Germany Bags and Luggage Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Bags (Cross Body Bags, Bags and Backpacks, Business Bags, Duffle Bags, Clutches, Others), Luggage (Soft Luggage, Hard Luggage, Wheeled Luggage, Non-Wheeled Luggage)), By Sales Channel (Retail Offline, Retail Online), By Material Type (Soft Case (Nylon, Polyester, Ballistic Nylon), Hard Case (Polycarbonate, ABS (Acrylonitrile Butadiene Styrene), Polypropylene)), By Price Category (Luxury, Mass/Economy, Premium), By Application (Travel, Business)

|

Major Players

|

Germany Bags and Luggage Market Statistics and Insights, 2026

- Market Size Statistics

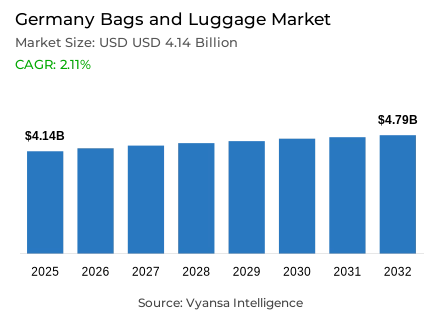

- Bags and luggage in Germany is estimated at USD 4.14 billion in 2025.

- The market size is expected to grow to USD 4.79 billion by 2032.

- Market to register a cagr of around 2.11% during 2026-32.

- Category Shares

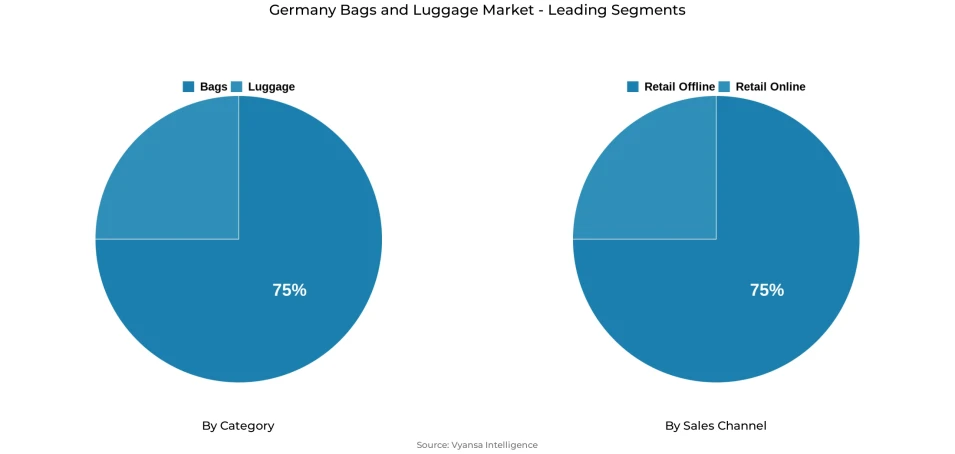

- Bags grabbed market share of 75%.

- Competition

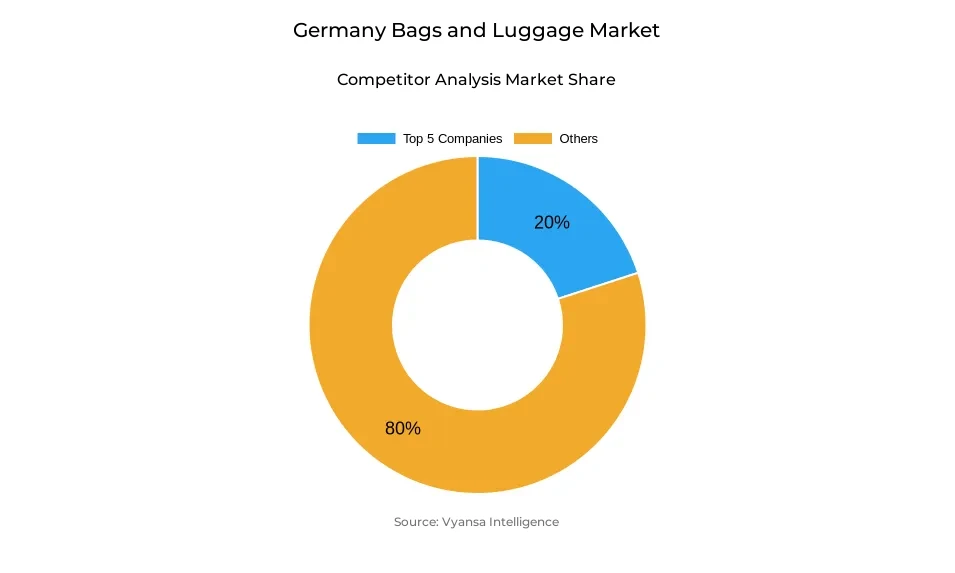

- More than 20 companies are actively engaged in producing bags and luggage in Germany.

- Top 5 companies acquired around 20% of the market share.

- adidas Group; Yves Saint Laurent Germany GmbH; Hermès GmbH; Samsonite GmbH; Rimowa GmbH etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

Germany Bags and Luggage Market Outlook

The Germany bags and luggage market is projected to experience stable growth over the forcastperiod due to rising travel activity and changing work patterns, despite continued end users caution. The market is estimated at USD 4.14 billion in 2025 and USD 4.79 billion in 2032, with a CAGR of about 2.11%. Although demand in 2024 was lower than pre-pandemic levels, the gradual increase in travel frequency and office attendance has helped stabilise the category.

The leading category will continue to be bags, accounting for about 75% of total market value. Handbags remain the largest product line due to daily usage and premium and luxury positioning. Meanwhile, wallets and other small leather goods are gaining traction because of their affordability and gifting appeal. Short-haul and last-minute travel also supports demand for lightweight and versatile bag formats such as backpacks.

Luggage demand is expected to increase gradually but selectively, as German end users prioritise durability, functionality, and long product life cycles. Hybrid and remote-working patterns continue to limit a full recovery in traditional business luggage, although awareness of the need for high-quality, portable solutions supports selective premium purchases. Sustainability considerations further reinforce preferences for fewer, longer-lasting products.

In terms of channels, retail offline is expected to hold approximately 75% of the market. Physical outlets remain relevant for quality assessment and expert guidance, particularly for handbags and luggage. While retail online continues to expand through omnichannel strategies, in-store purchasing remains central to value creation in Germany.

Germany Bags and Luggage Market Growth DriverRestoration of travel demand to sustain the replacement demand.

The level of travel activity in Germany is also very healthy, thus increasing the demand of practical carry goods like luggage and travel bags. According to a recent study, it is estimated that in 2024 there are around 496.1 million overnight stays in the country, which is a new historical high exceeding the numbers before the pandemic, and this reflects a high level of travel demand. This continued flow of travel keeps the demand of travel bags and luggage in terms of replacement and purchases at the base.

In addition, the area of domestic tourism, in its turn, is still showing resilience. Statistics show that domestic guests registered 410.8 million overnight stays in 2024, which is an indication of continuous enthusiasm towards travelling in Germany. High domestic travel behaviour supports the purchase cycles associated with functionality and frequent travel, and no longer solely with discretionary fashion upgrades.

Germany Bags and Luggage Market ChallengeFrugal domestic consumption restraining non-essential expenditures.

Germany end users spending habits are showing continued reserve, which is limiting discretionary purchases of non-necessity products like bags and luggage. The statistical portal of the European Central Bank indicates that the private final consumption spending real, chain-linked in Germany has been growing in the last few quarters at a modest pace, which indicates slow momentum in spending in 2024.

Moreover, the official statistics provided by the World Bank indicate that in 2023, households and NPISH final consumption expenditure constituted 50% of GDP, reflecting the fact that end users spending is a reserved portion of the overall economic activity. This environment focuses more on spending the necessary money and will buy luxury or non-urgent bags less frequently.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Germany Bags and Luggage Market TrendRising Sustainability-driven Purchase Preferences

Sustainability factors are becoming a major influence on purchasing decisions, even when it comes to buying accessories like bags and luggage. According to the German Environmental Agency, end users awareness about the environment is still high, with most end users considering environmental impact as a primary factor in their purchasing habits. As a result, the trend toward long lasting and sustainable goods as opposed to short-term ones is supported.

At the same time, the trend is further entrenched by EU level regulatory progress in response to false sustainability claims. The Green Claims programme by the European Commission enhances the regulation of environmental marketing, which compels brands to report clear sustainability claims. Consequently, end users in Germany are more concerned with lifecycle impacts and manufacturing processes when selecting bags and luggage.

Germany Bags and Luggage Market OpportunityDigital interaction and personalisation that makes products more relevant.

Personalisation and digital interaction represent an obvious opportunity for brands in the German bags and luggage market. Despite the lack of official government digital end users behaviour reports, Eurostat and national digital statistics indicate that the level of digital engagement remains high throughout the EU, including Germany, supporting personalised product discovery and online configuration experiences that can stimulate demand.

At the same time, there is an increasing preference among end users for functional value linked to technology-enabled features. Regulatory and standards discussions in the EU highlight growing interest in connected products that address both security and convenience needs among travellers. With the integration of digital and personalised solutions into the mainstream, brands that incorporate usability improvements and personalisation can become more relevant in a spend-wary culture.

Unlock Market Intelligence

Explore the market potential with our data-driven report

Germany Bags and Luggage Market Segmentation Analysis

By Category

- Bags

- Cross Body Bags

- Bags and Backpacks

- Business Bags

- Duffle Bags

- Clutches

- Others

- Luggage

- Soft Luggage

- Hard Luggage

- Wheeled Luggage

- Non-Wheeled Luggage

Bags represent the largest segment in the Germany bags and luggage market, with a share of around 75%. This dominance reflects the essential role of bags in everyday work, travel, and lifestyle usage. Handbags are the largest sub-category, supported by strong demand for premium and luxury designs that are typically viewed as long-term investments rather than impulse purchases.

The bags segment is expected to remain dominant throughout the forecast period, supported by end users interest in durability, sustainability, and design quality. German end users increasingly favour products that combine functionality with responsible sourcing, encouraging brands to focus on recycled materials and transparent production. Smaller leather goods such as wallets and coin pouches also contribute to growth due to their lower price points. Overall, value generation in the Germany bags and luggage market will remain anchored in the bags segment through 2026–32.

By Sales Channel

- Retail Offline

- Retail Online

Retail offline holds the highest share under the sales channel structure, accounting for around 75% of the Germany bags and luggage market. Physical retail remains highly relevant, as end users prefer to assess materials, craftsmanship, and comfort in person, particularly for infrequently purchased items such as handbags and luggage.

Looking ahead, offline retail is expected to retain its leadership, supported by specialist stores offering expert advice and broad assortments. While retail retail online continues to grow and facilitates price comparison and convenience, it primarily complements in-store purchasing through omnichannel strategies. The balance between digital tools and physical retail experiences will remain central to end users decision-making, ensuring offline channels continue to dominate bags and luggage sales in Germany during the forecast period.

List of Companies Covered in Germany Bags and Luggage Market

The companies listed below are highly influential in the Germany bags and luggage market, with a significant market share and a strong impact on industry developments.

- adidas Group

- Yves Saint Laurent Germany GmbH

- Hermès GmbH

- Samsonite GmbH

- Rimowa GmbH

- VF Europe BVBA

- Louis Vuitton Deutschland GmbH

- Chanel GmbH

- H&M Hennes & Mauritz BV & Co KG

- travelite GmbH & Co KG

Competitive Landscape

Germany bags and luggage market is characterised by a fragmented and highly competitive structure, shaped by cautious consumer spending and a strong sustainability mindset. Samsonite GmbH retained its overall leadership, supported by its strength in luggage and business bags, despite ongoing softness in demand. In handbags, luxury brands continue to play a central role, with Chanel maintaining its lead as designer handbags are increasingly perceived as long-term investment pieces. Alongside established leaders, mid-sized international players such as Shandong Ruyi Technology Group (with brands including Sandro, Maje, and Claudie Pierlot) recorded solid momentum from a low base. The market is further influenced by growing interest in durable, sustainable, and second-hand bags, which is intensifying competition and favouring brands that combine quality, transparency, and longevity.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Germany Bags and Luggage Market Policies, Regulations, and Standards

4. Germany Bags and Luggage Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Germany Bags and Luggage Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Cross Body Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Bags and Backpacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Business Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Duffle Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. Clutches- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Soft Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Hard Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Non-Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Material Type

5.2.3.1. Soft Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. Polyester- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.3. Ballistic Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Hard Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1. Polycarbonate- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2. ABS (Acrylonitrile Butadiene Styrene)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.3. Polypropylene- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Price Category

5.2.4.1. Luxury- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Mass/Economy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Application

5.2.5.1. Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Business- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. Germany Bags Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

7. Germany Luggage Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Samsonite GmbH

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Rimowa GmbH

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.VF Europe BVBA

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.Louis Vuitton Deutschland GmbH

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Chanel GmbH

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.adidas Group

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Yves Saint Laurent Germany GmbH

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.H&M Hennes & Mauritz BV & Co KG

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Hermès GmbH

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. travelite GmbH & Co KG

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Sales Channel |

|

| By Material Type |

|

| By Price Category |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.