Malaysia Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), Price Category (Mass, Premium), Sales Channel (Retail Offline, Retail Online)

|

Major Players

|

Malaysia Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

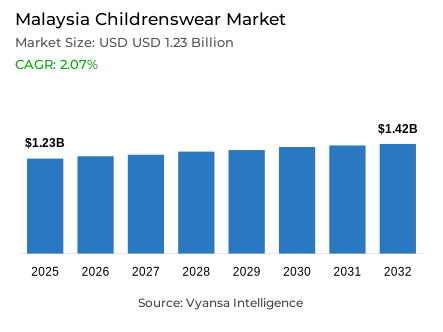

- Childrenswear in Malaysia is estimated at USD 1.23 billion in 2025.

- The market size is expected to grow to USD 1.42 billion by 2032.

- Market to register a cagr of around 2.07% during 2026-32.

- Product Type Shares

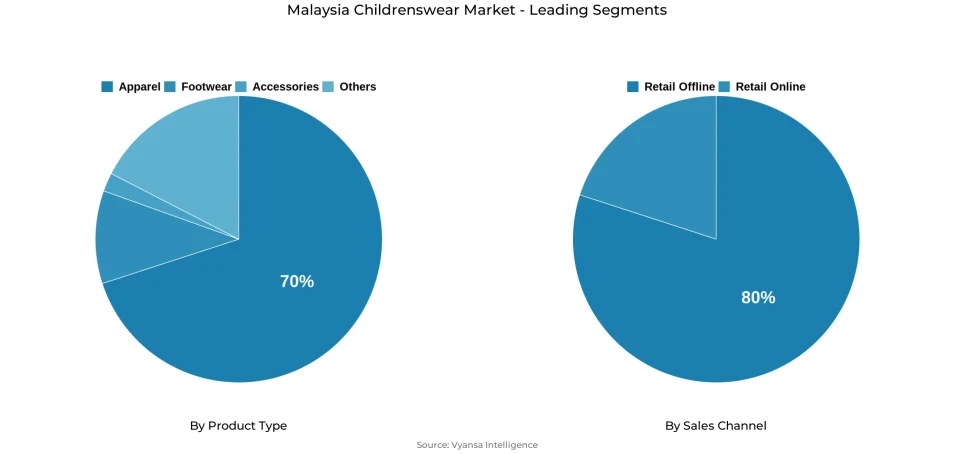

- Apparel grabbed market share of 70%.

- Competition

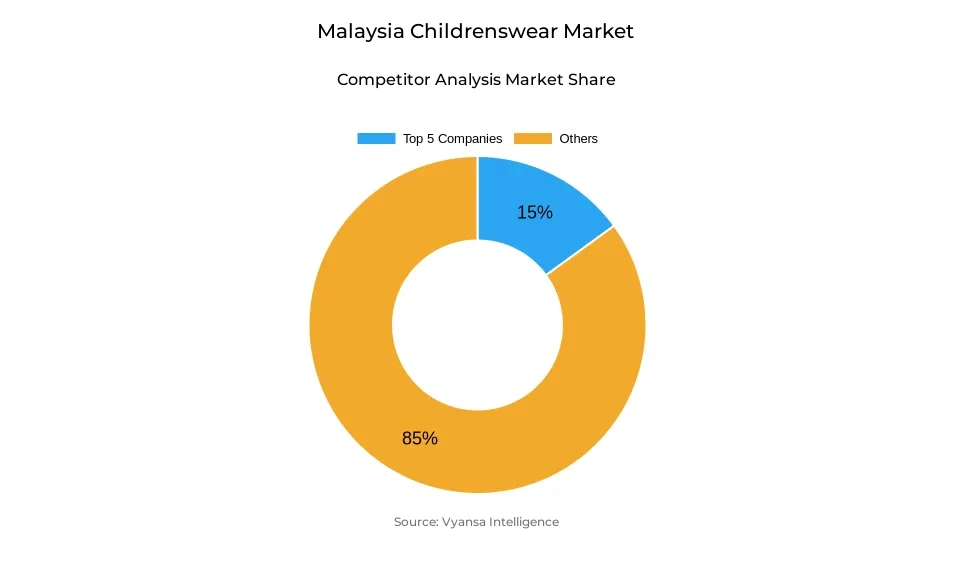

- More than 15 companies are actively engaged in producing childrenswear in Malaysia.

- Top 5 companies acquired around 15% of the market share.

- Roadget Business Pte Ltd; Nike Sales (M) Sdn Bhd; adidas (M) Sdn Bhd; Padini Holdings Bhd; Uniqlo (M) Sdn Bhd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

Malaysia Childrenswear Market Outlook

The Malaysia childrenswear market is forecasted to be around USD 1.23 billion in 2025, further growing to USD 1.42 billion in 2032, indicating a compound annual growth rate of 2.07% from the period between 2026 and 2032. This development is attributed to the revival of the social activities and travels among families due to the pandemic, which is quite a boost for increased expenditure on wearing garments for children. The offline revenue is being driven by the high usage of the shopping malls among families, though the brands such as The Baby Shop and Padini managed to keep it interesting through attractive discounts.

One of the most commonly purchased categories of products is clothing, encompassing close to 70% of the overall sales, propelled by the immense popularity of baby, boys', and girls' clothing. Fast fashion and low-cost brands such as H&M, Uniqlo, and Padini have started leveraging their collaborations with recognized franchises such as Disney and Dragon Ball Z to attract both kids and their parents together. However, the more affluent section of parents has started showing interest in brands such as Kays + Kins and Primeval Organic Baby Store, which use sustainable and quality fabrics derived from organic components.

retail offline is leading with about 80% market share, and this is driven by more outlets opening in metropolitan and busy malls. However, retail online is also rapidly revamping this marketplace. Shopee, Lazada, Shein Kids, and Temu are growing rapidly and are offering low prices and more products to end end users who are value-sensitive.

Looking ahead, the childrenswear market in Malaysia is forecast to realize its growth at the extremes of the market, namely the value and premium, as players increase accessibility through the use of omnichannel retailing. Moreover, the increased presence of licensed character wear and retail online lines is only set to improve the relationship, which will ensure the market records stable growth through to 2032.

Malaysia Childrenswear Market Growth DriverPromotional Strategies Enhancing Market Reach

The Malaysia Childrenswear Market is recording intense growth, and this is attributed by the intense promotion and pricing strategies undertaken by prominent brands. Games such as The Baby Shop and Padini Holdings LTD have engaged strategies such as discount offers and loyalty programs to target price-conscious end users. This has positively contributed to increased foot traffic and customer demand, especially within the baby wear and kids clothing product lines. Social media marketing and public displays have also improved the promotion of seasonal product lines, and this has contributed to increased conversions.

Additionally, such promotional offers assist brands to remain abreast of international trends that place intense emphasis on the cost factor as an important determinant of purchasing decisions. By the use of pricing and value-oriented promotion, brands are able to increase brand penetration and ensure internationally recognized growth on both virtual and offline markets.

Malaysia Childrenswear Market ChallengeIntense Market Fragmentation and Price Competition Limiting Value Growth

The Malaysia Childrenswear Market is experiencing chronic challenges due to high market fragmentation and price-based competition. As many local and foreign competitors, such as Padini, H&M, and Uniqlo, compete to win over the market, brands are turning to intensive discounting as a way of appealing to cost-conscious parents. Such strategies maintain sales volumes, but squeeze profit margins and hinder long-term value creation. Over-reliance on price promotions in the market has been exacerbated, especially in the face of increasing living expenses that reduce the purchasing power of households.

As a result, high-end and sustainable brands struggle to compete in terms of price and quality. This overcrowding of low-end products dilutes brand distinction and makes revenue growth even more difficult. Without new positioning or value-added services, brands might find it difficult to maintain loyalty and profitability in a market where price-sensitive buying behaviour is the order of the day.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Malaysia Childrenswear Market TrendRising Popularity of Character-Themed and Designer Collaborations

Growing interest in licensed character apparel and designer collaborations is shaping product innovation and brand strategies within the Malaysia childrenswear market. Parents and children are more inclined to wear clothes collections with popular characters like Barbie, Frozen, Sanrio, and Disney. H&M, Cotton On Kids, and Uniqlo are brands that are actively utilizing the opportunities of collaboration with international entertainment franchises to enhance the emotional appeal and prompt repeat buying. As an example, the Lisa Larson UT collection by Uniqlo combines fun and art with functionality, which is attractive to contemporary families that appreciate creativity and functionality.

These collections create a buzz with limited releases and at the same time increase brand awareness both online and offline. Entertainment influence and design innovation enable retailers to enhance their competitive advantage and keep pace with changing lifestyle preferences. This emerging amalgamation of fun, familiarity and fashion keeps on redefining brand positioning in the Malaysian childrenswear market.

Malaysia Childrenswear Market OpportunityExpansion of Online Platforms Offering Affordable and Diverse Collections

The Malaysia Childrenswear Market has a good opportunity with the rapid growth of digital retail. Online stores like Shopee, Lazada, Shein, and Temu are changing the accessibility of the market by offering low-cost and trendy collections that appeal to a wide audience. As an example, Shein Kids Malaysia has a wide variety of apparel that is convenient, stylish, and affordable, which is highly attractive to value-conscious families. Better logistics, safe payment systems, and quicker delivery networks also increase end user confidence and online adoption.

Moreover, these platforms allow smaller brands to enter national markets without significant brick-and-mortar investments. The further development of retail online with the help of advertising campaigns and convenient interfaces is likely to increase the speed of market penetration and the frequency of purchases. Digital growth will therefore continue to be a pillar of future growth, providing scale and cost effectiveness to market participants.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Malaysia Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Footwear

- Accessories

- Others

The segment with the highest share under the product type category is Apparel, which accounted for around 70% of the Malaysia Childrenswear Market. Apparel continues to dominate as it forms the core of children’s daily wardrobe, driven by constant demand for essentials like shirts, trousers, dresses, and schoolwear. Parents’ emphasis on comfort, quality, and design ensures that apparel remains the leading segment. Fast-fashion retailers such as Padini Holdings Ltd, H&M, and Uniqlo continue to introduce new collections and seasonal ranges, catering to both affordability and style-conscious end users.

The growth of the apparel segment is further supported by collaborations with popular franchises such as Disney, Pixar, and Transformers, which enhance brand visibility and appeal among children. Additionally, the increasing availability of premium options, featuring sustainable fabrics and high-quality finishes, reflects evolving preferences among parents with higher purchasing power.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel category is Retail Offline, which captured around 80% of the Malaysia Childrenswear Market. Physical stores remain the preferred choice for parents, as they allow them to evaluate fabric quality, fit, and comfort before purchase. The growing popularity of shopping malls and increased family outings have boosted foot traffic, benefiting brands like The Baby Shop and Padini, which offer attractive discounts and wide product selections.

Retail offline channels are also thriving due to their ability to create engaging in-store experiences and trust among end users. Department stores and branded outlets continue to expand their presence in urban areas, leveraging promotional campaigns and new store openings to strengthen visibility. This strong physical retail network ensures continued dominance of the offline segment throughout the forecast period.

List of Companies Covered in Malaysia Childrenswear Market

The companies listed below are highly influential in the Malaysia childrenswear market, with a significant market share and a strong impact on industry developments.

- Roadget Business Pte Ltd

- Nike Sales (M) Sdn Bhd

- adidas (M) Sdn Bhd

- Padini Holdings Bhd

- Uniqlo (M) Sdn Bhd

- Lifestyle Retail (M) Sdn Bhd

- H&M Retail Sdn Bhd

- Anakku Baby Products Sdn Bhd

- Skechers Malaysia Sdn Bhd

- Poney Garments Sdn Bhd

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Malaysia Childrenswear Market Policies, Regulations, and Standards

4. Malaysia Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Malaysia Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Malaysia Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Malaysia Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Malaysia Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Padini Holdings Bhd

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Uniqlo (M) Sdn Bhd

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Lifestyle Retail (M) Sdn Bhd

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.H&M Retail Sdn Bhd

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Anakku Baby Products Sdn Bhd

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Roadget Business Pte Ltd

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Nike Sales (M) Sdn Bhd

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.adidas (M) Sdn Bhd

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Skechers Malaysia Sdn Bhd

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Poney Garments Sdn Bhd

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.