Japan Air Freshener Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Candle Air Freshener, Car Air Freshener, Electric Air Freshener, Gel Air Freshener, Liquid Air Freshener, Spray/Aerosol Air Freshener, Others), By Fragrance (Camomile/Lavender, Lavender, Floral, Vanilla, Lemon, Breeze, Lavender/Vanilla, Cinnamon, Jasmine, Apple/Cinnamon, Rose, Orchid, Mint, Wood), By End User (Consumer, Institutional), By Sales Channel (Retail Online, Retail Offline)

- FMCG

- Dec 2025

- VI0537

- 120

-

Japan Air Freshener Market Statistics and Insights, 2026

- Market Size Statistics

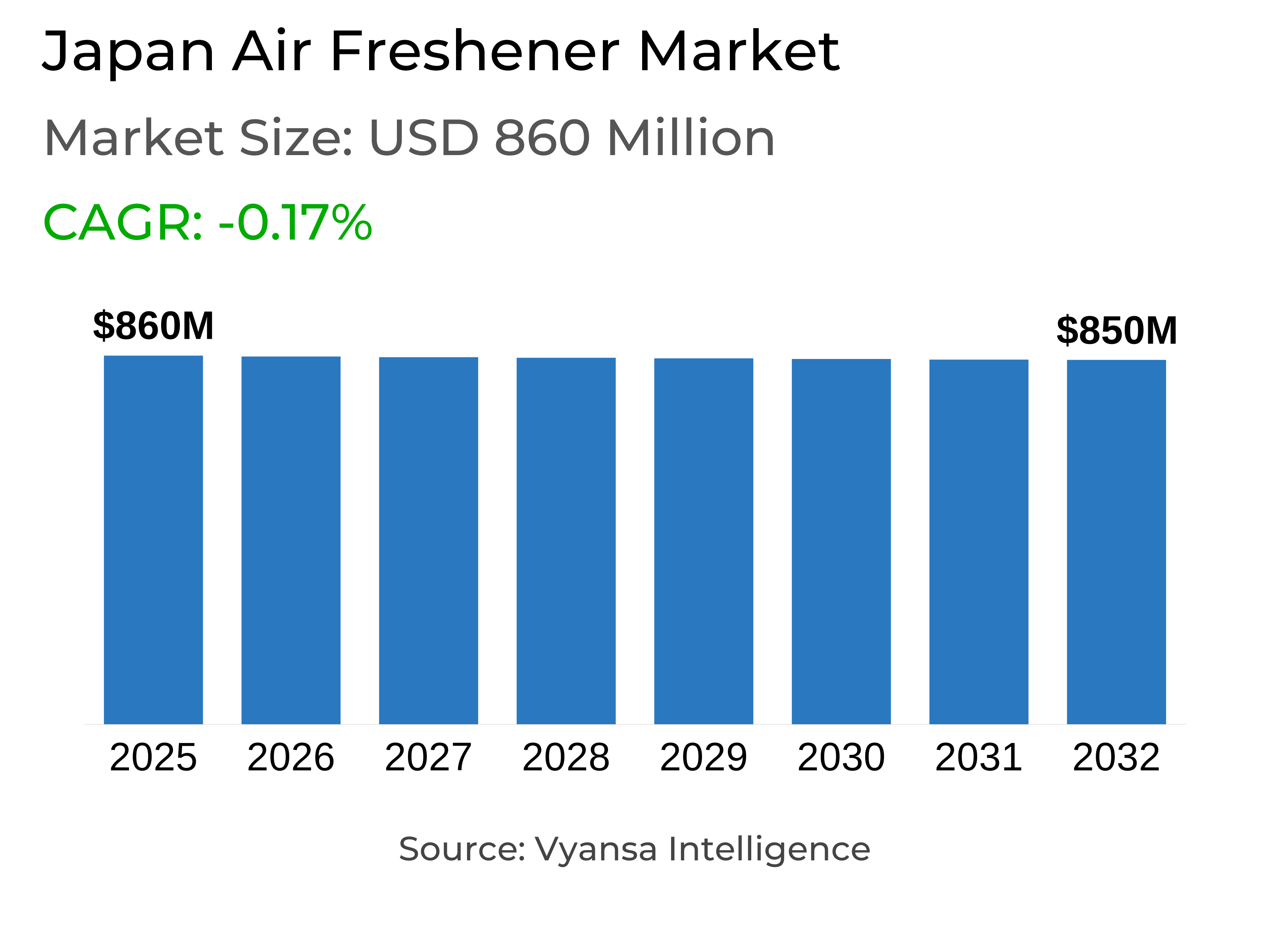

- Air Freshener Market in Japan is estimated at $ 860 Million.

- The market size is expected to grow to $ 850 Million by 2032.

- Market to register a CAGR of around -0.17% during 2026-32.

- Product Type Shares

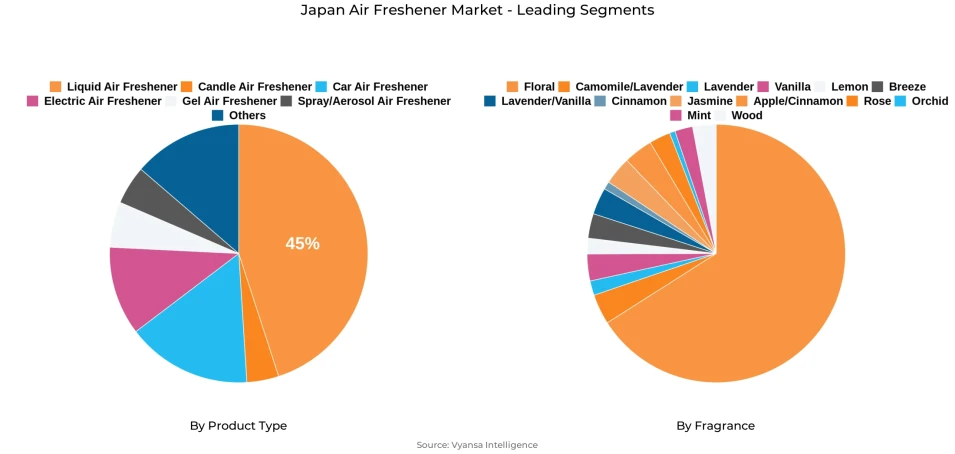

- Liquid Air Freshener grabbed market share of 45%.

- Competition

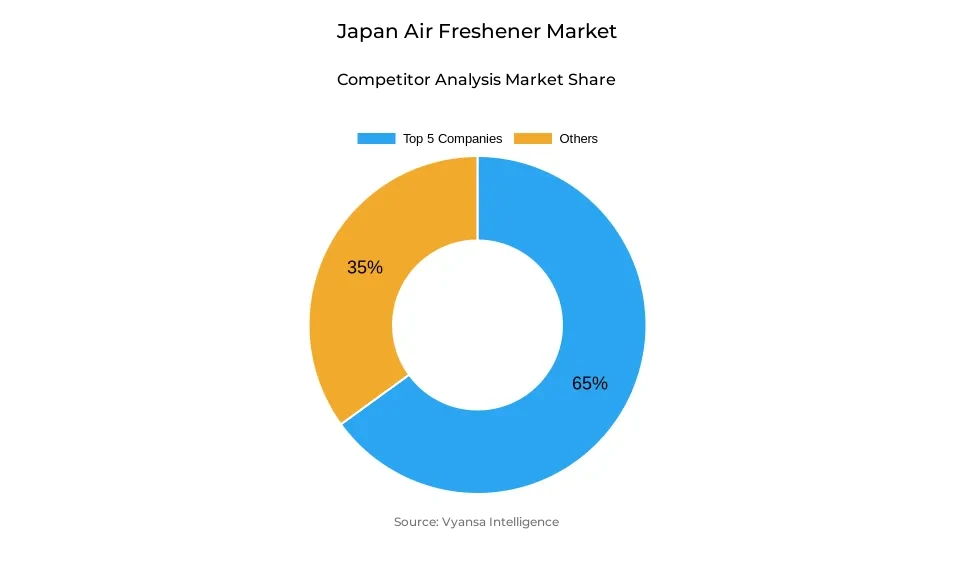

- More than 5 companies are actively engaged in producing Air Freshener Market in Japan.

- Top 5 companies acquired around 65% of the market share.

- Harukado Co Ltd, Dia Chemical Co Ltd, Taiko Pharmaceutical Co Ltd, Kobayashi Pharmaceutical Co Ltd, P&G Japan GK etc., are few of the top companies.

- Fragrance

- Floral continues to dominate the market.

Japan Air Freshener Market Outlook

The Japan air freshener market will continue to record stable retail volume sales during 2026–32, with retail current value growth following a slow but steady pattern. The market is marked by stiff competition, with over five entities involved in manufacturing actively and the top five companies with around 65% of the market share. Liquid air fresheners are anticipated to continue being the driving force of value growth as end users continue to move from gel air fresheners due to their constant fragrance delivery and emphasis on home wellness. Spray/aerosol air fresheners are also anticipated to maintain modest growth, appealing to end users who desire quick odour elimination at affordable prices.

Floral fragrances remain the market leader, a testament to Japan end users affinity for relaxing and soothing scents that promote relaxation and wellbeing at home. Value shifts after the pandemic have nudged end users to engage more positively with fragrances, shifting from purely deodorising products to those that provide pleasant and indulgent scent experiences. This has opened the door for brands to innovate and stand out by offering distinctive, long-lasting, and wellness-focused fragrances.

Personalization is one of the trends governing the market, with businesses creating products for particular situations, e.g., toilets, cars, and homes. Adjustable and refillable products, e.g., Febreze Easy Clip and Toilet Deodorisers, are becoming increasingly popular as they provide convenience, green-friendliness, and a personalized fragrance experience. Collaborations with lifestyle and character brands, e.g., ST Corp with Sanrio characters, are assisting businesses in reaching younger end users and fashion-conscious purchasers.

In the future, differentiation on the basis of fragrance innovation, premium fragrances, and customized solutions will continue to be essential. Brands that have long-lasting fragrance, wellness benefits, and sustainability features are likely to continue to hold a competitive advantage, while partnerships with beauty and fragrant products categories would result in a more integrated product ecosystem, further enhancing positioning within the market during the forecast period.

Japan Air Freshener Market Growth Driver

Emerging Health and Wellness Awareness

Increasing end users focus on health, wellness, and creating a calming home environment is shaping demand across the air freshener category.. Liquid air fresheners are most preferred because they offer constant fragrance, which appeals to end users' need to improve personal well-being. The shift from gel air fresheners to liquid alternatives is aided by increasing demand for green and natural products such as essential oils, which are seen as healthier and safer options compared to artificial scents.

Additionally, increasing significance of emotional comfort and stress relief is impacting buying behavior. End users actively look for air care solutions that offer relaxation and emotional well-being, directly affecting market expansion. Organizations offering fragrance-centric solutions, blending hygiene with wellness advantage, are consequently better placed to benefit from the increasing demand.

Japan Air Freshener Market Trend

Growing Focus on Fragrance Personalisation and Lifestyle-Oriented Air Care Solutions

Rising emphasis on unique fragrances and personalised air care solutions is influencing product innovation in the category. End users increasingly consider air care products not just odour eliminator, but also lifestyle enhancement products that improve individual comfort. This has resulted in the creation of products for specific situations, including vehicle car air fresheners with variable strength of scent and reusable toilet deodorisers with longer-lasting effectiveness.

Moreover, partnerships with niche brands, iconic characters, and high-end fragrance lines symbolize an overall move towards luxury, niche, and bespoke experiences. end users are crafting products that speak to personal lifestyles, especially among younger and dual-income families, situating air care as a natural part of daily routines and personal relaxation rituals.

Japan Air Freshener Market Opportunity

Expansion Through Premium and Scenario-Based Products

Growing emphasis on premium products and tailored solutions for specific settings is supporting market expansion. Brands can differentiate by providing products infused with natural essential oils, lasting fragrances, and plant-based fragrance blends. By addressing specific use cases – e.g., car, toilet, or home environments brands can deliver extremely personalised experiences that match individual needs and wants.

Also, the increasing popularity of upscale fragrances and lifestyle-oriented products makes it possible for firms to partner with luxury or niche players, riding established bases to extend market presence. Strategic product development in refillable, sustainable products also offers opportunities to target environmentally friendly end users, which helps further fortify brand loyalty and growth potential.

Japan Air Freshener Market Segmentation Analysis

By Product Type

- Candle Air Freshener

- Car Air Freshener

- Electric Air Freshener

- Gel Air Freshener

- Liquid Air Freshener

- Spray/Aerosol Air Freshener

- Others

The segment with highest market share under product type category is Liquid Air Fresheners, accounting for approximately 45% of market share. Japan end users favor liquid air fresheners because they can leave a fragrance all day, hence making homes more relaxing. Their demand is directly related to the broad health and wellness trend, and end users are looking more for products that promote personal health and well-being and also relax the home environment.

Liquid air fresheners are also powering value growth in the market as end users abandon other formats like gel air fresheners. The segment is boosted by innovations that feature natural ingredients and essential oils, demonstrating changing end users attitudes towards safer, environmentally friendly, and premium fragrance experiences. Ongoing product innovation by top players, such as new fragrances and car versions, further underpins the segment's firm market position.

By Fragrance

- Camomile/Lavender

- Lavender

- Floral

- Vanilla

- Lemon

- Breeze

- Lavender/Vanilla

- Cinnamon

- Jasmine

- Apple/Cinnamon

- Rose

- Orchid

- Mint

- Wood

The segment with highest market share under sales channels is Retail Offline, which still holds the largest share with nearly 65%. The Japan tend to buy air care products from drugstores, supermarkets, and convenience stores because they are readily accessible, they carry a variety of product types, and they can try new fragrances and formats at the store.

Retail Offline channels also facilitate impulse buys and enable end users to test fragrances before purchase. Although e-commerce keeps growing, Retail offline continues to be the most important channel for accessing most Japan end users, especially for liquid air fresheners and high-end fragrance products. The robust offline presence ensures that brands can stay seen, highlight new innovations, and serve various end users needs in various locations.

Top Companies in Japan Air Freshener Market

The top companies operating in the market include Harukado Co Ltd, Dia Chemical Co Ltd, Taiko Pharmaceutical Co Ltd, Kobayashi Pharmaceutical Co Ltd, P&G Japan GK, ST Corp, Johnson Co Ltd, Car Mate Mfg Co Ltd, etc., are the top players operating in the Japan Air Freshener Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Japan Air Freshener Market Policies, Regulations, and Standards

4. Japan Air Freshener Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Japan Air Freshener Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1. By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1. By Product Type

5.2.1.1. Candle Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Car Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Electric Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Gel Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Liquid Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.6. Spray/Aerosol Air Freshener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.7. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2. By Fragrance

5.2.2.1. Camomile/Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Lavender- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Floral- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Lemon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Breeze- Market Insights and Forecast 2022-2032, USD Million

5.2.2.7. Lavender/Vanilla- Market Insights and Forecast 2022-2032, USD Million

5.2.2.8. Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.9. Jasmine- Market Insights and Forecast 2022-2032, USD Million

5.2.2.10. Apple/Cinnamon- Market Insights and Forecast 2022-2032, USD Million

5.2.2.11. Rose- Market Insights and Forecast 2022-2032, USD Million

5.2.2.12. Orchid- Market Insights and Forecast 2022-2032, USD Million

5.2.2.13. Mint- Market Insights and Forecast 2022-2032, USD Million

5.2.2.14. Wood- Market Insights and Forecast 2022-2032, USD Million

5.2.3. By End User

5.2.3.1. Consumer- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Institutional- Market Insights and Forecast 2022-2032, USD Million

5.2.4. By Sales Channel

5.2.4.1. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5. By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Japan Candle Air Freshener Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1. By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

6.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

6.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Japan Car Air Freshener Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1. By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

7.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

7.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Japan Electric Air Freshener Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1. By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

8.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

8.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Japan Gel Air Freshener Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1. By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

9.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

9.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Japan Liquid Air Freshener Market Statistics, 2022-2032F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Japan Spray/Aerosol Air Freshener Market Statistics, 2022-2032F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By Fragrance- Market Insights and Forecast 2022-2032, USD Million

11.2.2. By End User- Market Insights and Forecast 2022-2032, USD Million

11.2.3. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

12. Competitive Outlook

12.1. Company Profiles

12.1.1. Kobayashi Pharmaceutical Co Ltd

12.1.1.1. Business Description

12.1.1.2. Product Portfolio

12.1.1.3. Collaborations & Alliances

12.1.1.4. Recent Developments

12.1.1.5. Financial Details

12.1.1.6. Others

12.1.2. P&G Japan GK

12.1.2.1. Business Description

12.1.2.2. Product Portfolio

12.1.2.3. Collaborations & Alliances

12.1.2.4. Recent Developments

12.1.2.5. Financial Details

12.1.2.6. Others

12.1.3. ST Corp

12.1.3.1. Business Description

12.1.3.2. Product Portfolio

12.1.3.3. Collaborations & Alliances

12.1.3.4. Recent Developments

12.1.3.5. Financial Details

12.1.3.6. Others

12.1.4. Johnson Co Ltd

12.1.4.1. Business Description

12.1.4.2. Product Portfolio

12.1.4.3. Collaborations & Alliances

12.1.4.4. Recent Developments

12.1.4.5. Financial Details

12.1.4.6. Others

12.1.5. Car Mate Mfg Co Ltd

12.1.5.1. Business Description

12.1.5.2. Product Portfolio

12.1.5.3. Collaborations & Alliances

12.1.5.4. Recent Developments

12.1.5.5. Financial Details

12.1.5.6. Others

12.1.6. Harukado Co Ltd

12.1.6.1. Business Description

12.1.6.2. Product Portfolio

12.1.6.3. Collaborations & Alliances

12.1.6.4. Recent Developments

12.1.6.5. Financial Details

12.1.6.6. Others

12.1.7. Dia Chemical Co Ltd

12.1.7.1. Business Description

12.1.7.2. Product Portfolio

12.1.7.3. Collaborations & Alliances

12.1.7.4. Recent Developments

12.1.7.5. Financial Details

12.1.7.6. Others

12.1.8. Taiko Pharmaceutical Co Ltd

12.1.8.1. Business Description

12.1.8.2. Product Portfolio

12.1.8.3. Collaborations & Alliances

12.1.8.4. Recent Developments

12.1.8.5. Financial Details

12.1.8.6. Others

12.1.9. Procter & Gamble Japan KK

12.1.9.1. Business Description

12.1.9.2. Product Portfolio

12.1.9.3. Collaborations & Alliances

12.1.9.4. Recent Developments

12.1.9.5. Financial Details

12.1.9.6. Others

12.1.10. Asahi Kasei Corp

12.1.10.1. Business Description

12.1.10.2. Product Portfolio

12.1.10.3. Collaborations & Alliances

12.1.10.4. Recent Developments

12.1.10.5. Financial Details

12.1.10.6. Others

13. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Fragrance |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.