Canada Childrenswear Market Report: Trends, Growth and Forecast (2026-2032)

By Product Type (Apparel (Baby and Toddler Wear, Boys Apparel, Girls Apparel), Footwear (Boys Footwear, Girls Footwear), Accessories (Boys Accessories, Girls Accessories), Others), By Age Group (Infant/Toddler (Below 2 years), Kids/Children (2 - 14 years)), By Price Category (Mass, Premium), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Jan 2026

- VI0757

- 120

-

Canada Childrenswear Market Statistics and Insights, 2026

- Market Size Statistics

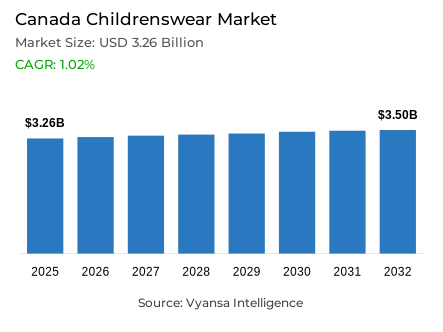

- Childrenswear in Canada is estimated at USD 3.26 billion in 2025.

- The market size is expected to grow to USD 3.5 billion by 2032.

- Market to register a cagr of around 1.02% during 2026-32.

- Product Type Shares

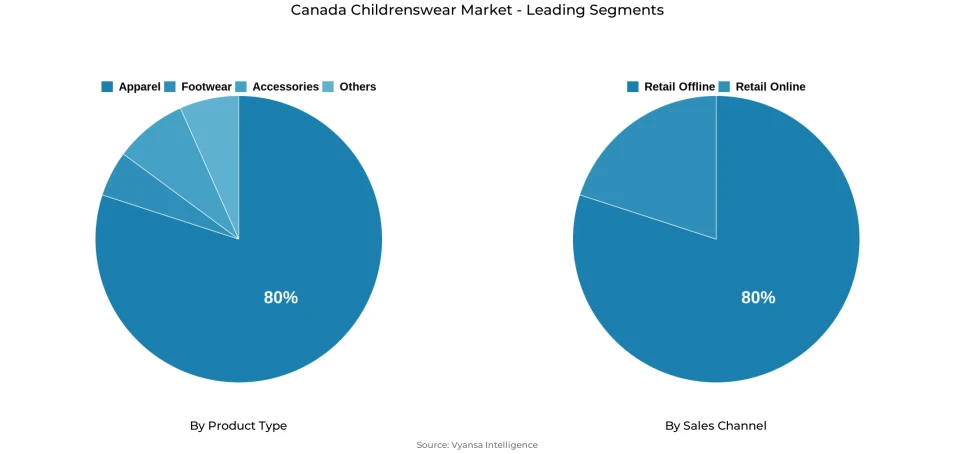

- Apparel grabbed market share of 80%.

- Competition

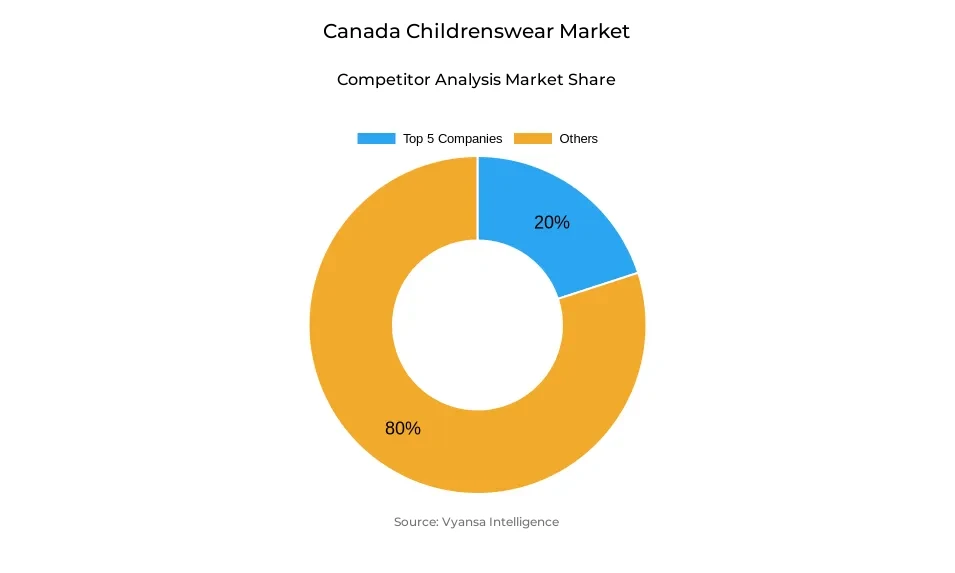

- Childrenswear in Canada is currently being catered to by more than 15 companies.

- Top 5 companies acquired around 20% of the market share.

- Canada Goose Holdings Inc; PVH Corp; Shein Distribution Canada Ltd; Loblaw Cos Ltd; Wal-Mart Canada Inc etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 80% of the market.

Canada Childrenswear Market Outlook

The Canada Childrenswear Market was valued around $3.26 billion in 2025, growing around $3.5 billion in 2032, at a CAGR of approximately 1.02% from 2026-2032. Notably, this is a slow growth rate, as this is a market that is facing challenges in demographics as well as user behavior. Indeed, the fact that Canada is having fewer births is limiting the number of potential users. The slow growth is further evidence of a stable market, as there is steady demand for basic childrenswear.

The Apparel category leads with a huge 80% market share, supported by steady demand for basic garments such as tops, bottoms, and outerwear. Parents look for practical and durable items with sustained value-for-money, especially during peak shopping seasons. Boy's apparel registers relatively better performance because of higher prices commanded against girls' wear, based on pricing factors that shape market behavior. The market stands moderately fragmented, with the leading five brands securing a cumulative 20% market share, signaling robust opportunities for both existing and new brands.

Retail offline has a strong hold over 80% of the market share as the need to see the quality and material of the clothing material used forces end user to visit the offline stores. Offline retailers have maintained the attraction of the end users with exclusive brands available for sale. However, the rise of retail online will increase the challenge of price as the costs will be lower by global sites.

Factors such as sustainability and the circular economy are anticipated to gain more prominence in the period covered by the forecast. Parents have been turning to hand-me-down children apparel, as well as sustainable fashion, to cope with economic conditions. The trending impact of a gender-neutral childrenswear line can in itself be related to the changes in societal thinking, for which Canadian retailers are embracing the concept of an unisex line of childrenswear.

Canada Childrenswear Market Growth DriverInflation-Driven Value Consciousness Shaping Purchasing Behaviour

The Canada Childrenswear Market is significantly influenced by the sustained rise in the cost of living, which is reshaping household spending priorities and purchasing behaviour across childrenswear categories. End user are becoming more frugal with their discretionary spends. There has been a shift in their preference towards essential apparel over non-essential purchases. This trend is clearly evident during the peak periods of shopping in a year. End user are concentrating on making the most of their spends during the back-to-school shopping season.

However, inflation does not reduce the demand for child wear because size transitions mean that constant replacement with new wear is inevitable. Consequently, demand is actually driven to be sustainable becauseend user are attracted to value-based decisions and prudent spending. The truth is that consumer behavior is not affected because wear that is affordably priced is still very appealing toend user.

Canada Childrenswear Market ChallengeLow Birth Rates and Growing Demand for Second-Hand Clothing

The Canada Childrenswear Market is increasingly affected by a sustained decline in birth rates, which is gradually limiting the expansion of the end-user base. The birth rate has a direct impact on the potential market of the end-user community. The lower the birth rate in Canada, the smaller the market expansion opportunities that the market has.

This is further fueled by the rise in demand for second-hand clothes, where parents have increasingly turned to thrifting and resale websites to cut expenses. Not only does this make end user less likely to buy new clothes, but competition for new clothing retailers is also on the rise.

Canada Childrenswear Market TrendGrowing Adoption of Second-Hand/Circular Fashion Models

The Canada Childrenswear Market is increasingly shaped by the growing adoption of second-hand purchasing and circular economy practices across the category. Today, parents are buying and selling gently used clothing. This trend is common due to two major factors parents looking for a smart way to save money due to an increase in living costs and parents who are adopting a circular economy in order to reduce environmental damage.

The increased interest in resale models indicates an overarching movement toward conscious consumption practices within society at large. In light of increased parental participation in this sustainable model, the children's wear market is now incorporating resale services into their offerings, indicating an overall shift in the structure of the market itself.

Canada Childrenswear Market OpportunityExtending the Demand Base to Sustainable and Inclusive Apparel

The Canada Childrenswear Market presents a notable opportunity as the growing adoption of second-hand purchasing and circular economy practices increasingly influences product demand, value perception, and sustainable consumption patterns across the category. With the growing concern for environmental impact, it is likely that parents will show preference for eco-friendly and sustainable clothing. As such, there will be an increased push for brands to include sustainable and recycled fabrics in their offerings.

However, inclusivity is emerging as a trend where end-users are increasingly showing interest in unisex clothing that aligns with contemporary social trends. Even brands such as roots and mark’s are working on sustainable and unisex lines. market players that focus on such developments are likely to position themselves better in a market and increase brand loyalty.

Canada Childrenswear Market Segmentation Analysis

By Product Type

- Apparel

- Baby and Toddler Wear

- Boys Apparel

- Girls Apparel

- Footwear

- Boys Footwear

- Girls Footwear

- Accessories

- Boys Accessories

- Girls Accessories

- Others

The segment with highest market share under product type is Apparele, constituties about 80% of the market. This is due to the importance of clothing items, which can be pointed to as the main type of purchase that parents make when clothing their children. Some of the Apparel types include tops, bottoms, dresses, and outerwear that constitute the main clothing items that children wear and that need to be frequently replaced due to growth.

The major factor propelling the Apparel business to such a high level is the steady demand generated across all age classes and purchasing occasions, especially within critical periods such as the back to school season. Parents are particularly concerned with functional and long-lasting clothing that can provide value for money, and brands with economical pricing structures are gaining popularity quite significantly. The business is buoyed by both new and second-hand markets, as used garments can readily be resold and reused, thus keeping the business leaders within the market.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel is retail offline segment holds the dominant position in the market in terms of the Sales Channel in the Canada Childrenswear Market, comprising a share of about 80%. The retail store continues to be one of the most sought-after destinations for parents, who are also able to gauge quality, fabric, and so on of a garment prior to making a purchase. Such a sentiment is especially prevalent in childrenswear. Conventional brick-and-mortar shopping destinations such as Hudson's Bay, as well as Mark's, continue to lure end users with their brand offerings and offline shopping experience.

This category also encompasses thrift shops and second-hand shopping destinations that have made significant headway with parents looking for budget-friendly options in light of economic pressures. Offline shopping despite the entry of e-commerce giants with competitive pricing continues to maintain its leading position with benefits such as instant availability of products, personal connections with customer service, and the practicality of touching the actual product, which appeals to parents in Canada shopping for childrenswear.

List of Companies Covered in Canada Childrenswear Market

The companies listed below are highly influential in the Canada childrenswear market, with a significant market share and a strong impact on industry developments.

- Canada Goose Holdings Inc

- PVH Corp

- Shein Distribution Canada Ltd

- Loblaw Cos Ltd

- Wal-Mart Canada Inc

- The Children's Place Retail Stores Inc

- Gap Canada Inc

- Carter's Inc

- Hudson's Bay Co

- Fast Retailing Co Ltd

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Canada Childrenswear Market Policies, Regulations, and Standards

4. Canada Childrenswear Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Canada Childrenswear Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product Type

5.2.1.1. Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Baby and Toddler Wear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Boys Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Girls Apparel- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Boys Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Girls Footwear- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Boys Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Girls Accessories- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Age Group

5.2.2.1. Infant/Toddler (Below 2 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Kids/Children (2 - 14 years)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Price Category

5.2.3.1. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Sales Channel

5.2.4.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

5.2.5.1. Competition Characteristics

5.2.5.2. Market Share & Analysis

6. Canada Apparel Childrenswear Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Canada Footwear Childrenswear Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Canada Accessories Childrenswear Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Age Group- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price Category- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Loblaw Cos Ltd

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Wal-Mart Canada Inc

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.The Children’s Place Retail Stores Inc

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Gap Canada Inc

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Carter’s Inc

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Canada Goose Holdings Inc

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.PVH Corp

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Shein Distribution Canada Ltd

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Hudson’s Bay Co

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Fast Retailing Co Ltd

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product Type |

|

| By Age Group |

|

| By Price Category |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.