Mexico Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Oct 2025

- VI0539

- 120

-

Mexico Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

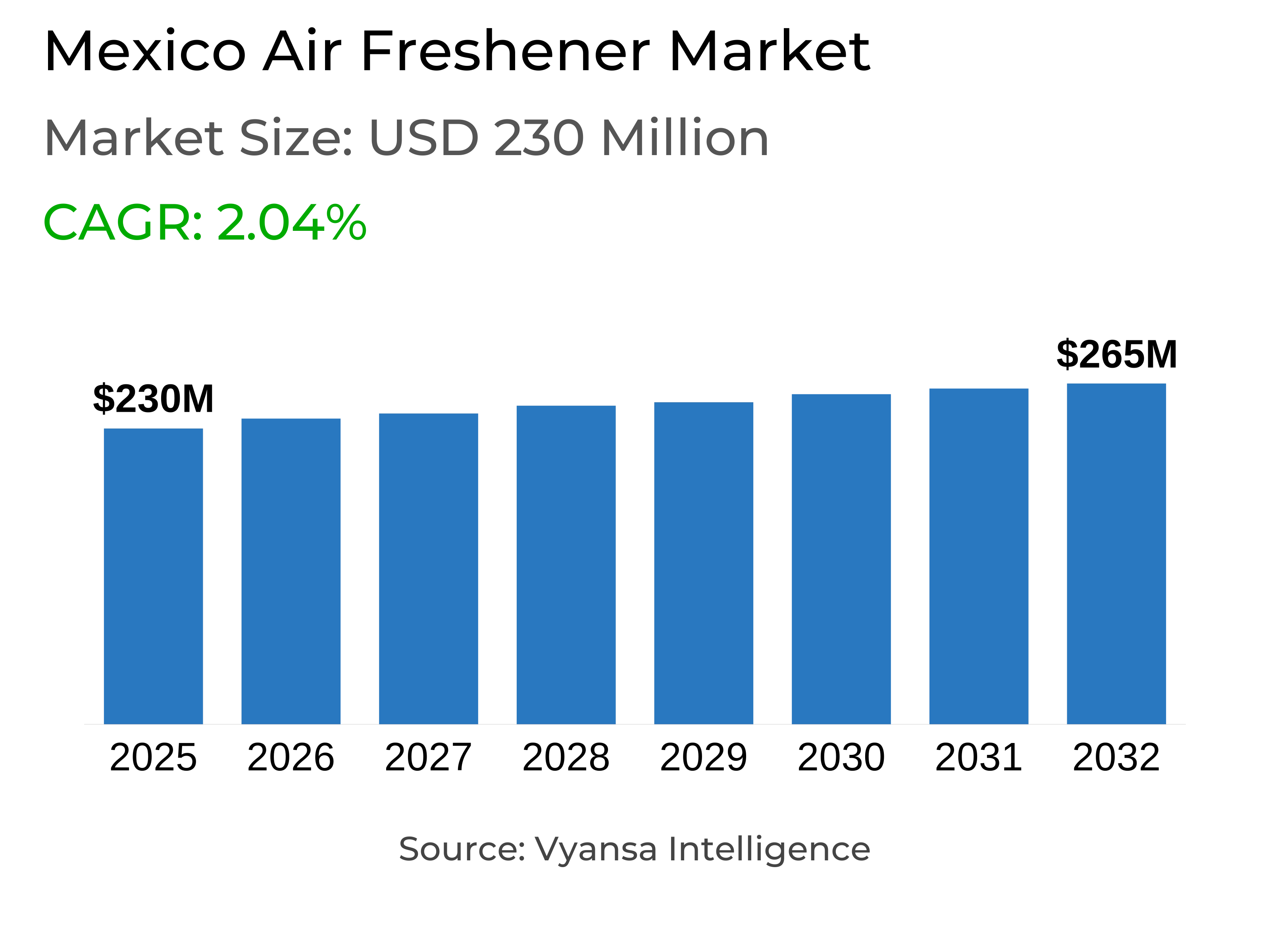

- Mexico Air Freshener Market in is estimated at $ 230 Million.

- The market size is expected to grow to $ 265 Million by 2032.

- Market to register a CAGR of around 2.04% during 2026-32.

- Product Type Shares

- Spray/Aerosol Air Freshener grabbed market share of 40%.

- Competition

- More than 5 companies are actively engaged in producing Air Freshener Market in Mexico.

- Top 5 companies acquired around 75% of the market share.

- Reckitt Benckiser (M) Sdn Bhd, Kobayashi Healthcare (M) Sdn Bhd, Farcent (M) Sdn Bhd, Procter & Gamble (M) Sdn Bhd, SC Johnson & Son (M) Sdn Bhd etc., are few of the top companies.

- Fragrance

- Lavender continues to dominate the market.

Mexico Air Freshener Market Outlook

The Mexico air freshener market is approximated at $230 million as of 2025 and is anticipated to grow to $265 million by 2032. There are well over five companies that are currently manufacturing air fresheners in the country, with the leading five players controlling approximately 75% of the market. Spray and aerosol forms will continue to be the largest segment because they are affordable, convenient, and readily available, whereas other forms like electric diffusers and PET bottle packaging will also grow as end-users demand convenience, resilience, and economy. Blister and strip packs will also experience growth in car, gel, and electric air fresheners.

Lavender and other floral scents are still leading the way, with seasonal and limited-edition fragrances appealing to end users seeking special experiences. Brands are now more often using social commerce platforms such as TikTok, Instagram, and Facebook to engage with end users through personalized products and fragrances that evoke particular places, such as coffee houses or boutiques. This enables brands to establish an emotional bond with end users while also encouraging self-care and wellness at home.

Pet ownership in Mexico is increasing, with increasingly more families having multiple pets. This presents opportunities for air fresheners brands to launch pet-safe products that fight odours in homes with fur babies. Providing solutions designed specifically for pet-friendly homes can assist brands in differentiating themselves and meeting a growing end users need.

Overall, Mexico air fresheners demand is poised to develop steadily over the forecast period with the aid of economic stability, increasing self-awareness and wellness awareness, and end-users' enthusiasm for personal, high-value fragrance experiences. Brands that emphasize innovation, multi-functionality, and pet-safe solutions are apt to increase market presence and capture new opportunities.

Mexico Air Freshener Market Growth Driver

Economic Stability Fosters Market Growth

Sustained economic conditions are supporting higher uptake of air fresheners in households. Low levels of unemployment, a contained rate of inflation, and positive exchange rates enhance household purchasing power, allowing end users to spend with confidence on home care products. Such conditions are supportive of sustained consumption of air fresheners and offer a stable setup for market growth.

The positive economic environment also favors imports of international brands, leading to broad availability of different formats and scents. Stability causes end users to look for premium and innovative offerings, including PET packages and private label lines in sync with trending fragrances, further propelling retail volume and value growth. Generally, the economic environment has a direct impact on market performance by fueling spending, promoting variety, and supporting brand penetration.

Mexico Air Freshener Market Trend

Increasing Demand for Innovative and Personalized Fragrances

End users in Mexico increasingly look for air fresheners that do more than simply remove basic odours, instead targeting innovative and personalized fragrance experiences. Scents that capture the essence of certain moods or places, like coffee shop or boutique-style fragrances, are becoming more popular. This trend is part of a general trend towards home wellness and the desire to create a homely, personalized space.

Brands are fighting back by creating distinctive fragrance profiles, seasonal collections, and products with natural or botanical ingredients. This trend for differentiation in the market has end users being more open to new fragrance and packaging forms. Personalisation and experience-oriented fragrances are defining product development and retail purchase decisions, affirming the role of imagination and sensory interaction in Mexico air freshener sales.

Mexico Air Freshener Market Opportunity

Development via Social Commerce and Digital Channels

Rising engagement through social commerce and e-commerce platforms is enhancing access to air freshener products. Reatil Online channels enable local and niche players to reach end-users directly, providing bespoke fragrances, plant-based ingredients, and limited-edition releases that are not heavily stocked in conventional retail.

Smellers.mx and other brands. They use TikTok and Instagram to reach end users, offer scenting space tips, and market emotionally resonant products. Online presence expansion improves visibility, enables targeted marketing, and generates sales from digitally empowered end users. During the forecast period, air fresheners companies can grow penetration, enhance brand loyalty, and reach untapped segments by investing strategically in Retail Online platforms.

Mexico Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

The segment with highest market share under product type category is Spray/Aerosol Air Fresheners, which holds approximately 40% of market share. They continue to be favored because they are inexpensive, convenient, and offer a wide range of scents. Spray/aerosol forms also provide end users with the option of controlling usage, compared to electric diffusers which need complementary equipment. Leading this category are major brands such as Glade, with private labels and other formats such as PET bottles driving volume sales growth.

Throughout the forecast period, spray/aerosol air fresheners will see sustained demand in Mexico owing to continued economic stability, end users convenience preference, and promotional activities based on seasons. The format remains a staple option in both modern and traditional trade channels, with end users being very receptive to new fragrances and festive versions.

By Fragrance

- Camomile/Lavender

- Lavender

- Floral

- Vanilla

- Lemon

- Breeze

- Lavender/Vanilla

- Cinnamon

- Jasmine

- Apple/Cinnamon

- Rose

- Orchid

- Mint

- Wood

The segment with highest market share under sales channels is Retail Offline, which remains supreme with 65% of market share. Physical stores continue to be Mexico end-users' first choice, with the advantage of instantaneous purchase, product assortment, and on-shelf promotion. Supermarkets and hypermarkets, such as HEB, are major drivers for this channel, which fosters the visibility of international and private label brands.

Throughout the forecasting period, retail offline shall be Mexico dominant sales channel for air fresheners products, with online platforms incrementally supplementing it. Retail Online provides access to visibility and reach for specialty and smaller brands, especially for end-users looking for custom or specialty fragrances, but offline shops will still dominate consumption in markets.

Top Companies in Mexico Air Freshener Market

The top companies operating in the market include Reckitt Benckiser (M) Sdn Bhd, Kobayashi Healthcare (M) Sdn Bhd, Farcent (M) Sdn Bhd, Procter & Gamble (M) Sdn Bhd, SC Johnson & Son (M) Sdn Bhd, Shaldan Malaysia, etc., are the top players operating in theMexico Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Mexico Air Freshener Market Policies, Regulations, and Standards

4. Mexico Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Mexico Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Mexico Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Mexico Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Mexico Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Mexico Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Mexico Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Mexico Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. SC Johnson & Son SA de CV

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. Reckitt Benckiser México SA de CV

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Procter & Gamble de México SA de CV

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Henkel Mexicana SA de CV

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Industrias H24 SA de CV

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.