Malaysia Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0538

- 120

-

Malaysia Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

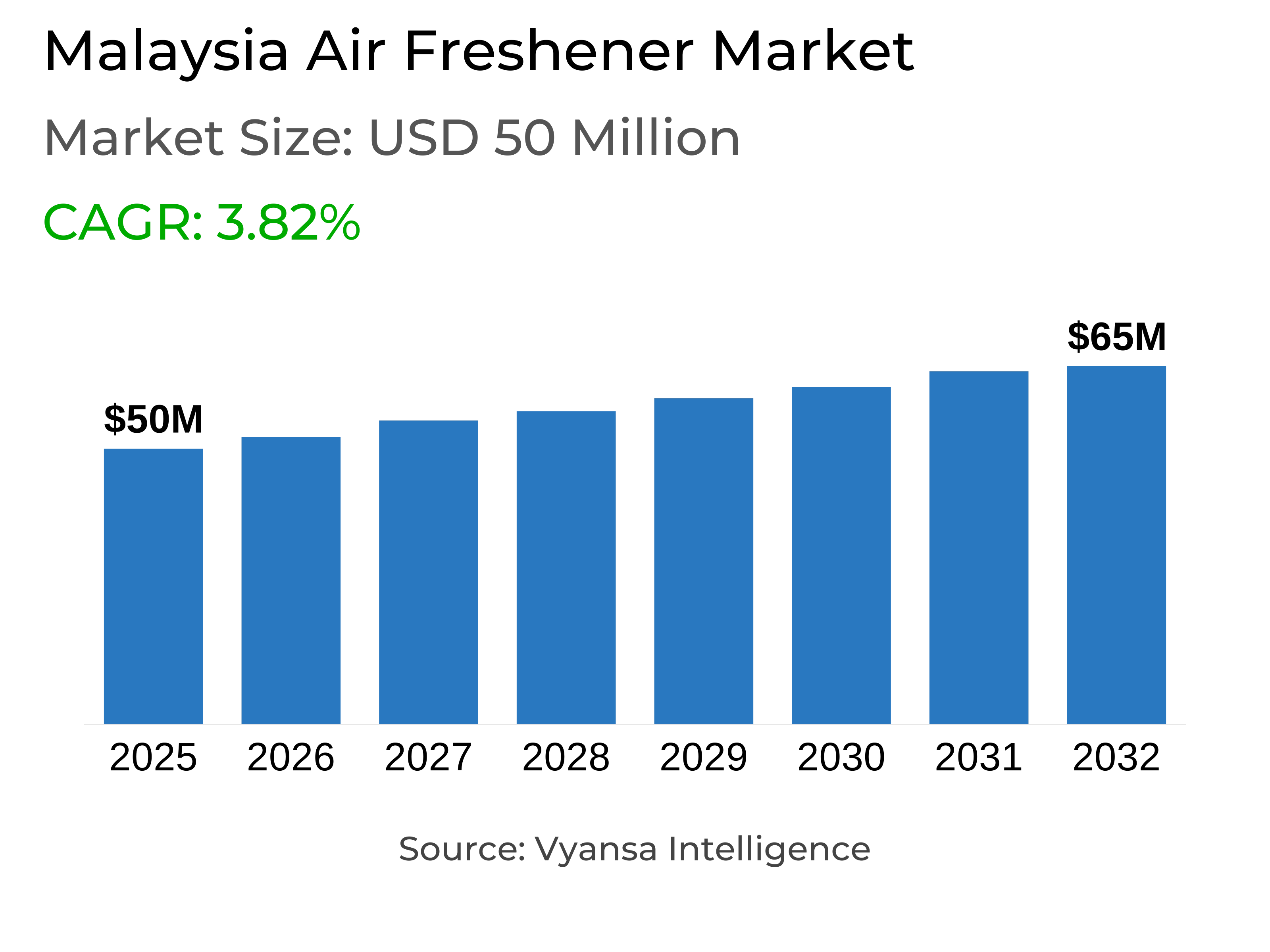

- Air Freshener Market in Malaysia is estimated at $ 50 Million.

- The market size is expected to grow to $ 65 Million by 2032.

- Market to register a CAGR of around 3.82% during 2026-32.

- Product Type Shares

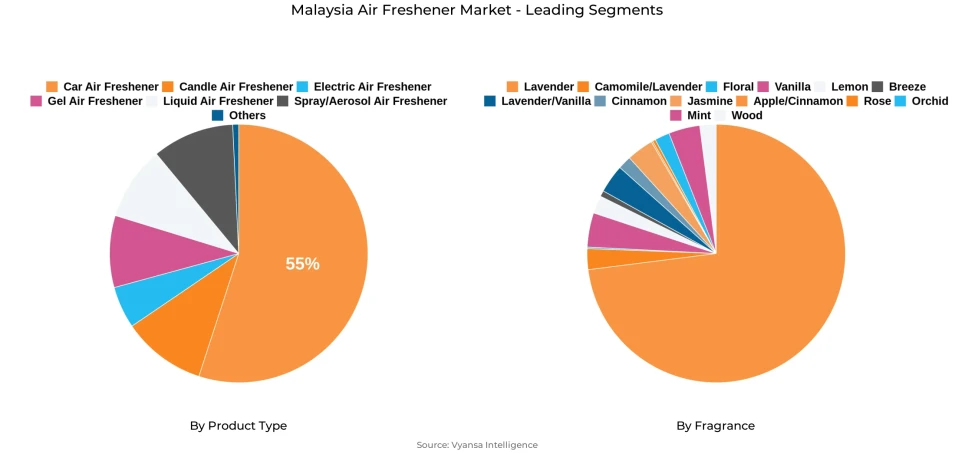

- Car Air Freshener grabbed market share of 55%.

- Competition

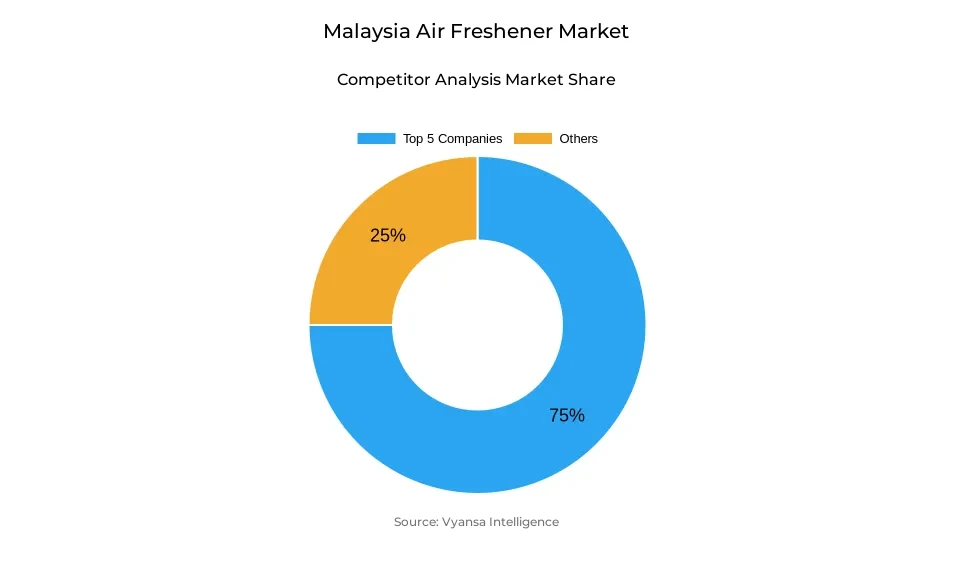

- More than 5 companies are actively engaged in producing Air Freshener Market in Malaysia.

- Top 5 companies acquired around 75% of the market share.

- Reckitt Benckiser (M) Sdn Bhd, Kobayashi Healthcare (M) Sdn Bhd, Farcent (M) Sdn Bhd, Procter & Gamble (M) Sdn Bhd, SC Johnson & Son (M) Sdn Bhd etc., are few of the top companies.

- Fragrance

- Lavender continues to dominate the market.

Malaysia Air Freshener Market Outlook

The Malaysia air freshener market is anticipated to expand steadily from $50 million in 2025 to $65 million in 2032. The market is very competitive, with over five companies actively producing, while the leading five players account for approximately 75% of the market. Car air fresheners are expected to be the largest segment by value with a volume CAGR of around 4.83%, led by strong car ownership and demand for air vent clips and gel products providing long-lasting fragrance for day-to-day driving.

Plant and natural air care items are becoming popular because end users are increasingly focused on holistic living as well as environmental sustainability. Players with eco-friendly and chemical-free products, like Esona, Gramp's Asia, and Eucapro, should gain from this trend. Essential oil diffusers, especially smart and adaptable ones, should pick up popularity with tech-conscious and health-focused end users. Lavender continues to lead the fragrance category, which is in line with domestic inclination toward calming and relaxing fragrances.

Aromatic candles and reed diffusers are poised to maintain solid growth, appealing to end users who appreciate both form and scent. Both are used as double-purpose decorative products, adding to home ambiance and following contemporary interior design. Candle warmers and extended-life diffusers are convenient and cozy, generating a warm and welcoming atmosphere and otherwise appealing to young, high-income households.

E-commerce will continue to grow as a central distribution channel, giving end users increased access to more brands and products, including niche and craft options. Physical stores will continue to play a significant role in spontaneous purchases, but online channels offer convenience and competitive price points. Overall, the market will be driven by increasing interest in multifunctional, natural, and premium air care solutions that support wellbeing and home comfort.

Malaysia Air Freshener Market Growth Driver

Growing Demand for Natural and Plant-Based Air Care

Greater preference for natural and plant-derived air fresheners is influencing product offerings and innovation. End users increasingly prefer air care products that contain no harsh chemicals, particularly young adults and parents with children or those who have sensitive skin. With such awareness, they opt for better-quality, environmentally friendly products to maintain safety and well-being within the home.

Electric air fresheners are especially sought after because they are convenient and continuously emit fragrance, contributing to sustained market growth. Apart from residential use, the tourism industry is also a source of demand, as holiday rental owners employ air care products in order to keep indoor spaces welcoming for their visitors. Natural and herbal products provided by companies like Esona and Gramp's Asia are on the rise, further contributing to the direction of market growth by aligning with green and health-oriented end users trends.

Malaysia Air Freshener Market Trend

Growing Demand for Multifunctional and Aesthetic Air Care Products

Rising demand for air care products that offer both fragrance and additional benefits, like insect control or aesthetic appeal, is shaping product development. Multifunctional air fresheners, fragrant candles, and reed diffusers are becoming more in demand as they improve indoor ambience as well as functionality. end users prefer products that are in line with contemporary home decor and lifestyle, providing lasting fragrance as well as decorative use.

This trend is compounded by increasing interest in wellness-focused and hotel-driven fragrances appealing to young, technologically savvy, and high-income end users. Diffusers using essential oils with intelligent features are catching on among end users in pursuit of bespoke aroma experiences. Brands that merge sensory delight with interior design or wellness value are seeing robust uptake, and the trend thus becomes a primary driver of product innovation and market growth.

Malaysia Air Freshener Market Opportunity

Premium and Smart Air Care Segments' Growth

There are ample opportunities in premium and technology-integrated air care products in the Malaysia Air Freshener Market. End users are now more open to spending on diffusers based on essential oils, scented candles, and reed diffusers that offer visual appeal, personalized fragrance, and wellness benefits. Wi-Fi-enabled smart diffusers with app-controlled functionality can target tech-oriented households, providing convenience and customized fragrance delivery.

High-end hotel-style fragrances and upscale plant-based products offer additional scope for differentiation aimed at high-end end users who desire living experiences that are holistic in nature. These segments can be used by brands to launch new product ranges, add to market share, and increase profitability. As greater online usage occurs, digital channels will become important in accessing younger, high-income, and health-conscious end users, augmenting the incumbent offline market and facilitating greater visibility for premium products.

Malaysia Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

The segment with highest market share under product type is Car Air Fresheners, which holds a market share of approximately 55%. The reason behind its dominance is fueled by Malaysia's large car population, where cars are the principal means of transport for majority households. Car air fresheners are a staple among regular commuters who spend long hours stuck in traffic, and as such, this product category is a steady player in the market. Air vent clips, being stylish and convenient to use, are particularly favored, while gel ones are liked for their lingering scent.

In the future, automobile air fresheners are expected to capture a volume CAGR of approximately 4.83%, driven by consistent demand from both direct end users and the hospitality industry, as holiday rental operators adopt them increasingly to ensure clean interiors. The steady dependence indicates the segment has solid long-term growth opportunities in the forecasted period.

By Fragrance

- Camomile/Lavender

- Lavender

- Floral

- Vanilla

- Lemon

- Breeze

- Lavender/Vanilla

- Cinnamon

- Jasmine

- Apple/Cinnamon

- Rose

- Orchid

- Mint

- Wood

The segment with highest market share under sales channel is Retail Offline, which has almost 70% of the market share. Physical stores like supermarkets, hypermarkets, and specialist stores are still ruling the roost in the Malaysia sales scene. End users prefer going to these stores for their instant availability of goods, lack of delivery fees, and convenience in comparing several brands and scents under a single roof.

Even as e-commerce has expanded considerably with its greater convenience and product ranges, the Retail offline segment continues to have its advantage with impulse purchases and scope for smelling the product prior to purchase. Promotional exercises, in-store offers, and eye-catching shop presentations also consolidate the offline channel's dominance. Thus, retail offline will continue to be the dominant sales channel for air fresheners in the forecast period, maintaining its grip in spite of growing online usage.

Top Companies in Malaysia Air Freshener Market

The top companies operating in the market include Reckitt Benckiser (M) Sdn Bhd, Kobayashi Healthcare (M) Sdn Bhd, Farcent (M) Sdn Bhd, Procter & Gamble (M) Sdn Bhd, SC Johnson & Son (M) Sdn Bhd, etc., are the top players operating in the Malaysia Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Malaysia Air Freshener Market Policies, Regulations, and Standards

4. Malaysia Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Malaysia Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Malaysia Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Malaysia Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Malaysia Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Malaysia Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Malaysia Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Malaysia Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Procter & Gamble (M) Sdn Bhd

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. SC Johnson & Son (M) Sdn Bhd

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. Reckitt Benckiser (M) Sdn Bhd

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Kobayashi Healthcare (M) Sdn Bhd

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Farcent (M) Sdn Bhd

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Shaldan Malaysia

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Amway (M) Sdn Bhd

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.