Mexico Bottled Water Market Report: Trends, Growth and Forecast (2026-2032)

By Type of Water (Carbonated Bottled Water, Flavoured Bottled Water, Functional Bottled Water, Still Bottled Water (Purified Water, Mineral Water, Spring Water, Plain Water)), By Packaging Material (Plastic Bottles, Glass Bottles, Metal Cans, Others (Tetra Pack Cartons, Bioplastics, etc.)), By Price Point (Mass, Premium), By Sales Channel (On Trade, Off Trade (Retail Offline, Retail Online))

|

Major Players

|

Mexico Bottled Water Market Statistics and Insights, 2026

- Market Size Statistics

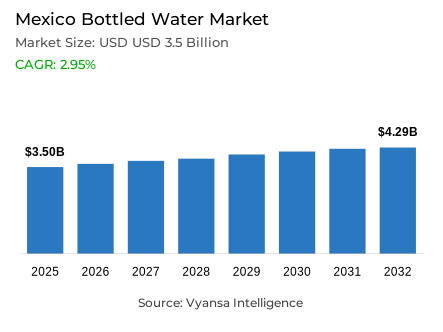

- Bottled water in Mexico is estimated at USD 3.5 billion in 2025.

- The market size is expected to grow to USD 4.29 billion by 2032.

- Market to register a cagr of around 2.95% during 2026-32.

- Type of Water Shares

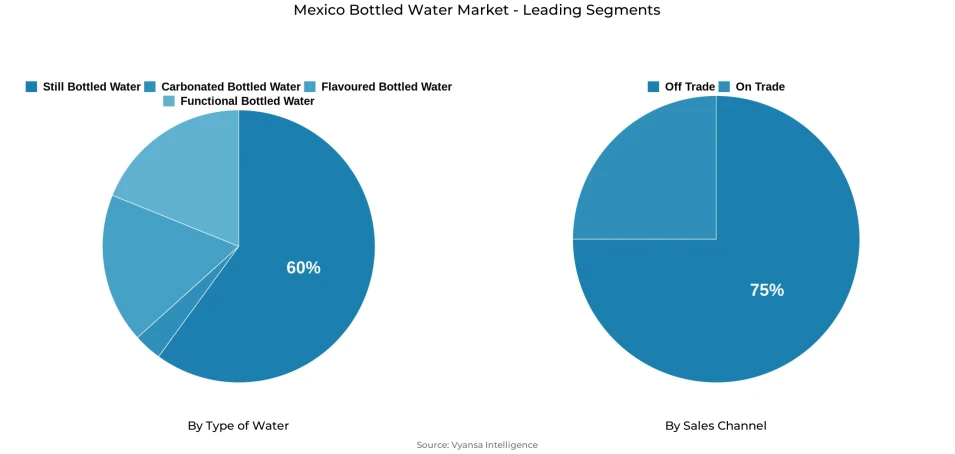

- Still bottled water grabbed market share of 60%.

- Competition

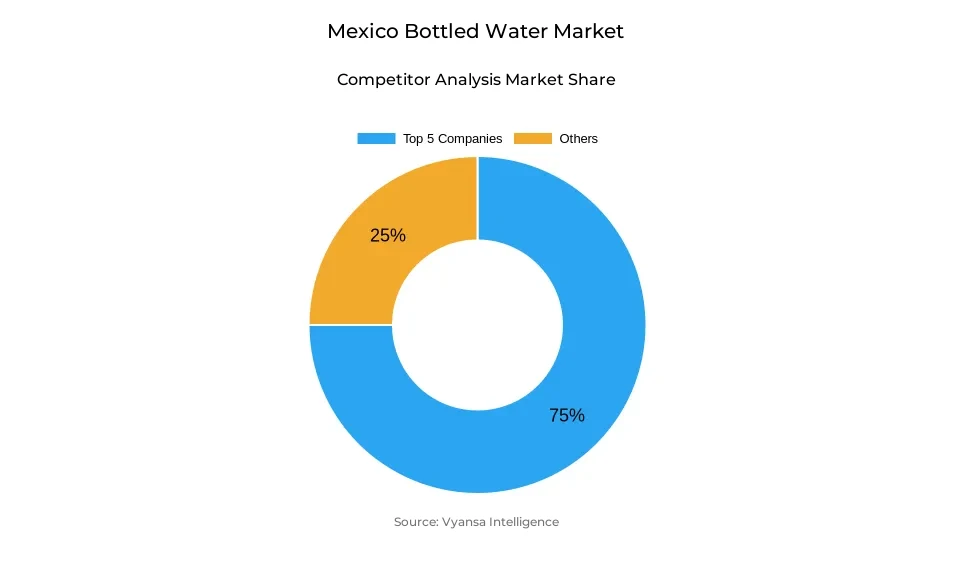

- Bottled water in Mexico is currently being catered to by more than 5 companies.

- Top 5 companies acquired around 75% of the market share.

- Envasadora de Aguas en México S de RL de CV (Agua Purificada Pureza Aga); Pepsi-Cola Mexicana SA de CV; Natural Waters of Viti Ltd; Coca-Cola Mexico; Danone de México SA de CV etc., are few of the top companies.

- Sales Channel

- Off trade grabbed 75% of the market.

Mexico Bottled Water Market Outlook

The Mexico bottled water market is estimated to be USD 3.5 billion in 2025 and is expected to be USD 4.29 billion in 2032 with a CAGR of 2.95% from 2026 to 2032. This steady growth indicates bottled water’s transition from a discretionary purchase to a daily necessity for end users. The rising awareness about health is also bringing about a change in the drinking culture, as bottled water is slowly replacing soft drinks in homes, especially those with kids. The rising fear of obesity and health-related issues has also elevated the status of bottled water as a healthier, sugar-free alternative in daily diets.

This shift in consumer behavior is also being reinforced by health regulation. The national prohibition of sugary beverages in schools that came into effect in March 2025 has increased the number of regular drinking events of bottled water among children and adolescents, instilling habits at a young age. Together with the continued levies of excise and warning labels on the front of the packs of high-sugar drinks, regulation is still undermining the competitiveness of carbonated and sweetened drinks. With no warning labels or formulation restrictions, bottled water enjoys the advantage of regulatory clarity, which makes it the default substitute beverage in both home and school-linked events.

The competitive pressure is rising in the wider non-sugary beverage arena. Ready-to-drink teas, sports drinks, and fortified beverages are being promoted as functional hydration products, increasing the threat of substitution in the discretionary and out-of-home situations. Bottled water maintains its fundamental relevance through its focus on purity, safety, and neutrality. The bottled water variants in flavored and carbonated versions also contribute to the demand by providing taste and refreshment without sugar, enabling end users to decrease sugar consumption without sacrificing the familiar consumption events.

Nevertheless, the bottled water is the most prevalent type, with about 60% of the market share because of its daily versatility and high trust levels among the end users. The off-trade channels contribute approximately 75% of the total sales, which indicates the significance of supermarkets, discounters, convenience stores, and local grocers in facilitating regular household replenishment and bulk buying in line with the role of bottled water as a staple product.

Mexico Bottled Water Market Growth DriverHealth Priorities Accelerate Substitution Toward Water

Increasing health awareness is reshaping beverage preferences in Mexico, with bottled water increasingly replacing sugar-rich soft drinks in daily consumption. Households, especially those with children, are giving preference to hydration that seems to be safer and free of sugar as the obesity rate and diet related diseases concern increases. Government initiatives aimed at reducing sugar consumption and encouraging healthier drink habits among school-going children are supported by the finding that, according to the ENSANUT 2022 -2023 (National Health and Nutrition Survey) in Mexico, about 37 per cent of school-going children (5-11 years) in Mexico are overweight or obese. It is against this backdrop that bottled water ceases to be regarded as discretionary but rather a basic element to diets, which used to be taken by carbonates and other sweetened drinks.

This behaviour change has been supported materially by regulatory action. In March 2025, Mexico enacted a nationwide ban on sugary beverage sales in schools under the Healthy Living programme eradicating carbonates, juices and sugary soft drinks in schools. This policy increases the frequency of consumption events of bottled water amongst children and adolescents, entrenching habits of use at a young age. The combined impact of societal-health pressure and regulation has marketed bottled water as the default substitute beverage, which has given the force of the structural influence on demand in house and school connected events.

Mexico Bottled Water Market ChallengeExpanding Functional Beverage Choices Intensify Competition

Bottled water faces growing pressure from an increasingly diverse non-sugary beverage landscape in Mexico. Ready-to-drink teas, sports drinks, and fortified beverages are actively positioning themselves as hydration solutions that have electrolyte, energy, or wellness benefits. This targets consumers who demand added functionality over simple refreshment, especially in the out-of-home and active context and as these segments support their health-oriented message, bottled water has a high threat of substitution, especially when functional claims are viewed as providing a better value.

According to official statistics, the non-alcoholic beverage sector is experiencing a growing diversification, which is being fuelled by the investment made by the manufacturers in innovation, flavour creation, and targeted promotion. The availability of more shelf space to functional drinks enhances the complexity of choice at the point of purchase, which makes it difficult to keep bottled water relevant on the basis of purity alone. Although bottled water continues to dominate daily hydration, the competition is increasing in the discretionary consumption occasions. To protect its position, it is becoming necessary to strengthen trust, safety, and regulatory neutrality as competitive advantages in a saturated, health-conscious beverage market.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Mexico Bottled Water Market TrendFlavoured and Carbonated Formats Redefine Water Consumption

One of the most significant changes in the consumption of bottled water is the fast adoption of flavoured and carbonated versions in place of traditional soft drinks. These formats enable end users to minimize sugar content and maintain taste, sensory and refreshment, which is in line with the changing dietary trends. Flavoured and sparkling waters are also taking over the same consumption events that were previously controlled by ordinary carbonates, especially at meals and social gatherings, which further supports the use of bottled water as a modern soft drink substitute as opposed to a functional product.

This migration is reinforced by Mexico’s strict front-of-pack warning label system, where black seals are placed on high-sugar, high-calorie, or high-sodium products. This kind of labelling will deter buying of traditional soft drinks and increase the appeal of bottled water versions that do not carry health warnings. Consequently, flavoured and carbonated bottled water satisfies indulgence needs without regulatory stigma, reinforcing premiumisation and differentiation in the category and maintaining its overall health-based positioning.

Mexico Bottled Water Market OpportunitySugar Regulation Creates Long Term Structural Headroom

The long-term regulatory pressure on sugar-sweetened drinks in Mexico provides a clear structural opportunity in the growth of bottled water. In addition to the school-level limitations, the nation still imposes excise taxes on sweetened beverages and keeps a watchful eye on the components like high-fructose corn syrup and artificial additives. These actions continue to undermine the competitiveness of the traditional soft drinks by raising compliance costs and reducing marketing flexibility, and bottled water is relatively free.

This policy direction is supported by public health data, which shows that Mexico remains one of the largest consumers of sugar-sweetened beverages on a per-capita basis with adults drinking an average of 166 litres of soda per person per year. This makes sugar reduction a national health priority that is long-term and not a short-term intervention. With regulation still limiting formulation and promotion in competing categories, bottled water enjoys the regulatory clarity and simplicity, which facilitates its consolidation as the safest, least restricted hydration choice.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Mexico Bottled Water Market Segmentation Analysis

By Type of Water

- Carbonated Bottled Water

- Flavoured Bottled Water

- Functional Bottled Water

- Still Bottled Water

- Purified Water

- Mineral Water

- Spring Water

- Plain Water

Still bottled water represents the largest segment by type, accounting for around 60% of the Mexico bottled water market. Its dominance reflects its role as a basic, everyday hydration solution embedded across household routines, workplaces, and educational settings. End users widely perceive still water as the purest and most neutral alternative to sugary beverages, reinforcing trust and habitual consumption. This perception is particularly important in health driven substitution, where simplicity and safety outweigh novelty or indulgence.

Leadership is further supported by versatility across usage occasions, from direct consumption to food preparation. While flavoured and carbonated waters are gaining visibility, still bottled water continues to anchor category volumes due to its compatibility with all age groups and dietary needs. Regular household replenishment, including bulk formats, sustains high frequency purchasing and positions still bottled water as the backbone of the market’s demand structure.

By Sales Channel

- On Trade

- Off Trade

- Retail Offline

- Retail Online

Off trade channels hold the largest share of bottled water distribution in Mexico, accounting for around 75% of total sales. This dominance reflects the importance of regular household purchasing through supermarkets, discounters, convenience stores, and small local grocers. Off trade outlets support bulk and repeat purchases, aligning with bottled water’s role as a staple product rather than an impulse item. End users rely on these channels for consistent availability, affordability, and proximity to residential areas.

Small local grocers are particularly influential, especially in neighbourhoods and smaller towns where modern retail penetration remains limited. Their strength lies in trust, accessibility, and familiarity with local purchasing habits, including garrafón usage. Informal credit and flexible purchasing further reinforce loyalty. Discounters complement this ecosystem by expanding aggressively into secondary cities and competing on price, making bottled water more accessible to price sensitive end users and reinforcing off trade leadership.

List of Companies Covered in Mexico Bottled Water Market

The companies listed below are highly influential in the Mexico bottled water market, with a significant market share and a strong impact on industry developments.

- Envasadora de Aguas en México S de RL de CV (Agua Purificada Pureza Aga)

- Pepsi-Cola Mexicana SA de CV

- Natural Waters of Viti Ltd

- Coca-Cola Mexico

- Danone de México SA de CV

- Nestlé México SA de CV

- Grupo Peñafiel SA de CV

- Electropura S de RL de CV

Competitive Landscape

Mexico’s bottled water market in 2025 is led by Coca-Cola Mexico, which continues to strengthen its position through portfolio diversification beyond carbonates. The company has expanded its leadership through the strong performance of Ciel in purified bottled water and the continued growth of Topo Chico in mineral water, allowing it to widen the gap with key competitors Danone de Mexico SA de CV and Nestlé Mexico SA de CV. Coca-Cola Mexico has also been among the most dynamic players, supported by heavy investment in advertising and aggressive promotional activity across channels. Frequent discounts, multipacks, and larger value formats have reinforced its competitiveness across still, mineral, and flavoured bottled water, intensifying pressure on rival brands.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Mexico Bottled Water Market Policies, Regulations, and Standards

4. Mexico Bottled Water Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Mexico Bottled Water Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Volume (Million Litres)

5.2. Market Segmentation & Growth Outlook

5.2.1.By Type of Water

5.2.1.1. Carbonated Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Flavoured Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Functional Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Still Bottled Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Purified Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Mineral Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Spring Water- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Plain Water- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Packaging Material

5.2.2.1. Plastic Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Glass Bottles- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Metal Cans- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Others (Tetra Pack Cartons, Bioplastics, etc.)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Point

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. On Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Off Trade- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Mexico Carbonated Bottled Water Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Volume (Million Litres)

6.2. Market Segmentation & Growth Outlook

6.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Mexico Flavoured Bottled Water Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Volume (Million Litres)

7.2. Market Segmentation & Growth Outlook

7.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Mexico Functional Bottled Water Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.1.2.By Volume (Million Litres)

8.2. Market Segmentation & Growth Outlook

8.2.1.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Point- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Mexico Still Bottled Water Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.1.2.By Volume (Million Litres)

9.2. Market Segmentation & Growth Outlook

9.2.1.By Type of Water- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Packaging Material- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Price Point- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1. Company Profiles

10.1.1. Coca-Cola Mexico

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Danone de México SA de CV

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Nestlé México SA de CV

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Grupo Peñafiel SA de CV

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Electropura S de RL de CV

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Envasadora de Aguas en México S de RL de CV (Agua Purificada Pureza Aga)

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Pepsi-Cola Mexicana SA de CV

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. Natural Waters of Viti Ltd

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Type of Water |

|

| By Packaging Material |

|

| By Price Point |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.