Malaysia Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

Category (Costume Jewellery, Fine Jewellery), Type (Earrings, Neckwear, Rings, Wristwear, Other), Collection (Diamond, Non-Diamond), Material Type (Gold, Platinum, Metal Combination, Silver), Sales Channel (Retail Offline, Retail Online), End User (Men, Women)

- FMCG

- Dec 2025

- VI0629

- 130

-

Malaysia Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

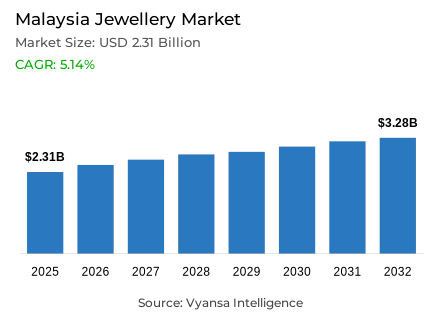

- Jewellery in Malaysia is estimated at USD 2.31 billion.

- The market size is expected to grow to USD 3.28 billion by 2032.

- Market to register a cagr of around 5.14% during 2026-32.

- Category Shares

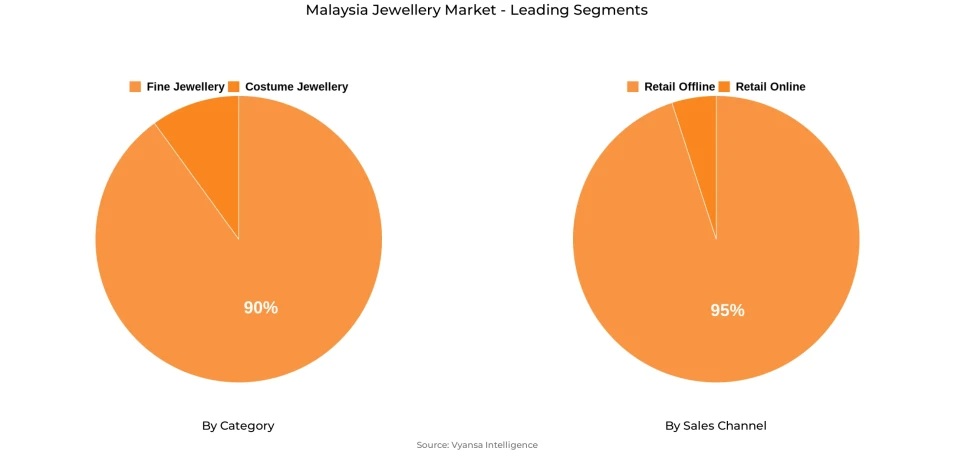

- Fine jewellery grabbed market share of 90%.

- Competition

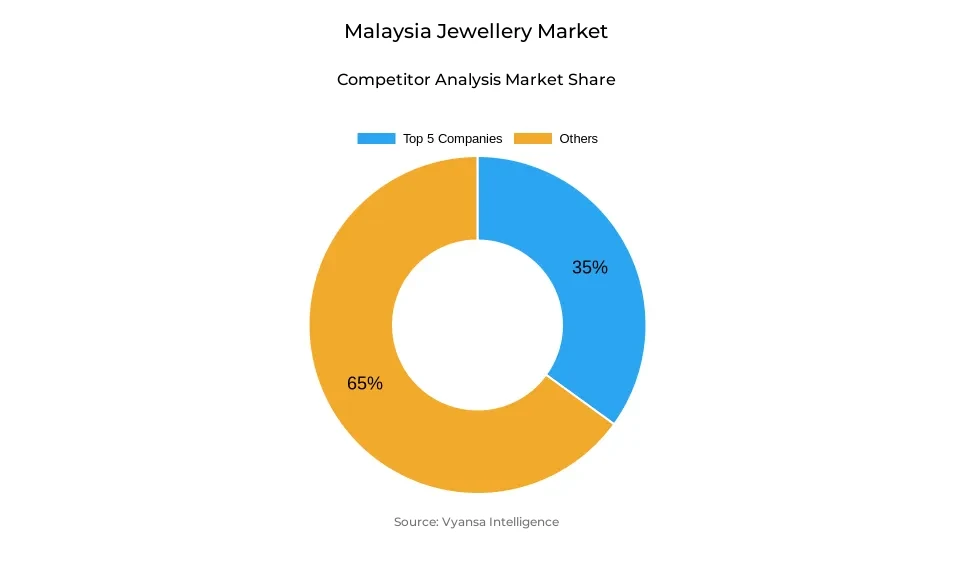

- More than 20 companies are actively engaged in producing jewellery in Malaysia.

- Top 5 companies acquired around 35% of the market share.

- Chopard (M) Sdn Bhd, Tiffany & Co Jewelers Malaysia Sdn Bhd, Pandora A/S, Poh Kong Holdings Bhd, Tomei Consolidated Bhd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 95% of the market.

Malaysia Jewellery Market Outlook

The Malaysia jewellery market is expected to grow from around USD 2.31 billion in 2025 to around USD 3.28 billion by 2032, registering a CAGR of around 5.14% during 2026-2032. This growth supported by the strong interest of end users in fine jewellery, particularly in gold and diamond pieces, which continue to be viewed as both beautiful and valuable investments. Combined with the cultural importance of gold, this is ensuring the market remain stable even with fluctuating prices, allowing fine jewellery to maintain the leading position with around 90% market share.

The growing trust of end users in retail offline stores is also supporting the market, with retail offline channels accounting for around 95% of the total sales. The ability to see and compare products in-person, along with guidance from experts, keeps traditional stores as the most preferred buying option. In-store promotions, discounts, and loyalty programs further encourage repeat purchases, showing the strength of this channel.

Still, evolving preferences are introducing new avenues for growth. Younger end users are showing increasing interested in costume jewellery and lab grown diamonds, appreciating their affordability, style, and eco friendly appeal. This shift is helping diversify the market, while fine jewellery still at the top. There is a balance of luxury with practicality among end users, which again works to keep demand across categories.

The industry is fairly competitive, with over 20 companies actively producing jewellery. The top five players account for around 35% of the total share, with strong local brands leading the sector and planning further expansion through both retail offline and online channels. Supported by cultural demand, ongoing investment appeal, and the growing momentum of established and emerging brands, the outlook for the jewellery market is expected to remain positive through 2032.

Malaysia Jewellery Market Growth DriverHigh Value of Gold Sustaining Demand for Fine Jewellery

Fine jewellery continues to show resilience since the end users view gold not only as a luxury but also a long term investment. According to the World Gold Council, national gold demand increased by 24.2% from 14.9 tonnes in 2021 to 18.5 tonnes in 2022, reflecting strong buying interest of end users in gold jewellery despite fluctuating prices. This moment will support steady sales for both retailers and local producers and will stabilize the growth of fine jewellery market.

At the same time, DOSM reports that around 80% of national gold manufacturing output currently comes from a single main production hub. This structure supports efficiency in supply and ensures that gold jewellery remains a trusted investment for end users who value long term security with style.

Malaysia Jewellery Market ChallengeRising Living Costs Limiting Jewellery Purchases

The end users are now becoming more cautious with their spending as the cost of living has continue to rise. Prices for essentials such as food, housing, and fuel are increasing, leaving less disposable income in the pockets of the end users for non essential items like jewellery. According to the ASEAN Consumer Sentiment Study 2023 by UOB, around 75% of Malaysia end users expect a recession within the next year and plan to reduce their purchase of luxury items. The cautious mindset is making it increasingly difficult for jewellery makers to maintain strong sales, especially premium fine jewellery, which depends on confident end user spending.

Meanwhile, retail industry data from Malaysia shows a slowdown the total retail sales declined by about 3% in the second quarter of 2025. This decline reflects weaker demand for high value goods as end users shift towards fulfilling basic needs. Hence, the jewellery market may also experience slower growth in the short term due to reduced end user spending power.

Malaysia Jewellery Market TrendIncreasing Demand for Lab Grown Diamonds

Lab grown diamond jewellery is gaining greater acceptance among end users as they seek sustainable and more affordable options. Lab grown diamonds produced using advanced technology by various brands, offer the same beauty and appeal as natural diamonds. According to, the Malaysia External Trade Development Corporation reported a 30.5% rise in jewellery exports to USD 67000 million between January and April 2024, highlighting growing demand globally for more ethical and sustainable products. This reflects a shift among modern end users, who increasingly value environmentally responsible jewellery that is also more affordable.

At the same time, cultured diamonds are helping the jewellery market market transition toward more ethical and eco-friendly offerings. End users who once preffered mined diamonds are now accepting lab grown as alternative, which reduces environmental impact. The total jewellery trade, including exports and imports reached USD 133000 million, surged 33.5% year on year during the same period, This growth underscores strong activity in sustainable jewellery manufacturing and exports.

Malaysia Jewellery Market OpportunityRising Demand for Costume Jewellery in the Market

As younger end user looks for items that reflect their personal style and identity,nterest in costume jewellery has been rising. These end users often prefer minimalist designs that allow them to express creativity while staying fashionable. In the third quarter of 2024, Malaysia’s retail and wholesale trade subsector, including fashion and costume jewellery, grew by 4.2%, reflecting stronger local spending on lifestyle and fashion products. With more end user seeing costume jewellery as a form of self expression and not just a luxury, demand for these products remains robust.

Meanwhile, the popularity of simple and stylish jewellery hhas encouraged local designers to create more innovative collections. The services sector supporting retail trade further grew by 5.2% in Q3 2024, further reflecting strong domestic consumption. This positive growth environment supports innovation and expansion in costume jewellery, as local designers and small businesses cater to the fashion preferences of end users of younger generations, who continue to steady market growth.

Malaysia Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

Fine jewellery continues to held a share of around 90% of the overall sales within the market. This dominance is mainly due to the continuous preference of the end users towards gold and diamond products since they consider it not only beautiful but also for their long term value. The high value of gold has further strengthen demand for fine jewellery, with many end users still considering fine jewellery as one of the best means of investment. Local jewellers have also focused their efforts on providing a range of elegant designs that combine fashion with long term value, helping to maintain fine jewellery’s lead over other categories.

Moreover, fine jewellery remains closely related to cultural and social occasions. Many end users purchase gold and precious pieces for weddings, festivals, and other special celebrations, thus generating steady sales throughout the year. This emotional and traditional importance continues to secure its dominant position in the market.

By Sales Channel

- Retail Offline

- Retail Online

The retail offline segment accounts for around 95% of the market's share under the sales channel segment. Jewellery stores are still considered by end users as the most trusted place to view, touch, and compare products before purchase. The personal experience, expert advice, and assurance of products quality continue to favor retail offline stores. Many jewellers also use in-store promotions, discounts, and loyalty programs to build long term relationships with the end users.

Meanwhile, retail online sales are growing but still represent a small share of the market. Some brands make use of social media platforms to promote new collections and engage with end users through live sessions. Despite this, traditional stores remain dominant, as jewellery is still considered as a valuable purchase that the end users prefer to make in person.

Top Companies in Malaysia Jewellery Market

The top companies operating in the market include Chopard (M) Sdn Bhd, Tiffany & Co Jewelers Malaysia Sdn Bhd, Pandora A/S, Poh Kong Holdings Bhd, Tomei Consolidated Bhd, Wah Chan Consolidated Sdn Bhd, Habib Jewels Sdn Bhd, Mystique Universal Sdn Bhd, Richemont Luxury Malaysia Sdn Bhd, SK Jewellery Pte Ltd, etc., are the top players operating in the Malaysia jewellery market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Malaysia Jewellery Market Policies, Regulations, and Standards

4. Malaysia Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Malaysia Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Malaysia Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Malaysia Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Titan Co Ltd

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Poh Kong Holdings Bhd

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Tomei Consolidated Bhd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Wah Chan Consolidated Sdn Bhd

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Habib Jewels Sdn Bhd

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Mystique Universal Sdn Bhd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Chopard (M) Sdn Bhd

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Tiffany & Co Jewelers Malaysia Sdn Bhd

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Pandora A/S

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Richemont Luxury Malaysia Sdn Bhd

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.