India Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

Category (Costume Jewellery, Fine Jewellery), Type (Earrings, Neckwear, Rings, Wristwear, Other), Collection (Diamond, Non-Diamond), Material Type (Gold, Platinum, Metal Combination, Silver), Sales Channel (Retail Offline, Retail Online), End User (Men, Women)

- FMCG

- Dec 2025

- VI0641

- 115

-

India Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

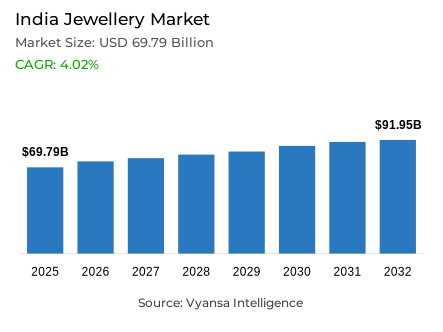

- Jewellery in India is estimated at USD 69.79 billion.

- The market size is expected to grow to USD 91.95 billion by 2032.

- Market to register a cagr of around 4.02% during 2026-32.

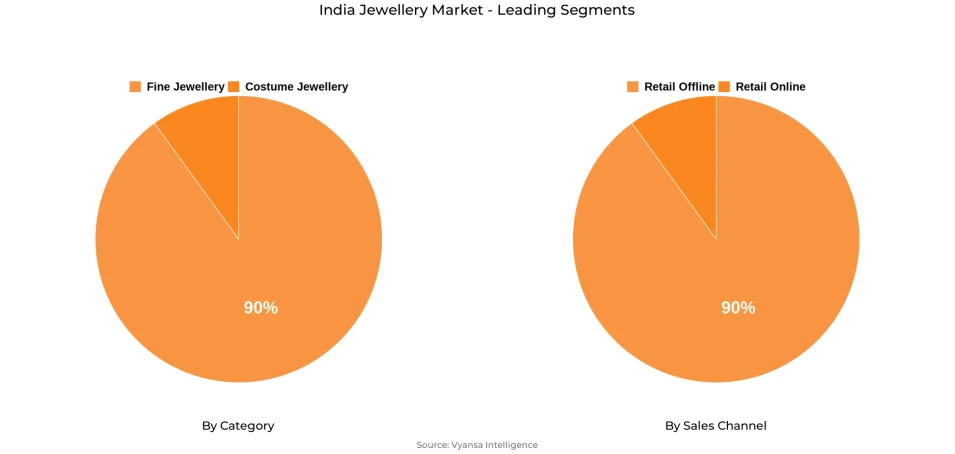

- Category Shares

- Fine jewellery grabbed market share of 90%.

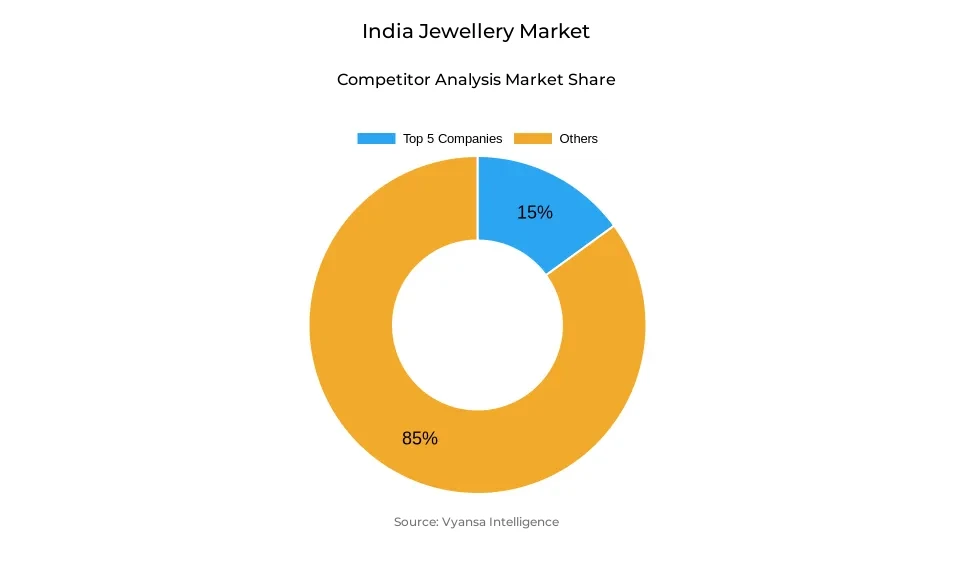

- Competition

- More than 10 companies are actively engaged in producing jewellery in India.

- Top 5 companies acquired around 15% of the market share.

- PC Jeweller Ltd; Tribhovandas Bhimji Zaveri Delhi Pvt Ltd; Bhima Jewellery & Diamonds Pvt Ltd; Titan Co Ltd; Malabar Group etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 90% of the market.

India Jewellery Market Outlook

The India jewellery market is estimated at around USD 69.79 billion in 2025 and is projected to reach around USD 91.95 billion by 2032, growing at a CAGR of around 4.02% during 2026-2032. This steady rise reflects how cultural traditions, weddings, and festivals continue to play a strong role in keeping jewellery demand high. Even as gold prices remain elevated, end users continue to view jewellery as both a symbol of heritage and a secure investment, keeping the market resilient and emotionally driven.

Fine jewellery is dominant in the market, with around 90% share, reflecting the sustained demand for gold and diamond ornaments. The end users appreciate the workmanship and emotional significance of such ornaments, besides being a source of financial security. This continued increase in gold import outlines the continuous demand for high end ornaments connecting luxury to cultural significance, which will keep this category at the core of the market. The market also demonstrates a strong dependence on physical stores.

Retail offline channels account for around 90% of the total sales in jewellery, indicating that in-person shopping remains the most trusted buying method. Most end users are making jewellery purchases that are personal and sentimental, through the physical inspection and trust in the seller. This reinforces the continued relevance of showrooms even as digital experiences become more common.

It is expected that, over the coming years, increased disposable incomes, improved awareness about lab made diamonds, and fashion preferences would be key market influencers. As end users move towards lightweight and sustainable designs, the sector will continue to grow but retain its strong cultural base. All these elements together will create a stable and progressively developing outlook for India jewellery market till 2032.

India Jewellery Market Growth DriverFestive and Wedding Celebrations Supporting Strong Jewellery Demand

Weddings and festivals remain major factor that support the jewellery demand. After the pandemic, revival of celebrations led to consistent double digit growth in value and volume terms. According to MOSPI, India's household consumption expenditure rose by over 9% in 2024, boosting gold and jewellery purchases during cultural events. These occasions carry deep emotional and traditional significance, where gold plays an essential part in rituals and gifting. The surge in jewellery buying during Dhanteras and Diwali highlights how cultural habits continue to support the market even during unusual increases in gold prices.

Typically, sales are higher in the second half of the year due to the wedding season and festive purchases. Urban end users, mainly from Tier 1 and Tier 2 cities, tend to plan their purchases around these events, reflecting rising levels of disposable incomes and also, deep rooted cultural traditions. Flexible payment options and a wider variety of designs have also enhanced the accessibility of jewellery to more end users.

India Jewellery Market ChallengeRising Gold Prices Limiting Affordability and Sales Growth

The increase in gold prices continues to make jewellery less affordable for middle income end users. The Reserve Bank of India has reported that, on average, gold prices in 2024 increased by more than 10% year on year, due to global price volatility and higher import costs. Mostly the fine jewellery relies on gold, these price fluctuations directly impact production expenses and retail prices. This leads some end users to delay purchases of traditional heavy jewellery and choosing smaller, lighter pieces instead.

This sustained price pressure has made it difficult for end users to buy jewellery either for investment or to give as gifts. Many still consider gold a secure and emotionally significant asset, but rising costs are forcing them to adjust their spending habits. This situation has also brought about a stronger focus on balancing design with affordability, reflecting the financial constraints of many families during major life events.

India Jewellery Market TrendShift Toward Lightweight and Fashionable Designs

A noticeable transition can be seen in the fact that there is an increased demand from end users for lightweight, fashionable costume jewellery. More yound end users are joining the workforce have raised demand for quick wearable, affordable accessories. According to NSO reports the urban female employment increased by about 6% in 2024, thereby overall creating a better market for ornaments used daily, suiting daily routines. This change is now even influencing design choices, with many moving to minimal, elegant styles that blend modern aesthetics with traditional charm.

Moreover, this growing attraction to affordable priced fashion pieces highlights how the idea of luxury is getting redefined. For the end user comfort and style in their day to day self expression have become more important than having heavy gold ornaments. Costume jewellery plays the role in maintaining the cultural connection while staying in one's budget. Such a change in mindset has brought jewellery into everyday fashion rather than it being just a purchase for special occasions.

India Jewellery Market OpportunityLab-Grown Diamonds Creating Affordable Luxury Growth Space

The emergence of lab grown diamonds has opened up the new paths for the significant growth in the jewellery industry. These diamonds are visually indistinguishable from natural ones, and also match them in quality, and have become especially popular with younger audiences and environmentally conscious end users. According to the Ministry of Commerce and Industry, polished lab grown diamonds exports grew by over 25% as of 2024, reflecting global and domestic demand. With their lower cost and ethically production, they appeal to those seeking affordable luxury and are making ownership of diamond more accessible for wider base of end users.

Government support is further strengthening this segment through research funding initiatives, exemptions of import duties on diamond seeds, and training programs provided to small manufacturers by the MSME Ministry. As end user become more aware, end users will shift towards lab grown options that are affordable, beautiful, and sustainable. This shift is expected to redefine the future of luxury jewellery into more inclusive and environmentally conscious.

India Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

Fine jewellery holds around 90% of the market share in the jewellery category. This significant share indicates that jewellery purchase in India remains strongly focused on crafted gold and diamond pieces, rather than on coins and bars. The end users prefer fine jewellery because of the artistry, resale value, and the ability to hold cultural meaning, and, at the same time, they used it to invest in long term wealth.

According to DGCIS, the import value of gold in India has increased by 30.89% in FY 2023-24, indicating the continuous demand for fine materials used in jewellery making. Even with alternative investments like gold coins or digital gold is gaining momentum, wearing gold jewellery holds a special emotional and traditional significance that keeps this category at an undisputed lead. Its ability to balance design appeal with lasting value keeps it firmly ahead in market contribution.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline makes up around 90% of the market share. This strong domination indicates that a majority of the end users still prefer visiting a store physically in order to buy jewellery and, more precisely, gold and diamond ones. These are emotional and high value purchases wherein buyers seek personal trust, visual confirmation, and a secure buying experience. Traditional showrooms remain central while buying jewellery on major festivals and weddings due to the cultural importance of in person inspection and human interaction.

According to the Gems and Jewellery Export Promotion Council, the demand for jewellery in India reached 563.4 tonnes in 2024, supported mainly by store based retail sales. Even as technologies such as augmented reality try-ons and virtual consultations grew in popularity, they largely complement the in-store journey rather than surpass it. This ensures that retail offline continues to be the most preferred and reliable jewellery purchase channel.

List of Companies Covered in India Jewellery Market

The companies listed below are highly influential in the India jewellery market, with a significant market share and a strong impact on industry developments.

- PC Jeweller Ltd

- Tribhovandas Bhimji Zaveri Delhi Pvt Ltd

- Bhima Jewellery & Diamonds Pvt Ltd

- Titan Co Ltd

- Malabar Group

- Kalyan Jewellers India Pvt Ltd

- Joyalukkas Holdings

- Rajesh Exports Ltd

- C Krishniah Chetty & Sons Pvt Ltd

- Reliance Retail Ltd

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. India Jewellery Market Policies, Regulations, and Standards

4. India Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. India Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. India Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. India Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Titan Co Ltd

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Malabar Group

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Kalyan Jewellers India Pvt Ltd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Joyalukkas Holdings

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Rajesh Exports Ltd

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.PC Jeweller Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Tribhovandas Bhimji Zaveri Delhi Pvt Ltd

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Bhima Jewellery & Diamonds Pvt Ltd

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.C Krishniah Chetty & Sons Pvt Ltd

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Reliance Retail Ltd

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.