Germany Infantry Fighting Vehicle Market Report: Trends, Growth and Forecast (2026-2032)

By Mobility (Wheeled, Tracked), By Configuration (Amphibious, Non-Amphibious), By Vehicle Type (Armored Personnel Carrier, Mechanized Infantry Combat Vehicle, Light Infantry Fighting Vehicle, Heavy Infantry Fighting Vehicle), By Fire Power (Low Caliber Armament, Medium Caliber Armament, High Caliber Armament), By Application (Combat, Armored Reconnaissance, Patrolling, Others), By By End User (Military, Paramilitary, Government)

- Aerospace & Defense

- Nov 2025

- VI0417

- 110

-

Germany Infantry Fighting Vehicle Market Statistics and Insights, 2026

- Market Size Statistics

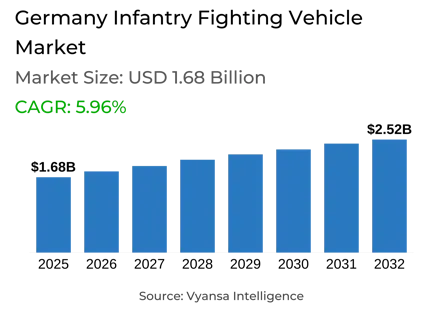

- Infantry Fighting Vehicle in Germany is estimated at $ 1.68 Billion.

- The market size is expected to grow to $ 2.52 Billion by 2032.

- Market to register a CAGR of around 5.96% during 2026-32.

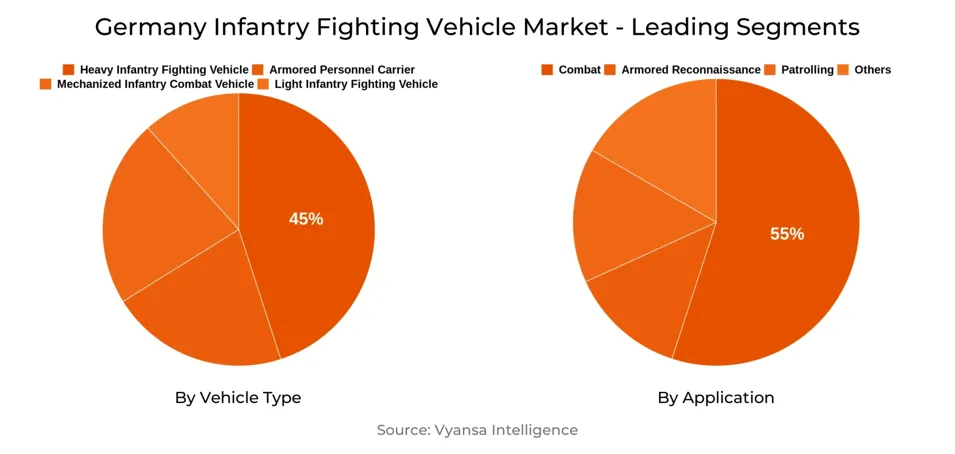

- Vehicle Type Shares

- Heavy Infantry Fighting Vehicle grabbed market share of 45%.

- Competition

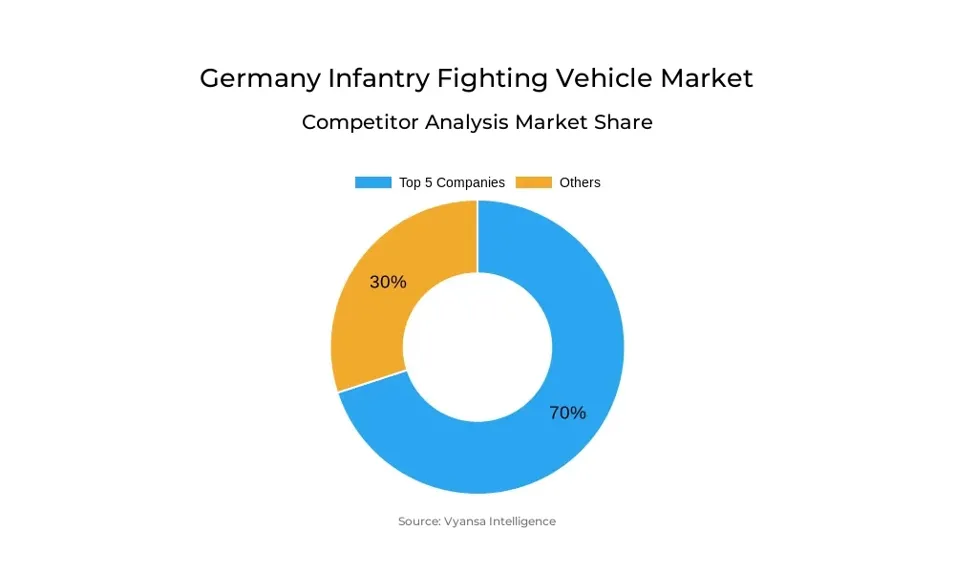

- More than 10 companies are actively engaged in producing Infantry Fighting Vehicle in Germany.

- Top 5 companies acquired 70% of the market share.

- Dynamit Nobel Defence (DND), Jenoptik AG, Rohde & Schwarz GmbH & Co. KG, Rheinmetall AG, KNDS Deutschland (KMW) etc., are few of the top companies.

- Application

- Combat grabbed 55% of the market.

Germany Infantry Fighting Vehicle Market Outlook

Germany Infantry Fighting Vehicle Market stands at USD 1.68 billion currently. The market is growing steadily owing to the demand for advanced mechanized units to cater to the Bundeswehr frontline operations. Combat use leads the market, accounting for 55% of the overall demand, as Germany emphasizes utilizing IFVs such as Puma and Marder for intensive combat missions.

The Heavy Infantry Fighting Vehicle segment is anticipated to experience the highest growth rate, with a volume CAGR of approximately 44.1%, due to the Bundeswehr's preference for high-mobility vehicles that are highly protected. The segment is the key driver of Germany's armored vehicle production and modernization, and it is securing investment by major manufacturers.

The market has several companies that are actually involved in manufacturing IFVs in Germany, and the leading 5 companies have around 70% of the market share. Leading companies are Rheinmetall and KNDS, which specialize in both complete vehicles and essential subsystems like engines, transmissions, sensors, and fire-control systems.

Overall, the German IFV market will grow to USD 2.52 billion by 2032, driven by rising defense budgets, NATO commitments, and the upgrading of ageing fleets of vehicles. The growth will open up prospects for manufacturers and subsystem suppliers to increase production, create advanced technologies, and build up market position in domestic and European defence markets.

Germany Infantry Fighting Vehicle Market Growth Driver

Rising Geopolitical Tensions and NATO Commitments Driving Demand

Increasing geopolitical tensions in Europe are compelling Germany to enhance its mechanized army. Berlin has invested huge amounts under the "Zeitenwende" policy in revamping its land equipment, and USD 18,000 million has been assigned to the "Dimension Land" program, under which Infantry Fighting Vehicles (IFVs) such as Puma have been included. In 2025, the Bundestag sanctioned a further USD 1,600 million for new Puma IFVs that will replace ageing Marder fleets. These investments are not simply about national defense but also about meeting NATO readiness objectives. Germany has committed to maintaining a minimum of three heavy brigades combat-capable for NATO by 2027, which needs hundreds of new IFVs in service.

Meanwhile, NATO obligations are fueling persistent demand throughout the supply chain. Germany has promised to raise defense expenditure to 3.5% of GDP by 2029, nearly doubling yearly defense spending. Such an outlay provides stable budgets for long-term IFV contracts and upgrades. Firms such as Rheinmetall and KNDS profit directly from bulk orders, whereas subsystem suppliers such as HENSOLDT (sensors), RENK (transmissions), and MTU (engines) profit from integration and retrofit contracts. For instance, Rheinmetall has already boosted its production capacity at Unterlüß to speed up deliveries of Pumas and Lynxes. These actions demonstrate how NATO commitments decrease uncertainty, allowing German defense industry to ramp up production and achieve technological supremacy in Europe's IFV market.

Germany Infantry Fighting Vehicle Market Challenge

High Production and Maintenance Costs Increasing Financial Pressure

High maintenance and production costs are a major problem for Germany's Infantry Fighting Vehicle industry. The nation's pride, the Puma IFV, is among the priciest in the world and sells at an estimated cost of USD 18 million per vehicle. High costs burden the German defense budget even after establishing the USD 108 billion special defense fund. Increasing procurement expenses also render it challenging for producers such as Rheinmetall and KNDS to stay competitive in overseas markets, where nations tend to prefer affordable substitutes.

Maintenance contributes to additional cost pressure. For example, 18 Puma vehicles employed for a large exercise needed emergency upgrading and repair, costing approximately USD 900 million after breaking down during an exercise in 2022. These examples illustrate the extent to which reliability issues increase lifecycle costs. For the Bundeswehr, this results in fewer vehicles being deployed within budget constraints, while industry operators suffer from blame for delay and cost overrun.

Germany Infantry Fighting Vehicle Market Trend

Autonomous & AI-Enabled Systems Improving Operational Efficiency

Germany's Infantry Fighting Vehicle sector is increasingly adopting autonomous and AI-driven systems to drive operational efficacy. For example, Rheinmetall's PATH Autonomous Kit (A-kit) is a robotic control software package that can be easily added onto any existing vehicle fleet to provide autonomous capabilities. This enables enhanced navigation and decision-making, minimizing the cognitive burden on human operators while facilitating more efficient mission execution.

Players in the market are taking advantage of this development by investing in cutting-edge technologies and collaborations. An example is Rheinmetall, which has set up three new centers of excellence to speed the creation of autonomous vehicle technology. The company is also working with U.S. software expert Auterion to develop common operating standards for autonomous battlefield drones with an aim to integrate such systems into a single military framework. These programs show how the use of autonomous and AI-based systems is reshaping Germany's IFV market towards more efficient and effective military campaigns.

Germany Infantry Fighting Vehicle Market Opportunity

Modernization of Aging Vehicle Fleet Offering Lucrative Opportunity

Germany's Infantry Fighting Vehicle Market is witnessing a major opportunity through the modernization of its aging fleet of vehicles. The Puma IFV, to replace the Marder, is leading the change. In 2023, Germany sanctioned the full modernization of 143 Puma vehicles to the most modern S1 standard, which improves capabilities with modern features such as high-resolution day and night cameras and the integration of the MELLS multirole lightweight guided missile system. The modernization will be finished by 2029, which indicates Germany's dedication to having a technologically advanced and capable IFV fleet.

Market players are keenly taking advantage of this trend towards modernization. Rheinmetall has received orders to provide more Puma IFVs and has boosted its manufacturing capacity to cater to the higher demand. Rheinmetall is also creating a new modular training system for the Puma to improve training efficiency and effectiveness for the Bundeswehr. These developments not only help ensure Germany's defense goals but also put industry players in a position to gain from increasing demand for modernized IFVs

Germany Infantry Fighting Vehicle Market Segmentation Analysis

By Vehicle Type

- Armored Personnel Carrier

- Mechanized Infantry Combat Vehicle

- Light Infantry Fighting Vehicle

- Heavy Infantry Fighting Vehicle

The most market-share-intensive segment under Vehicle Type in the Germany Infantry Fighting Vehicle Market 2026-32 is the Heavy Infantry Fighting Vehicle, which commands approximately 45% of the market. This segment is propelled by the Bundeswehr's focus on inducting sophisticated, well-armored IFVs such as the Puma. These IFVs are favored for frontline mechanized brigades and NATO operations because of their high firepower, mobility, and survivability. The heavy IFV emphasis guarantees stable orders and long-term contracts to top manufacturers and subsystem vendors, thus making it the leading market revenue contributor.

Other categories, such as medium and light IFVs, still exist but hold smaller portions of the market. Procurement is mostly through direct government sources, which affords stability and predictable demand to manufacturers like Rheinmetall, KNDS, and their subsystem partners. This organized method enables both vehicle manufacturers and subsystem suppliers to plan production and investments confidently for 2026-32.

By Application

- Combat

- Armored Reconnaissance

- Patrolling

- Others

Combat is the most prominent segment within Application in the Germany Infantry Fighting Vehicle Market 2026-32, with a share of around 55% of the market. The reason for this is mainly because the Bundeswehr emphasizes operational deployment of IFVs such as the Puma and the Marder in frontline missions where mobility, firepower, and protection are the most important considerations. Combat use calls for weaponized vehicles with sophisticated weapon systems, sensors, and armor, placing a demand on both finished vehicles and dedicated subsystems. The priority for combat-capable fleets guarantees continuous orders and long-term business to manufacturers and subsystem providers.

Reconnaissance, support, and training other application segments account for the rest of the market share but are smaller compared to the above. Procurement is heavily centralized through direct government channels, ensuring predictability and stability for market participants. This enables manufacturers and vendors to plan production, upgrades, and technology integration effectively for the 2026-32 period.

Top Companies in Germany Infantry Fighting Vehicle Market

The top companies operating in the market include Dynamit Nobel Defence (DND), Jenoptik AG, Rohde & Schwarz GmbH & Co. KG, Rheinmetall AG, KNDS Deutschland (KMW), Rolls-Royce Power Systems (MTU), RENK Group AG, HENSOLDT AG, L3Harris Technologies, Thales Group, etc., are the top players operating in the Germany Infantry Fighting Vehicle Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Germany Infantry Fighting Vehicle Market Policies, Regulations, and Standards

4. Germany Infantry Fighting Vehicle Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Germany Infantry Fighting Vehicle Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Mobility

5.2.1.1. Wheeled- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Tracked- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Configuration

5.2.2.1. Amphibious- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Non-Amphibious- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Vehicle Type

5.2.3.1. Armored Personnel Carrier- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Mechanized Infantry Combat Vehicle- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Light Infantry Fighting Vehicle- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Heavy Infantry Fighting Vehicle- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Fire Power

5.2.4.1. Low Caliber Armament- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Medium Caliber Armament- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. High Caliber Armament- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Application

5.2.5.1. Combat- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Armored Reconnaissance- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Patrolling- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6. By End User

5.2.6.1. Military- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Paramilitary- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Government- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. Germany Wheeled Infantry Fighting Vehicle Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Configuration- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Vehicle Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Fire Power- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End Users- Market Insights and Forecast 2022-2032, USD Million

7. Germany Tracked Infantry Fighting Vehicle Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Configuration- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Vehicle Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Fire Power- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Application- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End Users- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Rheinmetall AG

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.KNDS Deutschland (KMW)

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Rolls-Royce Power Systems (MTU)

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.RENK Group AG

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.HENSOLDT AG

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Dynamit Nobel Defence (DND)

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Jenoptik AG

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Rohde & Schwarz GmbH & Co. KG

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.L3Harris Technologies

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Thales Group

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Mobility |

|

| By Configuration |

|

| By Vehicle Type |

|

| By Fire Power |

|

| By Application |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.