Germany Main Battle Tanks Market Report: Trends, Growth and Forecast (2026-2032)

By Weight (Light Weight, Medium Weight, Heavy Weight), By Solution (Line Fit, Retro Fit), By Component (Turret System, Internal Combustion Engine, Wheel and Track, Situational Awareness, Weaponry Systems, Others)

- Aerospace & Defense

- Nov 2025

- VI0419

- 125

-

Germany Main Battle Tanks Market Statistics and Insights, 2026

- Market Size Statistics

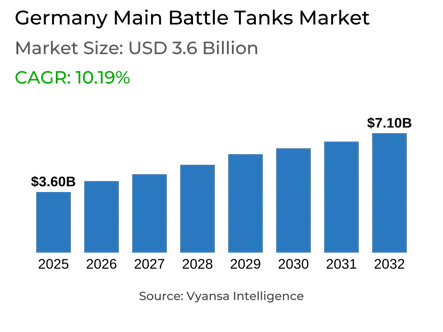

- Main Battle Tanks in Germany is estimated at $ 3.6 Billion.

- The market size is expected to grow to $ 7.1 Billion by 2032.

- Market to register a CAGR of around 10.19% during 2026-32.

- Component Shares

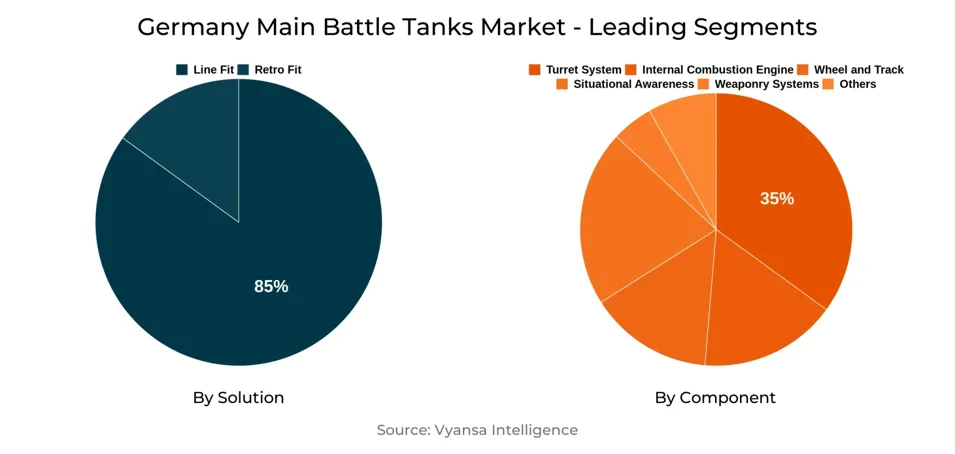

- Turret System grabbed market share of 35%.

- Turret System to witness a volume CAGR of around 7.46%.

- Competition

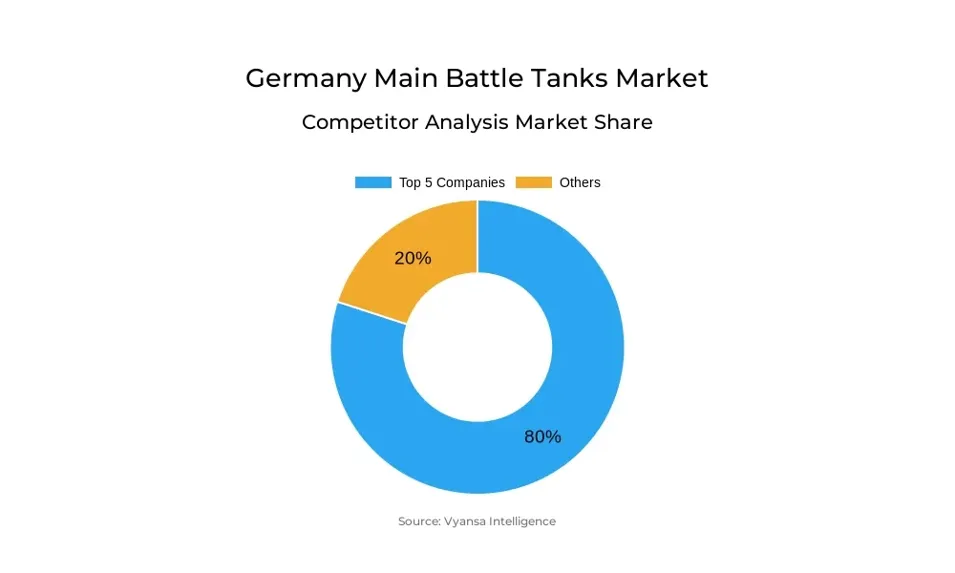

- More than 10 companies are actively engaged in producing Main Battle Tanks in Germany.

- Top 5 companies acquired 80% of the market share.

- Diehl Defence, EuroTrophy, Thyssenkrupp, KNDS Deutschland, Rheinmetall AG etc., are few of the top companies.

- Solution

- Line Fit grabbed 85% of the market.

Germany Main Battle Tanks Market Outlook

The Germany main battle tanks market is valued at USD 3.6 billion currently and is expected to grow to USD 7.1 billion by 2032. This high growth is an indication of the modernization of the armored fleet as well as boosting the production capacity in the country to serve local defense requirements and those of NATO. Germany's rising defense expenditure is also driving the need for these tanks, and this has been a conducive environment for the supply chain and manufacturers in the industry.

The most important part in the market is the turret system, which has a crucial function in combat effectiveness. The turret system is anticipated to develop at a volume CAGR of roughly 7.46% between 2026 and 2032, backed by technology upgrades and the fusion of enhanced digital and targeting capabilities. This indicates the significance of subsystems to contribute towards overall market growth and improve battlefield performance.

Market competition is concentrated, with the top five firms controlling approximately 80% of market share, indicative of a high level of market concentration among market leaders. They are supported by giant government orders and robust export prospects, further fortifying their market positions.

Regarding the solution, line fit leads by far with 85% market share. The demand is driven by the need for the installation of systems from the factory in new tanks, ensuring that they can be used operationally as soon as possible and minimizing later adjustments. As there is still ongoing procurement of upgraded main battle tanks, line fit will remain the solution of choice, again solidifying its dominant position in Germany.

Germany Main Battle Tanks Market Growth Driver

Rising Geopolitical Tensions and NATO Commitments Driving Demand

In face of mounting geopolitical tensions, especially in the wake of Russia's incursion into Ukraine in 2022, Germany has pledged to significantly step up its defense expenditure. The nation seeks to increase its defense spending to 3.5% of GDP by 2029, outpacing NATO's current 2% target and meeting the alliance's expanded defense investment goals. This pledge entails a USD 117.20 billion modernization fund to improve military capabilities, such as the acquisition of advanced main battle tanks like the Leopard 2A8. These initiatives are meant to enhance Germany's defense posture and meet NATO's readiness standards.

To achieve these aims, Germany has commissioned the acquisition of 105 Leopard 2A8 tanks in a USD 3.40 billion deal, with deliveries set for 2027-2030. The tanks are meant to arm a NATO combat brigade in Lithuania to boost deterrence in Eastern Europe. Germany also intends to buy 18 Leopard 2A8 tanks to replace those provided to Ukraine earlier, marking a strategic move to replenish and upgrade its armor forces.

Germany Main Battle Tanks Market Challenge

High Production and Maintenance Costs Increasing Financial Pressure

The creation and acquisition of cutting-edge main battle tanks impose a considerable financial strain on Germany’s defense industry. The Leopard 2A8 initiative serves as a prime illustration, featuring a recent contract valued at approximately USD 3,140 million for 105 tanks, averaging close to USD 30 million per unit. The elevated expenses per platform hinder the ability to scale production, particularly when significant quantities are needed to fulfill NATO obligations. Besides acquisition, modern systems featuring digital fire control, AI integration, and modular armor considerably elevate unit expenses in relation to earlier Leopard versions.

Maintenance imposes an additional level of financial strain. Running a Leopard 2 tank can incur expenses of several hundred thousand dollars each year when considering spare parts, fuel, training, and upgrades throughout its lifecycle. Throughout a 30-year duration of service, the total long-term ownership expense frequently surpasses the original acquisition cost. For Germany and its industrial associates, reconciling the necessity for advanced capabilities with the constraints of budget limitations continues to be a significant challenge in achieving affordability while fulfilling NATO readiness standards.

Germany Main Battle Tanks Market Trend

Autonomous & AI-Enabled Systems Improving Operational Efficiency

The adoption of artificial intelligence and autonomous technologies has been a top trend in Germany's principal battle tank industry. The two technologies are utilized to enhance target acquisition, battlefield awareness, and battlefield decision-making. Rheinmetall's Panther KF51, for example, which was showcased in 2022, features an AI-aided fire control and the capability to be paired with unmanned turrets and drones while it is driving. This saves crew workload and enhances efficiency, particularly in high-intensity environments of combat where speed and accuracy are paramount.

Market players are making massive investments in such technologies since they give them a competitive advantage in domestic procurement as well as exports. Germany's more than USD 108,890 million defense modernization fund has allocated a major portion for digital and AI-supported platforms. Adopting AI-based systems, manufacturers like Rheinmetall are not only fulfilling NATO's digital warfare needs but also making German tanks leaders in the future armored warfare.

Germany Main Battle Tanks Market Opportunity

Replacement of Ageing Leopard 2 Fleet Offering Lucrative Opportunity

Germany's Leopard 2 tank fleet, which is vital to its armored forces, is aging, with many of its tanks dating back to the 1980s and 1990s. With various incremental modifications, still a significant percentage of these tanks do not meet NATO's evolving standards of combat readiness. In response to this, the government has launched large-scale modernization and replacement programs. In 2023, Berlin closed a deal of about USD 3,140 million for 105 Leopard 2A8 tanks, to be delivered between 2027 and 2030. In addition, smaller deals such as the exchange of 18 Leopard 2A8 tanks for those supplied to Ukraine have already been made, an indication that procurement will continue on a steady basis rather than a onetime event.

This cycle of replacement presents a major business opportunity for main contractors like KNDS Germany, as well as component suppliers. The program creates demand not only for new MBTs but also for advanced fire control systems, active protection systems, and digital battlefield integration technologies. Apart from Germany's domestic orders, other allied nations such as Norway and the Czech Republic have placed Leopard 2A8 orders worth USD 1,880 million and USD 1,560 million, respectively, highlighting the ripple effect that German modernization has in spurring change across Europe. The combination of domestic fleet upgrading and spill-over demand positions the Leopard 2 replacement program as a multi-billion-dollar growth opportunity for the MBT industry over the next decade.

Germany Main Battle Tanks Market Segmentation Analysis

By Component

- Turret System

- Internal Combustion Engine

- Wheel and Track

- Situational Awareness

- Weaponry Systems

- Others

The most preferred segment with the largest market share in the component category is the Turret System, which held almost 35% of the Germany main battle tank market in 2026. The large market share of turret systems is attributed mainly to their paramount importance in upgrading combat performance, adding sophisticated fire control, and supporting future-generation weapon systems. This leadership role demonstrates consistent investments in the modernization of current Leopard 2 fleets and the acquisition of highly advanced variants like the Leopard 2A8, which depend significantly on advanced turret technology for better battlefield performance.

In the future, the turret system segment is anticipated to continue its strong growth trajectory, with a volume CAGR of approximately 7.46% over 2026–2032. This growth is underpinned by Germany's plans for modernization under its USD 108,900 million defense investment fund that focuses on next-generation tank upgrades. Ongoing demand for digitalized and AI-fitted turret subsystems will also keep turret systems as the biggest and fastest-growing segment in the nation's main battle tank market.

By Solution

- Line Fit

- Retro Fit

The most dominant segment of the solution type is Line Fit, with a market share of around 85% of the Germany main battle tank market in the year 2026. Line fit is largely dominant since the majority of newly produced tanks like the Leopard 2A8 are being shipped with up-to-date systems already installed, making them combat-ready from the start. This preference lowers the necessity of expensive retrofitting and underscores Germany's emphasis on bringing its armored fleet up to date according to NATO standards.

Throughout the forecast period 2026–2032, the line fit segment will continue its strong leadership, supported by Germany's large-scale procurement drives under its USD 108,900 million defense modernization initiative. Through high-value contracts for main battle tanks prioritizing factory-installed solutions, suppliers remain keen on providing integrated, cutting-edge systems. Consequently, line fit is likely to stay the solution of choice, enhancing its dominance in the nation's main battle tank sector.

Top Companies in Germany Main Battle Tanks Market

The top companies operating in the market include Diehl Defence, EuroTrophy, Thyssenkrupp, KNDS Deutschland, Rheinmetall AG, Rolls-Royce Power Systems, HENSOLDT, RENK Group AG, GDELS (General Dynamics European Land Systems), Thales Group, etc., are the top players operating in the Germany Main Battle Tanks Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Germany Main Battle Tanks Market Policies, Regulations, and Standards

4. Germany Main Battle Tanks Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Germany Main Battle Tanks Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Weight

5.2.1.1. Light Weight- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Medium Weight- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Heavy Weight- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Solution

1.1.1.1. Line Fit- Market Insights and Forecast 2022-2032, USD Million

1.1.1.2. Retro Fit- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Component

1.1.1.3. Turret System- Market Insights and Forecast 2022-2032, USD Million

1.1.1.4. Internal Combustion Engine- Market Insights and Forecast 2022-2032, USD Million

1.1.1.5. Wheel and Track- Market Insights and Forecast 2022-2032, USD Million

1.1.1.6. Situational Awareness- Market Insights and Forecast 2022-2032, USD Million

1.1.1.7. Weaponry Systems- Market Insights and Forecast 2022-2032, USD Million

1.1.1.8. Others- Market Insights and Forecast 2022-2032, USD Million

1.1.2.By Competitors

1.1.2.1. Competition Characteristics

1.1.2.2. Market Share & Analysis

2. Germany Light Weight Main Battle Tanks Market Statistics, 2022-2032F

2.1. Market Size & Growth Outlook

2.1.1.By Revenues in US$ Million

2.2. Market Segmentation & Growth Outlook

2.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

2.2.2.By Solution- Market Insights and Forecast 2022-2032, USD Million

3. Germany Medium Weight Main Battle Tanks Market Statistics, 2022-2032F

3.1. Market Size & Growth Outlook

3.1.1.By Revenues in US$ Million

3.2. Market Segmentation & Growth Outlook

3.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

3.2.2.By Solution- Market Insights and Forecast 2022-2032, USD Million

4. Germany Heavy Weight Main Battle Tanks Market Statistics, 2022-2032F

4.1. Market Size & Growth Outlook

4.1.1.By Revenues in USD Million

4.2. Market Segmentation & Growth Outlook

4.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

4.2.2.By Solution- Market Insights and Forecast 2022-2032, USD Million

5. Competitive Outlook

5.1. Company Profiles

5.1.1.KNDS Deutschland

5.1.1.1. Business Description

5.1.1.2. Product Portfolio

5.1.1.3. Collaborations & Alliances

5.1.1.4. Recent Developments

5.1.1.5. Financial Details

5.1.1.6. Others

5.1.2.Rheinmetall AG

5.1.2.1. Business Description

5.1.2.2. Product Portfolio

5.1.2.3. Collaborations & Alliances

5.1.2.4. Recent Developments

5.1.2.5. Financial Details

5.1.2.6. Others

5.1.3.Rolls-Royce Power Systems

5.1.3.1. Business Description

5.1.3.2. Product Portfolio

5.1.3.3. Collaborations & Alliances

5.1.3.4. Recent Developments

5.1.3.5. Financial Details

5.1.3.6. Others

5.1.4.HENSOLDT

5.1.4.1. Business Description

5.1.4.2. Product Portfolio

5.1.4.3. Collaborations & Alliances

5.1.4.4. Recent Developments

5.1.4.5. Financial Details

5.1.4.6. Others

5.1.5.RENK Group AG

5.1.5.1. Business Description

5.1.5.2. Product Portfolio

5.1.5.3. Collaborations & Alliances

5.1.5.4. Recent Developments

5.1.5.5. Financial Details

5.1.5.6. Others

5.1.6.Diehl Defence

5.1.6.1. Business Description

5.1.6.2. Product Portfolio

5.1.6.3. Collaborations & Alliances

5.1.6.4. Recent Developments

5.1.6.5. Financial Details

5.1.6.6. Others

5.1.7.EuroTrophy

5.1.7.1. Business Description

5.1.7.2. Product Portfolio

5.1.7.3. Collaborations & Alliances

5.1.7.4. Recent Developments

5.1.7.5. Financial Details

5.1.7.6. Others

5.1.8.Thyssenkrupp

5.1.8.1. Business Description

5.1.8.2. Product Portfolio

5.1.8.3. Collaborations & Alliances

5.1.8.4. Recent Developments

5.1.8.5. Financial Details

5.1.8.6. Others

5.1.9.GDELS (General Dynamics European Land Systems)

5.1.9.1. Business Description

5.1.9.2. Product Portfolio

5.1.9.3. Collaborations & Alliances

5.1.9.4. Recent Developments

5.1.9.5. Financial Details

5.1.9.6. Others

5.1.10. Thales Group

5.1.10.1. Business Description

5.1.10.2. Product Portfolio

5.1.10.3. Collaborations & Alliances

5.1.10.4. Recent Developments

5.1.10.5. Financial Details

5.1.10.6. Others

6. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Weight |

|

| By Solution |

|

| By Component |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.