Japan Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

Category (Costume Jewellery, Fine Jewellery), Type (Earrings, Neckwear, Rings, Wristwear, Other), Collection (Diamond, Non-Diamond), Material Type (Gold, Platinum, Metal Combination, Silver), Sales Channel (Retail Offline, Retail Online), End User (Men, Women)

- FMCG

- Dec 2025

- VI0659

- 130

-

Japan Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

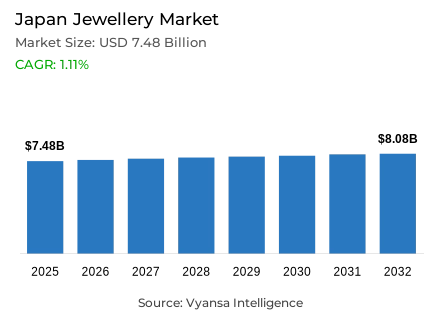

- Jewellery in Japan is estimated at USD 7.48 billion.

- The market size is expected to grow to USD 8.08 billion by 2032.

- Market to register a cagr of around 1.11% during 2026-32.

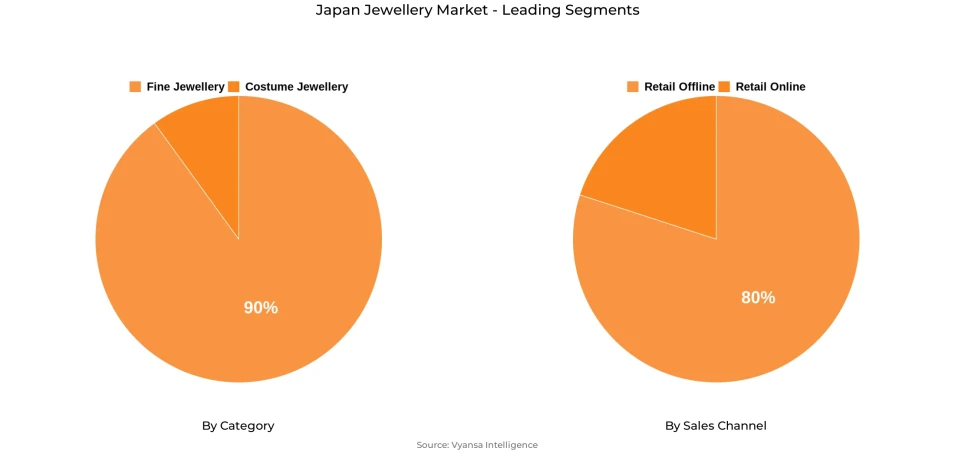

- Category Shares

- Fine jewellery grabbed market share of 90%.

- Competition

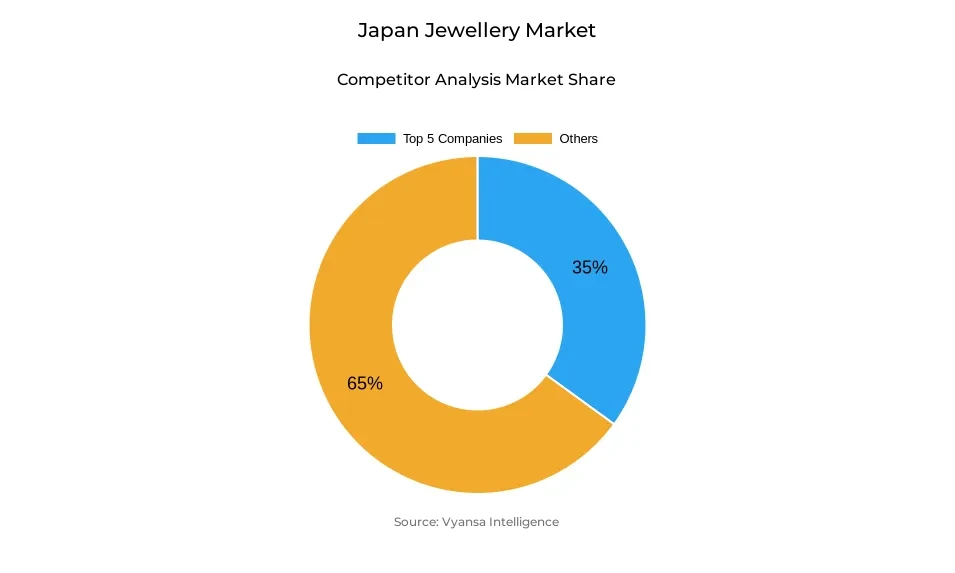

- More than 20 companies are actively engaged in producing jewellery in Japan.

- Top 5 companies acquired around 35% of the market share.

- K Mikimoto & Co Ltd; Fdc Products Inc; Chanel KK; Richemont Japan Ltd; Tiffany & Co Japan Inc etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

Japan Jewellery Market Outlook

The Japan jewellery market is valued at around USD 7.48 billion in 2025, the market is projected to reach around USD 8.08 billion by 2032, exhibiting a CAGR of around 1.11% during 2026-2032. This steady pace indicates that end users are balancing traditional purchasing habits with modern preferences. The market is mature however, continued interest from both domestic buyers and foreigners keeps demand running high, particularly in urban centers, where jewellery remains very relevant to culture and social life.

The competitive landscape includes more than 20 companies producing jewellery, with the top five holding around 35% of the total share. Large, established players lead with trusted names and premium collections, while smaller designers focus on creativity, craftsmanship, and personal service. It is this blend that keeps the industry dynamic, encouraging innovation and helping brands attract different types of end users.

Fine jewellery holds a share of around 90% in the product category, supported by its strong cultural and emotional equity. In remains in demand due to its workmanship, durability, and association with sentimental occasions. High end collections that celebrate milestones and express personal identity keep this category at the core of the market.

Retail offline stores account for around 80% of total sales in the sales channel segment, showing that in-person shopping remains the most trusted choice among end users. Physical outlets allow end users to see, touch, and compare pieces directly, building trust in high value purchases. Department stores and branded boutiques reinforce this with exhibitions and personal service, thus helping to assure loyalty and long term involvement within the jewellery market.

Japan Jewellery Market Growth DriverDepartment Stores Bringing Back Jewellery Growth

Jewellery sales are improving as large retail stores are becoming important destination for international and local purchasers. According to the Economic Census for Business Activity (2023), department stores remain key retail centres with total retail sales over USD 12 billion. These stores provide a platform for new jewellery brands to showcase their work to the end users and build trust. Their central location and strong reputation helps bring exposure and consistent traffic to smaller brands.

Tourism is also contributing to this recovery. As reported by the Japan National Tourism Organization, around 30 million international visitors arrived in the nation in 2023, supporting the growth of luxury retail, including jewellery. Pearl sales, live showcases, and exhibitions are helping Japanese craftsmanship to buyers from around the world, bringing renewed energy and visibility to the industry.

Japan Jewellery Market ChallengeFewer Marriages Causing Lower Bridal Jewellery Sales

Today, more end users are postponing marriage or choosing not to get married at all, which is affecting the demand for bridal jewellery. According to the Vital Statistics of Japan, over 525,000 marriages were officiated in 2022 and the marriage rate fell below 4.2 per 1,000 population, indicating a continuous decline. With fewer couples choosing to marry, this is leading to a declining need for engagement rings and bridal sets influenced by the changing lifestyle, living costs, and lower births rate.

Furthermore, research from the National Institute of Population and Social Security Research shows that interest in marriage is weakening further among younger end users. Although the government has introduced support measures such as matchmaking activity and childcare assistance, the overall impact remains limited. As a result, bridal jewellery sales are still struggling with no clear sign of recovery.

Japan Jewellery Market TrendMales Showing More Interest in Jewellery

Male end users are increasingly buying jewellery as a way to express their personality and fashion preferences. While there are no official statistics that measure men’s jewellery sales separately, more male end users attended the International Jewellery Show Yokohama 2023, held n support of the Japan Jewellery Association, indicates growing interest in both purchasing and designing jewellery. In response, brands are introducing jewellery collections for male end users, while some shops are hosting exhibitions of jewellery on mannequins with high end fashion, so male end users feel more comfortable wearing accessories in everyday or formal settings.

Additionally, the leading fashion and luxury houses have introduced full jewellery collections for their male end users, combining classic and modern design aesthetics. This development is supported by lifestyle pattern surveys from the Ministry of Economy, Trade and Industry, which indicates growing awareness of male grooming and personal style. As the male end user group views jewellery as part of everyday identity, the demand for jewellery is expected to remain solid

Japan Jewellery Market OpportunitySmart Rings Joining Jewellery and Technology

New forms of jewellery that embed technology are beginning to attract the interest of end users. For instance, smart rings can monitor fitness or sleep and some model even enable contactless payments while remaining fashionable. This development is supported by Japan's governmental innovative policies in digital devices and wearables through organizations like the Japan External Trade Organization (JETRO). These accessories show how technology and fashion can come together in useful and stylish ways, thus appealing today's end user in search of functionality without giving up on style.

Additionally, jewellers are creating decorative accessories that compliment smart rings so that they appear more fashionable. Government initiatives under the Digital Agency also indicate support for the expansion of wearable payment technology. With increased usage of smart devices, this kind of jewellery is likely to be one of the fastest growing areas. It's also a new segment for a jeweller to combine creativity with innovation in such a simple and practical way.

Japan Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

The segment with the highest share under category is fine Jewellery, which holds around 90% of the total market. This strong position is supported by the deep cultural association of fine jewellery and traditional gifting, weddings, and luxury occasions. The Craftsmanship, precious metals, and gemstones that signify quality and lasting value remain attractive to end users. High end pieces are often purchased to mark personal milestones, hence making fine jewellery the preferred choice over other types.

Furthermore, fine jewellery has benefited from strong demand across both local and tourist driven sales. Department stores, boutiques, and brand outlets continue to carry exclusive designs targeting domestic and international end users. Premium collections still remain symbols of elegance and reflect the social status of people; thus, fine jewellery is expected to retain its clear dominance during the forecast period as well.

By Sales Channel

- Retail Offline

- Retail Online

The segment holds the highest share under the sales channel category, is retail offline accounting for around 80% of the total market share. This dominance comes from the strong presence of physical stores, which remain the primary point of contact for end users when purchasing jewellery. Many end users visit stores to personally see and try products before buying. This makes offline channels more reliable for high value items such as fine jewellery, as end user can trust the sales staff and assess quality directly.

Moreover, department stores and brand boutiques create engaging experience through exhibitions, events, and exclusive showcases that attract both local and international end users. These activities help strengthen brand image and encourage loyalty. Therefore, retail offline channels are expected to continue leading in the sale of jewellery in years to come.

List of Companies Covered in Japan Jewellery Market

The companies listed below are highly influential in the Japan jewellery market, with a significant market share and a strong impact on industry developments.

- K Mikimoto & Co Ltd

- Fdc Products Inc

- Chanel KK

- Richemont Japan Ltd

- Tiffany & Co Japan Inc

- Bulgari Japan Ltd

- Kuwayama Corp

- As-me Estelle Co Ltd

- Kering Japan Ltd

- LVMH Watch & Jewelry KK

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Japan Jewellery Market Policies, Regulations, and Standards

4. Japan Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Japan Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Japan Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Japan Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Richemont Japan Ltd

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Tiffany & Co Japan Inc

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Bulgari Japan Ltd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Kuwayama Corp

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.As-me Estelle Co Ltd

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.K Mikimoto & Co Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Fdc Products Inc

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Chanel KK

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Kering Japan Ltd

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. LVMH Watch & Jewelry KK

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.