Germany Integrated Air and Missile Defence Market Report: Trends, Growth and Forecast (2026-2032)

By Range (Short Range (0.5-10 km), Medium Range (11-40 km), Long Range (Above 40 km)), By Product (Weapon Systems, Command & Control Systems, Radar Systems), By Installation Type (Fixed Systems, Portable Systems), By Components (Guidance Systems, Propulsion Systems, Sensors, Others), By Application (Military, Homeland Security, Critical Infrastructure Defence), By End-User (Army, Air Force, Navy)

- Aerospace & Defense

- Nov 2025

- VI0418

- 125

-

Germany Integrated Air and Missile Defence Market Statistics and Insights, 2026

- Market Size Statistics

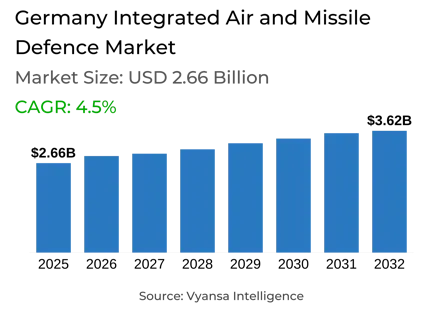

- Integrated Air and Missile Defence in Germany is estimated at $ 2.66 Billion.

- The market size is expected to grow to $ 3.62 Billion by 2032.

- Market to register a CAGR of around 4.5% during 2026-32.

- Product Shares

- Weapon Systems grabbed market share of 55%.

- Competition

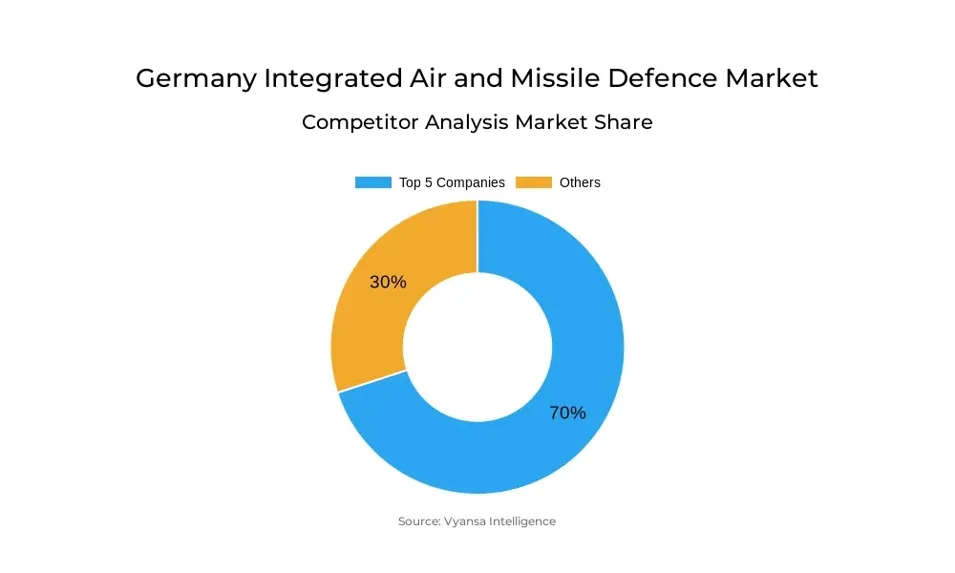

- More than 10 companies are actively engaged in producing Integrated Air and Missile Defence in Germany.

- Top 5 companies acquired 70% of the market share.

- Airbus SE, Lockheed Martin, Thales Deutschland, RTX Corporation, Rheinmetall AG etc., are few of the top companies.

- Application

- Military grabbed 70% of the market.

Germany Integrated Air and Missile Defence Market Outlook

The Germany Integrated Air and Missile Defence (IAMD) market is estimated at $2.66 Billion today and is expected to increase to $3.62 Billion by 2032, marking a consistent growth fueled by increasing security threats and ongoing modernization of the Bundeswehr defence capabilities. The market is significantly dominated, with the top three dominant players holding 70% of the overall share, reflecting the prominence of experienced vendors like Rheinmetall, Diehl Defence, HENSOLDT, MBDA Deutschland, and Lockheed Martin in the provision of cutting-edge air and missile defense solutions.

By product, weapon systems dominate the market, followed by command and control and radar systems, as Germany makes investments in multi-layered defense against aerial threats such as drones, ballistic, and cruise missiles. On application, the military segment constitutes the largest share at 70%, indicative of the country's foremost concern with national defense and NATO obligations, while homeland security and critical infrastructure defense constitute the balance of the market.

This growth potential is backed by Germany's continuing acquisition plans, such as Patriot missile battery acquisitions, IRIS-T SLM systems, and TLVS integration efforts, which together contribute to national air defense preparedness. Augmenting focus on domestic manufacturing and integration of next-generation C2 and sensor fusion capabilities is likely to further boost the market and offer opportunities for technology development and local industry involvement.

Overall, the German IAMD market will experience moderate growth over 2032, fueled by military investment strategy, consolidation among major suppliers, and increased emphasis on upgrading air and missile defense capabilities in response to emerging regional threats.

Germany Integrated Air and Missile Defence Market Growth Driver

Rising Geopolitical Tensions and NATO Commitments Boosting Demand

The market is witnessing tremendous growth because of mounting geopolitical tensions and the nation's strengthened commitments to NATO. The Russian invasion of Ukraine in 2022 increased security fears in Europe, which made Germany rethink its defense positioning. In reaction, Germany committed to raising its defense spending, with the aim of ensuring that it meets NATO's 2% GDP defense spending threshold. This promise has seen considerable spending on air defense infrastructure, such as the purchase of advanced technologies like the Patriot missile system and the IRIS-T SLM. For example, Germany spent around USD 11.76 billion on the purchase of the US-made Patriot system and USD 2.5 billion on the locally manufactured IRIS-T.

These strategic investments not only strengthen Germany's national defense but also enrich the overall European security architecture. Germany's inclusion in programs such as the European Sky Shield Initiative reiterates its dedication to multilateral defense and regional stability. Through the integration of cutting-edge air defense systems and the promotion of international partnerships, Germany is emerging as a central actor in NATO's defense infrastructure. This forward-looking strategy not only responds to immediate security concerns but also guarantees sustained security against future airborne threats, thus confirming Germany's status in ensuring a safe and secure Europe.

Germany Integrated Air and Missile Defence Market Challenge

Delay in the Procurement Cycle Impeding Growth

The procurement cycle delays have a major impact on the market, slowing down the acquisition and deployment of key defense systems. With higher defense budgets, multi-year approval procedures, bureaucratic processes, and coordination among agencies act as clogs that hinder timely delivery of systems like Patriot missile batteries and IRIS-T SLMs. These delays lower the readiness of the Bundeswehr, creating holes in air and missile defense coverage amid increasing geopolitical tensions in Europe.

In addition, slow purchasing cycles obstruct industrial momentum for German suppliers such as Rheinmetall, Diehl, and HENSOLDT. Production and workforce planning are impacted, as manufacturers cannot cost-effectively ramp up manufacturing without solid, on-time contracts. This unpredictability restricts investment in new technology and postpones the modernization of Germany's air defense architecture, constraining the country's capability to respond effectively to evolving aerial threats.

Germany Integrated Air and Missile Defence Market Trend

Integration of Advanced C2 & Sensor Fusion Shaping Market Dynamics

Germany's Integrated Air and Missile Defence market is becoming more defined by integration of state-of-the-art Command and Control (C2) systems with robust sensor fusion capabilities. The trend arises in response to the need to neutralize sophisticated and rapidly changing aerial threats in the form of drones, hypersonic missiles, and swarming doctrines. Contemporary air defence systems call for imperceptible interoperability of sensors, effectors, and C2 networks to provide instant and precise threat detection and engagement. For example, HENSOLDT's TRML-4D radar, which is one of the core elements of the IRIS-T SLM system, uses AI-driven target recognition to deliver real-time tracking of up to 1,500 targets to improve situational awareness and decision-making.

Some players in the industry are taking advantage of this by creating and implementing integrated solutions that merge sensor data fusion with sophisticated C2 architectures. HENSOLDT, together with Diehl Defence, is leading the way in this by employing software-defined architectures and advanced sensor fusion to enhance Germany's air defense. In addition, the ODIN'S EYE II program, under the leadership of OHB System AG, seeks to provide a European satellite-based early warning system against ballistic and hypersonic missiles, further highlighting the strategic value of combined sensor and C2 systems in contemporary defense strategies. The developments reflect a major trend towards network-centric, modular, and AI-based defense architectures in the market.

Germany Integrated Air and Missile Defence Market Opportunity

Extension of Air Defence to Homeland & Critical Infrastructure Offering Lucrative Opportunity

The market is experiencing a strategic realignment towards deploying air defense capabilities to safeguard the homeland and key infrastructure. This transition is fueled by increasing threats posed by state and non-state actors in the form of cyberattacks, drone swarms, and ballistic missiles, which threaten key sectors like energy, transport, and healthcare. The government's reaction involves the passage of the KRITIS law, which obliges operators in critical sectors to deploy particular protective measures for structures serving at least 500,000 individuals.

Industry experts are taking advantage of this situation by designing integrated systems with cutting-edge sensors, command and control systems, and effectors to protect strategic infrastructure. For example, HENSOLDT's TRML-4D radar and Diehl Defence's IRIS-T SLM system provide improved detection and interception capabilities and create a strong network of defense. In addition, the PEGASUS airborne reconnaissance system, which HENSOLDT is working on, will contribute to continuous surveillance and signal intelligence, further enhancing Germany's defense capabilities. These developments reflect an increasing focus on homeland defense in Germany's IAMD strategy.

Germany Integrated Air and Missile Defence Market Segmentation Analysis

By Product

- Weapon Systems

- Command & Control Systems

- Radar Systems

The largest market segment within the product category within Germany's Integrated Air and Missile Defence (IAMD) market is Weapon Systems, and it has captured 55% of the market. This is mainly powered by the Bundeswehr's increased procurement of sophisticated missile systems like the Patriot batteries and IRIS-T SLM units. Weapon systems are the fundamental element of Germany's IAMD concept, offering the main defensive capability against aerial and missile threats, including drones, ballistic missiles, and cruise missiles. The high percentage indicates continued investment in both domestically sourced and imported missile platforms to support building up the nation's layered air defense architecture.

Command & Control Systems and Radar Systems share the rest of the market, assisting the operational effectiveness of weapon systems. C2 systems facilitate effective coordination and timely decision-making, while radar systems assist in key detection and tracking. Overall, these segments support weapon systems, but the latter still dominate because of their direct effect on Germany's air and missile defence readiness and capability.

By Application

- Military

- Homeland Security

- Critical Infrastructure Defence

The most dominant segment in the Application category in Germany's Integrated Air and Missile Defence (IAMD) market is Military, with a strong 70% market share. The strong market share is fueled by the ongoing modernization programs of the Bundeswehr, such as the procurement of Patriot missile batteries, IRIS-T SLM systems, and TLVS integration. Its military applications are still the top priority of Germany's IAMD program, defending national airspace and key military infrastructure from air threats like drones, cruise missiles, and ballistic missiles. The high market share is a manifestation of significant government investment in readiness operations and sophisticated defensive capabilities.

The other application, including Homeland Security and Critical Infrastructure Defence, covers the remaining 30% of the market. These segments supplement military use by offering air defence capabilities to safeguard critical civilian infrastructure, such as airports, energy sites, and transportation facilities. The preponderant military segment, however, reflects Germany's strategic emphasis on maintaining strong national defence and NATO commitments.

Top Companies in Germany Integrated Air and Missile Defence Market

The top companies operating in the market include Airbus SE, Lockheed Martin, Thales Deutschland, RTX Corporation, Rheinmetall AG, HENSOLDT, Diehl Defence, MBDA Deutschland, Saab AB, Leonardo S.p.A., etc., are the top players operating in the Germany Integrated Air and Missile Defence Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Germany Integrated Air & Missile Defence Market Policies, Regulations, and Standards

4. Germany Integrated Air & Missile Defence Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Germany Integrated Air & Missile Defence Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Range

5.2.1.1. Short Range (0.5-10 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Medium Range (11-40 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Long Range (Above 40 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product

5.2.2.1. Weapon Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Command & Control Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Radar Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Installation Type

5.2.3.1. Fixed Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Portable Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Components

5.2.4.1. Guidance Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Propulsion Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Sensors- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Application

5.2.5.1. Military- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Homeland Security- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Critical Infrastructure Defence- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End-User

5.2.6.1. Army- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Air Force- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Navy - Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. Germany Short Range (0.5-10 km) Integrated Air & Missile Defence Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Installation Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Components- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End Users- Market Insights and Forecast 2022-2032, USD Million

7. Germany Medium Range (11-40 km) Integrated Air & Missile Defence Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Installation Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Components- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End Users- Market Insights and Forecast 2022-2032, USD Million

8. Germany Long Range (Above 40 km) Integrated Air & Missile Defence Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Installation Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Components- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By End Users- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.RTX Corporation

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Rheinmetall AG

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.HENSOLDT

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Diehl Defence

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.MBDA Deutschland

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Airbus SE

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Lockheed Martin

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Thales Deutschland

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.Saab AB

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Leonardo S.p.A.

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Range |

|

| By Product |

|

| By Installation Type |

|

| By Components |

|

| By Application |

|

| By End-User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.