Mexico Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), Price Category (Mass, Premium), Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

Mexico Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

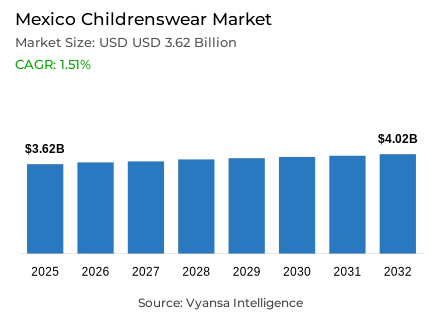

- Childrenswear in Mexico is estimated at USD 3.62 billion in 2025.

- The market size is expected to grow to USD 4.02 billion by 2032.

- Market to register a cagr of around 1.51% during 2026-32.

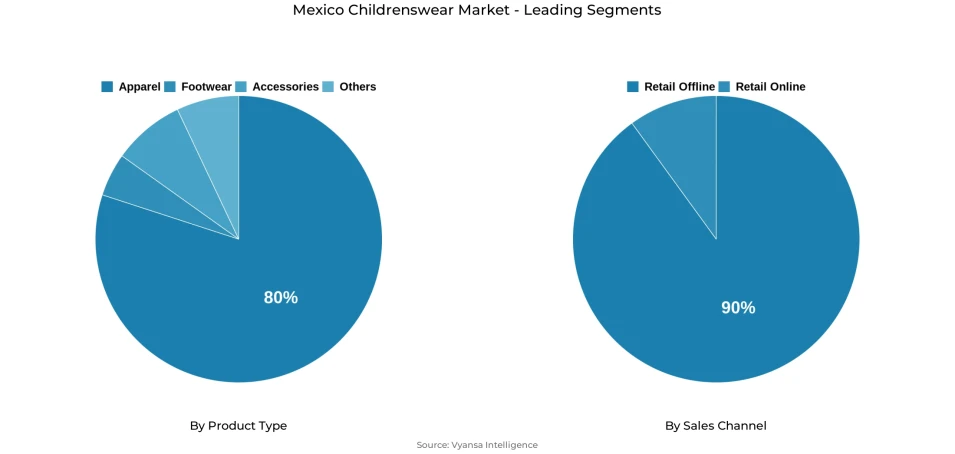

- Product Type Shares

- Apparel grabbed market share of 80%.

- Competition

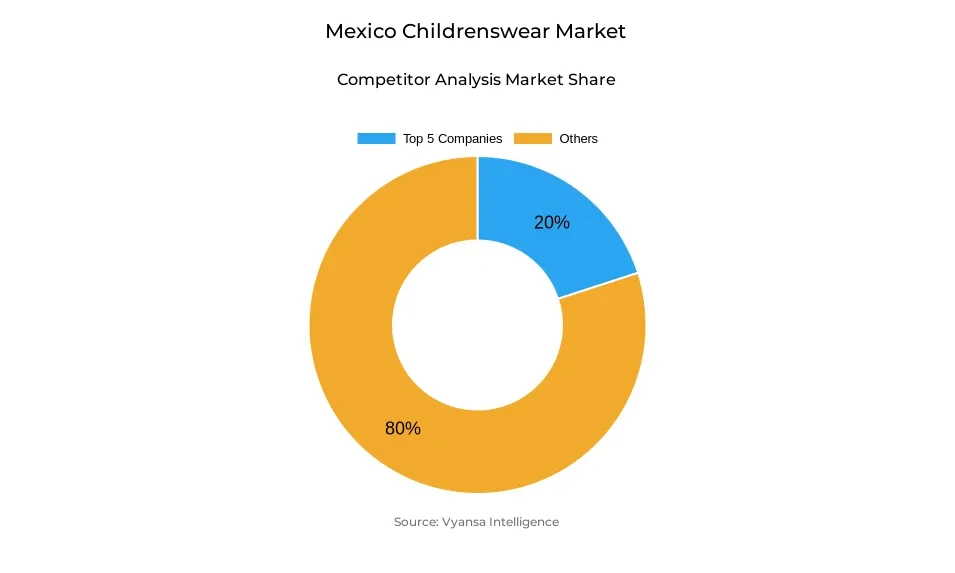

- More than 20 companies are actively engaged in producing childrenswear in Mexico.

- Top 5 companies acquired around 20% of the market share.

- Massimo Dutti México SA de CV; Yale de Mexico SA de CV; C&A México S de RL; Baby Creysi SA de CV; Controladora Milano SA de CV etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 90% of the market.

Mexico Childrenswear Market Outlook

The Mexico childrenswear market is projected to expand at a steady and moderate pace, increasing from USD 3.62 billion in 2025 to approximately USD 4.02 billion by 2032, reflecting a compound annual growth rate (CAGR) of around 1.51% during 2026–2032. Despite the fact that the market is still struggling with the issues caused by inflation and low purchasing power, the value growth is still supported by the steady demand of children clothes. Affordability remains a priority among parents, with many choosing more affordable alternatives and reusing clothes, whereas local boutique and online brands meet the need of fashionable, culturally-inspired clothing at affordable prices.

The product landscape will be dominated by the apparel segment that has almost 80% of the total market share. The brands like Baby Creysi and Milano are able to retain their leading positions by diversifying their product range and store network, whereas smaller boutique brands like Koromi Kids and Hola Pequeno are gaining popularity with their Mexican-inspired designs. This combination of tradition and innovation helps both old and new brands to flourish even in the face of economic limitations.

Retail offline channels on the distribution side contribute almost 90% of the total market sales because in-person shopping is essential to Mexican families who want to evaluate the quality of products before making a purchase. Physical stores and supermarkets are still enjoying high sales due to affordability and accessibility, but online stores like Shein and Temu are quickly becoming popular among digitally savvy parents.

The market will probably become more integrated with omnichannel retailing and digital marketing in the next several years, especially with the help of so-called mom influencers on social media. Such partnerships will assist the brands to build stronger emotional ties with the end users, build stronger brand loyalty and generate new growth opportunities despite the fact that the birth rate of the country is still declining.

Mexico Childrenswear Market Growth DriverPromotional Strategies Reinforcing Market Reach

The Mexico Childrenswear Market is experiencing a long-term growth due to the strong promotional activities and marketing partnerships between the major brands. The companies are spending a lot of money on social media campaigns, loyalty programs, and seasonal discounts to appeal to parents who want both affordability and quality. Retailers like Baby Creysi and Cuidado con el Perro are still growing their presence with influencer tie-ups and online advertisements, so they can be seen in both online and offline platforms.

Such promotional campaigns do not only enhance brand recall but also assist in creating emotional attachment with families. Through appealing prices and interactive campaigns, brands are enhancing accessibility and loyalty among middle-income families. The increased emphasis on promotions and targeted marketing is one of the key aspects of increasing the reach and maintaining the consistent sales pace in the Mexican childrenswear environment.

Mexico Childrenswear Market ChallengeDeclining Birth Rate Affecting Market Expansion

The falling birth rate in Mexico remains a long term threat to the children wear market. As the number of births per year is declining, the possible end-user pool is slowly dwindling, which affects the general demand of children clothes. The number of children in families is decreasing because of the changing lifestyles, economic factors, and the social priorities, which result in the decrease in the market volume.

This population change forces the brands to change their strategies to remain profitable. Firms are increasingly emphasizing on high quality, durability, and value products to promote increased expenditure per child. Nevertheless, it is still challenging to maintain high growth because the market is experiencing slower rates of young end user replenishment. The current decline in birth rates will probably curtail growth and compel retailers to be creative to maintain competitiveness.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Mexico Childrenswear Market TrendShift Toward Casualwear in Educational Institutions

A notable trend shaping the Mexico childrenswear market is the growing acceptance of casual attire across schools and other educational institutions. Numerous private and semi-private schools are relaxing their dress-code rules, permitting children to dress in casual and multi-purpose clothes rather than in formal uniforms. This change is increasing the demand of everyday wear like t-shirts, jeans, and sport-study athleisure wear.

Parents are becoming more inclined to buy multi-purpose clothes that are durable, comfortable, and stylish to wear to school. The retailers are reacting by providing collections that combine casual designs with functional features that can be worn on a daily basis. This shift in dress codes is also affecting buying habits, as brands are increasingly investing in comfort-based and versatile childrenswear collections in the market.

Mexico Childrenswear Market OpportunityThe Power of “Mom Influencers” in Brand Engagement

Rising influence of parent-focused digital creators is expected to significantly strengthen brand engagement and support future growth in the Mexico childrenswear market. These social media influencers establish a good relationship with parents by providing genuine product reviews, styling ideas, and parenting tips. Their familiar narratives build trust and have a major impact on buying behavior in the digital space.

Brands that work with such influencers reach highly engaged audiences and enjoy credible, emotion-driven marketing. With the increased level of digital interaction, collaboration with mom influencers will be a crucial marketing tool of apparel companies. The trend will allow brands to build stronger visibility, loyalty, and community-based engagement that resonates with the current values of modern parenting and online shopping behaviour.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Mexico Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Footwear

- Accessories

- Others

The segment with the highest share under the product type category in the Mexico childrenswear market is Apparel, holding around 80% of the total market share. The strong performance of this segment is driven by the continuous demand for stylish yet affordable clothing, even amid economic pressures. Parents in Mexico are increasingly opting for practical and budget-friendly options, with brands such as Shein and Temu becoming popular for their competitive pricing. At the same time, established local brands like Baby Creysi and Milano continue to lead through trust, familiarity, and strong distribution networks.

Within apparel, a rising interest in local boutique labels such as Célestin & Jacobin, Koromi Kids, and Hola Pequeño showcases the growing demand for unique, culturally inspired designs. These brands resonate with parents seeking fashionable yet accessible clothing options, reflecting a shift towards supporting local creativity while maintaining affordability and quality balance.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel in the Mexico childrenswear market is Retail Offline, which accounts for nearly 90% of the total market share. Physical stores remain the preferred choice for Mexican parents, who value the ability to assess fabric quality, fit, and comfort before purchasing. Large-scale retailers and supermarkets continue to dominate due to their affordability and wide reach, making them accessible even to price-sensitive end users.

However, the retail landscape is evolving as retail online platforms like Shein, Temu, and Liverpool Online gain popularity for their convenience and attractive deals. While reatil online is expanding, traditional stores still play a vital role in driving impulse purchases and offering in-person promotions. Going forward, a gradual shift towards omnichannel strategies is expected as brands combine online accessibility with in-store experiences to strengthen engagement and sales.

List of Companies Covered in Mexico Childrenswear Market

The companies listed below are highly influential in the Mexico childrenswear market, with a significant market share and a strong impact on industry developments.

- Massimo Dutti México SA de CV

- Yale de Mexico SA de CV

- C&A México S de RL

- Baby Creysi SA de CV

- Controladora Milano SA de CV

- Industrias Bunny Baby SA de CV

- Fabrilmalla SA de CV

- Zara México SA de CV

- Bonetera Orbe SA de CV

- Fashion Choice Pte Ltd

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Mexico Childrenswear Market Policies, Regulations, and Standards

4. Mexico Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Mexico Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Mexico Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Mexico Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Mexico Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Baby Creysi SA de CV

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Controladora Milano SA de CV

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Industrias Bunny Baby SA de CV

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Fabrilmalla SA de CV

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Zara México SA de CV

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Massimo Dutti México SA de CV

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Yale de Mexico SA de CV

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.C&A México S de RL

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Bonetera Orbe SA de CV

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Fashion Choice Pte Ltd

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.