Italy Bags and Luggage Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Bags (Cross Body Bags, Bags and Backpacks, Business Bags, Duffle Bags, Clutches, Others), Luggage (Soft Luggage, Hard Luggage, Wheeled Luggage, Non-Wheeled Luggage)), By Sales Channel (Retail Offline, Retail Online), By Material Type (Soft Case (Nylon, Polyester, Ballistic Nylon), Hard Case (Polycarbonate, ABS (Acrylonitrile Butadiene Styrene), Polypropylene)), By Price Category (Luxury, Mass/Economy, Premium), By Application (Travel, Business)

|

Major Players

|

Italy Bags and Luggage Market Statistics and Insights, 2026

- Market Size Statistics

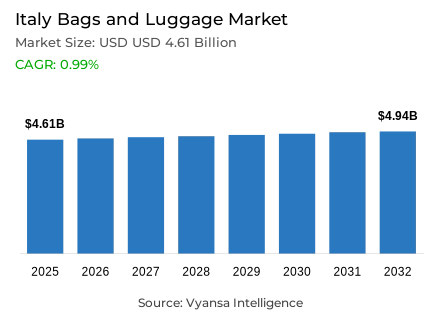

- Bags and luggage in Italy is estimated at USD 4.61 billion in 2025.

- The market size is expected to grow to USD 4.94 billion by 2032.

- Market to register a cagr of around 0.99% during 2026-32.

- Category Shares

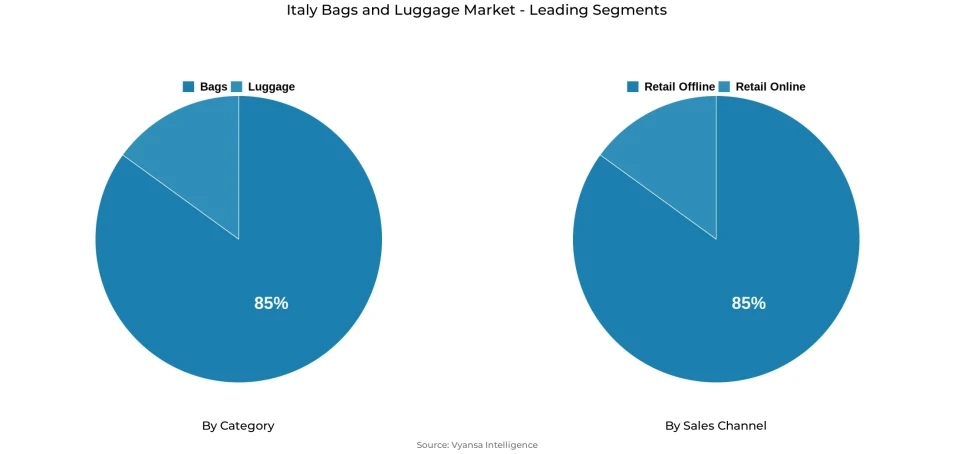

- Bags grabbed market share of 85%.

- Competition

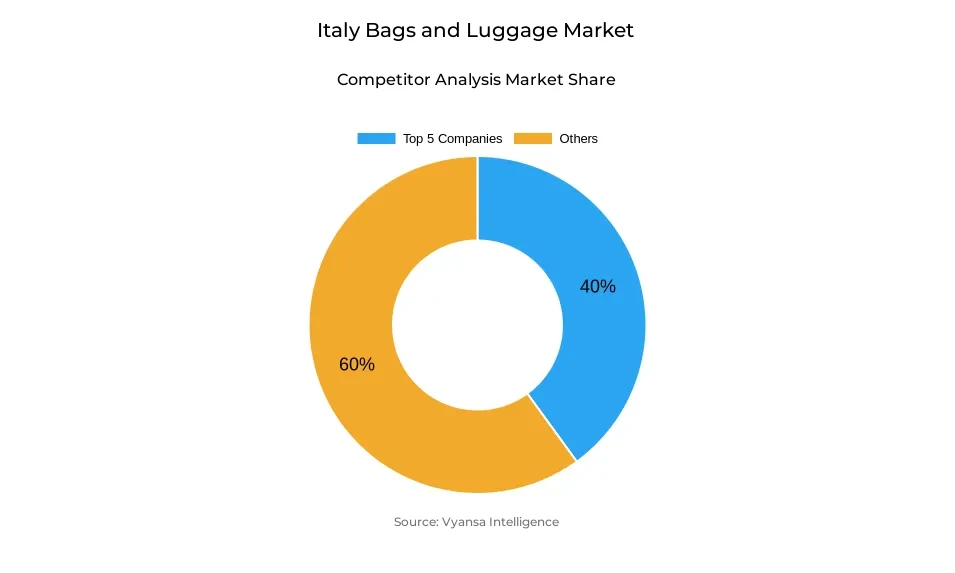

- More than 20 companies are actively engaged in producing bags and luggage in Italy.

- Top 5 companies acquired around 40% of the market share.

- Kuvera SpA; Samsonite Italia Srl; Michael Kors Srl; Guccio Gucci SpA; LVMH Italia SpA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Italy Bags and Luggage Market Outlook

Italy bags and luggage market is projected to grow to USD 4.61 billion in 2025 and USD 4.94 billion in 2032 with a compound annual growth rate of about 0.99% in the period between 2026 and 2032. The forecast period is expected to be characterized by a modest growth, as the economy continues to exert pressure on household spending, offset by the slow recovery of tourism and stable demand of travel related products.

The primary growth driver is expected to be luggage, which will be backed by the rising domestic and international travel. The recovery of the inbound tourism, especially to the major cultural cities like Rome, Florence and Venice, has been sustaining the demand, especially in the premium and luxury segments. Luggage is becoming a functional and fashion-oriented item, and with the tightening of airline baggage regulations, it is becoming a replacement and upgrade item.

Bags and handbags are also expected to register good performance in general, with luxury handbags having a substantial portion because of the high-income end users and international tourists. Nevertheless, the growth will be limited by the continued inflation and increasing production expenses in terms of raw materials, energy and logistics, especially to smaller players and non-luxury segments. Smaller products like wallets and coin pouches will not perform well because of the falling average unit prices.

The focus of innovation in the category will be on sustainability. The Italian end users are becoming more sensitive to recycled materials, clear supply chains and ethical manufacturing. Both luxury and local brands will likely keep investing in eco-friendly materials, circular-economy projects and sustainable designs, which will define a stable yet cautious growth until 2032.

Italy Bags and Luggage Market Growth DriverRevival of International Tourism Fuelling Travel Accessory Demand

International tourism is recovering strongly in Italy thus creating a boost in new demand in travel related accessories especially luggage and high quality travel bags. The number of tourist nights in Italy in 2024 was 458.4 million, which is 2.5% higher than the record figures of 2023. The number of non-resident tourists exceeded 250 million presences, and the annual growth was 6.8%, which constitutes 54.6% of the total accommodation demand. This active inbound tourism, which is concentrated in the key cultural cities like Venice, Florence and Rome, is directly translated into long term buying of high quality luggage and fashion accessories.

The post-pandemic period has seen end-user travel enthusiasm at a high level, and Italians themselves are actively involved in leisure travel. Tourism is a major contributor to the economy, and internal tourism spending is estimated at EUR 202.7 billion in 2023. The tourism industry now occupies 14.4% of the total employment in Italy and 9.6% of the national GDP including indirect impacts. Luggage has become a visible fashion product in the luxury market, with an average price that is more expensive as travellers are starting to perceive travel accessories as both practical and aspirational fashion.

Italy Bags and Luggage Market ChallengePurchasing Power Constraints Limiting Discretionary Spending

Inflation is also a major limitation to discretionary spending by end-users, especially in demand of non-essential products like bags and handbags. In 2023, Italy had a prolonged inflation of 5.7% on average based on the Harmonised Index of Consumer Prices, with lower-income households having an inflation of 6.5% on average than higher-income households of 5.7%. This difference underscores the fact that middle- and low-income end users are more vulnerable to purchasing-power erosion and thus are more sensitive to non-essential purchases such as luxury handbags and fashion accessories.

Even though inflation has decreased to an average of 1.0% in 2024, compared to 5.7% in 2023, core inflation without volatile energy and food items is still high at 2.0%, continuing to put pressure on manufacturers in terms of input costs. The increasing prices of raw materials, energy and transportation have compelled manufacturers to raise prices, which further deter price sensitive end users to buy. Smaller manufacturers are especially under pressure because they have to operate in a high-cost environment and compete in a limited end-user spending environment.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Italy Bags and Luggage Market TrendShift Towards Eco-Conscious Materials and Sustainable Production

The end-user tastes are changing to eco-friendly and sustainable bags and luggage due to the increasing environmental awareness in Italy. The high urbanisation level of Italy is 72.29% in 2024, which contributes to the increased awareness of end-users regarding environmental impact. Eurobarometer 2023 shows that 73% of EU end users, including Italians, now consider environmental impact very important or fairly important when making purchase decisions, and 60% of them actively purchase products with a lower environmental footprint.

This change is transforming the product development in the industry as brands are shifting towards recycled and bio-based products like recycled PET polyester and materials made out of waste apples. The aesthetics of luxury handbags are also moving beyond logo-heavy designs to more subtle, classic Quiet Luxury designs, which is a fundamental shift in the perception of exclusivity and prestige by the end users. The major manufacturers have shifted their focus to supply-chain transparency, durability and circular-economy values and high-end craftsmanship. This is a structural repositioning of the category, in which sustainability credentials and responsible production are emerging as central brand value propositions and not marginal marketing attributes.

Italy Bags and Luggage Market OpportunityGrowing Affluent Tourist Segment Supporting Premium Positioning

Wealthy global travelers are a huge potential of high-quality and luxury bags and luggage manufacturers. Italy had 133.6 million total tourist arrivals in 2023, of which 67.9 million international visitors were 50.8% of the total, with Germany at 19.9%, the United States at 11.1% and France at 8.2% being the major markets. The Chinese tourists are a very significant market in terms of luxury goods, as they have a high propensity to spend on high quality personal accessories and fashion products. Non-resident tourist presences increased 6.8% year-on-year in 2024, which shows further recovery and growth of this high-value customer segment.

Physical retail experts still control the sales because wealthy end users still appreciate the physical shopping experience, professional advice and the opportunity to evaluate quality prior to buying. Hyper-personalisation, unique service experiences and Quiet Luxury aesthetics are becoming the means by which luxury brands distinguish themselves, focusing on discretion and timelessness, rather than logos. The wealthier households are more resilient to inflation pressures, as they can continue to buy high-end products. The convergence of the recovery of international tourism, wealthy domestic end users and the change in luxury aesthetics presents an opportunity to the premium-positioned luggage and bags to serve the high-end, high-spending end-user segments by 2032.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Italy Bags and Luggage Market Segmentation Analysis

By Category

- Bags

- Cross Body Bags

- Bags and Backpacks

- Business Bags

- Duffle Bags

- Clutches

- Others

- Luggage

- Soft Luggage

- Hard Luggage

- Wheeled Luggage

- Non-Wheeled Luggage

The segment with highest market share under Category is bags with the share of about 85%. This dominance highlights the ubiquitous nature of bags in the workplace, educational, leisure, and travel settings in Italy. Backpacks and business bags have proven to be resilient, supported by academic pursuits, sports involvement, and long-term professional mobility.

Luxury bags remain very important in this segment especially in urban centers that are tourism intensive. Despite the effects of inflation on the domestic demand, the sales of the premium Italian and European brands have been maintained by international visitors, particularly those in the high spending markets. During the forecast period, bags will continue to dominate the top spot due to product diversification, sustainability-based innovation, and continued popularity as fashion and lifestyle accessories.

By Sales Channel

- Retail Offline

- Retail Online

The Retail Offline channels are the most dominant in the sales channel classification with about 85% of the market share. In Italy, physical retail is still essential, especially when it comes to purchasing higher-value items like handbags and luggage, where consumers appreciate the chance to touch, feel, and get professional advice before purchase.

Offline sales remain dominated by bags and luggage specialists, which enjoy brand-driven experiences and personalized service. Online retail channels have continued to grow, but at a moderated rate as consumers shift back to brick and mortar stores, particularly in high-end products. Retail offline will maintain its leadership over the forecast period, as it will be backed by the footfall created by tourism and the need to have in-store expertise.

List of Companies Covered in Italy Bags and Luggage Market

The companies listed below are highly influential in the Italy bags and luggage market, with a significant market share and a strong impact on industry developments.

- Kuvera SpA

- Samsonite Italia Srl

- Michael Kors Srl

- Guccio Gucci SpA

- LVMH Italia SpA

- Prada SpA

- Hermès International SCA

- Chanel Italia SpA

- Gianni Versace Srl

- Christian Dior Italia Srl

Competitive Landscape

Italy’s bags and luggage market is shaped by a strong divide between global luxury houses and a wide base of mid-priced and specialist players. Luxury brands such as Louis Vuitton, Gucci, and Prada continue to dominate value sales, supported by international tourism and demand from high-income consumers, particularly in major cities of art. Their focus on discreet, timeless design aligned with the “quiet luxury” trend has reinforced brand desirability. Outside luxury, competition is fragmented, with manufacturers facing cost pressures from rising raw material and energy prices. Innovation increasingly centres on sustainability, with brands such as Pinko, Mandarina Duck, and Carpisa differentiating through recycled and bio-based materials. Specialist retailers remain central to competition, while e-commerce has stabilised as consumers return to physical stores for high-involvement purchases.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Italy Bags and Luggage Market Policies, Regulations, and Standards

4. Italy Bags and Luggage Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Italy Bags and Luggage Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Cross Body Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Bags and Backpacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Business Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Duffle Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. Clutches- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Soft Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Hard Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Non-Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Material Type

5.2.3.1. Soft Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. Polyester- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.3. Ballistic Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Hard Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1. Polycarbonate- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2. ABS (Acrylonitrile Butadiene Styrene)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.3. Polypropylene- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Price Category

5.2.4.1. Luxury- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Mass/Economy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Application

5.2.5.1. Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Business- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Italy Bags Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

7. Italy Luggage Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Guccio Gucci SpA

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.LVMH Italia SpA

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Prada SpA

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Hermès International SCA

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Chanel Italia SpA

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Kuvera SpA

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Samsonite Italia Srl

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Michael Kors Srl

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Gianni Versace Srl

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Christian Dior Italia Srl

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Sales Channel |

|

| By Material Type |

|

| By Price Category |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.