Hong Kong Jewellery Market Report: Trends, Growth and Forecast (2026-2032)

Category (Costume Jewellery, Fine Jewellery), Type (Earrings, Neckwear, Rings, Wristwear, Other), Collection (Diamond, Non-Diamond), Material Type (Gold, Platinum, Metal Combination, Silver), Sales Channel (Retail Offline, Retail Online), End User (Men, Women)

- FMCG

- Jan 2026

- VI0626

- 110

-

Hong Kong Jewellery Market Statistics and Insights, 2026

- Market Size Statistics

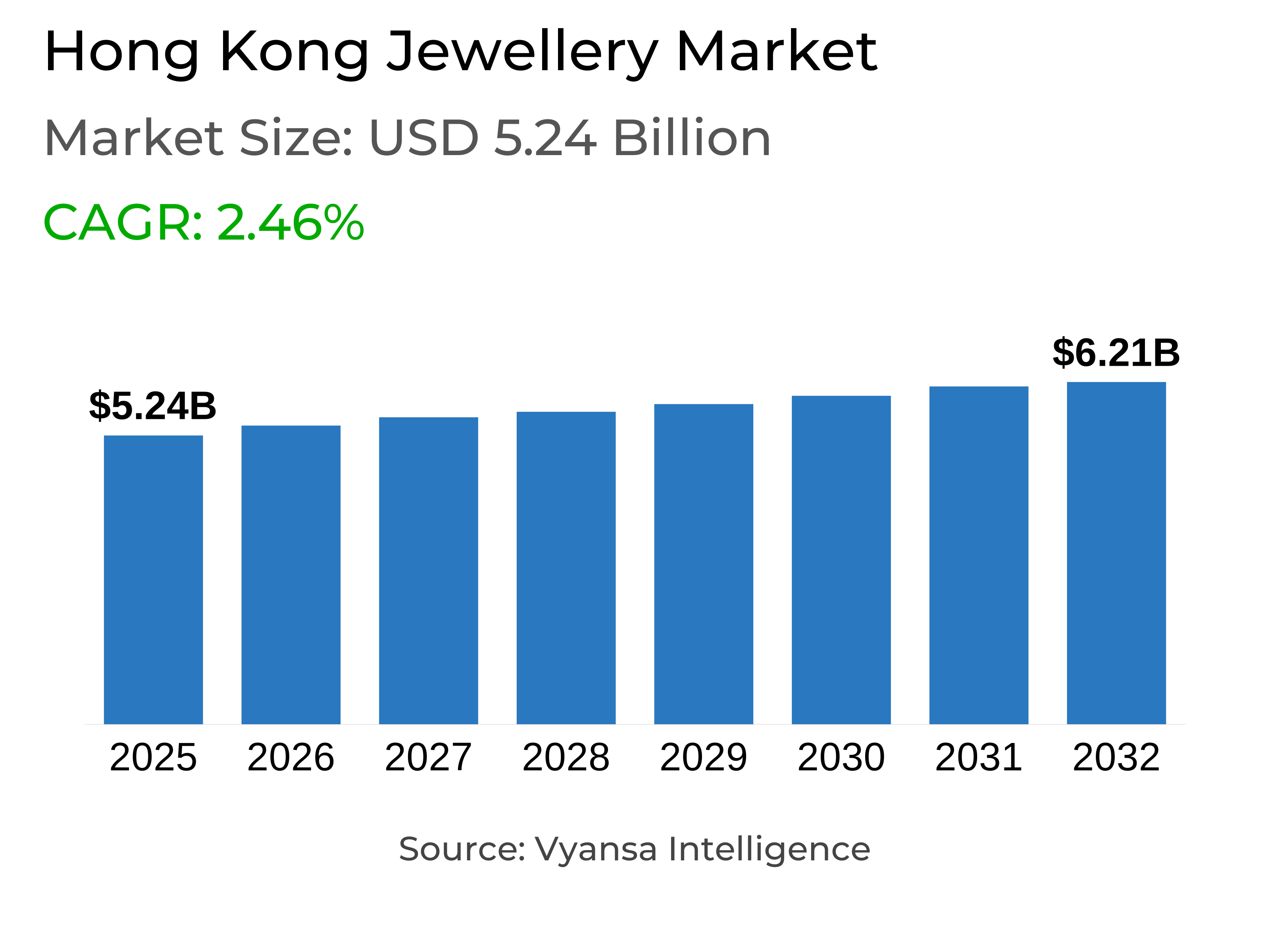

- Jewellery in Hong Kong is estimated at USD 5.24 billion.

- The market size is expected to grow to USD 6.21 billion by 2032.

- Market to register a cagr of around 2.46% during 2026-32.

- Category Shares

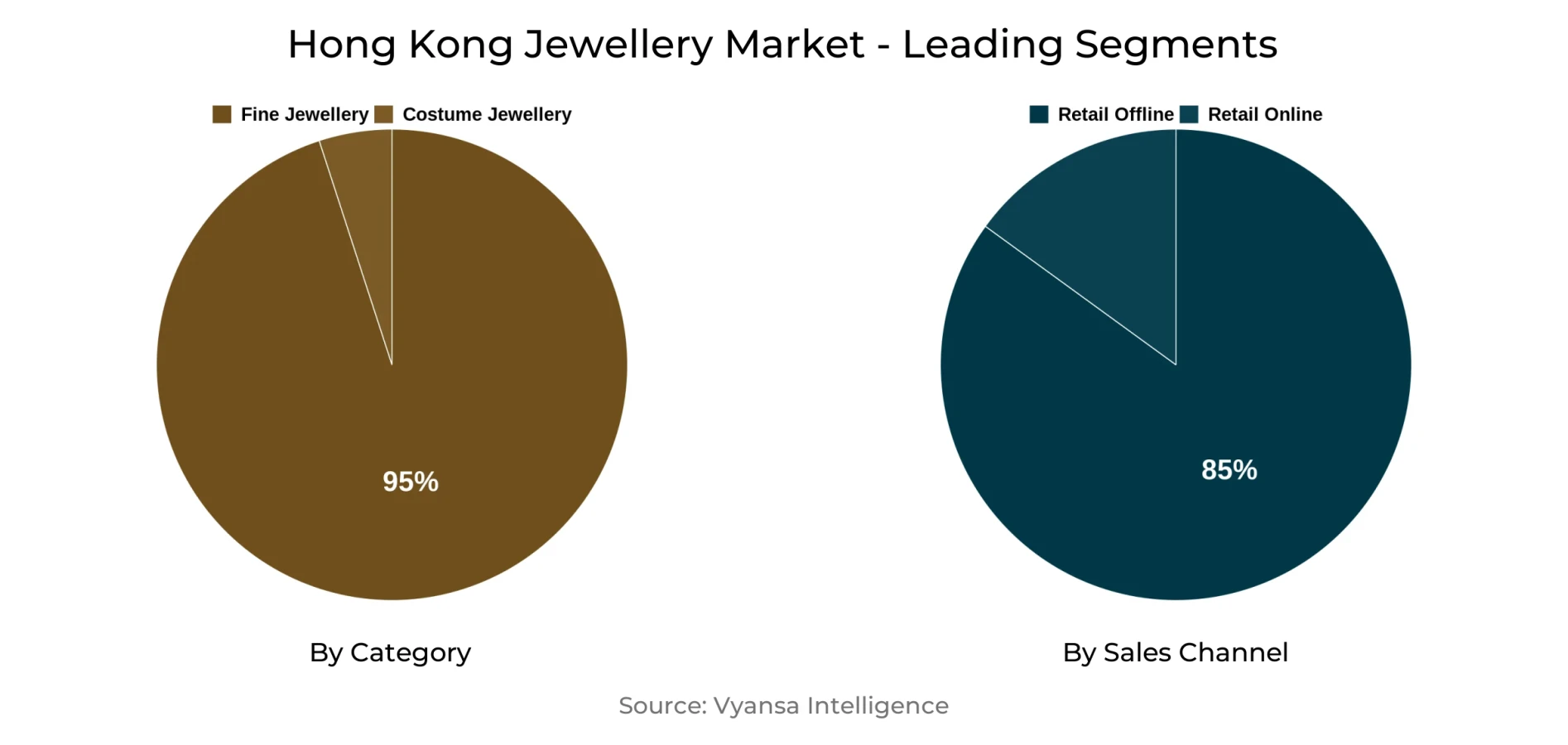

- Fine jewellery grabbed market share of 95%.

- Competition

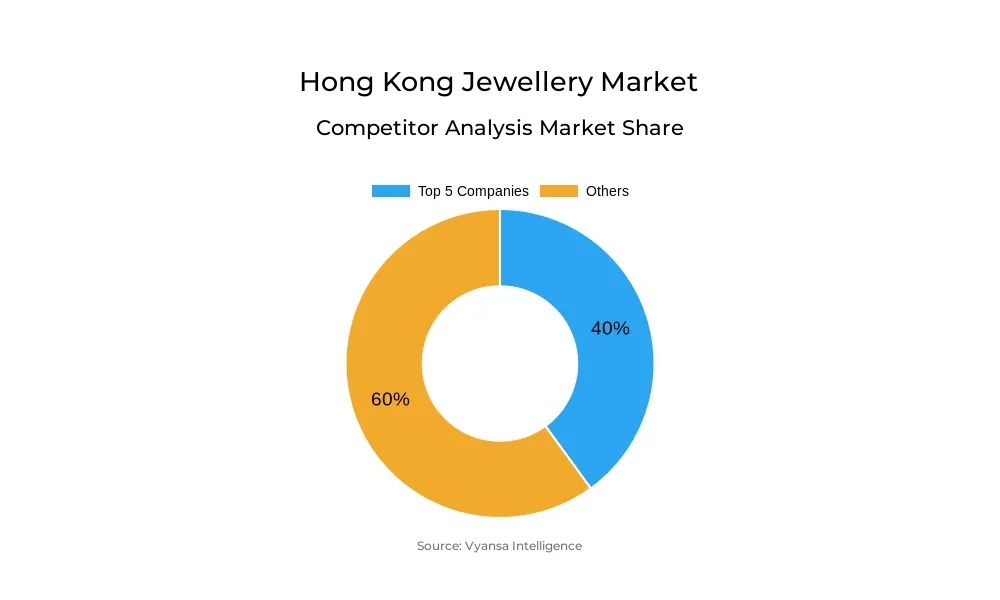

- More than 15 companies are actively engaged in producing jewellery in Hong Kong.

- Top 5 companies acquired around 40% of the market share.

- Bulgari Asia Pacific Ltd, Graff Diamonds (Hong Kong) Ltd, Chanel HK Ltd, Chow Tai Fook Jewellery Group Ltd, Chow Sang Sang Holdings International Ltd etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 85% of the market.

Hong Kong Jewellery Market Outlook

The Hong Kong jewellery market is approximated to be worth around USD 5.24 billion in 2025 and will reach around USD 6.21 billion by 2032 with a CAGR of around 2.46% from 2026-2032. The market keeps expanding with end users perceiving jewellery not just as a fashion item but also a symbol of wealth and security. While there are certain difficulties such as high gold prices and low tourist demand, the market is strong due to the constant local demand and brands continuous attempts to remain trendy and attractive.

Fine jewellery has the greatest market share, and around 95% of overall sales. This is due to the fact that end users appreciate gold and diamond jewellery for its enduring beauty and emotional significance. Fine jewellery is also regarded as an investment piece, particularly in times of uncertainty. Brands are also refreshing their product lines with more fashionable and innovative designs that appeal to younger end users, making the category strong.

Retail offline retail channels maintain the strong position with around 85% of the market share. End users prefer to purchase jewellery from retail offline outlets, which allow them to physically view and inspect the quality of the products. Personal advise and trust established through store experiences contributes a lot in sales for this segment. Jewellery and watch specialist stores are the biggest contributors to this category.

The top five companies together hold around 40% of the market share, showing that a few strong brands continue to lead the industry. These brands are focusing on brand transformation, creative collaborations, and artistic storytelling to attract younger end users. With these efforts and a stable economic outlook, the jewellery market is set to see steady and positive growth in the coming years.

Hong Kong Jewellery Market Growth Driver

Brand Transformation to Engage Younger Jewellery Buyers

The leading jewellery brand is helping the market grow by rebranding its image to better connect with younger end users. It is updating its classic brand image to remain modern while retaining its deep history. Younger end users are looking for jewellery that can express their individuality and personal values therefore, the brand has launched a new, simplified logo that uses "China Red" in order to celebrate its traditional roots in a relevant way. The new visual identity makes the brand feel younger and modern while still honoring its cultural history.

In addition to rebrading the image, the business is also updating the stores to keep up with the current design and enhance the experience of shopping in there stores. It will be adding collections that are rooted in Chinese culture, craft, and innovation to share the story of its heritage with the end users of younger generation. The brand is also using significant marketing outreach to engage with this group, and create both awareness and an emotional connection, which should contribute to ongoing market demand for thoughtful, yet modern, jewellery.

Hong Kong Jewellery Market Challenge

Falling Jewellery Sales Due to Weaker Tourist Spending and High Gold Prices

Jewellery sales are now facing a tough time after an impressive recovery in the past. Retail volume sales are also declining sharply, particularly for fine jewellery. This is primarily due to declining tourist spending on the fine jewellery. Tourists used to spend a lot on the jewellery in pre covid era, but today higher living costs and a strong currency have kept them away from spending. Therefore, many end users are also choosing to spend more on foreign travel and high end experiences rather than on buying jewellery, further contributing to weaker sales in the market.

In addition to that, increasing gold prices are further creating more pressure on the current situation. Gold has become extremely costly due to the economic and geopolitical uncertainty, and this is further making the fine jewellery more expensive than ever. Because of that, end users are becoming cautious with their expenditures and prefer to delay in buying gold jewellery. Because of that, large retailers are experiencing steep falls in sales, indicating how expensive gold is and poor tourist spending combined are creating strong challenges for the jewellery sector.

Hong Kong Jewellery Market Trend

Art Integration Strengthens Brand Heritage in Luxury Jewellery

Luxury jewellery brands has started to use the arts and culture to demonstrate their heritage and form emotional connections with end users. As the number of end users who visits stores are declining and the sales are slowing due to the economic uncertainty, brands are focusing on long term approaches that will add more brand value. The jewellery brands now finding other ways to express their history, creativity, and craftsmanship through the storytelling that is inspired by art. In engaging with art, brands have the possibility to establish deeper emotional connections with end users who are looking for meaning and experience rather than simply luxury.

Moreover, numerous established brands are now teaming up with artists and sponsoring art events to make this concept a reality. For instance Cartier sponsored an exhibition honoring women's contributions to art, while Van Cleef & Arpels teamed up with a French artist to create a spring themed campaign. By integrating art and jewellery design, these brands are not only maintaining their image but are also targeting younger, experience based end users. This growing application of art in branding, demonstrates how luxury jewellers are remodeling their image in innovative ways through creativity and culture.

Hong Kong Jewellery Market Opportunity

Brand Collaborations to Attract Younger Jewellery Buyers

As end users of younger generation become prominent buyers in the jewellery market, jewellery brands are now working on how to provide appealing and modern jewellery products. Collaborations with famous brands and cultural icons is expected to become a significant way for brands to engage with these younger end users. By collaborating with well known Intellectual Properties (IP), jewellery designers can work on creating limited edition jewellery products that feels new and exclusive. This will allow brands to engage with Millennials and Gen Z, who want one of a kind jewellery that reflects their style and individuality.

For instance, Pandora partnered with Disney to create character themed jewellery items have appealed the younger end users thanks to their focus on customised designs. In the similar way, Chow Tai Fook also collaborated with the Palace Museum to launch a collection inspired by ancient treasures, shows their intent of joining heritage with creativity. Jewellery and fashion brands are coming together to create fresh and exciting collections.

Hong Kong Jewellery Market Segmentation Analysis

By Category

- Costume Jewellery

- Fine Jewellery

The segment with the highest share in the market is fine jewellery, which holds around 95% of the total share. This strong share comes from the deep cultural meaning attached to fine jewellery and its association with important life milestones such as weddings and celebrations, as it is linked to premium high end materials. It is still seen as a form of wealth and a stable long term investment among the end users. Demand remains high for gold and diamond jewellery items, as they are appreciated for their long lasting beauty and craftsmanship.

At the same time, luxury brands are introducing modern and stylish collections to appeal to younger end users who seek personal expression through jewellery. Many brands are combining heritage style with modern details to keep premium jewellery relevant among the end users of younger generation. Subsequently, this segment will continue to dominate in the near future based on both emotional and investment demand.

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel is retail offline, holding around 85% of the market. Most end users prefer visiting physical stores to explore jewellery in person before buying. This allows them to see the design, quality, and craftsmanship up close, which builds stronger trust and confidence in their purchase. The offline retail format also provides personalised customer service, helping end users choose jewellery that matches their needs and style preferences.

Additionally, most jewellery sales take place through jewellery and watch specialist stores, which continue to be the main retail format under the offline channel. These stores provide a broad range of fine jewellery, allowing end users to explore luxury collections and exclusive designs in one place. While retail online sales are gradually increasing, physical stores continue to lead because end users value the personal touch, trust, and experience that come with in-person shopping.

Top Companies in Hong Kong Jewellery Market

The top companies operating in the market include Bulgari Asia Pacific Ltd, Graff Diamonds (Hong Kong) Ltd, Chanel HK Ltd, Chow Tai Fook Jewellery Group Ltd, Chow Sang Sang Holdings International Ltd, Richemont Asia Pacific Ltd, Luk Fook Holdings (International) Ltd, Tiffany & Co Asia Pacific Ltd, APM Monaco SAM, Pandora Jewelry Asia-Pacific Ltd, etc., are the top players operating in the Hong Kong jewellery market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Hong Kong Jewellery Market Policies, Regulations, and Standards

4. Hong Kong Jewellery Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Hong Kong Jewellery Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Costume Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Fine Jewellery- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Type

5.2.2.1. Earrings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Neckwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Rings- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Wristwear- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Other- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Collection

5.2.3.1. Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Non-Diamond- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Material Type

5.2.4.1. Gold- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Platinum- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Metal Combination- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Silver- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Sales Channel

5.2.5.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

5.2.7.1. Competition Characteristics

5.2.7.2. Market Share & Analysis

6. Hong Kong Costume Jewellery Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Hong Kong Fine Jewellery Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Collection- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Chow Tai Fook Jewellery Group Ltd

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Chow Sang Sang Holdings International Ltd

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Richemont Asia Pacific Ltd

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Luk Fook Holdings (International) Ltd

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Tiffany & Co Asia Pacific Ltd

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Bulgari Asia Pacific Ltd

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Graff Diamonds (Hong Kong) Ltd

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Chanel HK Ltd

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.APM Monaco SAM

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Pandora Jewelry Asia-Pacific Ltd

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Type |

|

| By Collection |

|

| By Material Type |

|

| By Sales Channel |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.