France Electric Bus Battery Pack Market Report: Trends, Growth and Forecast (2026-2032)

By Propulsion Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle), By Battery Chemistry (Lithium Iron Phosphate, Nickel Cobalt Aluminum, Nickel Cobalt Manganese, Nickel Manganese Cobalt, Others), By Capacity (Less than 15 kWh, 15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh), By Battery Form (Cylindrical, Pouch, Prismatic), By Method (Laser, Wire), By Component (Anode, Cathode, Electrolyte, Separator), By Material Type (Cobalt, Lithium, Manganese, Natural Graphite, Nickel, Others)

- Mobility

- Dec 2025

- VI0558

- 120

-

France Electric Bus Battery Pack Market Statistics and Insights, 2026

- Market Size Statistics

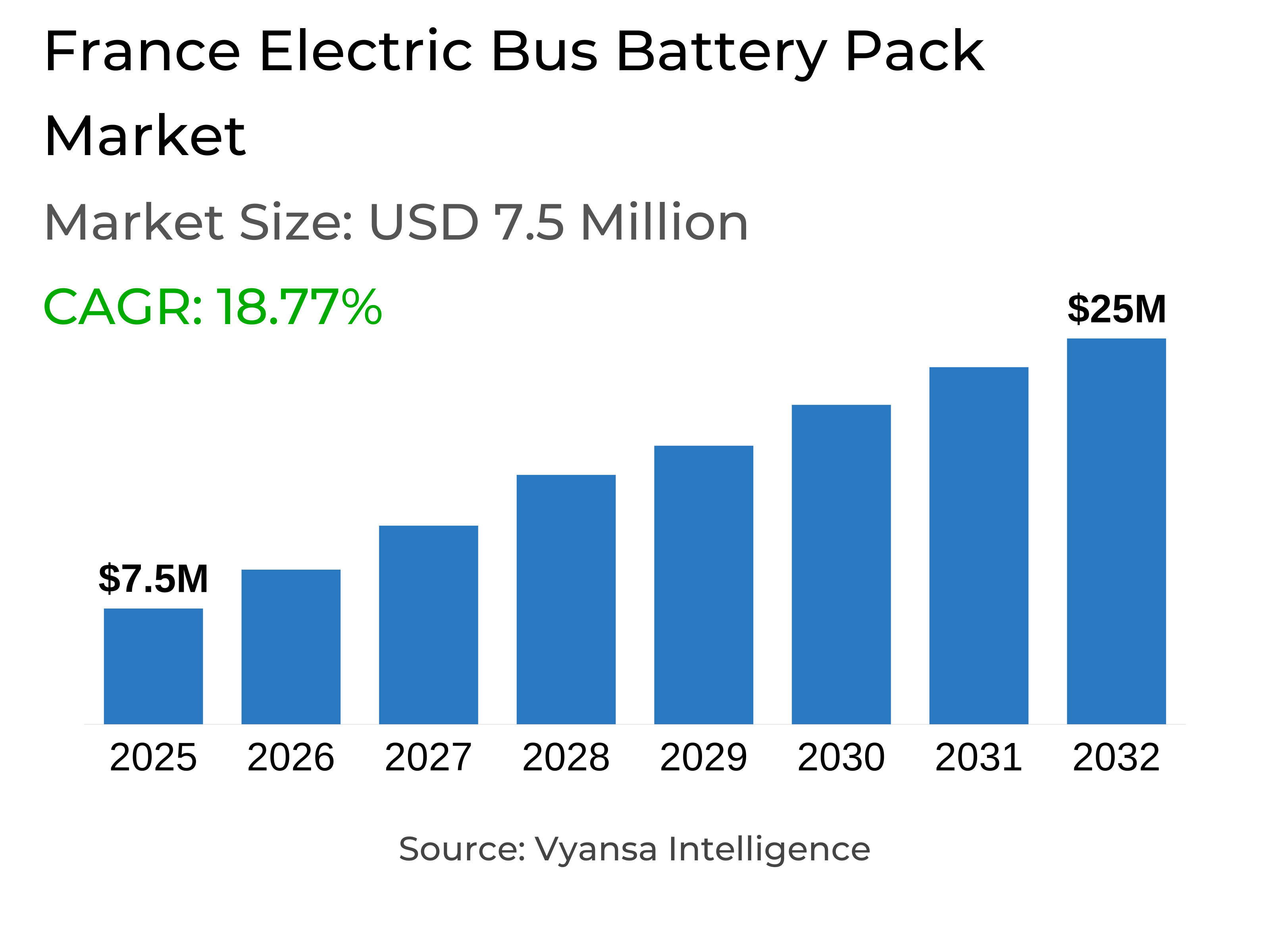

- Electric Bus Battery Pack in France is estimated at $ 7.5 Million.

- The market size is expected to grow to $ 25 Million by 2032.

- Market to register a CAGR of around 18.77% during 2026-32.

- Propulsion Type Shares

- Battery Electric Vehicle grabbed market share of 90%.

- Competition

- More than 10 companies are actively engaged in producing Electric Bus Battery Pack in France.

- Top 5 companies acquired around 75% of the market share.

- Elecsys France, IRIZAR S.COOP., LG Energy Solution Ltd., Akasol AG, Automotive Cells Company (ACC) etc., are few of the top companies.

- Battery Chemistry

- Nickel Manganese Cobalt grabbed 50% of the market.

France Electric Bus Battery Pack Market Outlook

France Electric Bus Battery Pack Market is expected to see robust growth based on promising national and European sustainability targets. In 2025, the market is estimated at $7.5 million and is expected to reach $25 million by 2032 at a CAGR of approximately 18.77% over the period 2026–32. Government incentives such as the "Bonus écologique" offer substantial financial rewards to municipalities and public transport agencies to opt for electric buses, while city initiatives such as Paris eliminating diesel buses by 2025 drive the move towards zero-emission transport. Firm policy support and strategies for fleet electrification still fuel market growth.

The demand is dominated by Battery Electric Vehicles (BEVs), which captured almost 90% of new electric bus registrations in 2023. BEVs are favored for their quiet ride, zero emissions, and lower lifetime expenses, becoming the fleet operators' first choice. Public and private investments in charging infrastructure reinforce the uptake of BEVs further, promising efficient operations and cost savings to end users.

Battery chemistry trends also influence market dynamics, with Nickel Manganese Cobalt (NMC) batteries commanding approximately 50% of total utilization through 2023. NMC technology is popular due to high energy density, long life and dependability under urban and intercity use cases. Ongoing developments in NMC formulations are enhancing durability and charge retention, driving operational efficiency and minimizing downtime for fleet operators.

Growth opportunities are supported by growing Low Emission Zones in French cities, driving high-demand battery packs with excellent quality. Suppliers can take advantage of system integration, performance enhancement, and aftersales services as urban authorities hasten bus electrification. With continuous innovation in future-proof battery technologies, France will become a leader in sustainable public transport solutions, driving a strong market growth pattern up to 2032.

France Electric Bus Battery Pack Market Growth DriverPolicy Support and Green Mobility Goals Strengthen Market Growth

France's electric bus battery pack sector is picking up robust pace as a result of ambitious European and national sustainability targets. The government's "Bonus écologique" initiative has up to €50,000 incentives for new electric buses as an incentive for widespread adoption by municipalities and public transport agencies. This reflects France's overall aim of reaching carbon neutrality by 2050, positioning electrification as a key plank in its decarbonization strategy for the transport sector. Local governments are increasingly investing in electric fleets as part of their climate action plans.

Paris is a good example of this transition with its pledge to eliminate diesel buses by 2025, having only electric or biogas-fueled buses in its fleet. The National Low Emission Mobility Plan further enforces this path by requiring new public buses to be "clean." Consequently, more than 60% of all new bus registrations in 2023 were completely electric, an indication of the market's speeding up towards zero-emission mobility.

France Electric Bus Battery Pack Market ChallengeSupply Dependencies and Raw Material Shortages Restrict Expansion

Even with robust policy momentum, the France Electric Bus Battery Pack Market is confronting persistent supply chain risks. The French Agency for Ecological Transition (ADEME) indicates that more than 70% of lithium, nickel, and cobalt incorporated in Europe's battery manufacturing is imported, rendering producers vulnerable to global price swings and logistics disruptions. These dependencies contribute to higher production costs and longer lead times for electric bus assembly lines, slowing the rate of fleet electrification.

Moreover, geopolitical risks and export curbs by dominant material supply bases like China and Indonesia have increased procurement challenges for French battery manufacturers. Such issues periodically interfere with production timelines and limit the scale-up of electric bus adoption. As a result, government and private sector operators alike are focusing on the localization of supply chains, the building out of recycling facilities, and the creation of secure European sourcing in order to build resilience for long-term expansion.

France Electric Bus Battery Pack Market TrendRapid Transition Toward Advanced Battery Technologies

The industry is experiencing a rapid shift towards next-generation battery technologies that increase efficiency and range. By 2023, as per the International Energy Agency, over 45% of electric buses in France used Nickel Manganese Cobalt (NMC) batteries, which possess better energy density and an extended lifecycle when compared to conventional chemistries. This transition is facilitating the needs of demanding urban and intercity services for fleet operators while reducing operational and maintenance costs.

At the same time, French innovation networks that connect research centers, startups, and international manufacturers are driving developments in solid-state and high-performance lithium technologies. These activities are focused on enhancing energy efficiency, safety, and charging speed. Through ongoing investment from the public and private sectors, these innovations will become the new standards for battery performance and enable faster charging integration into France's electric bus network.

France Electric Bus Battery Pack Market OpportunityUrban Electrification Creates Lucrative Market Opportunities

The growing adoption of Low Emission Zones (LEZ) in major French cities is creating new business opportunities for the providers of electric bus battery packs. The Urban Transport Observatory reports that at least 80 cities as of 2023 had adopted LEZs, forcing local public transportation providers to shift to electric drives to meet emission standards. The regulatory driver has led to an upsurge in demand for quality battery packs suitable for both urban and regional transit systems.

While cities sprint toward environmental regulations, manufacturers are discovering new opportunities in system integration, battery maintenance, and performance enhancement. The accelerating electrification of city bus fleets is also fueling aftersales markets, such as maintenance and second-life applications. These forces not only reinforce local manufacturing potential but also make France a front runner in Europe's shift towards sustainable public mobility solutions.

France Electric Bus Battery Pack Market Segmentation Analysis

By Propulsion Type

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

Under the propulsion type segmentation, Battery Electric Vehicles (BEVs) dominate with the greatest share, capturing nearly 90% of new electric bus registrations in 2025. Their superior position is owing to firm policy support, extensive infrastructure rollout, and the already proven reliability of completely electric technology in urban service. BEVs offer end consumers quiet, zero-emission transportation and lower lifetime expenses than hybrid or hydrogen-based alternatives.

Government-backed programs and charging network rollout have established BEVs as the first choice among fleet operators looking to meet decarbonization goals. Additionally, the ease of BEV maintenance and improvements in charging efficiency enable higher fleet uptime and cost savings. All these factors have solidly placed BEVs as the backbone of France's public transport electrification push.

By Battery Chemistry

- Lithium Iron Phosphate

- Nickel Cobalt Aluminum

- Nickel Cobalt Manganese

- Nickel Manganese Cobalt

- Others

Nickel Manganese Cobalt (NMC) battery-dominated the battery chemistry segmentation, NMC batteries control the France Electric Bus Battery Pack Market with share if around 50% in 2025. NMC technology is preferred due to high energy density and long cycle life, thus being appropriate for urban and intercity electric buses that need longer ranges between charging. Its equilibrium of performance and safety makes it a trustworthy option for large-scale public transport electrification initiatives.

French transport companies increasingly opt for NMC batteries due to their flexibility and performance under changing load conditions. Additionally, ongoing progress in NMC formulations improves durability and charge holding, further minimizing downtime and operating costs for fleet operators. The demonstrated performance of this chemistry continues to solidify its position as the first choice for maximizing range and sustainability in electric bus operation.

Top Companies in France Electric Bus Battery Pack Market

The top companies operating in the market include Elecsys France, IRIZAR S.COOP., LG Energy Solution Ltd., Akasol AG, Automotive Cells Company (ACC), Blue Solutions SA (Bolloré Group), BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), Liten CEA Tech (COMMISSARIAT A L' ENERGIE ATOMIQUE ET AUX ENERGIES ALTERNATIVES), Microvast Holdings Inc, etc., are the top players operating in the France Electric Bus Battery Pack Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Electric Bus Battery Pack Market Policies, Regulations, and Standards

4. France Electric Bus Battery Pack Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Electric Bus Battery Pack Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Propulsion Type

5.2.1.1. Battery Electric Vehicle- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Plug-in Hybrid Electric Vehicle- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Battery Chemistry

5.2.2.1. Lithium Iron Phosphate- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Nickel Cobalt Aluminum- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Nickel Cobalt Manganese- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Nickel Manganese Cobalt- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Capacity

5.2.3.1. Less than 15 kWh- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. 15 kWh to 40 kWh- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. 40 kWh to 80 kWh- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Above 80 kWh- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Battery Form

5.2.4.1. Cylindrical- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Pouch- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Prismatic- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Method

5.2.5.1. Laser- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Wire- Market Insights and Forecast 2022-2032, USD Million

5.2.6. By Component

5.2.6.1. Anode- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Cathode- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Electrolyte- Market Insights and Forecast 2022-2032, USD Million

5.2.6.4. Separator- Market Insights and Forecast 2022-2032, USD Million

5.2.7. By Material Type

5.2.7.1. Cobalt- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Lithium- Market Insights and Forecast 2022-2032, USD Million

5.2.7.3. Manganese- Market Insights and Forecast 2022-2032, USD Million

5.2.7.4. Natural Graphite- Market Insights and Forecast 2022-2032, USD Million

5.2.7.5. Nickel- Market Insights and Forecast 2022-2032, USD Million

5.2.7.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.8. By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. France Battery Electric Vehicle Electric Bus Battery Pack Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Battery Chemistry- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Capacity- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Battery Form- Market Insights and Forecast 2022-2032, USD Million

6.2.4. By Method- Market Insights and Forecast 2022-2032, USD Million

6.2.5. By Component- Market Insights and Forecast 2022-2032, USD Million

6.2.6. By Material Type- Market Insights and Forecast 2022-2032, USD Million

7. France Plug-in Hybrid Electric Vehicle Electric Bus Battery Pack Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Battery Chemistry- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Capacity- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Battery Form- Market Insights and Forecast 2022-2032, USD Million

7.2.4. By Method- Market Insights and Forecast 2022-2032, USD Million

7.2.5. By Component- Market Insights and Forecast 2022-2032, USD Million

7.2.6. By Material Type- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1. Akasol AG

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2. Automotive Cells Company (ACC)

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3. Blue Solutions SA (Bolloré Group)

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4. BYD Company Ltd.

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5. Contemporary Amperex Technology Co. Ltd. (CATL)

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6. Elecsys France

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7. IRIZAR S.COOP.

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8. LG Energy Solution Ltd.

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9. Liten CEA Tech (COMMISSARIAT A L' ENERGIE ATOMIQUE ET AUX ENERGIES ALTERNATIVES)

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Microvast Holdings Inc

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Propulsion Type |

|

| By Battery Chemistry |

|

| By Capacity |

|

| By Battery Form |

|

| By Method |

|

| By Component |

|

| By Material Type |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.