Austria Colour Cosmetics Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Eye Make-Up (Eye Liner/Pencil, Eye Shadow, Mascara, Others), Facial Make-Up (BB/CC Creams, Blusher/Bronzer/Highlighter, Foundation/Concealer, Powder, Others), Lip Products (Lip Gloss, Lip Liner/Pencil, Lipstick, Others), Nail Products (Nail Polish, Nail Treatments/Strengthener, Polish Remover, Others), Colour Cosmetics Sets/Kits), By Price (Premium, Mass), By Gender (Men, Women, Unisex), By Packaging Type (Travel/Mini Size, Standard Size, Professional/Salon Size), By Form (Creams/Gels, Lotions, Sprays, Solid, Others), By Nature (Organic, Inorganic), By Sales Channel (Retail Offline, Retail Online)

- FMCG

- Jan 2026

- VI0736

- 110

-

Austria Colour Cosmetics Market Statistics and Insights, 2026

- Market Size Statistics

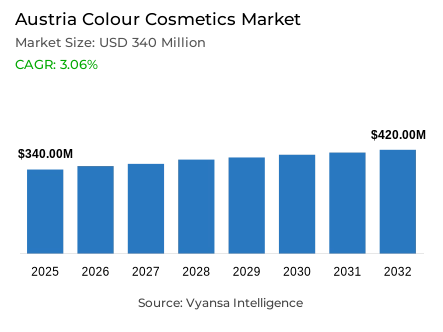

- Colour cosmetics in Austria is estimated at USD 340 million in 2025.

- The market size is expected to grow to USD 420 million by 2032.

- Market to register a cagr of around 3.06% during 2026-32.

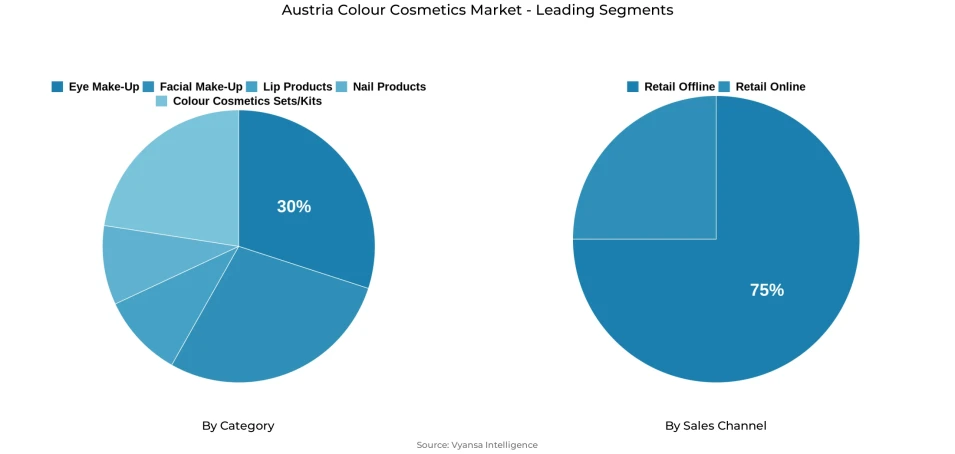

- Category Shares

- Eye make-up grabbed market share of 30%.

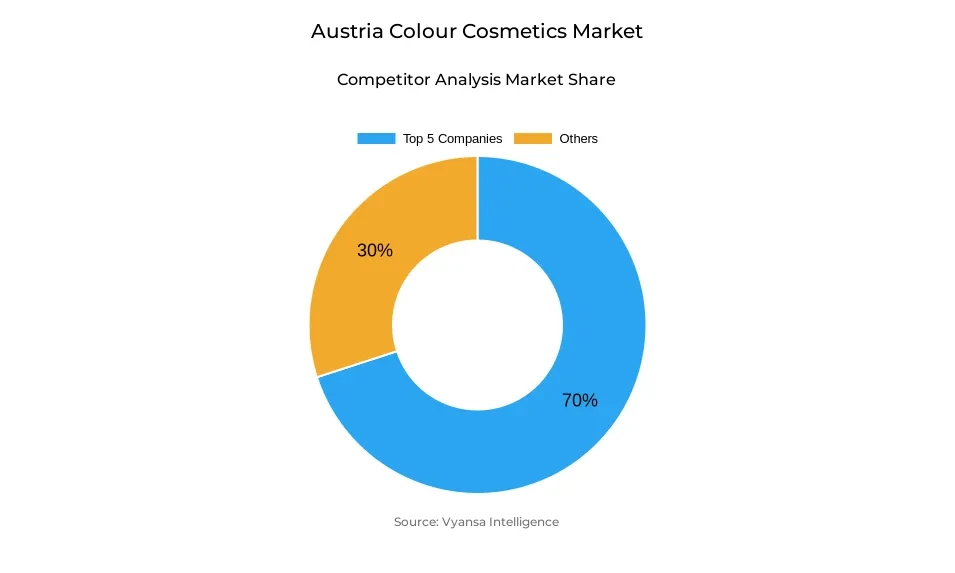

- Competition

- More than 20 companies are actively engaged in producing colour cosmetics in Austria.

- Top 5 companies acquired around 70% of the market share.

- Christian Dior GmbH; Kiko Austria GmbH; Chanel GmbH; L'Oréal Österreich GmbH; Cosnova GmbH etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Austria Colour Cosmetics Market Outlook

The Austria Colour Cosmetics Market, which is currently valued at USD 340 million in 2025, is expected to reach a valuation of USD 420 million in 2032, registering a CAGR of approximately 3.06%. The growth in this market over the next eight years will be fuelled by a tremendous end user following for revolutionary and skin-enriching makeup products. The increasing visibility on online media platforms is also set to drive new end user engagements in this market. The rising use of products with hyaluronic acid, shea butter, niacinamide, and vitamins C and E is also likely to maintain favourable levels in this market. The use of eye makeup, which already holds a remarkable market share of approximately 30%, is also likely to remain at the forefront.

There will also be a performance of superior colour cosmetic products over mass products until 2032, because of increased branding, aspirational, and improved formulations. Lip care products, especially superior lipsticks and lip gloss, are expected to witness one of the sharpest increases as end users are demanding lip products that are long-lasting, hydrating, and multi-functional. These products are increasingly combining skincare benefits with superior pigmentation and textures, which will lure end users, irrespective of their higher prices. Superior eye makeup, especially mascara, will also contribute to enhanced growth value because of frequent use and loyalty to superior brands.

Distribution will still be driven to a large extent by retail offline distribution, which currently represents 75% of overall sales, with the key being beauty specialists like Douglas and Marionnaud. These will still draw in their customers with their expertise, customer service, loyalty schemes, and other discount offers aimed at getting more end users to spend on the premium categories. Retail online, on the other side, will still be the most evolving distribution platform.

Looking forward, innovation will play its part in the market with more attention given to sustainability, formulation disclosure, and online engagement. Refill packaging, healthier ingredients, and multi-performance packaging are set to become more popular, including in the high-end and mass markets. Social media sites such as TikTok and Instagram will continue to play a major role in awareness, influencer, and storytelling for end users to keep on growing the Austria colour cosmetic market over the forcast period.

Austria Colour Cosmetics Market Growth Driver

Skinification and Digitally Enabled Beauty Awareness

A major force continuing to support market growth is the ongoing skinification trend, characterised by the integration of skincare active ingredients into make-up formulations. This is supported by Austria very high level of access to digital technologies. According to the EU's digital statistics, internet usage among Austrians aged 16 to 74 years in 2024 was 95%. This goes a long way in spreading information on various actives and products via the internet.

Such broad technology engagement enables end users to educate themselves on actives such as hyaluronic acid or niacinamide, learn more about claims related to skin benefits, and analyze formulations, thereby fueling interest for make-up meets skincare formulations translating into greater investments within this self-reinforcing phenomenon of skinification.

Austria Colour Cosmetics Market Challenge

Shifting end user Focus Undermining Some Sub-Categories

One notable challenge lies in the rapidly evolving digital beauty landscape, where aesthetics and trend cycles are heavily skewed towards face and lip products, often resulting in comparatively limited visibility and investment for sub-categories such as nail products. The beauty trends directed by the usage of social networks among those who are 65% of the Austrian population in 2024 make people focus more on visible products with expressive use rather than nail polish, for instance.

Consequently, the high-end nail polish category and the other non-performing categories will find themselves with reduced relevance and purchasing frequency. With the current changes in the digital narrative and the resultant dominance in the beauty domain, the task of continued investment in the preceding categories becomes moot.

Austria Colour Cosmetics Market Trend

Digital-first Beauty Culture and Personalization of Beauty Routines

The continued expansion of digital beauty culture represents a sustained trend, reshaping product discovery, brand engagement, and purchasing behaviour through social media platforms and creator-led content. Today, product discovery and usage are increasingly led by digital platforms rather than physical in-store trying. For instance, with internet penetration at a remarkable 95% in Austria as of 2024, the majority of the population has access to beauty information and reviews. These make it easy for beauty trends and new beauty standards to spread.

Additionally, there is also a growing need for customized beauty rituals, as people crave beauty products that cater to their skin type, lifestyle, and beauty ideals. Skinification trends, long-wear formulations, and multipurpose lines indicate that people crave customized, high-performance beauty solutions, which is increasingly being made possible by digital platforms that provide customized content and recommendations from other users, making beauty routines more customized, dynamic, and self-directed.

Austria Colour Cosmetics Market Opportunity

Sustainable & Refillable Cosmetics for the Conscious end user

A significant opportunity arises from the increased environmental conscientiousness evident in the Austrian community as well as the desire for eco-friendly and hence refillable cosmeceuticals. According to European statistics for environmental protection and waste management, Austria has appeared prominently as a country in the European Union that exhibits a high recycling level and environmental conscientiousness. Although specific statistics concerning the disposal of cosmeceuticals do not exist, the Austrian market end users display strong environmental concern and favor environmentally oriented products. This environmental inclination indicates a good willingness to accept the concept of the refillable cosmeceutical cases, lipsticks, mascaras, and compact powder holders.

Moreover, given that 95% of the adult population is utilizing the internet, the messages that resonate with sustainability can reach many end users in a short period. This is because end users with environmentally conscious ideals can be targeted through refill packaging, openness in ingredient information, and sustainable procurement practices, thus attracting them as loyal end users. With these coming together, it is apparent that growth in eco-luxury ethical colour cosmetics in Austria is an opportunity.

Austria Colour Cosmetics Market Segmentation Analysis

By Category

- Eye Make-Up

- Eye Liner/Pencil

- Eye Shadow

- Mascara

- Others

- Facial Make-Up

- BB/CC Creams

- Blusher/Bronzer/Highlighter

- Foundation/Concealer

- Powder

- Others

- Lip Products

- Lip Gloss

- Lip Liner/Pencil

- Lipstick

- Others

- Nail Products

- Nail Polish

- Nail Treatments/Strengthener

- Polish Remover

- Others

- Colour Cosmetics Sets/Kits

The segment with highest market share under Category is eye make-up, which took home 30% market share in the Austrian market for color cosmetics. Eye make-up led in terms of both volume and value, with end users preferring products that long last in the market and have the ability to enhance the eyes. Mascara in particular was the most commonly used product.

Social media and Skinification trends drove these demands, as end users looked for products that deliver performance as well as skin benefits. Influencer content drove trial and discovery, and purchase intentions were driven further by beauty experts in stores. All these led to a significant share being maintained by eye makeup.

By Sales Channel

- Retail Offline

- Retail Online

The segment with highest market share under Sales Channel is retail offline, which accounted for 75% of the share . Beauty specialist retailers were the single most important outlet for contributing to value sales through offline, with end users offered various product ranges, end user experiences, free consultations, and loyalty schemes that aided trade-up behaviour and loyalty.

Supermarkets and health and beauty retailers also promoted offline dominance through the offer of both mass and premium brands and the running of promotions. Although the e-commerce market was the most rapidly growing market, the professional services and availability associated with offline shopping ensured that this remained the main marketplace for the purchase of colour cosmetics.

List of Companies Covered in Austria Colour Cosmetics Market

The companies listed below are highly influential in the Austria colour cosmetics market, with a significant market share and a strong impact on industry developments.

- Christian Dior GmbH

- Kiko Austria GmbH

- Chanel GmbH

- L'Oréal Österreich GmbH

- Cosnova GmbH

- Coty Prestige Austria GmbH

- Estée Lauder Cosmetics GesmbH

- Rewe International AG

- dm-Drogerie Markt GmbH & Co KG

- Amway GmbH

Competitive Landscape

The Leading the color cosmetics market in 2024 was L'Oréal Österreich followed by dm-Drogeriemarkt. The extensive product range offered by L'Oréal Österreich in the mass market and premium brands such as L'Oréal Paris, NYX PRO, Lancome, Maybelline New York, essie, and Urban Decay helped the company lead. Maybelline was the market leader in sales overall; however, NYX PRO had the greatest growth. Through a record investment in digital and celebrity advertising campaigns like Kendall Jenner and Cara Delevingne, end users increasingly recognized the company. Additionally, sustainability priorities via "L'Oréal for the Future" helped build greater trust. Not far behind was dm-Drogeriemarkt as the company with the greatest growth. DM used their expansive store chains, competitiveness on prices, and developing private brands such as trend !T Up, s.he colour & style, and alverde Naturkosmetik. These brands drew attention for offering high-quality and lasting formulas at a low price. Such strong global brands with burgeoning creative private brands created a more diverse market for color cosmetics in the Austrian market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Austria Colour Cosmetics Market Policies, Regulations, and Standards

4. Austria Colour Cosmetics Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Austria Colour Cosmetics Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Eye Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Eye Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Eye Shadow- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Mascara- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Facial Make-Up- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. BB/CC Creams- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Blusher/Bronzer/Highlighter- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Foundation/Concealer- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Powder- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Lip Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.1. Lip Gloss- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.2. Lip Liner/Pencil- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.3. Lipstick- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Nail Products- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.1. Nail Polish- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.2. Nail Treatments/Strengthener- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.3. Polish Remover- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Price

5.2.2.1. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Mass- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Gender

5.2.3.1. Men- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Women- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Unisex- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Packaging Type

5.2.4.1. Travel/Mini Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Standard Size - Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Professional/Salon Size- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Form

5.2.5.1. Creams/Gels- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Lotions- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Sprays- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Solid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Nature

5.2.6.1. Organic- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Inorganic- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Sales Channel

5.2.7.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.7.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.8.By Competitors

5.2.8.1. Competition Characteristics

5.2.8.2. Market Share & Analysis

6. Austria Eye Make-Up Colour Cosmetics Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

6.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

6.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7. Austria Facial Make-Up Colour Cosmetics Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

7.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

7.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

8. Austria Lip Products Colour Cosmetics Market Statistics, 2022-2032

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in USD Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

8.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

8.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

9. Austria Nail Products Colour Cosmetics Market Statistics, 2022-2032

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in USD Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Price- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Gender- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

9.2.5.By Form- Market Insights and Forecast 2022-2032, USD Million

9.2.6.By Nature- Market Insights and Forecast 2022-2032, USD Million

9.2.7.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

10. Austria Colour Cosmetics Sets/Kits Colour Cosmetics Market Statistics, 2022-2032

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in USD Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Price- Market Insights and Forecast 2022-2032, USD Million

10.2.2. By Gender- Market Insights and Forecast 2022-2032, USD Million

10.2.3. By Packaging Type- Market Insights and Forecast 2022-2032, USD Million

10.2.4. By Form- Market Insights and Forecast 2022-2032, USD Million

10.2.5. By Nature- Market Insights and Forecast 2022-2032, USD Million

10.2.6. By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

11. Competitive Outlook

11.1. Company Profiles

11.1.1. L'Oréal Österreich GmbH

11.1.1.1. Business Description

11.1.1.2. Product Portfolio

11.1.1.3. Collaborations & Alliances

11.1.1.4. Recent Developments

11.1.1.5. Financial Details

11.1.1.6. Others

11.1.2. Cosnova GmbH

11.1.2.1. Business Description

11.1.2.2. Product Portfolio

11.1.2.3. Collaborations & Alliances

11.1.2.4. Recent Developments

11.1.2.5. Financial Details

11.1.2.6. Others

11.1.3. Coty Prestige Austria GmbH

11.1.3.1. Business Description

11.1.3.2. Product Portfolio

11.1.3.3. Collaborations & Alliances

11.1.3.4. Recent Developments

11.1.3.5. Financial Details

11.1.3.6. Others

11.1.4. Estée Lauder Cosmetics GesmbH

11.1.4.1. Business Description

11.1.4.2. Product Portfolio

11.1.4.3. Collaborations & Alliances

11.1.4.4. Recent Developments

11.1.4.5. Financial Details

11.1.4.6. Others

11.1.5. Rewe International AG

11.1.5.1. Business Description

11.1.5.2. Product Portfolio

11.1.5.3. Collaborations & Alliances

11.1.5.4. Recent Developments

11.1.5.5. Financial Details

11.1.5.6. Others

11.1.6. Christian Dior GmbH, Parfums

11.1.6.1. Business Description

11.1.6.2. Product Portfolio

11.1.6.3. Collaborations & Alliances

11.1.6.4. Recent Developments

11.1.6.5. Financial Details

11.1.6.6. Others

11.1.7. Kiko Austria GmbH

11.1.7.1. Business Description

11.1.7.2. Product Portfolio

11.1.7.3. Collaborations & Alliances

11.1.7.4. Recent Developments

11.1.7.5. Financial Details

11.1.7.6. Others

11.1.8. Chanel GmbH

11.1.8.1. Business Description

11.1.8.2. Product Portfolio

11.1.8.3. Collaborations & Alliances

11.1.8.4. Recent Developments

11.1.8.5. Financial Details

11.1.8.6. Others

11.1.9. dm-Drogerie Markt GmbH & Co KG

11.1.9.1. Business Description

11.1.9.2. Product Portfolio

11.1.9.3. Collaborations & Alliances

11.1.9.4. Recent Developments

11.1.9.5. Financial Details

11.1.9.6. Others

11.1.10. Amway GmbH

11.1.10.1.Business Description

11.1.10.2.Product Portfolio

11.1.10.3.Collaborations & Alliances

11.1.10.4.Recent Developments

11.1.10.5.Financial Details

11.1.10.6.Others

12. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Price |

|

| By Gender |

|

| By Packaging Type |

|

| By Form |

|

| By Nature |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.