20%, significantly lowering contractors’ operational costs.

Mexico Off the Road (OTR) Tire Market Challenge

Dependence on Imports and Natural Rubber Price Volatility

The heavy reliance on imports of natural rubber and semi-finished tires is majorly hindering the market growth. According to the Bank of Mexico, more than 85% of the rubber used domestically is imported from Asia, primarily Thailand and Indonesia.

Volatility in international rubber prices, up 14% in 2024, has put pressure on local manufacturers’ margins. The National Association of Tire Distributors and Retreaders (Andellac) revelaed that this cost inflation undermines competitiveness against markets such as Brazil and the United States.

Furthermore, the lack of sufficient recycling and tire waste management infrastructure adds to production costs. Limited government incentives for local production continue to constrain the development of a strong national value chain.

Mexico Off the Road (OTR) Tire Market Trend

Digitalization and Smart OTR Tire Monitoring

The Mexico OTR tire market is witnessing increasing adoption of smart technologies that enable real-time monitoring and optimisation of tire performance. According to reports from Bridgestone Mexico, there has been a 22% increase in the use of tire pressure and temperature sensors in heavy commercial vehicles in 2024, thanks to efforts to maximize machine time.

Real-time data analysis prevents failures, lowers fuel consumption, and maximizes the lifespan of tires. Telematics system implementations in the mining and construction sectors in the country have minimized maintenance expenditures by as much as 10%, as cited by Michelin Connected Fleet.

Digitalization combined with predictive wear management is becoming the norm among industrial vehicle fleets. It is this trend that is driving the need for the development of smart tires that can communicate with remote monitoring systems.

Mexico Off the Road (OTR) Tire Market Opportunity

Rising Demand for Sustainable and Retreadable OTR Tires

The increasing emphasis on environmentally responsible practices represents a strategic opportunity for OTR tire producers to align product development and operations with sustainability-oriented demand. It is stated that 75% of the total waste output of the rubber market that is classified under heavy machinery is the driving factor for recycling procedures among Mexico.

The manufacturing sector is emerging with environmentally friendly compounds and processes for retreading that entail lower waste. Retreadable OTR tires are being preferred increasingly by miners and farmers, as Michelin Mexico claims that their manufacturing has the potential for costing up to 35% less.

A medium-term prospect for growth is presented by the promotion of the circular economy by the Mexican government, along with tax incentives for clean technologies. This could make Mexico a regional center for eco-friendly OTR tires.

Mexico Off the Road (OTR) Tire Market Segmentation Analysis

By Equipment Type

- Earthmoving Equipment

- Excavator

- Grader

- Loader

- Bulldozer

- Road Roller

- Others

- Material Handling Equipment

- Forklifts

- Cranes

- Agriculture Equipment

- Tractor

- Grain Harvester

- Others

The largest segment is earthmoving equipment, accounting for 60% of the market. Its dominance stems from increased construction and mining projects requiring heavy machinery with high traction. According to Cámara Mexicana de la Industria de la Construcción (CMIC), over 30,000 excavators and front loaders were used in infrastructure projects in 2024, boosting demand for heat- and abrasion-resistant OTR tires.

Manufacturers have developed lines tailored for extreme conditions. Yokohama and BKT introduced “cut-resistant” models that extend durability by 25%, minimizing operational downtime. These innovations reinforce the segment’s leadership in the national market.

Finally, the renewal of machinery fleets among construction and mining firms continues to sustain growth. Fleet replacement programs supported by the Secretaría de Hacienda y Crédito Público (SHCP) are driving the adoption of premium and eco-friendly tires to improve overall operational efficiency.

By End User

- Construction

- Industry

- Mining

- Agriculture

- Ports

The construction segment leads with a 50% market share, driven by ongoing road and energy projects. According to the Ministry of Infrastructure, Communications, and Transport (SICT), the expansion of 5,000 km of highways in 2024 required heavy-duty machinery equipped with high-performance OTR tires.

Manufacturers have responded by introducing models designed for rocky and arid terrains, improving traction and stability. Trelleborg reported an 18% increase in sales to Mexico contractors in 2024 due to its low-pressure tire line.

The construction sector is expected to maintain leadership owing to national road and railway modernization programs. These investments will sustain demand for high-capacity OTR tires over the next decade.

List of Companies Covered in Mexico Off the Road (OTR) Tire Market

The companies listed below are highly influential in the Mexico off the road (OTR) tire market, with a significant market share and a strong impact on industry developments.

- Michelin

- Triangle

- Trelleborg

- Yokohama

- Galaxy

- BKT

- Bridgestone

- Pirelli Numaticos S.A. de C.V

- Goodyear Tires and Rubber Company

- CST Tires

Recent Developments

- Bridgestone, 2025:

The company invested USD 100 million to expand production capacity, targeting regional supply for mining and construction sectors.

- Michelin, 2025:

The new line integrates remote monitoring of pressure and temperature, enhancing heavy machinery performance.

- Yokohama, 2025:

The program aims to reduce industrial rubber waste by 20% through tire reuse and retreading solutions.

- BKT, 2024:

Designed for the Mexican mining industry, they enhance durability and reduce operational failure risks.

- Trelleborg, 2024:

The expansion strengthens service capacity for industrial and agricultural clients through new regional logistics centers.

Frequently Asked Questions

Related Report

- Market Segmentation

- Research Scope

- Research Methodology

- Definitions and Assumptions

- Executive Summary

- Mexico Off the Road (OTR) Tire Import & Export Statistics

- Mexico Off the Road (OTR) Tire Market Supply Chain Analysis

- Mexico Off the Road (OTR) Tire Hotspot and Opportunities

- Mexico Off the Road (OTR) Tire Market Policies, Regulations, and Standards

- Mexico Off the Road (OTR) Tire Market Dynamics

- Growth Factors

- Challenges

- Trends

- Opportunities

- Mexico Off the Road (OTR) Tire Market Statistics, 2022-2032F

- Market Size & Growth Outlook

- By Revenues in USD Million

- By Units Sold (Thousand Units)

- Market Segmentation & Growth Outlook

- By Equipment Type

- Earthmoving Equipment- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Excavator- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Grader- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Loader- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Bulldozer- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Road Roller- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Others- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Material Handling Equipment- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Forklifts- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Cranes- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Agriculture Equipment- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Tractor- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Grain Harvester- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Others- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Earthmoving Equipment- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Demand Type

- OEM- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Aftermarket- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Sales Channel

- Direct Sales- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Multi Brand Stores & Exclusive Outlets- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Online- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Tire Type

- Radial- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Bias- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Tire Size

- Tire Size 1- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Tire Size 2- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Tire Size 3- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Tire Size 4- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Tire Size 5- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Price Category

- Budget- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Economy- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Premium- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- By Equipment Type

- Market Size & Growth Outlook

- Mexico Earthmoving Equipment Tire Market Statistics, 2022-2032

- Market Size & Growth Outlook

- By Revenues in USD Million

- By Units Sold (Thousand Units)

- Market Segmentation & Growth Outlook

- By Equipment Type Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Demand Type- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Sales Channel- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Tire Type- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Tire Size- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Price Category- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Market Size & Growth Outlook

- Mexico Material Handling Equipment Tire Market Statistics, 2022-2032

- Market Size & Growth Outlook

- By Revenues in USD Million

- By Units Sold (Thousand Units)

- Market Segmentation & Growth Outlook

- By Equipment Type Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Demand Type- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Sales Channel- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Tire Type- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Tire Size- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Price Category- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Market Size & Growth Outlook

- Mexico Agriculture Equipment Tire Market Statistics, 2022-2032

- Market Size & Growth Outlook

- By Revenues in USD Million

- By Units Sold (Thousand Units)

- Market Segmentation & Growth Outlook

- By Equipment Type Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Demand Type- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Sales Channel- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Tire Type- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Tire Size- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- By Price Category- Tire Sales & Forecast 2022-2032, USD Million in Thousand Units

- Market Size & Growth Outlook

- Competitive Outlook

- Company Profiles

- Goodyear Tires and Rubber Company

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Pirelli Numaticos, S.A. de C.V

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- CST Tires

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Continental

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Michelin

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Triangle

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Bridgestone

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- BKT

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Double Coin Tires

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Zhongce Rubber Group

- Business Description

- Product Portfolio

- Collaborations & Alliances

- Recent Developments

- Financial Details

- Others

- Goodyear Tires and Rubber Company

- Company Profiles

- Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Equipment Type |

|

| By Demand Type |

|

| By Sales Channel |

|

| By Tire Type |

|

| By Tire Size |

|

| By End User |

|

| By Price Category |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.