Germany Premium Beauty and Personal Care Market Report: Trends, Growth and Forecast (2025-2030)

By Product (Colour Cosmetics, Fragrances, Deodorants, Hair Care, Skin Care, Bath and Shower, Baby and Child-specific Products), By End User (Men’s, Women’s, Unisex), By Sales Channel (Online, Offline)

- FMCG

- Oct 2025

- VI0032

- 122

-

Germany Premium Beauty and Personal Care Market Statistics, 2025

- Market Size Statistics

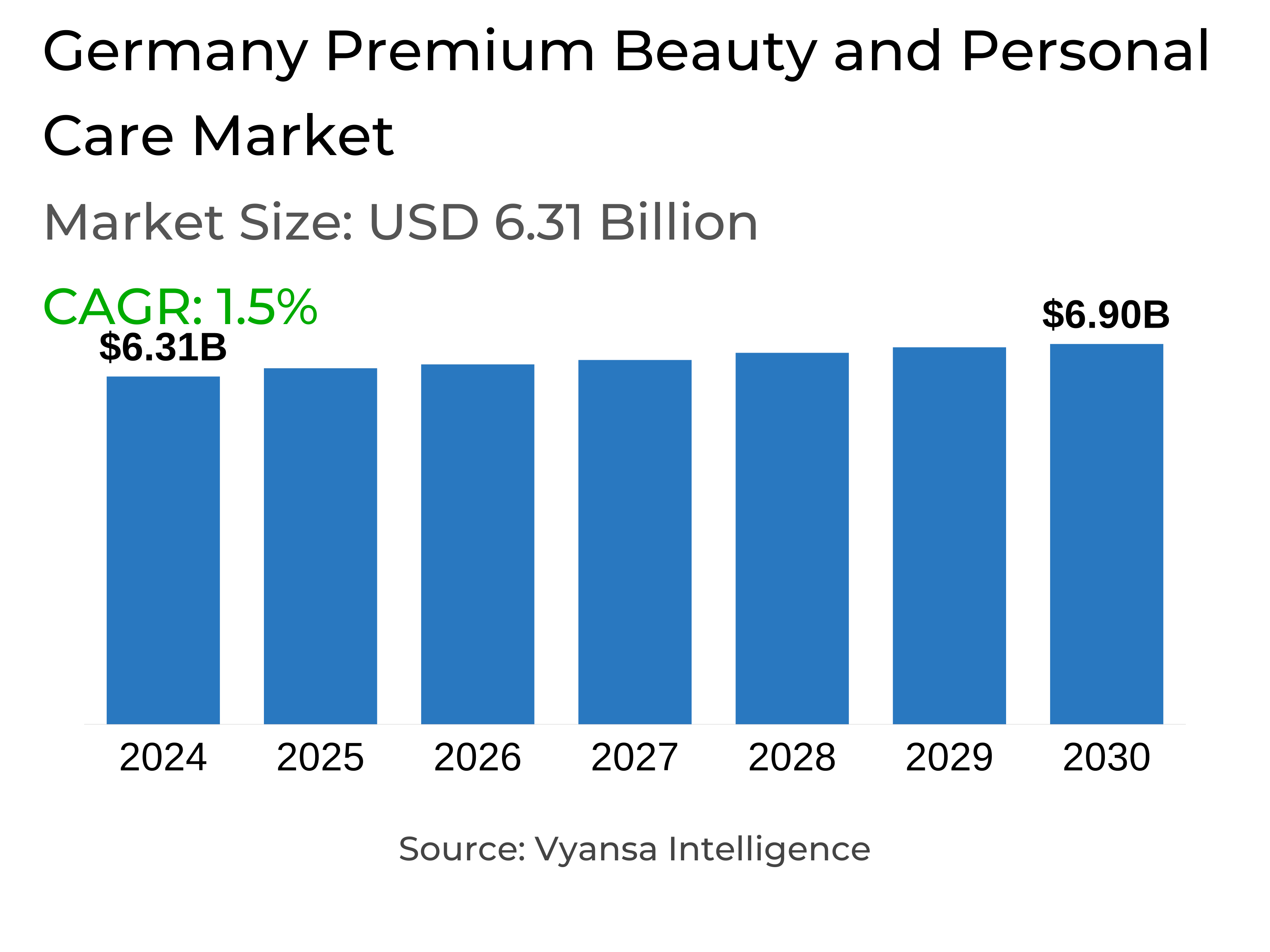

- Premium Beauty and Personal Care in Germany is estimated at $ 6.31 Billion.

- The market size is expected to grow to $ 6.9 Billion by 2030.

- Market to register a CAGR of around 1.5% during 2025-30.

- Product Shares

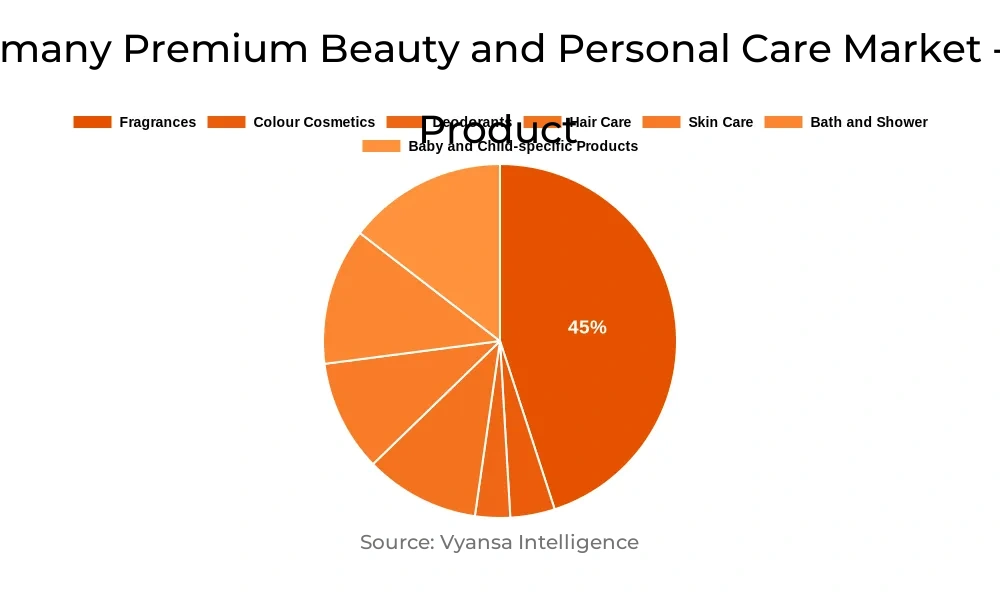

- Premium Fragrances grabbed market share of 45%.

- Competition

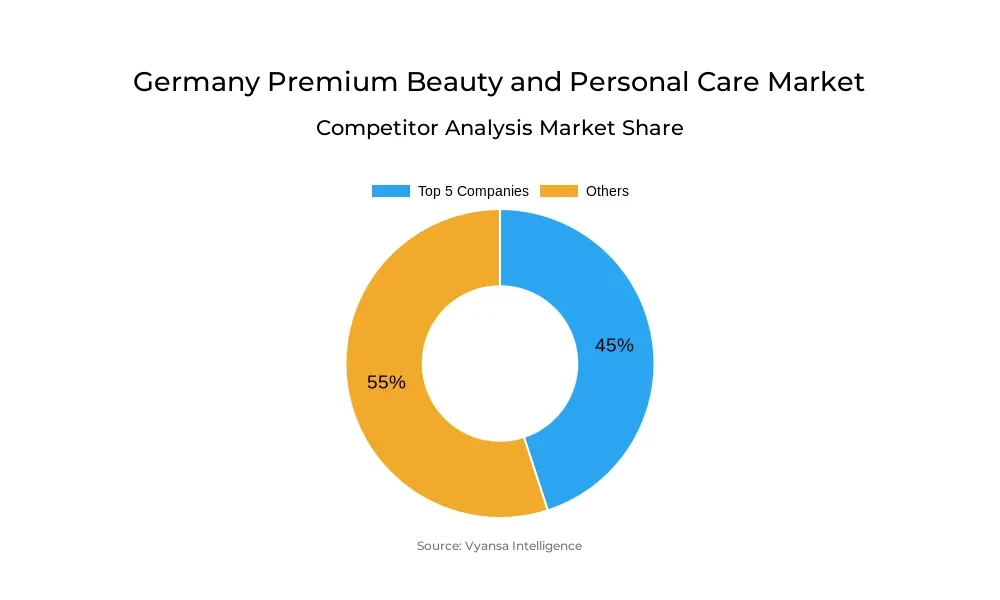

- More than 20 companies are actively engaged in producing Premium Beauty and Personal Care in Germany.

- Top 5 companies acquired 45% of the market share.

- Puig Deutschland GmbH, Kao Germany GmbH, Rituals Cosmetics Germany GmbH, L'Oréal Deutschland GmbH, Coty Deutschland GmbH etc., are few of the top companies.

Germany Premium Beauty and Personal Care Market Outlook

Germany premium beauty and personal care market will keep on rising gradually from 2025 through to 2030. Affluent consumers opt for premium products since they perceive them as an investment in their health. They emphasize quality rather than quantity, opting for fewer high-end brands compared to a high number of mass-market goods. Premium fragrance, skincare, and color cosmetics categories will be in demand. Even as color cosmetics have seen their share of challenges, high-end foundations and other products remain popular among consumers who value product quality and skin benefits.

The "lipstick effect" that sees consumers purchase smaller luxuries in times of economic uncertainty will continue to hold. High-end consumers spend money on fewer, better-quality products, not many low-cost ones. This development favors premium beauty since consumers can pay extra for luxury and efficacy even in tough times. Dermocosmetics skincare will also develop well with stronger growth, led by greater skin health awareness and demand for products that enhance the appearance and health of the skin.

Post-pandemic socializing will continue to fuel premium fragrances and deodorant sales and premium sun care products, as increased sun protection awareness lifts the category. Technology will play a significant part in enabling people to select the correct products. Virtual and augmented reality gadgets are innovations that will enable people to try on makeup virtually and discover tailored-to-their-needs skincare, making it easier and more interactive to shop online.

Sustainability and natural ingredients will grow as priorities among consumers, prompting brands to develop eco-friendly, biodegradable products. Customized beauty experiences will become highly desirable, with consumers preferring brands that are effective. Although premium-led, discounts and promotions will continue to be crucial in the market, allowing premium products to reach more consumers. In total, the premium sector will continue to outpace the mass market and experience consistent value growth over the next few years.

Germany Premium Beauty and Personal Care Market Growth Driver

Premium beauty and personal care market is poised to continue stable value growth throughout the forecast period. This is being stimulated by more affluent consumers who still highly value premium products, such that this segment is performing better than mass-market equivalents. There is a high prospect in specialist goods and premium dermocosmetics, particularly those with added values such as skincare or colour cosmetics containing UV protection. These crossovers are generating new opportunities, further enhancing the segment's popularity. In sum, the continued demand for quality, effective, and innovative premium products is a major driver pushing the market ahead through 2025-30.

Germany Premium Beauty and Personal Care Market Trend

A sustainable strategy has become essential, with high-end beauty and personal care companies increasingly under pressure to responsibly source ingredients and create natural, degradable formulas. Through the fusion of natural ingredients with science, these products can be both highly effective and safe, answering the increasing demand for environmentally friendly options.

Meanwhile, consumers increasingly look for individualised experiences that confer precise benefits to suit specific requirements. Identifiable branding and established efficacy are key drivers in their selection. Dermocosmetics can benefit immensely from these tendencies, as they effectively merge individualised care with sustainable, reliable formulations. It is anticipated that this fusion will drive strong market growth in the dermocosmetics category during the forecasting period.

Germany Premium Beauty and Personal Care Market Opportunity

Promotion and discount are the main factors behind the sales, even in the premium category. Promotion activities continue to be a key element of competition across beauty and personal care, food, and home care segments. Shoppers keep finding products discounted across price levels so they can buy as per brand or price preference. This poses a very strong opportunity for brands to entice more purchase by offering good timing promotions.

Discounting is a major sales strategy for retailers as well, but one that supplements their promotional efforts from the brands. Discounting premium products brings them within reach and within the purchasing power of a greater number of consumers, including younger mass consumers. This allows a lot of consumers to opt out of buying several mass-market equivalent products in favor of a single discounted premium product, offering a huge growth path for premium brands.

| Report Coverage | Details |

|---|---|

| Market Forecast | 2025-30 |

| USD Value 2024 | $ 6.31 Billion |

| USD Value 2030 | $ 6.9 Billion |

| CAGR 2025-2030 | 1.5% |

| Largest Category | Premium Fragrances segment leads with 45% market share |

| Top Drivers | Strong Demand from Affluent Consumers Fuels Growth |

| Top Trends | Sustainability and Personalisation Driving Market Growth |

| Top Opportunities | Promotions and Discounting Boost Accessibility and Growth |

| Key Players | Puig Deutschland GmbH, Kao Germany GmbH, Rituals Cosmetics Germany GmbH, L'Oréal Deutschland GmbH, Coty Deutschland GmbH, Estée Lauder Cos GmbH, LVMH Perfumes & Cosmetics GmbH, Chanel GmbH, Pierre Fabre Dermo-Kosmetik GmbH, Weleda AG and Others. |

Germany Premium Beauty and Personal Care Market Segmentation

Premium Fragrances possesses the highest market share in Premium Beauty and Personal Care Market. The reason behind this robust performance is users resuming social lives post-pandemic and the extensive portfolio of premium fragrances offered at department stores. The rising social activity urges users to use these luxury fragrances more often, which leads to a huge boost in sales.

Premium Sun Care also has a significant share, as a result of increasing knowledge regarding sun protection. In addition to this, Premium Colour Cosmetics are still doing well. Premium Deodorants are also growing, which suggests that people are using deodorant more often in their day-to-day lives.

Top Companies in Germany Premium Beauty and Personal Care Market

The top companies operating in the market include Puig Deutschland GmbH, Kao Germany GmbH, Rituals Cosmetics Germany GmbH, L'Oréal Deutschland GmbH, Coty Deutschland GmbH, Estée Lauder Cos GmbH, LVMH Perfumes & Cosmetics GmbH, Chanel GmbH, Pierre Fabre Dermo-Kosmetik GmbH, Weleda AG, etc., are the top players operating in the Germany Premium Beauty and Personal Care Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Germany Premium Beauty and Personal Care Market Policies, Regulations, and Standards

4. Germany Premium Beauty and Personal Care Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Germany Premium Beauty and Personal Care Market Statistics, 2020-2030F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Product

5.2.1.1. Colour Cosmetics- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.1. Eye Make-Up- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.2. Facial Make-Up- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.3. Lip Products- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.4. Nail Products- Market Insights and Forecast 2020-2030, USD Million

5.2.1.1.5. Colour Cosmetics Sets/Kits- Market Insights and Forecast 2020-2030, USD Million

5.2.1.2. Fragrances- Market Insights and Forecast 2020-2030, USD Million

5.2.1.3. Deodorants- Market Insights and Forecast 2020-2030, USD Million

5.2.1.4. Hair Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5. Skin Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.1. Body Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.2. Facial Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.3. Hand Care- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.4. Skin Care Sets/Kits- Market Insights and Forecast 2020-2030, USD Million

5.2.1.5.5. Sun Protection- Market Insights and Forecast 2020-2030, USD Million

5.2.1.6. Bath and Shower- Market Insights and Forecast 2020-2030, USD Million

5.2.1.7. Baby and Child-specific Products- Market Insights and Forecast 2020-2030, USD Million

5.2.2.By End User

5.2.2.1. Men’s- Market Insights and Forecast 2020-2030, USD Million

5.2.2.2. Women’s- Market Insights and Forecast 2020-2030, USD Million

5.2.2.3. Unisex- Market Insights and Forecast 2020-2030, USD Million

5.2.3.By Sales Channel

5.2.3.1. Online- Market Insights and Forecast 2020-2030, USD Million

5.2.3.2. Offline- Market Insights and Forecast 2020-2030, USD Million

5.2.4.By Competitors

5.2.4.1. Competition Characteristics

5.2.4.2. Market Share & Analysis

6. Germany Premium Colour Cosmetics Market Outlook, 2020-2030F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2020-2030, USD Million

6.2.2.By End User- Market Insights and Forecast 2020-2030, USD Million

6.2.3.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

7. Germany Premium Fragrances Market Outlook, 2020-2030F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By End User- Market Insights and Forecast 2020-2030, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

8. Germany Premium Deodorants Market Outlook, 2020-2030F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By End User- Market Insights and Forecast 2020-2030, USD Million

8.2.2.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

9. Germany Premium Hair Care Market Outlook, 2020-2030F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By End User- Market Insights and Forecast 2020-2030, USD Million

9.2.2.By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

10. Germany Premium Skin Care Market Outlook, 2020-2030F

10.1. Market Size & Growth Outlook

10.1.1. By Revenues in US$ Million

10.2. Market Segmentation & Growth Outlook

10.2.1. By Product- Market Insights and Forecast 2020-2030, USD Million

10.2.2. By End User- Market Insights and Forecast 2020-2030, USD Million

10.2.3. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

11. Germany Premium Bath and Shower Market Outlook, 2020-2030F

11.1. Market Size & Growth Outlook

11.1.1. By Revenues in US$ Million

11.2. Market Segmentation & Growth Outlook

11.2.1. By End User- Market Insights and Forecast 2020-2030, USD Million

11.2.2. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

12. Germany Premium Baby and Child-specific Products Market Outlook, 2020-2030F

12.1. Market Size & Growth Outlook

12.1.1. By Revenues in US$ Million

12.2. Market Segmentation & Growth Outlook

12.2.1. By Sales Channel- Market Insights and Forecast 2020-2030, USD Million

13. Competitive Outlook

13.1. Company Profiles

13.1.1. L'Oréal Deutschland GmbH

13.1.1.1. Business Description

13.1.1.2. Product Portfolio

13.1.1.3. Collaborations & Alliances

13.1.1.4. Recent Developments

13.1.1.5. Financial Details

13.1.1.6. Others

13.1.2. Coty Deutschland GmbH

13.1.2.1. Business Description

13.1.2.2. Product Portfolio

13.1.2.3. Collaborations & Alliances

13.1.2.4. Recent Developments

13.1.2.5. Financial Details

13.1.2.6. Others

13.1.3. Estée Lauder Cos GmbH

13.1.3.1. Business Description

13.1.3.2. Product Portfolio

13.1.3.3. Collaborations & Alliances

13.1.3.4. Recent Developments

13.1.3.5. Financial Details

13.1.3.6. Others

13.1.4. LVMH Perfumes & Cosmetics GmbH

13.1.4.1. Business Description

13.1.4.2. Product Portfolio

13.1.4.3. Collaborations & Alliances

13.1.4.4. Recent Developments

13.1.4.5. Financial Details

13.1.4.6. Others

13.1.5. Chanel GmbH

13.1.5.1. Business Description

13.1.5.2. Product Portfolio

13.1.5.3. Collaborations & Alliances

13.1.5.4. Recent Developments

13.1.5.5. Financial Details

13.1.5.6. Others

13.1.6. Puig Deutschland GmbH

13.1.6.1. Business Description

13.1.6.2. Product Portfolio

13.1.6.3. Collaborations & Alliances

13.1.6.4. Recent Developments

13.1.6.5. Financial Details

13.1.6.6. Others

13.1.7. Kao Germany GmbH

13.1.7.1. Business Description

13.1.7.2. Product Portfolio

13.1.7.3. Collaborations & Alliances

13.1.7.4. Recent Developments

13.1.7.5. Financial Details

13.1.7.6. Others

13.1.8. Rituals Cosmetics Germany GmbH

13.1.8.1. Business Description

13.1.8.2. Product Portfolio

13.1.8.3. Collaborations & Alliances

13.1.8.4. Recent Developments

13.1.8.5. Financial Details

13.1.8.6. Others

13.1.9. Pierre Fabre Dermo-Kosmetik GmbH

13.1.9.1. Business Description

13.1.9.2. Product Portfolio

13.1.9.3. Collaborations & Alliances

13.1.9.4. Recent Developments

13.1.9.5. Financial Details

13.1.9.6. Others

13.1.10. Weleda AG

13.1.10.1. Business Description

13.1.10.2. Product Portfolio

13.1.10.3. Collaborations & Alliances

13.1.10.4. Recent Developments

13.1.10.5. Financial Details

13.1.10.6. Others

14. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Product |

|

| By End User |

|

| By Sales Channel |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.