Japan Bags and Luggage Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Bags (Cross Body Bags, Bags and Backpacks, Business Bags, Duffle Bags, Clutches, Others), Luggage (Soft Luggage, Hard Luggage, Wheeled Luggage, Non-Wheeled Luggage)), By Sales Channel (Retail Offline, Retail Online), By Material Type (Soft Case (Nylon, Polyester, Ballistic Nylon), Hard Case (Polycarbonate, ABS (Acrylonitrile Butadiene Styrene), Polypropylene)), By Price Category (Luxury, Mass/Economy, Premium), By Application (Travel, Business)

|

Major Players

|

Japan Bags and Luggage Market Statistics and Insights, 2026

- Market Size Statistics

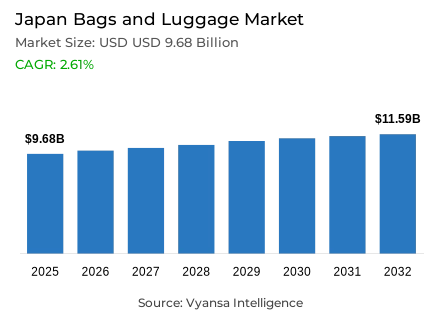

- Bags and luggage in Japan is estimated at USD 9.68 billion in 2025.

- The market size is expected to grow to USD 11.59 billion by 2032.

- Market to register a cagr of around 2.61% during 2026-32.

- Category Shares

- Bags grabbed market share of 85%.

- Competition

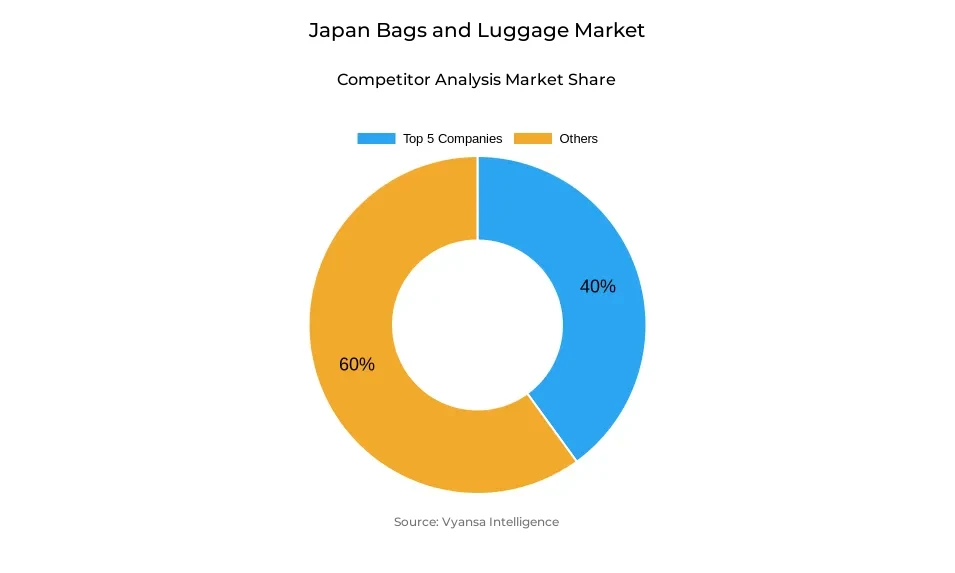

- More than 20 companies are actively engaged in producing bags and luggage in Japan.

- Top 5 companies acquired around 40% of the market share.

- Samsonite Japan Co Ltd; LVMH Fashion Group Japan KK; Chanel KK; Louis Vuitton Japan KK; Hermès Japon Co Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

Japan Bags and Luggage Market Outlook

The Japan bags and luggage market is projected to grow to USD 9.68 billion in 2025 and to USD 11.59 billion in 2032, with a compound annual growth rate of about 2.61% in the period 2026–2032. The forecast period will be backed by a mix of strong inbound tourism and continued spending by high-end domestic end users, which will make Japan one of the more resilient markets in the region.

The inbound demand will continue to be a significant growth pillar, especially luggage. International tourists are more likely to buy big suitcases to carry their souvenirs and hence increase the sales of the high capacity models. The proportion of tax-free purchases in tourist-intensive destinations is significant, which highlights the significance of foreign tourists. Meanwhile, the luxury consumption is the primary driver of domestic demand of bags, and high-income end users consider premium bags as investment or resale assets. Mini bags remain popular among younger customers as they provide an affordable point of entry into the luxury brands.

In addition to travel and luxury, the demand patterns are being influenced by increased awareness of disasters. The occurrence of frequent earthquakes and typhoons has heightened the end-user attention to emergency preparedness, which has led to a consistent interest in disaster bags that are meant to hold essential supplies. Compact and lifestyle-integrated designs are also innovations in this space that will be able to support baseline demand during the forecast period.

In the future, the development of school bags and the development of the second-hand market will also contribute to growth. School bag sales are still maintained by demographic decline, increased unit prices and gifting culture. In the meantime, official resale programmes and robust second-hand ecosystem attract both domestic and inbound customers, which strengthens the long-term development of the bags and luggage market in Japan.

Japan Bags and Luggage Market Growth DriverSurge in Inbound Tourism Driving Luggage and Travel Accessory Demand

The inbound tourism in Japan is growing in an unprecedented rate thus generating a strong demand of luggage and travel related bags. The country is expected to receive about 36.9 million international visitors in 2024, which is about 16% higher than the 2019 record of 31.9 million. This trend is reflected in all the key source markets, with East Asia leading in visitor flows. The key source markets are South Korea, 8.8 million visitors, an increase of 26.7% per year China, 7.0 million visitors, an increase of 187.9% per year and Taiwan, 6.0 million visitors, an increase of 43.8% per year.

Inbound tourism expenditure was at an all-time high of about JPY 8.1 trillion, which is equivalent to USD 53.3 billion in 2024, with per-capita expenditure standing at JPY 227,000, which is equivalent to USD 1,493. This is a tourism-related spending that is currently the second-largest export of Japan after automobile exports. The use of large suitcases over 90 litres is especially popular with inbound tourists who buy souvenirs, and tax-free sales make up about 40% of all luggage sales at flagship retail stores, which shows that international travellers continue to demand high-quality travel accessories.

Japan Bags and Luggage Market ChallengeRising Disaster Preparedness Anxiety Spurring Emergency Bag Demand

Japan is at a high risk of natural disasters, especially earthquakes, which makes disaster-preparedness bags a necessity among end-users as a household item. The Earthquake Research Committee of the government re-estimated the 30-year probability of a Ninkai Trough megathrust earthquake, estimating it to be about 60–90% or more or 20–50% by other calculation methods, thus becoming a permanent worry of the Japanese people. In March 2025, the government estimated worst-case scenario effects of about 298,000 fatalities and economic losses of more than USD 2 trillion, or about JPY 292 trillion, due to a possible Nankai Trough megathrust earthquake.

After major seismic events, including the magnitude 7.1 earthquake in Miyazaki Prefecture in August 2024, end-user panic rises, and retailers report a spike in the sale of disaster bags. These bags are usually filled with basic survival supplies, such as water, emergency food, portable toilets, flashlights, first-aid supplies, and cold-weather equipment. Many retailers and manufacturers such as home centre chains, Iris Ohyama, and Muji have reacted to increased disaster awareness by adding disaster bag product lines and stock. The revised Basic Plan on Disaster Risk Reduction released by the Japanese government in July 2025 highlights the necessity of expedited emergency-preparedness efforts, which supports end-user demand on accessible and reliable disaster-preparedness solutions.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Japan Bags and Luggage Market TrendSmart and Assistive Luggage Redefining Product Function and Accessibility

The trends that can be identified is the shift in the purely functional luggage to smart and supportive mobility solutions, especially among vulnerable users. Japan is testing an AI suitcase a suitcase-like autonomous robot that will help visually impaired people safely reach their destinations through obstacle detection, route planning, and haptic feedback. The National Museum of Emerging Science and Innovation leads the project in collaboration with the Consortium of Advanced Assistive Mobility Platform, and industry partners include Omron Corporation, Alps Alpine Co. Ltd., Shimizu Corporation, and IBM Japan Ltd. these partners combine sensors, image recognition, and dialogue AI into luggage form factors.

Since April 2024, demonstration trials have been conducted in large shopping malls, New Chitose Airport, and Miraikan, and daily trial operations are being conducted to enhance navigation technology in congested settings and obstacle avoidance. The AI suitcase will be chosen as a demonstration in the Smart Mobility Expo in the Expo 2025 Osaka Kansai where several units will be used both indoors and outdoors between April and October 2025 to test the working model of social implementation and detect technical problems. The reservation system has already opened and has a capacity of one to four people per AI suitcase in Japanese, English and Chinese. This change is an indicator of a larger trend where luggage is no longer a passive container but an active mobility aid and accessibility solution, thus creating new product categories that integrate travel, assistive technology, and robotics innovation, and potentially transforming the expectations of premium luggage during the forecast period.

Japan Bags and Luggage Market OpportunityExpansion of Second-Hand and Resale Markets Creating Accessibility to Luxury Brands

The second-hand and official brand resale market is growing at a rapid rate, thus providing new end-user access to high-quality and luxury bags and contributing to sustainability objectives within the framework of the UN Sustainable Development Goals. Major luxury brands and manufacturers are creating official resale programmes. Since 2021, Tsuchiya Kaban, a well-known manufacturer of leather-products, has gathered around 1,600 used bags, reselling more than 700 of them after professional repairs and cleaning at a price 20–50% lower than new products, with sales growing every year. These resale programs give end users confidence in the quality of the product, durability assurances and after sales services such as repair services and manufacturers can cut down on environmental impact and wastage.

The major second-hand retailers focus on domestic and inbound end users by expanding and localising. In November 2023, Komehyo, a major second-hand retailer, launched a new outlet in Shibuya, with Instagrammable retail experiences and multilingual service in English and Chinese, with an estimated equal ratio of Japanese and international shoppers. Likewise, Second Street opened a store with a luxury-brand-oriented store in Shibuya in September 2024, aimed at younger end users and inbound tourists who want to buy the famous high-quality pre-owned products in Japan. The potential of this two-market opportunity, which is the domestic sustainability consciousness and cost-saving imperative coupled with the international tourists preference of Japan as a source of quality second-hand goods, offers growing revenue prospects to both the established luxury brands and specialised resale retailers over the forecast period.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Japan Bags and Luggage Market Segmentation Analysis

By Category

- Bags

- Cross Body Bags

- Bags and Backpacks

- Business Bags

- Duffle Bags

- Clutches

- Others

- Luggage

- Soft Luggage

- Hard Luggage

- Wheeled Luggage

- Non-Wheeled Luggage

The category classification is dominated by bags, which take up about 85% of the market. This dominance indicates the high position of handbags, backpacks, and school bags in the daily life of Japanese people, both at work, school, and during leisure activities. The luxury bags are a significant player in this segment, which is backed by the high-end domestic end users and the inbound tourists who are after high quality and investment grade products.

Cultural and lifestyle factors, such as gifting culture and increasing acceptance of second-hand luxury goods, also favor bags. School bags, especially randoseru, still have a commanding presence even with a shrinking child population, with the average prices and family gifting habits increasing the value. Bags will continue to dominate the market in the forecast period, which will be backed by innovation, premiumisation, and continued demand in both new and reused products.

By Sales Channel

- Retail Offline

- Retail Online

The largest segment of the sales channel category is the retail offline channels, which occupies about 80% of the market. In Japan, bags and luggage are still sold in physical stores, especially high-end, luxury, and functional products where the final consumer appreciates quality checks, authenticity, and personalised service.

Luxury boutiques, department stores, specialist luggage retailers, and second-hand stores are especially significant in offline channels, which appeal to both domestic and international shoppers and tourists. Offline sales are also enhanced by tax-free shopping and in-store services in multiple languages. Although online retail channels exist, face-to-face shopping is likely to remain popular during the forecast period, and retail offline will be able to maintain its leading role until 2032.

List of Companies Covered in Japan Bags and Luggage Market

The companies listed below are highly influential in the Japan bags and luggage market, with a significant market share and a strong impact on industry developments.

- Samsonite Japan Co Ltd

- LVMH Fashion Group Japan KK

- Chanel KK

- Louis Vuitton Japan KK

- Hermès Japon Co Ltd

- Prada Japan Co Ltd

- Kering Japan Ltd

- Coach Japan LLC

- Christian Dior KK

- Bottega Veneta Japan Ltd

Competitive Landscape

Japan bags and luggage market is shaped by a strong luxury segment, robust inbound tourism demand, and a rapidly expanding second-hand ecosystem. Luxury brands, led by Hermès Japon Co Ltd, perform strongly due to high resale values and investment appeal, with iconic products such as the Birkin reinforcing exclusivity and demand among affluent domestic consumers and inbound tourists. At the same time, second-hand specialists like Komehyo and Second Street are gaining prominence, leveraging Japan’s reputation for high-quality pre-owned goods and low counterfeit risk. Beyond luxury, functional and purpose-driven products are emerging, including disaster preparedness bags and innovative concepts such as AI-assisted luggage, adding new competitive dimensions to a market increasingly driven by quality, functionality, and long-term value.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Japan Bags and Luggage Market Policies, Regulations, and Standards

4. Japan Bags and Luggage Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Japan Bags and Luggage Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Cross Body Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Bags and Backpacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Business Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Duffle Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. Clutches- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Soft Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Hard Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Non-Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Material Type

5.2.3.1. Soft Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. Polyester- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.3. Ballistic Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Hard Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1. Polycarbonate- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2. ABS (Acrylonitrile Butadiene Styrene)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.3. Polypropylene- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Price Category

5.2.4.1. Luxury- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Mass/Economy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Application

5.2.5.1. Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Business- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Japan Bags Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

7. Japan Luggage Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Louis Vuitton Japan KK

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Hermès Japon Co Ltd

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Prada Japan Co Ltd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Kering Japan Ltd

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Coach Japan LLC

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Samsonite Japan Co Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.LVMH Fashion Group Japan KK

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Chanel KK

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Christian Dior KK

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Bottega Veneta Japan Ltd

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Sales Channel |

|

| By Material Type |

|

| By Price Category |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.