Mexico Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

Category (Costume Jewellery, Fine Jewellery), Type (Earrings, Neckwear, Rings, Wristwear, Other), Collection (Diamond, Non-Diamond), Material Type (Gold, Platinum, Metal Combination, Silver), Sales Channel (Retail Offline, Retail Online), End User (Men, Women)

- FMCG

- Dec 2025

- VI0635

- 115

-

Mexico Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

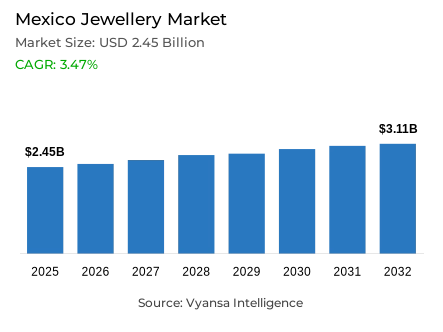

- Jewellery in Mexico is estimated at USD 2.45 billion.

- The market size is expected to grow to USD 3.11 billion by 2032.

- Market to register a cagr of around 3.47% during 2026-32.

- Category Shares

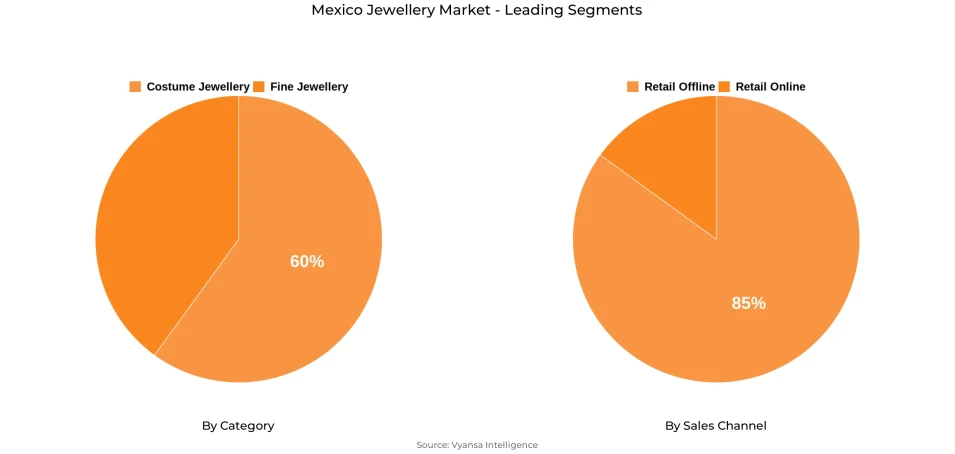

- Costume jewellery grabbed market share of 60%.

- Competition

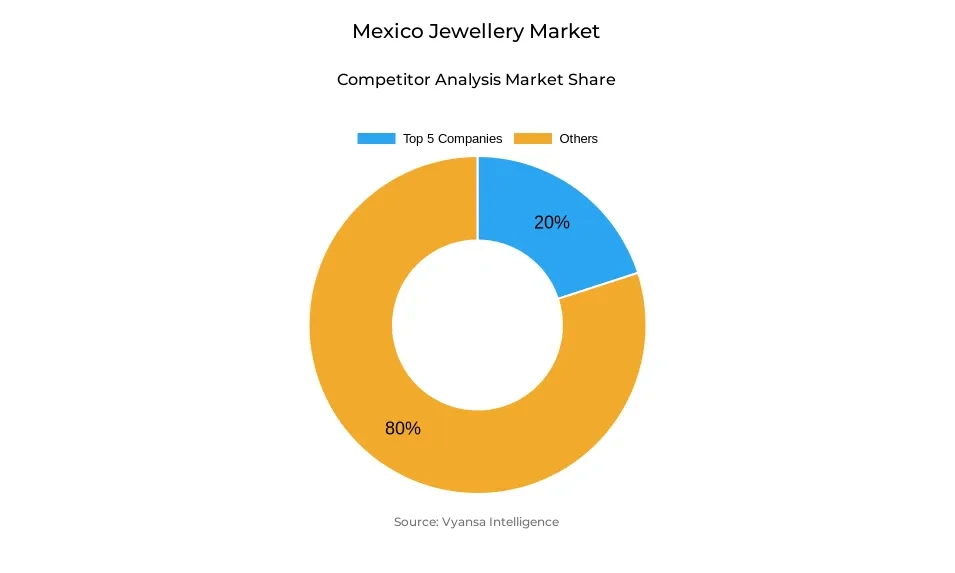

- More than 20 companies are actively engaged in producing jewellery in Mexico.

- Top 5 companies acquired around 20% of the market share.

- Pandora Jewelry Mexico SA de CV, Richemont de México SA de CV, Bvlgari Comercial Mexico SA de CV, Joyerías Bizzarro SA de CV, Joyería Tous SA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Mexico Jewellery Market Outlook

The Mexico jewellery market is valued at around USD 2.45 billion in 2025 and is estimated to reach a value of around USD 3.11 billion by 2032, growing at a CAGR of around 3.47% during 2026-2032. The market continues to see stable demand for fine jewellery amongst its wealthy end users, whose spending stays strong even during slower economic periods. The demand for 14–18 carat gold and gemstone jewellery among these end users has helped luxury products stay strong, which in turn has helped stabilize the overall market.

Additionally, costume jewellery accounts for around 60% of the market share, this is due to the affordability and wide range of products within the segment. This segment is appealing the fashion conscious end users who want fashionable designs without paying the cost of fine jewellery. The fine jewellery segment however, continues to expand among luxury buyers who value, quality and craftsmanship while balancing demand at different price points.

The retail offline channel, with around 85% of market sales, remains dominant because a majority of the end users still prefer buying jewellery from stores where they can see the product and try it on. Physical outlets offer a personal and emotional way of buying, especially in the fine jewellery category. Retail online sales gained focus during the pandemic, but retail online platforms remains a smaller part of the market, focused mainly on low priced costume items.

There are over 20 companies operating in Mexico's jewellery industry, with the top five accounting for around 20% of the entire share. The strong presence of these companies results in consistent availability of jewellery products and competitive quality standards. Collectively, the combination of rising cultural expression, growing interest in luxury, and the expansion of retail offline network will continue to support steady growth in the jewellery market until 2032.

Mexico Jewellery Market Growth DriverFine Jewellery Shows Resilience in the Market

Fine jewellery continues to perform well, as high income end users keep spending even when the overall growth of jewellery demand is slow. Their spending behavior does not change with economic variation, which helps in keeping the premium segment strong while the demand for costume jewellery softens. The category is mainly driven by 14-18 carat gold and stones such as sapphires and rubies. Mexico economy grew 3.2% in 2023, according to the World Bank and INEGI, while the number of millionaires reached approximately 172,000, with wealth likely to rise annually by 6.8% through 2025. These are indications of a strong base of wealthy end users who sustain the luxury jewellery segment.

Moreover, further growth of this wealth end users group contributes to the fact that fine jewellery retains its value appeal. According to OECD data, around 1,060 ultra high net worth individuals exist within the country, ensuring a stable market for exclusive designs. With per capita disposable income projected at USD 11,240 in 2025, strong purchasing power continues to favor premium jewellery. End users in this group prefer quality and craftsmanship, making them loyal to luxury products that are less affected by short term market changes.

Mexico Jewellery Market ChallengeFalling Demand for Wedding Rings and Baptismal Medals

The constant decline in marriages has directly affected the demand for wedding rings. According to INEGI, registered marriages in 2023 declined to 501,529 from 507,052 in the previous year. The marriage rate has also slightly decreased from 5.7 to 5.6 per 1,000 inhabitants, showing a consistent downward movement. Younger end user are increasingly choosing to live together without formal marriage, which has reduced the relevance of traditional jewellery pieces such as wedding bands, although engagement rings continue to hold some appeal.

At the same time, the decline in birth rates has reduced demand for baptismal medals, which are traditionally given to newborns as a symbolic gift. According to CONAPO, birth registrations fell from 1,891,388 in 2022 to 1,820,888 in 2023, while the fertility rate dropped to 1.60. These items once held emotional and religious value, but fewer baptisms now mean fewer purchases of such pieces. With both marriages and births decreasing, the long term market for traditional ceremonial jewellery is likely to remain under pressure.

Mexico Jewellery Market TrendRising Interest in Unisex Jewellery Celebrating Diversity

Inclusivity and personal expression have become important, and it is gaining importance among end users. For instance, during 2024, Bizzarro introduced unisex collections that included rings, pendants, and colorful bracelets reflecting individuality and self confidence.According to INEGI, Mexico's population is estimated to be between 130 and 132 million. At the same time, more people are living alone, and the number of single person households is expected to grow by 21.7% by 2028. This is the demographic change that supports the demand for modern and gender neutral jewellery, allowing each end users to express themselves.

Moreover, the focus on diversity creates closer emotional contacts between brands and end users. Campaigns for individuality, such as "Destellos de libertad", are part of the wider social acceptance of equality and personal freedom. Young audiences appreciate authenticity and creative designs that go beyond traditional gender-based conventions, helping unisex jewellery to become a dynamic and inclusive category.

Mexico Jewellery Market OpportunityLuxury Brands Blend Mexican Artistry with Global Design

The luxury jewellery brands strengthen the connection with end users by showcasing Mexico culture both in their designs and store environments. Central Mexico, especially Mexico City, is home to more than 40% of the country's billionaires and nearly 68% of ultra high net worth end users, according to INEGI. These have now become the prime spots for strategies related to cultural integration in which brands use local art, colors, and craftsmanship in a luxury environment. This not only deepens emotional connections but also enhances brand identity linked to national pride.

Additionally, tourism plays a key role in supporting this direction. According to an estimate by the Ministry of Tourism, Mexico has received around 42 million international tourists in 2024, many such visitors contribute to purchases in the luxury retail segment. Luxury shopping tourism brought in about USD 1.2 billion last year, growing around 15% annually. The increasing investments in the high end retail sector are reflected in an expansion of around 85,000 square meters between 2019 and 2023. This fusion of culture and luxury continues to draw in both locals and international visitors looking for unique, locally inspired jewellery.

Mexico Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

The costume jewellery category holds the highest share in the market, accounting for around 60% of the total value. This segment keeps its leading position due to the affordable design and wide product choices that attract a larger end user group. Costume jewellery attracts people who like fashionable accessories without the high cost of fine pieces. It is also more available across stores and online platforms, helping it maintain a leading position in the overall jewellery market.

However, fine jewellery continues to see steady growth as luxury buyers seek gold and gemstone based products. While costume jewellery dominates in volume, fine jewellery adds more value with quality, craftsmanship, and brand appeal. The balance between both categories is what keeps such a diverse market going, serving everyday fashion needs while catering to premium lifestyle preferences.

By Sales Channel

- Retail Offline

- Retail Online

The retail offline segment dominated the share with a contribution of around 85% to the total market under the sales channel category. Most sales of jewellery in Mexico are still taking place through physical stores, because end users want to see and experience the products first before making a purchase. Fine jewellery involves higher emotional value, and requires close inspection of quality, design, and craftsmanship. As a result, the preference for in-store experiences makes retail offline stores the main channel for selling both fine and costume jewellery.

While the pandemic increased online sales, growth has stabilized since then. E-commerce plays a supplementary role for costume jewellery items in the low price range because it's convenient but lacks the feel and emotional connect associated with store visits. The offline shopping environment lets end-users enjoy personalized service, so it remains a dominant and trusted channel when it comes to purchases of jewellery.

Top Companies in Mexico Jewellery Market

The top companies operating in the market include Pandora Jewelry Mexico SA de CV, Richemont de México SA de CV, Bvlgari Comercial Mexico SA de CV, Joyerías Bizzarro SA de CV, Joyería Tous SA, Tiffany & Co de Mexico SA de CV, Swarovski Crystal SA de CV, Grupo Bogue Internacional SA de CV, Tanya Moss SA de CV, Grupo de Diseño Helguera SA de CV, etc., are the top players operating in the Mexico jewellery market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Mexico Jewellery Market Policies, Regulations, and Standards

4. Mexico Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Mexico Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Mexico Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Mexico Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Joyerías Bizzarro SA de CV

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Joyería Tous SA

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Tiffany & Co de Mexico SA de CV

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Swarovski Crystal SA de CV

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Grupo Bogue Internacional SA de CV

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Pandora Jewelry Mexico SA de CV

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Richemont de México SA de CV

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Bvlgari Comercial Mexico SA de CV

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Tanya Moss SA de CV

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Grupo de Diseño Helguera SA de CV

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.