Asia-Pacific Fuel Cell Electric Vehicle Market Report: Trends, Growth and Forecast (2026-2032)

By Vehicle (Passenger Vehicles (Hatchback, Sedan, SUV), Commercial Vehicles (Light Commercial Vehicles (LCV), Medium Commercial Vehicles (MCV), Heavy Commercial Vehicles (HCV))), By Fuel Cell (Proton Exchange Membrane Fuel Cells (PEMFC), Phosphoric Acid Fuel Cells (PAFC), Solid Oxide Fuel Cells (SOFC)), By Range (Short Range (Below 250 Miles), Medium Range (250 – 500 Miles), Long Range (Above 500 Miles)), By Application (Personal Use, Public Transport, Freight & Logistics), By Refueling Infrastructure (On-Board Hydrogen Storage, Off-Board Hydrogen Refueling), By End User (Private, Fleet Operators), By Country (Japan, South Korea, China, India, Australia, Indonesia, Malaysia, Thailand, Rest of Asia Pacific)

- Mobility

- Oct 2025

- VI0499

- 161

-

Asia-Pacific Fuel Cell Electric Vehicle Market Statistics and Insights, 2026

- Market Size Statistics

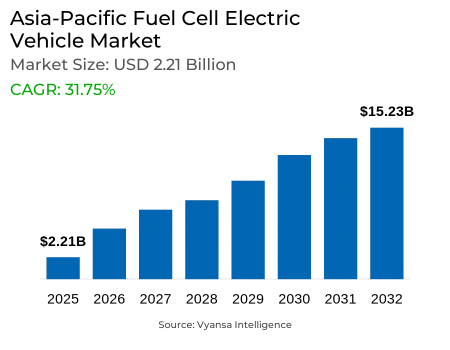

- Asia-Pacific Fuel Cell Electric Vehicle Market is estimated at $ 2.21 Billion.

- The market size is expected to grow to $ 15.23 Billion by 2032.

- Market to register a CAGR of around 31.75% during 2026-32.

- Vehicle Shares

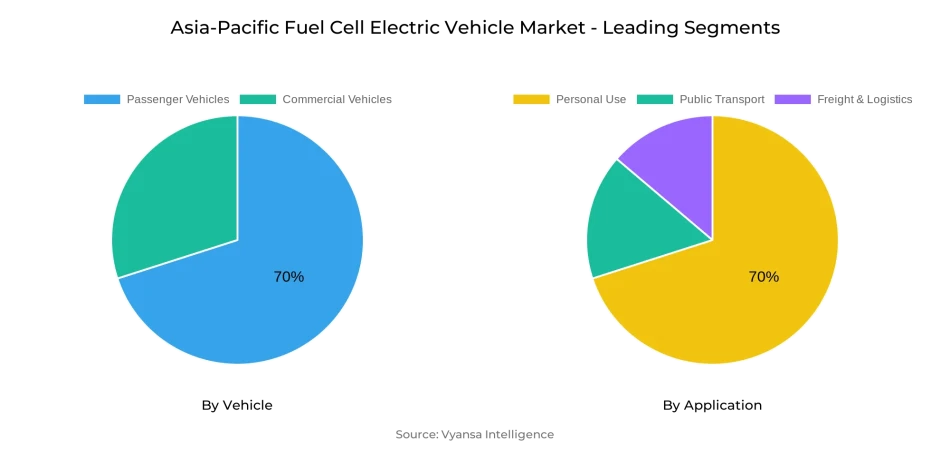

- Passenger Vehicles grabbed market share of 70%.

- Competition

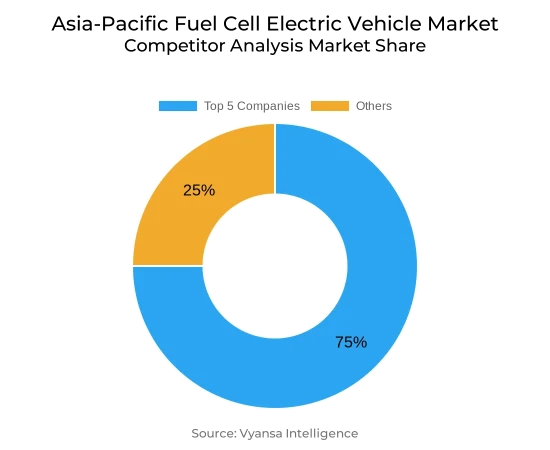

- More than 10 companies are actively engaged in producing Fuel Cell Electric Vehicle in Asia-Pacific.

- Top 5 companies acquired 75% of the market share.

- Tata Motors Limited, Mitsubishi Motors Corporation, Mercedes Benz AG, Toyota Motor Corporation, Hyundai Motor Company etc., are few of the top companies.

- Application

- Personal Use grabbed 70% of the market.

- Country

- Japan leads with a 90% share of the Asia-Pacific Market.

Asia-Pacific Fuel Cell Electric Vehicle Market Outlook

Asia-Pacific Fuel Cell Electric Vehicle Market, which was worth USD 2.21 billion in 2025, is expected to be worth USD 15.23 billion by 2032 and grow at a strong CAGR of about 31.75% from 2026–2032. The growth is being spurred by the increasing installation of hydrogen refueling stations in major nations, with Japan, South Korea, and Australia governments heavily investing in infrastructure. Public–private collaborations between energy businesses and automakers are also facilitating vehicle uptake with hydrogen availability, reinforcing end-user confidence.

High prices for fuel cell stacks and hydrogen storage systems are still a hindrance to battery vehicles, particularly for cost-conscious end customers. Companies are concentrating on volume production, optimized stack design, and materials innovation in order to decrease prices. Subsidies from governments and tax benefits are offering temporary mitigation, but mass market implementation will rely on the attainment of manufacturing economies that decrease overall costs and increase vehicle affordability.

Commercial fleets like buses and trucks in Japan and China are a key driver in proving hydrogen technology at scale. The region had over 5,000 heavy-duty fuel cell vehicles on the road as of 2024, providing real-world experience that is valuable to both passenger and fleet markets. Passenger vehicles currently lead with 70% market share, based on government subsidies and significant support from automakers, and are the single largest growth driver.

By application, personal use dominates 70% of total deployments, with individual consumers purchasing fuel cell vehicles for commuter and intercity travel. By country, Japan dominates the market with close to 90% share due to several decades of R&D, early commercialization, and an advanced hydrogen refueling infrastructure. With ongoing infrastructure development and robust policy incentives, Japan will be the cornerstone of market growth in the Asia-Pacific region through 2032.

Asia-Pacific Fuel Cell Electric Vehicle Market Growth Driver

Infrastructure Expansion Supporting Market Growth

The Asia-Pacific fuel cell electric vehicle market is experiencing the pace of uptake boosted by the aggressive deployment of hydrogen refueling stations in the leading countries. The Japanese, South Korean, and Australian governments are directing significant investment towards growing station networks, lowering refueling hurdles, and enhancing end-user confidence. Particularly, South Korea has boosted hydrogen station numbers over 50% since 2021, providing better availability in both urban centers and rural corridors. This has directly enabled the persistent deployment of fuel cell electric vehicles in the country.

Public–private partnerships are taking a focal position in infrastructure development. Automakers and energy companies are increasingly partnering to co-fund station buildouts, while local governments simplify planning and permitting procedures. These coordinated efforts facilitate a balance between the deployment of vehicles and hydrogen availability, enabling clean integration of fuel cell vehicles into conventional transportation systems and supporting long-term adoption.

Asia-Pacific Fuel Cell Electric Vehicle Market Challenge

High Upfront Costs Limiting Adoption

Even with the rosy projections, financing costs are still a major limiting factor for the Asia-Pacific Fuel Cell Electric Vehicle Market. Fuel cell stacks and hydrogen storage systems still have higher prices than battery-based systems, posing cost-affordability issues for price-conscious fleet operators and individual consumers. Low volumes of competitively priced models mean that end-user options are limited, decelerating the adoption pace.

To overcome these cost barriers, producers are seeking mass production and electrolysis and stack development innovations. Subsidies on hydrogen production and vehicle purchase tax reductions minimize initial costs, but ultimate success hinges upon material advances and higher efficiency in manufacturing. Without reductions in the cost of technologies at the technology level, mass-market penetration will continue to be a creeping event, especially in more limited purchasing power economies.

Asia-Pacific Fuel Cell Electric Vehicle Market Trend

Commercial Fleets Driving Market Momentum

Commercial fleets are coming forward as the key adopters of fuel cell technology, supporting growth in the Asia-Pacific Fuel Cell Electric Vehicle Market. Long-distance freight operations in Japan and China have utilized fuel cell trucks by logistics operators, leveraging their high range and quick refueling advantages. As of 2024, the region boasted more than 5,000 fuel cell heavy-duty trucks and buses plying important transport routes, marking a significant shift toward zero-emission commercial mobility.

These commercial operations are critical in proving fuel cell technology at scale. Fleet operations generate real-world data improving vehicle design, fueling practices, and service standards while accelerating supply-chain evolution. With heavy-duty and bus markets established as operationally and economically viable, passenger vehicles can benefit through economies of scale and technology transfer, leading to more robust adoption in multiple end-user categories.

Asia-Pacific Fuel Cell Electric Vehicle Market Opportunity

Expanding Opportunities in Niche Applications

Outside of mainstream markets, niche uses are opening new development opportunities in the Asia-Pacific Fuel Cell Electric Vehicle Market. Distant and off-grid regions with no dependable charging infrastructure are strong use cases for hydrogen cars, where high energy density and flexible refueling present notable advantages. In rural Australia and some island nations, pilot programs have been rolling out fuel cell buses for tourism and community transport, demonstrating their convenience in areas not well served by traditional networks.

The inclusion of renewable hydrogen production further bolsters these uses. Solar-powered electrolysis with hydrogen fueling stations offers localized, clean energy cycles and mitigates dependence on central grids. These niche use cases not only prove the versatility of fuel cell vehicles but also correlate with larger decarbonization goals, showing that hydrogen technology can answer both mobility and environmental needs in a variety of regional settings.

Asia-Pacific Fuel Cell Electric Vehicle Market Country Analysis

Japan leads the Asia-Pacific Fuel Cell Electric Vehicle Market, controlling almost 90% of all registrations. Its dominance is supported by decades of government-backed R&D funding, aggressive emissions-cutting targets, and early commercialization of ground-breaking models like the Toyota Mirai. Japan's large hydrogen station network and positive policy environment have fostered a support system for mass-market adoption.

Its robust industrial foundation and interrelated supply chains further strengthen its position. Automotive manufacturers, energy firms, and government entities work together closely to meet increasing demand through hydrogen production, storage, and distribution. With ongoing investment in infrastructure and stable policy support, Japan stands ready to maintain its dominant position, setting standards for other Asia-Pacific nations in technological progress and market implementation.

Asia-Pacific Fuel Cell Electric Vehicle Market Segmentation Analysis

By Vehicle

- Passenger Vehicles

- Commercial Vehicles

Passenger vehicles are the dominant segment within the Asia-Pacific Fuel Cell Electric Vehicle Market, capturing around 70% of all registrations. Robust manufacturer support, combined with focused government incentives, has spurred adoption of passenger cars, especially in urban centers. Passenger cars are facilitated by well-developed refueling infrastructure, rendering them a sensible choice for urban commuter travel and long-distance transportation.

Adoption in the segment has been mostly concentrated on government fleet rollouts and premium car models, highlighting the technology's range and speed advantages in high-profile environments like executive fleets and taxi operations. Broader end-user penetration will necessitate cost reductions in manufacturing as well as greater hydrogen station availability. Passenger cars will nevertheless continue to contribute the most to market growth during the forecast period.

By Application

- Personal Use

- Public Transport

- Freight & Logistics

Personal use is the largest application segment of the Asia-Pacific Fuel Cell Electric Vehicle Market, accounting for around 70% of deployments. Individual consumers are attracted to the merits of zero-emission operation, extended range for long-distance travel, and government-supported ownership subsidies. This renders hydrogen-powered vehicles an attractive model for daily commuting, intercity travel, and recreational travel throughout the region.

Adoption within this segment is also an important driver of hydrogen pattern development, especially around residential blocks and along highway corridors. Personal vehicle preference supports investment in hydrogen infrastructure to maintain refueling facilities in alignment with increasing end-user demand. With the development of station networks, personal usage adoption will further intensify, making it the biggest application within the regional market.

Top Companies in Asia-Pacific Fuel Cell Electric Vehicle Market

The top companies operating in the market include Tata Motors Limited, Mitsubishi Motors Corporation, Mercedes Benz AG, Toyota Motor Corporation, Hyundai Motor Company, Honda Motor Co. Ltd, General Motor Company, Nissan Motor Corporation, Siac Motor Corporation Limited, Zhejiang Geely Holding Group Co., etc., are the top players operating in the Asia-Pacific Fuel Cell Electric Vehicle Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Asia-Pacific Fuel Cell Electric Vehicle Market Policies, Regulations, and Standards

4. Asia-Pacific Fuel Cell Electric Vehicle Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Asia-Pacific Fuel Cell Electric Vehicle Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Vehicle

5.2.1.1. Passenger Vehicles- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Hatchback- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Sedan- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. SUV- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Commercial Vehicles- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Light Commercial Vehicles (LCV)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Medium Commercial Vehicles (MCV)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Heavy Commercial Vehicles (HCV)- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fuel Cell

5.2.2.1. Proton Exchange Membrane Fuel Cells (PEMFC)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Phosphoric Acid Fuel Cells (PAFC)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Solid Oxide Fuel Cells (SOFC)- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By Range

5.2.3.1. Short Range (Below 250 Miles)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Medium Range (250 – 500 Miles)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Long Range (Above 500 Miles)- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Application

5.2.4.1. Personal Use- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Public Transport- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Freight & Logistics- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Refueling Infrastructure

5.2.5.1. On-Board Hydrogen Storage- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Off-Board Hydrogen Refueling- Market Insights and Forecast 2022-2032, USD Million

5.2.6. By End User

5.2.6.1. Private- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Fleet Operators- Market Insights and Forecast 2022-2032, USD Million

5.2.7. By Country

5.2.7.1. Japan

5.2.7.2. South Korea

5.2.7.3. China

5.2.7.4. India

5.2.7.5. Australia

5.2.7.6. Indonesia

5.2.7.7. Malaysia

5.2.7.8. Thailand

5.2.7.9. Rest of Asia Pacific

5.2.8. By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Japan Fuel Cell Electric Vehicle Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Vehicle- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By Fuel Cell- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Range- Market Insights and Forecast 2022-2032, USD Million

6.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.5. By Refueling Infrastructure- Market Insights and Forecast 2022-2032, USD Million

6.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

7. South Korea Fuel Cell Electric Vehicle Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Vehicle- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By Fuel Cell- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Range- Market Insights and Forecast 2022-2032, USD Million

7.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.5. By Refueling Infrastructure- Market Insights and Forecast 2022-2032, USD Million

7.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

8. China Fuel Cell Electric Vehicle Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Vehicle- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By Fuel Cell- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Range- Market Insights and Forecast 2022-2032, USD Million

8.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.5. By Refueling Infrastructure- Market Insights and Forecast 2022-2032, USD Million

8.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

9. India Fuel Cell Electric Vehicle Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Vehicle- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By Fuel Cell- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Range- Market Insights and Forecast 2022-2032, USD Million

9.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

9.2.5. By Refueling Infrastructure- Market Insights and Forecast 2022-2032, USD Million

9.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

10. Australia Fuel Cell Electric Vehicle Market Statistics, 2022-2032F

10.1.Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2.Market Segmentation & Growth Outlook

10.2.1. By Vehicle- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Fuel Cell- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Range- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Refueling Infrastructure- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

11. Indonesia Fuel Cell Electric Vehicle Market Statistics, 2022-2032F

11.1.Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2.Market Segmentation & Growth Outlook

11.2.1. By Vehicle- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By Fuel Cell- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Range- Market Insights and Forecast 2022-2032, USD Million

11.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

11.2.5. By Refueling Infrastructure- Market Insights and Forecast 2022-2032, USD Million

11.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

12. Malaysia Fuel Cell Electric Vehicle Market Statistics, 2022-2032F

12.1.Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2.Market Segmentation & Growth Outlook

12.2.1. By Vehicle- Market Insights and Forecast 2022-2032, USD Million

12.2.2. By Fuel Cell- Market Insights and Forecast 2022-2032, USD Million

12.2.3. By Range- Market Insights and Forecast 2022-2032, USD Million

12.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

12.2.5. By Refueling Infrastructure- Market Insights and Forecast 2022-2032, USD Million

12.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

13. Thailand Fuel Cell Electric Vehicle Market Statistics, 2022-2032F

13.1.Market Size & Growth Outlook

13.1.1. By Revenues in US$ Million

13.2.Market Segmentation & Growth Outlook

13.2.1. By Vehicle- Market Insights and Forecast 2022-2032, USD Million

13.2.2. By Fuel Cell- Market Insights and Forecast 2022-2032, USD Million

13.2.3. By Range- Market Insights and Forecast 2022-2032, USD Million

13.2.4. By Application- Market Insights and Forecast 2022-2032, USD Million

13.2.5. By Refueling Infrastructure- Market Insights and Forecast 2022-2032, USD Million

13.2.6. By End User- Market Insights and Forecast 2022-2032, USD Million

14. Competitive Outlook

14.1.Company Profiles

14.1.1. Toyota Motor Corporation

14.1.1.1. Business Description

14.1.1.2. Product Portfolio

14.1.1.3. Collaborations & Alliances

14.1.1.4. Recent Developments

14.1.1.5. Financial Details

14.1.1.6. Others

14.1.2. Hyundai Motor Company

14.1.2.1. Business Description

14.1.2.2. Product Portfolio

14.1.2.3. Collaborations & Alliances

14.1.2.4. Recent Developments

14.1.2.5. Financial Details

14.1.2.6. Others

14.1.3. Honda Motor Co. Ltd

14.1.3.1. Business Description

14.1.3.2. Product Portfolio

14.1.3.3. Collaborations & Alliances

14.1.3.4. Recent Developments

14.1.3.5. Financial Details

14.1.3.6. Others

14.1.4. General Motor Company

14.1.4.1. Business Description

14.1.4.2. Product Portfolio

14.1.4.3. Collaborations & Alliances

14.1.4.4. Recent Developments

14.1.4.5. Financial Details

14.1.4.6. Others

14.1.5. Nissan Motor Corporation

14.1.5.1. Business Description

14.1.5.2. Product Portfolio

14.1.5.3. Collaborations & Alliances

14.1.5.4. Recent Developments

14.1.5.5. Financial Details

14.1.5.6. Others

14.1.6. Tata Motors Limited

14.1.6.1. Business Description

14.1.6.2. Product Portfolio

14.1.6.3. Collaborations & Alliances

14.1.6.4. Recent Developments

14.1.6.5. Financial Details

14.1.6.6. Others

14.1.7. Mitsubishi Motors Corporation

14.1.7.1. Business Description

14.1.7.2. Product Portfolio

14.1.7.3. Collaborations & Alliances

14.1.7.4. Recent Developments

14.1.7.5. Financial Details

14.1.7.6. Others

14.1.8. Mercedes Benz AG

14.1.8.1. Business Description

14.1.8.2. Product Portfolio

14.1.8.3. Collaborations & Alliances

14.1.8.4. Recent Developments

14.1.8.5. Financial Details

14.1.8.6. Others

14.1.9. Siac Motor Corporation Limited

14.1.9.1. Business Description

14.1.9.2. Product Portfolio

14.1.9.3. Collaborations & Alliances

14.1.9.4. Recent Developments

14.1.9.5. Financial Details

14.1.9.6. Others

14.1.10. Zhejiang Geely Holding Group Co.

14.1.10.1. Business Description

14.1.10.2. Product Portfolio

14.1.10.3. Collaborations & Alliances

14.1.10.4. Recent Developments

14.1.10.5. Financial Details

14.1.10.6. Others

15. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Vehicle |

|

| By Fuel Cell |

|

| By Range |

|

| By Application |

|

| By Refueling Infrastructure |

|

| By End User |

|

| By Country |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.