Egypt Mining Equipment Market Report: Trends, Growth and Forecast (2026-2032)

By Equipment Type (Surface Mining Equipment, Underground Mining Equipment, Mineral Processing Equipment, Drills and Breakers, Crushing, Pulverizing and Screening Equipment, Loaders and Haul Trucks), By Automation Level (Manual Equipment, Semi-Autonomous Equipment, Fully Autonomous Equipment), By Powertrain Type (Internal-Combustion Engine Vehicles, Battery-Electric Vehicles, Hybrid Vehicles), By Power Output (Less than 500 HP, 500 to 1,000 HP, Above 1,000 HP), By Application (Metal Mining, Mineral Mining, Coal Mining)

- Mobility

- Dec 2025

- VI0557

- 115

-

Egypt Mining Equipment Market Statistics and Insights, 2026

- Market Size Statistics

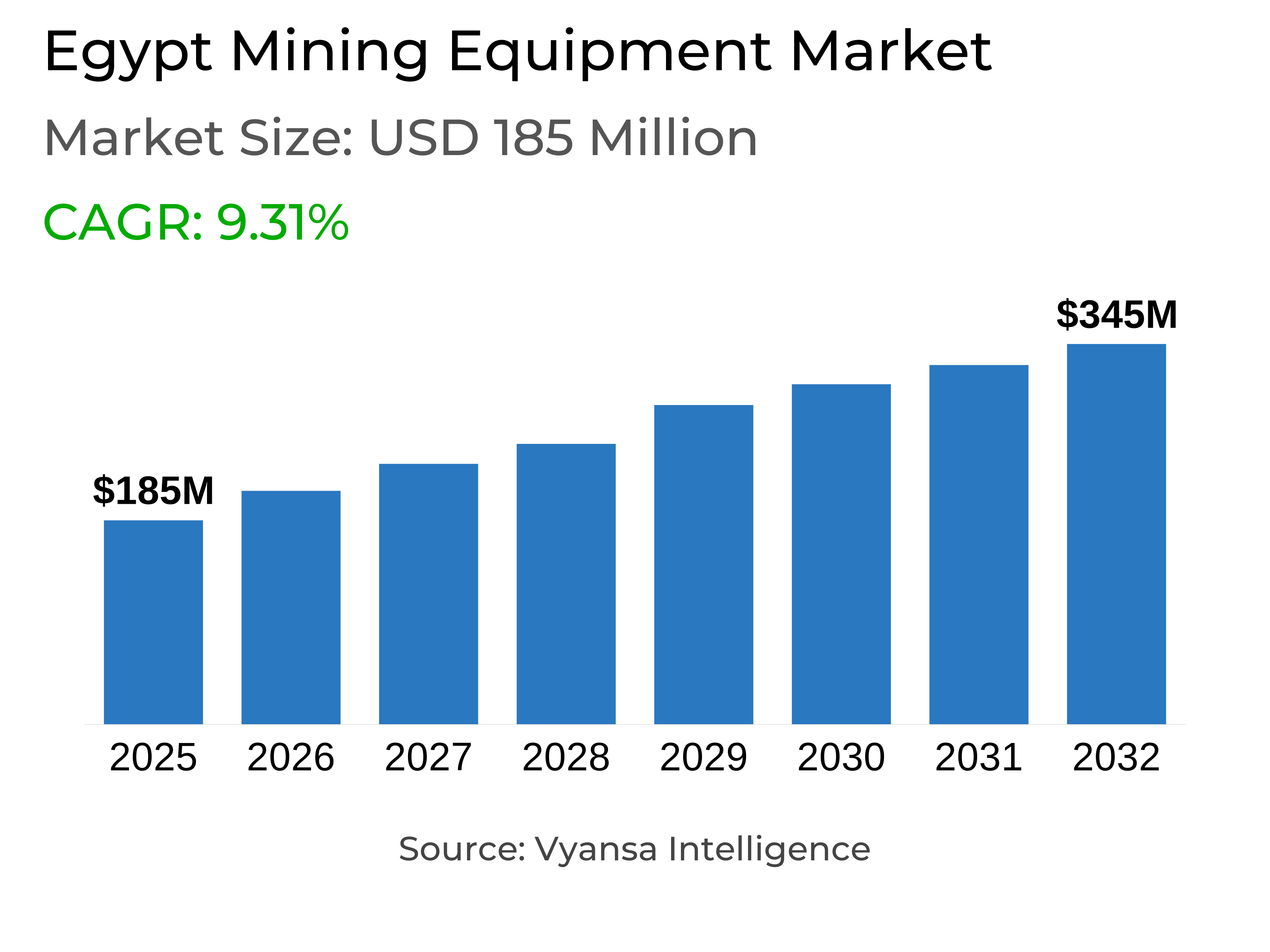

- Mining Equipment in Egypt is estimated at $ 185 Million.

- The market size is expected to grow to $ 345 Million by 2032.

- Market to register a CAGR of around 9.31% during 2026-32.

- Equipment Type Shares

- Surface Mining Equipment grabbed market share of 60%.

- Competition

- More than 10 companies are actively engaged in producing Mining Equipment in Egypt.

- Top 5 companies acquired around 70% of the market share.

- Hitachi Construction Machinery, Volvo Construction Equipment, XCMG Group, Caterpillar Inc., Komatsu Ltd. etc., are few of the top companies.

- Automation Level

- Manual Equipment grabbed 70% of the market.

Egypt Mining Equipment Market Outlook

Egypt is seeing major investments in upgrading its mining activities to improve productivity and minimize downtime. Government programs are increasingly supporting fleet modernization and maintenance initiatives, in line with 3.5% of the national GDP contribution by mineral resources in 2022. Equipment reliability is being prioritized by end users to achieve export quotas and maximize operational expenses in the face of competitive international commodity prices. Suppliers offer modular designs and rapid-deployment solutions that minimize downtime and maintain operations.

The Egypt mining equipment market is at $185 million in 2025 and will grow to $345 million by 2032, at a CAGR of approximately 9.31%. Infrastructure boosts to desert and rural regions remain a hindrance to operations, with about 70% of roads in such conditions that they are unpaved and poor rail connections leading to increased use of long-distance trucks. The ports' congestion as well as poor specialized loading facilities remain affecting the supply chain. It will require investment in dedicated terminals, multimodal transport corridors, and upgrading road networks to address these logistic challenges. Without these advancements, the end-users will have to prepare for long lead times as well as combined logistics strategies to facilitate ongoing smooth operation.

Technological adoption is continuously transforming the mining operations, with automated sensor networks and survey drones enabling real-time monitoring of the equipment as well as environmental conditions. Predictive analytics are also being used to maximize ore recovery and resource efficiency, improving operational efficiency as well as safety. Semi-autonomous as well as technology is gaining popularity, although traditional manual equipment maintains market leadership with approximately 70% of the market share, due to availability of the workforce, cost-effectiveness, as well as simple training requirements.

The Surface mining equipment possesses the largest market share in the Equipment Type category, around 60%, as open-pit mining dominates. The end customers opt for large excavators, haul trucks, and wheel loaders because of their scalability, robustness, and ease of maintenance in the Egyptian desert environment. Egypt provides abundant mineral reserves, supportive government policies, along with increasing exploration activities, thus the Egypt mining equipment market is expected to be robust with immense opportunities for the end users as well as the suppliers to increase gradually in different mining segments.

Egypt Mining Equipment Market Growth Driver

Rising Demand for Enhanced Operational Efficiency

Egypt is undergoing aggressive investment to upgrade mining operations to enhance productivity with reduced downtime. Government programs are guiding monies to perform upgrading fleets using extensive care campaigns, mirroring the 3.5% national GDP contribution of mineral resources in 2022. End users are worried about equipment reliability in order to meet export levels with minimal operation expense in the context of competitive global commodity prices. The suppliers are responding with modular machinery concepts as well as rapid-deployment solutions that cut idling time in half with increased operating continuity.

Egypt Mining Equipment Market Challenge

Infrastructure Limitations Affecting Equipment Deployment

Even with rich mineral resources, rural and desert areas have infrastructure deficits that pose major operational challenges. An estimated 70% of supporting roads are unpaved, making it difficult to move heavy equipment. Limited connectivity via rail networks means a reliance on long-haul trucking, which raises delivery costs and project lead times. Peak periods lead to port congestion, which makes delays worse, and demurrage charges have an impact on supply chain productivity. The absence of specialized loading facilities also limits timely handling of minerals and project delivery.

Surviving such logistics hurdles requires investment in multimodal transport connections, specialized terminals, and upgraded road networks. Until such infrastructure upgrades take place, end users continue to feel the lag in equipment delivery and project schedules. Both service providers and operators need to plan for lengthy lead times, which puts value on combined logistics strategies in sustaining mining operations cost-effectively.

Egypt Mining Equipment Market Trend

Integration of Advanced Mining Technologies

Automated sensor networks and drone aerial surveys are increasingly being applied across Egypt's mining operations, with sensor deployments increasing 25% in 2023. The technologies allow real-time monitoring of equipment health and environmental conditions with resulting higher levels of safety and reduced operating risk. Real-time information benefits end-users through improved drilling, blasting, and material transfer decision-making. Predictive analytics solutions also aligns ore extractive patterns with past performance, enabling better utilization of resources.

The digital revolution fuels the enhancement of operational efficiency and positions Egypt among the leaders in the deployment of high-end mining technologies across the MENA region. The technologies allow operators to reduce downtime, enhance precision, and optimize equipment performance. Deployment of the technologies supports the implementation of mega-scale as well as midterm mining operations to achieve higher rates of productivity as well as long-term sustainability.

Egypt Mining Equipment Market Opportunity

Untapped Mineral Reserves Driving Investment Potential

Egypt possesses phosphate deposits of over 700 million tonnes, among the greatest on the planet, with excellent revenue generation prospects. Growth in global fertilizer input consumption is driving overseas investment into exploration as well as production. Immense gold as well as iron ore deposits discovered in the Eastern Desert lie dormant, driving strategic partnerships as well as expansion plans. Government incentives like tax benefits in addition to simplified licensing also encourage investment streams, so the environment is conducive to both end users as well as equipment vendors.

Stepped-up exploration activities trigger mining capex on drilling rig, loader, and processing machinery. Egypt's abundant natural resources endowment and preferential policies position it as a mining capex hotspot. Final customers become exposed to new equipment, while suppliers enjoy the widening pool of orders for specialty equipment to achieve long-term success across different segments of the mining industry.

Egypt Mining Equipment Market Segmentation Analysis

By Equipment Type

- Surface Mining Equipment

- Underground Mining Equipment

- Mineral Processing Equipment

- Drills and Breakers

- Crushing

- Pulverizing and Screening Equipment

- Loaders and Haul Trucks

The surface mining equipment has the largest share of around 60% in the Equipment Type category. Open-pit mining is dominant in mineral mining with preference for large-sized excavators, haul trucks, and high-throughput wheel loaders and mixed ore-type operation. End users prefer surface machines for their scalability, durability, and suitability for desert conditions. The manufacturers outfit the machines with strengthened cooling aspects along with dust controls in order to enhance performance and life.

Economies of scale and convenient servicing make surface mining equipment the choice of most miners. The choice is a result of the country's geology as well as the abundance of large mining operations. Constant requirements of the machines make producers always worried about innovation, durability, and tailored solutions to the requirements of the end user in Egypt's mining sector.

By Automation Level

- Manual Equipment

- Semi-Autonomous Equipment

- Fully Autonomous Equipment

Manual equipment has the largest market share of around 70% of the Automation Level segment, reflecting widespread application of conventional machinery. The majority of medium-grade as well as small mines continue to employ the drills, loaders, and conveyors which have to be operated programmatically by individuals. The reason is simple availability of manpower, cost-effectiveness, as well as simple training requirements, making manual systems cost-effective for most end users.

The sector is serviced with on-site maintenance and supply of parts to ensure continuity of operation among operators who prefer proven reliability over automation. While digital and semi-autonomous technology is becoming increasingly popular, manual equipment remains central to the Egyptian mining culture. The prevailing dominance reaffirms the balance between technological advancement and realistic operating imperatives across the industry.

Top Companies in Egypt Mining Equipment Market

The top companies operating in the market include Hitachi Construction Machinery, Volvo Construction Equipment, XCMG Group, Caterpillar Inc., Komatsu Ltd., Sandvik AB, Epiroc AB, Liebherr-International AG, SANY Group, Doosan Infracore, etc., are the top players operating in the Egypt Mining Equipment Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Egypt Mining Equipment Market Policies, Regulations, and Standards

4. Egypt Mining Equipment Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Egypt Mining Equipment Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Equipment Type

5.2.1.1. Surface Mining Equipment- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Underground Mining Equipment- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Mineral Processing Equipment- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Drills and Breakers- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Crushing, Pulverizing and Screening Equipment- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Loaders and Haul Trucks- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Automation Level

5.2.2.1. Manual Equipment- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Semi-Autonomous Equipment- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Fully Autonomous Equipment- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Powertrain Type

5.2.3.1. Internal-Combustion Engine Vehicles- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Battery-Electric Vehicles- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Hybrid Vehicles- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Power Output

5.2.4.1. Less than 500 HP- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. 500 to 1,000 HP- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Above 1,000 HP- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Application

5.2.5.1. Metal Mining- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Mineral Mining- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Coal Mining- Market Insights and Forecast 2022-2032, USD Million

5.2.6. By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Egypt Surface Mining Equipment Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Automation Level- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Powertrain Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Power Output- Market Insights and Forecast 2022-2032, USD Million

6.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

7. Egypt Underground Mining Equipment Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Automation Level- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Powertrain Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Power Output- Market Insights and Forecast 2022-2032, USD Million

7.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

8. Egypt Mineral Processing Equipment Mining Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Automation Level- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By Powertrain Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Power Output- Market Insights and Forecast 2022-2032, USD Million

8.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

9. Egypt Drills and Breakers Mining Equipment Market Statistics, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Automation Level- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By Powertrain Type- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Power Output- Market Insights and Forecast 2022-2032, USD Million

9.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

10. Egypt Crushing, Pulverizing and Screening Equipment Mining Market Statistics, 2020-2030F

10.1.Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2.Market Segmentation & Growth Outlook

10.2.1. By Automation Level- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Powertrain Type- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Power Output- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

11. Egypt Loaders and Haul Trucks Mining Equipment Market Statistics, 2020-2030F

11.1.Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2.Market Segmentation & Growth Outlook

11.2.1. By Automation Level- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Powertrain Type- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Power Output- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1.Company Profiles

12.1.1. Caterpillar Inc.

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Komatsu Ltd.

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Sandvik AB

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Epiroc AB

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Liebherr-International AG

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Hitachi Construction Machinery

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Volvo Construction Equipment

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. XCMG Group

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. SANY Group

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Doosan Infracore

12.1.10.1. Business Description

12.1.10.2. Product Portfolio

12.1.10.3. Collaborations & Alliances

12.1.10.4. Recent Developments

12.1.10.5. Financial Details

12.1.10.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Equipment Type |

|

| By Automation Level |

|

| By Powertrain Type |

|

| By Power Output |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.