France Electric Commercial Vehicle Battery Pack Market Report: Trends, Growth and Forecast (2026-2032)

By Body Type (Bus, Light Commercial Vehicle (LCV), Medium & Heavy-Duty Truck (M&HDT)), By Propulsion Type (Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV)), By Battery Chemistry (Lithium Iron Phosphate (LFP), Nickel Cobalt Aluminum Oxide (NCA), Nickel Cobalt Manganese (NCM), Nickel Manganese Cobalt (NMC), Others), By Capacity (Less than 15 kWh, 15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh), By Battery Form (Prismatic Cells, Pouch Cells, Cylindrical Cells), By Method (Laser, Wire), By Component (Anode, Cathode, Electrolyte, Separator), By Material Type (Cobalt, Lithium, Manganese, Natural Graphite, Nickel, Others)

- Mobility

- Dec 2025

- VI0559

- 115

-

France Electric Commercial Vehicle Battery Pack Market Statistics and Insights, 2026

- Market Size Statistics

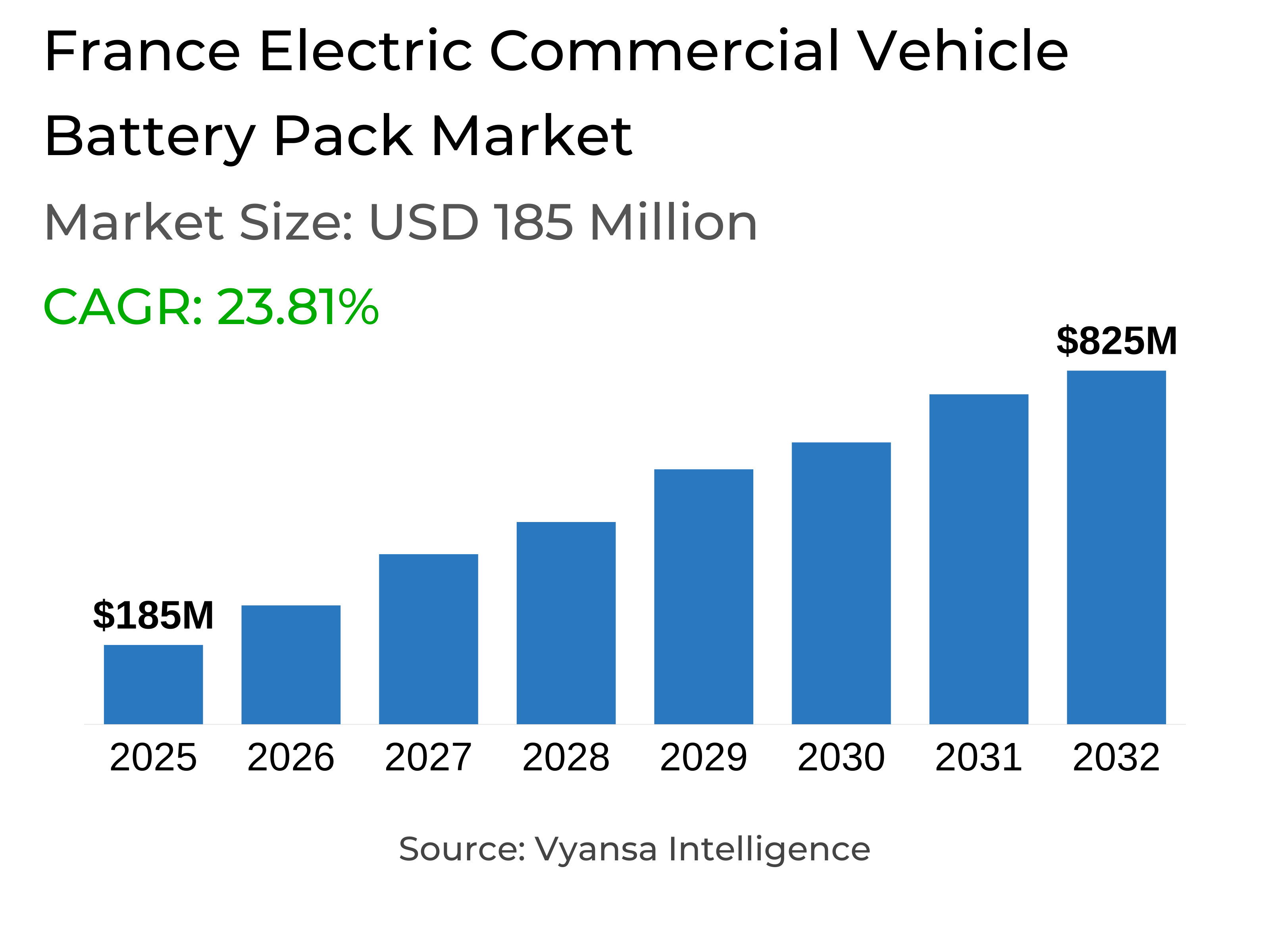

- Electric Commercial Vehicle Battery Pack in France is estimated at $ 185 Million.

- The market size is expected to grow to $ 825 Million by 2032.

- Market to register a CAGR of around 23.81% during 2026-32.

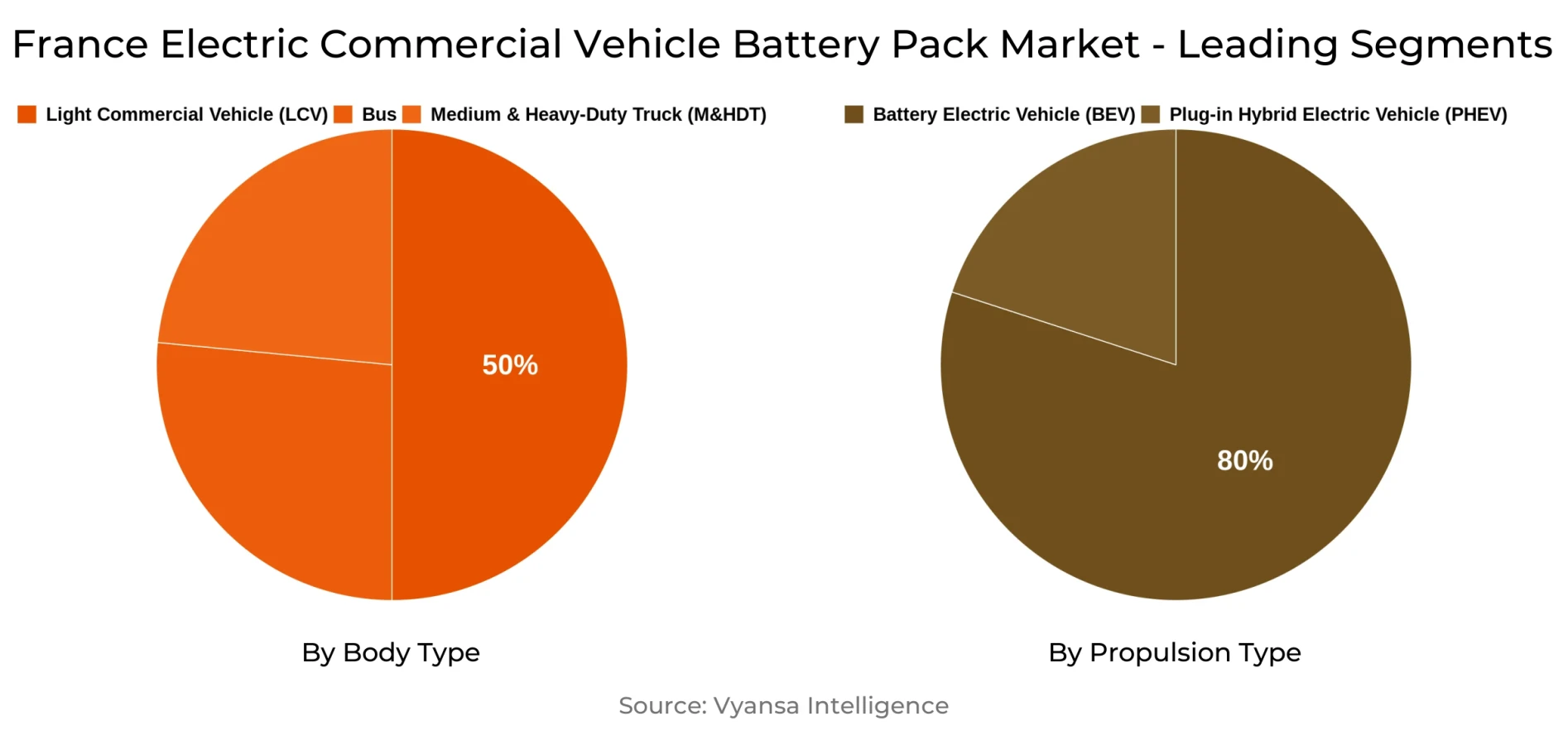

- Body Type Shares

- Light Commercial Vehicle (LCV) grabbed market share of 50%.

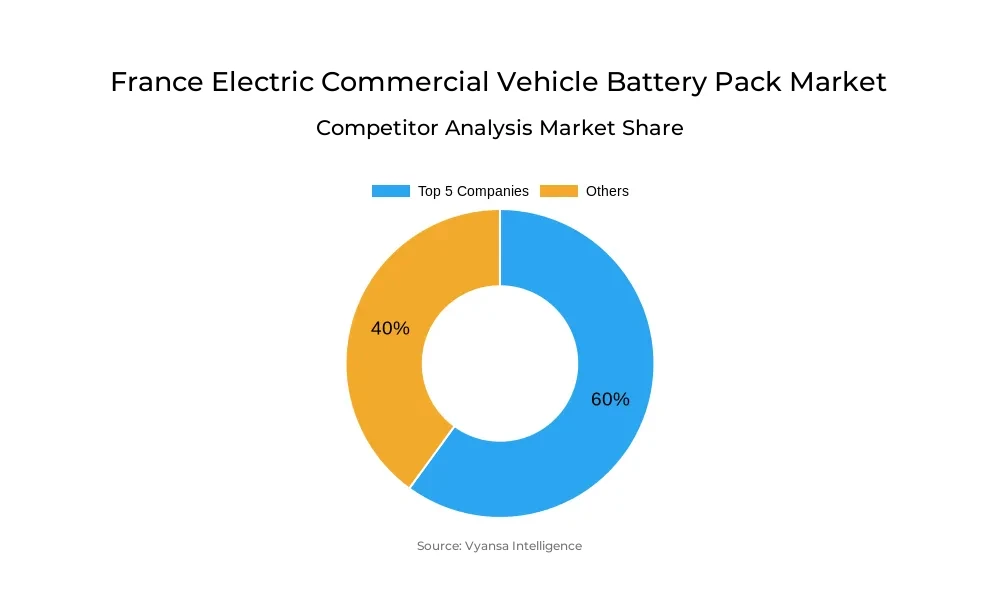

- Competition

- More than 10 companies are actively engaged in producing Electric Commercial Vehicle Battery Pack in France.

- Top 5 companies acquired around 60% of the market share.

- Elecsys France, Forsee Power, Groupe Renault, Akasol AG, Automotive Cells Company (ACC) etc., are few of the top companies.

- Propulsion Type

- Battery Electric Vehicle (BEV) grabbed 80% of the market.

France Electric Commercial Vehicle Battery Pack Market Outlook

France Electric Commercial Vehicle Battery Pack Market is around USD 185 million in 2025 and is expected to reach about USD 825 million by 2032, with a CAGR of almost 23.81% from 2026–2032. This swift growth comes with the backdrop of the country's strong charging infrastructure with more than 154,000 public charging stations as of 2024—a 31% year-on-year growth. Government programs like the €3 billion "France Relance" package have been essential in driving wide-scale charger installation, lowering installation prices, and stimulating private investment to catalyze the electrification of fleets in logistics and services sectors.

Despite firm policy support, commercial fleets are confronted with a number of operational and technical challenges. The 2025 Mobility Orientation Law, which requires charger installations within parking facilities, puts pressure on fleet operators to ramp up infrastructure quickly. Meanwhile, grid capacity constraints and sluggish permitting processes delay charger deployment, especially in regional markets. To address these issues, cooperation between utilities, fleet operators, and local governments is crucial in promoting balanced grid management as well as seamless market progression.

Battery Electric Vehicles (BEVs) lead the charge in terms of propulsion preference, with around 80% market share in 2025, as fleets increasingly opt for zero-emission, low-maintenance, and cost-effective options. The growth in charging infrastructure and battery performance contribute to further BEV uptake, especially by delivery and logistics fleets operating inside cities. The focus turns to scalable and recyclable cell architectures to hit energy density, durability, and sustainability requirements.

Within the Body Type segmentation, Light Commercial Vehicles (LCVs) dominate with almost 50% share, popular for the perfect combination of payload capacity and agility in congested city conditions. Their demand is fueled by the rise in e-commerce, last-mile delivery, and service fleets necessitating high-stop-and-go operations. Modular and mid-size battery packs tailored for LCVs are likely to continue as the foremost growth driver of the France Electric Commercial Vehicle Battery Pack Market till 2032.

France Electric Commercial Vehicle Battery Pack Market Growth DriverExpanding Infrastructure Strengthens Market Growth

France is witnessing strong growth in its charging network, strongly reinforcing commercial electric vehicle adoption. At the end of December 2024, France had 154,694 public charging points, a 31% year-on-year growth and offering end users with safe access to both urban and rural areas. This wide coverage gives fleets confidence, enabling them to recharge conveniently during delivery and logistics operations.

Robust policy backing further underlines such advancement. In 2024, the government directed €3 billion under the "France Relance" scheme to develop EV infrastructure, reducing installation costs and encouraging private operators to roll out high-power stations. This is a critical initiative in making convenient charging accessible, thus fueling commercial fleet electrification and limiting reliance on fossil-fuel-powered vehicles in major mobility sectors.

France Electric Commercial Vehicle Battery Pack Market ChallengeRegulatory and Grid Barriers Slow Deployment

France's policy-led electrification targets are ambitious but pose operational and regulatory difficulties for commercial fleets. The 2025 Mobility Orientation Law requires buildings with 20 or more parking places to fit out at least 5% of them with chargers, forcing fleet operators to retrofit depots quickly in order to stay compliant. The regulation, although visionary, also imposes financial and logistical burdens, particularly for smaller transport companies operating ageing infrastructure.

Concurrently, constrained grid capacity is a mounting challenge. The high rate of charger deployment requires grid upgrades, but many areas are experiencing permit and grid connection delays. These technical pinch points extend project times and costs. To address them, greater coordination between fleet managers, utilities, and local governments must occur to deliver a smooth, national transition to electric commercial mobility.

France Electric Commercial Vehicle Battery Pack Market TrendRising Demand for High-Power Charging Solutions

French commercial fleet operators are increasingly installing high-power DC fast chargers to keep downtime to a minimum and preserve productivity. In 2024, 45% of new public charging installations were DC fast, compared with 38% in 2023, representing a clear trend toward rapid recharging solutions. This increasing proportion indicates the operating imperative of logistics and delivery fleets run on tight timetables.

As this trend grows stronger, site selection strategies are adapting correspondingly. Logistics centers, distribution facilities, and highway rest areas now focus on ultra-fast charging in the 150–350 kW range, which can resupply batteries within less than 30 minutes. These advances improve route agility, lower vehicle idle time, and enable longer-range operations without oversized battery packs, hence maximizing total cost of ownership for commercial end users.

France Electric Commercial Vehicle Battery Pack Market OpportunityExpanding Fleet Electrification Unlocks Growth Prospects

France's accelerating growth in its charging network has provided a strong basis for generalized commercial fleet electrification. 317,501 battery electric vans were registered by the end of 2024, representing 68% of total light commercial EVs, a figure increasing from 62% in 2023. This trend reflects the growing transition away from diesel and towards zero-emission transport solutions, especially in delivery and urban logistics fleets.

Manufacturers and integrators are best placed to take advantage by providing scalable, modular battery packs aligned to various payload and range needs. Moreover, value-added services including operations and maintenance (O&M), fleet energy management, and second-life battery use offer new revenue streams. Strategic partnerships with charging operators and energy suppliers can also simplify operations, lower costs, and further enhance long-term competitiveness for commercial fleet end users.

France Electric Commercial Vehicle Battery Pack Market Segmentation Analysis

By Body Type

- Bus

- Light Commercial Vehicle (LCV)

- Medium & Heavy-Duty Truck (M&HDT)

Under the Body Type segmentation, the Light Commercial Vehicles (LCVs) account for the leading segment, capturing around 50% share of total electric commercial vehicle registrations in France in 2025. LCVs succeed to occupy the top spot by striking a balance between load carrying capacity and maneuverability, which positions them suitably for urban logistics, delivery fleets, and service operations. Their widespread adoption generates demand for small, mid-range battery packs optimized for frequent stop-start driving cycles characteristic of last-mile usage.

At the same time, medium and heavy commercial vehicles collectively take up the other around 50% share. These segments need bigger battery modules that can support increased payloads and longer distances but experience slower take-up from higher buy prices and charging times. As such, battery pack suppliers are focusing on modular solutions for LCVs while scaling up large-format capacity incrementally to keep pace with changing fleet needs across all vehicle classes.

By Propulsion Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

Battery Electric Vehicles (BEVs) lead the way in the Propulsion Type category, covering around 80% of all French electric commercial vehicle battery pack registrations during 2025. Fleets favor BEVs because they offer zero tailpipe emissions, are cost-effective to operate, and are compatible with the growing national charging network. This lead category compounds requirements for sophisticated, high-energy-density battery modules to support increased driving ranges and rapid recharging cycles.

Conversely, plug-in hybrid and fuel cell electric vehicles share the balance of remaining around 20% market share. These competitors struggle to gain traction with slower adoption rates fueled by increased initial costs, sparse hydrogen refueling infrastructure, and sophisticated system integration. To help deal with increased BEV adoption, suppliers are investing in flexible production facilities, novel thermal management systems, and recyclable cell chemistries that support fleet sustainability and performance mandates.

Top Companies in France Electric Commercial Vehicle Battery Pack Market

The top companies operating in the market include Elecsys France, Forsee Power, Groupe Renault, Akasol AG, Automotive Cells Company (ACC), Blue Solutions SA (Bolloré Group), BMZ Batterien-Montage-Zentrum GmbH, Contemporary Amperex Technology Co. Ltd. (CATL), IRIZAR S.COOP., Leclanché SA, etc., are the top players operating in the France Electric Commercial Vehicle Battery Pack Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Electric Commercial Vehicle Battery Pack Market Policies, Regulations, and Standards

4. France Electric Commercial Vehicle Battery Pack Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Electric Commercial Vehicle Battery Pack Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Body Type

5.2.1.1. Bus- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Light Commercial Vehicle (LCV)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Medium & Heavy-Duty Truck (M&HDT)- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Propulsion Type

5.2.2.1. Battery Electric Vehicle (BEV)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Plug-in Hybrid Electric Vehicle (PHEV)- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Battery Chemistry

5.2.3.1. Lithium Iron Phosphate (LFP)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Nickel Cobalt Aluminum Oxide (NCA)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Nickel Cobalt Manganese (NCM)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Nickel Manganese Cobalt (NMC)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Capacity

5.2.4.1. Less than 15 kWh- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. 15 kWh to 40 kWh- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. 40 kWh to 80 kWh- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Above 80 kWh- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Battery Form

5.2.5.1. Prismatic Cells - Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Pouch Cells - Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Cylindrical Cells- Market Insights and Forecast 2022-2032, USD Million

5.2.6. By Method

5.2.6.1. Laser- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Wire- Market Insights and Forecast 2022-2032, USD Million

5.2.7. By Component

5.2.7.1. Anode- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Cathode- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Electrolyte- Market Insights and Forecast 2022-2032, USD Million

5.2.7.4. Separator- Market Insights and Forecast 2022-2032, USD Million

5.2.8. By Material Type

5.2.8.1. Cobalt- Market Insights and Forecast 2022-2032, USD Million

5.2.8.2. Lithium- Market Insights and Forecast 2022-2032, USD Million

5.2.8.3. Manganese- Market Insights and Forecast 2022-2032, USD Million

5.2.8.4. Natural Graphite- Market Insights and Forecast 2022-2032, USD Million

5.2.8.5. Nickel- Market Insights and Forecast 2022-2032, USD Million

5.2.8.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.9. By Competitors

5.2.9.1. Competition Characteristics

5.2.9.2. Market Share & Analysis

6. France Bus Electric Commercial Vehicle Battery Pack Market Statistics, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Propulsion Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Battery Chemistry- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Capacity- Market Insights and Forecast 2022-2032, USD Million

6.2.4. By Battery Form- Market Insights and Forecast 2022-2032, USD Million

6.2.5. By Method- Market Insights and Forecast 2022-2032, USD Million

6.2.6. By Component- Market Insights and Forecast 2022-2032, USD Million

6.2.7. By Material Type- Market Insights and Forecast 2022-2032, USD Million

7. France Light Commercial Vehicle (LCV) Electric Commercial Vehicle Battery Pack Market Statistics, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Propulsion Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Battery Chemistry- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Capacity- Market Insights and Forecast 2022-2032, USD Million

7.2.4. By Battery Form- Market Insights and Forecast 2022-2032, USD Million

7.2.5. By Method- Market Insights and Forecast 2022-2032, USD Million

7.2.6. By Component- Market Insights and Forecast 2022-2032, USD Million

7.2.7. By Material Type- Market Insights and Forecast 2022-2032, USD Million

8. France Medium & Heavy-Duty Truck (M&HDT) Electric Commercial Vehicle Battery Pack Market Statistics, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Propulsion Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By Battery Chemistry- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Capacity- Market Insights and Forecast 2022-2032, USD Million

8.2.4. By Battery Form- Market Insights and Forecast 2022-2032, USD Million

8.2.5. By Method- Market Insights and Forecast 2022-2032, USD Million

8.2.6. By Component- Market Insights and Forecast 2022-2032, USD Million

8.2.7. By Material Type- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1. Akasol AG

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2. Automotive Cells Company (ACC)

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3. Blue Solutions SA (Bolloré Group)

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4. BMZ Batterien-Montage-Zentrum GmbH

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5. Contemporary Amperex Technology Co. Ltd. (CATL)

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6. Elecsys France

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7. Forsee Power

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8. Groupe Renault

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9. IRIZAR S.COOP.

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Leclanché SA

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Body Type |

|

| By Propulsion Type |

|

| By Battery Chemistry |

|

| By Capacity |

|

| By Battery Form |

|

| By Method |

|

| By Component |

|

| By Material Type |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.