Italy Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

Category (Costume Jewellery, Fine Jewellery), Type (Earrings, Neckwear, Rings, Wristwear, Other), Collection (Diamond, Non-Diamond), Material Type (Gold, Platinum, Metal Combination, Silver), Sales Channel (Retail Offline, Retail Online), End User (Men, Women)

- FMCG

- Dec 2025

- VI0653

- 130

-

Italy Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

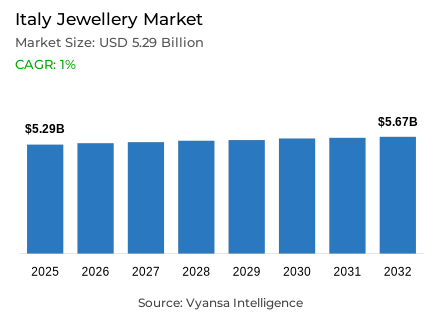

- Jewellery in Italy is estimated at USD 5.29 billion.

- The market size is expected to grow to USD 5.67 billion by 2032.

- Market to register a cagr of around 1% during 2026-32.

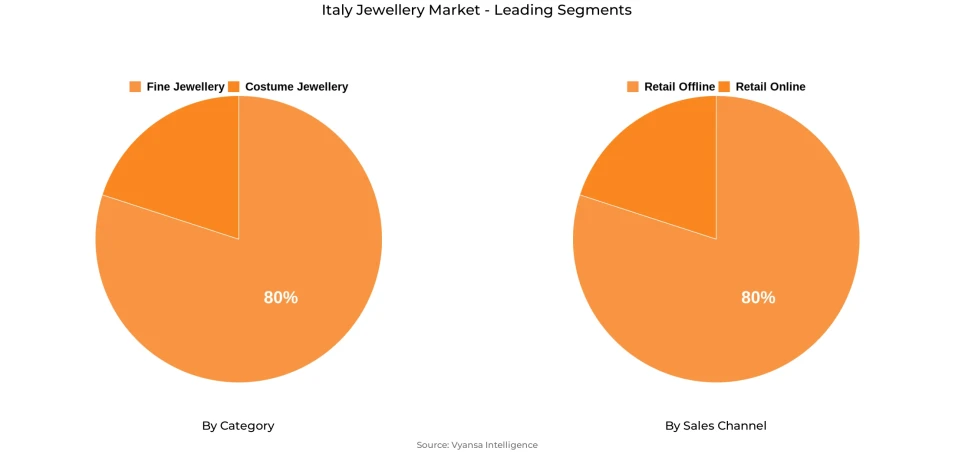

- Category Shares

- Fine jewellery grabbed market share of 80%.

- Competition

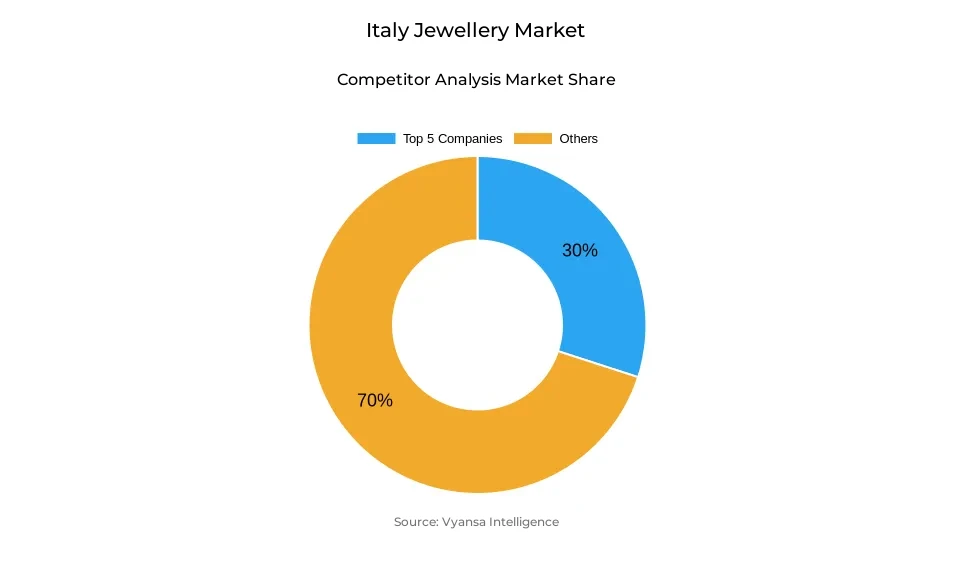

- More than 20 companies are actively engaged in producing jewellery in Italy.

- Top 5 companies acquired around 30% of the market share.

- Swarovski Internazionale d'Italia SpA; Bros Manifatture Srl; Morellato SpA; Pandora Italia Srl; Richemont SA, Cie Financière etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

Italy Jewellery Market Outlook

The Italy jewellery market was valued at around USD 5.29 billion in 2025 and is expected to reach around USD 5.67 billion by 2032, growing at a CAGR of around 1% during 2026–2032. Such steady growth reflects the strong cultural and emotional attachment that end users have with jewellery, especially with the recovery of weddings, events, and social gatherings. jewellery remains an important component of self-expression and gifting, and fine craftsmanship and sentimental value continue to drive steady demand across the country.

Fine jewellery leads the demand in the market, with a share of around 80%, supported by the preference for gold, silver, and precious stone designs representing tradition and artistry. The end-user traditionally views them as a valuable investment to remember any important date and to keep for life. The skill of artisans and continued design innovation keeps fine jewellery highly regarded among all categories.

Retail offline is leading the market share with around 80%. The physical store is preferred as it allows the end user to see, feel, and try out products before purchase. Even with growing retail online activity, the majority of buyers still visit stores for trusted advice and personal service. This mix of digital search and in-store experience keeps offline retail strong.

This market also shows healthy competition, with over 20 active jewellery producers, while the top five participants hold up to 30% of the market share. This balance between traditional art and modern innovation contributes to gradual growth, thus keeping the jewellery market resilient and culturally important for many years.

Italy Jewellery Market Growth DriverRevival of Social and Cultural Celebrations Supporting Jewellery Demand

Weddings, events, and social gatherings have caused a strong resurgence in the demand for jewellery. Wedding ornaments are also back in demand for personal use and as a gift among end users, showing renewed enthusiasm for social events. Fine jewellery, in particular, benefits from associations with special life moments and emotional expression. The sentimental attachment increases the importance of jewellery beyond mere decoration, enabling end users to appreciate it both as an accessory and as a valuable investment. This emotional attachment keeps strengthening the performance of the market as a whole.

Besides, jewellery plays a very important role in the expression of identity and tradition. In 2023, weddings in Italy went up to over 180,000, up 7.2% from the same period a year earlier, therefore directly contributing to increased purchases of jewellery. Exports of gold jewellery also went up to €7.7 billion, while retail sales of jewellery and watches went up by 5.4%, showing clear signs of recovery. These tendencies confirm once more that jewellery is deeply tied to social life and emotional value.

Italy Jewellery Market ChallengeRising Compliance Costs from Responsible Gold Sourcing Rules

Over the recent years, responsible sourcing regulations have been putting new pressure on jewellery makers. In the EU, the Conflict Minerals Regulation has led to a requirement for companies to trace and verify the origin of gold and other key minerals. The result is more paperwork and increased audit requirements throughout the supply chain, with particularly heavy burdens placed on small workshops and traditional artisans. Such changes are driving up operational costs for many producers, while extending sourcing times negatively impacts the flow of raw materials and finished jewellery in circulation.

In these high-inflation and high-material-price times, the cost of complying with such new rules is growing. Compliance costs now account for about 8-12% of total operating costs for small firms, while the input prices of precious metals rose 4.6% in 2024 and energy costs went up 9.3%. As 72% of all manufacturers cannot pass such costs on to end users, profit margins have fallen by 2-4 percentage points, raising uncertainty for local producers.

Italy Jewellery Market TrendGrowing Interest in Lab-Grown Diamonds Among New Buyers

Lab grown diamonds are gaining favor with new jewellery buyers increasingly. Definitely, they are gaining appeal since they resemble natural diamonds, yet their price is a bit lower, thus making it more possible for end users of smaller budgets to buy and wear diamond jewellery. This has brought one more category of ens users that values style and luxury at affordable prices. Whereas prestige goes with natural ones, lab-made diamonds appeal to those end user seeking elegance in practicality.

This reflects a broader change in attitude among young purchasers. In 2024, lab grown diamonds accounted for 12% of all diamond jewellery sales in Italy, up from 7% in 2022, with prices 40–60% lower than natural stones. About 68% of buyers under 35 are open to lab grown diamonds, thus helping the expansion of this market segment. Their coexistence points to an evolution in openness toward sustainable and inclusive choices.

Italy Jewellery Market OpportunityTechnology Integration Creating New Paths for Creativity and Engagement

Consumption of technology is increasing, and the way jewellery is conceptualized, manufactured, and consumed is changing. Digital tools such as augmented reality, 3D printing, and virtual display will allow creators to experiment with designs and offer increasingly interactive experiences. These innovations offer the possibility for end users to view jewellery before purchase and thus make the act of buying more engaging. The connection between creativity and technology is the link that triggers the generation of ideas and assists designers in reaching end users in new ways.

The digital shift should therefore provide a path for young professionals to join the ranks of the jewellery sector that they regard as modern and creative. In 2024, 81% of the major Italian manufacturers had adopted 3D printing and 59% of retailers used virtual try-on tools: e-commerce accounted for 14% of national jewellery sales and design graduate entries went up by 17%. The digital progress really renews artistic energy and strengthens creative growth.

Italy Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

The share of fine jewellery in the market is around 80%. This segment leads in the market because it has a deep cultural linkage with the designs of gold, silver, and precious stones that reflect tradition and skill. End-users will go for fine jewellery in weddings, family occasions, and gifting, which they consider an investment for a lifetime, having emotional as well as monetary value. Thus, the art and timelessness of these pieces make this category, even today, the most trusted and admired of all types.

Furthermore, the high concentration of skilled artisans and established workshops also contributed to the growth in fine jewellery. Continuous innovation in design and integration of modern style keep this segment appealing for traditional and young end users. Its consistent demand evidences that fine jewellery forms the very core of the jewellery industry.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline contributes to the highest share with a contribution of around 80% of the market share. The physical stores remain the first choices for end users to buy jewellery due to the fact that most end-users prefer to see and feel products before making the purchase. They also consider expert guidance from store personnel who reassure them on making confident purchase decisions. Several end-users visit stores after checking out products online; hence, both digital research combined with in-store experiences helps to create a balance between convenience and personal interaction that keeps physical stores highly dominant in the sale of jewellery.

At the same time, the offline retail sector innovates and excels in services. The jewellery specialists expand showrooms and offer customized designs to meet varied tastes. With increased e-commerce, the physical stores are still more trusted and sought after, proving their continuity in the jewellery industry.

List of Companies Covered in Italy Jewellery Market

The companies listed below are highly influential in the Italy jewellery market, with a significant market share and a strong impact on industry developments.

- Swarovski Internazionale d'Italia SpA

- Bros Manifatture Srl

- Morellato SpA

- Pandora Italia Srl

- Richemont SA, Cie Financière

- Bulgari SpA

- Stroili Oro Group SpA

- Pomellato SpA

- Damiani SpA

- UnoAErre Industries SpA

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Italy Jewellery Market Policies, Regulations, and Standards

4. Italy Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Italy Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Italy Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Italy Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Pandora Italia Srl

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Richemont SA, Cie Financière

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Bulgari SpA

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Stroili Oro Group SpA

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Pomellato SpA

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Swarovski Internazionale d'Italia SpA

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Bros Manifatture Srl

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Morellato SpA

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Damiani SpA

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. UnoAErre Industries SpA

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.