Germany Ammunition and Smart Munitions Market Report: Trends, Growth and Forecast (2026-2032)

By Caliber (Small Caliber (up to 12.7mm), Medium Caliber (12.7mm- 40mm), Large Caliber (Above 40 mm- 155 mm), Extra Large Caliber (Artillery and Tanks Main Gun Rounds)), By Product Type (Artillery Ammunition, Tank Ammunition, Small-arms Ammunition, Mortar Ammunition, Rocket and Guided Ammunition, Naval & Aerial Ammunition), By Technology (Conventional Ammunition, Smart Ammunition, Precision Ammunition, Advanced Fuzing Ammunition), By End User (Military, Homeland Security, Sporting, Hunting, Self-Defense, Others)

- Aerospace & Defense

- Nov 2025

- VI0415

- 115

-

Germany Ammunition and Smart Munitions Market Statistics and Insights, 2026

- Market Size Statistics

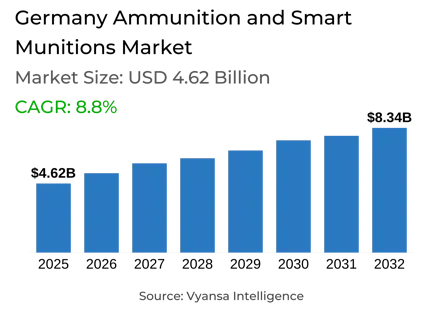

- Ammunition and Smart Munitions in Germany is estimated at $ 4.62 Billion.

- The market size is expected to grow to $ 8.34 Billion by 2032.

- Market to register a CAGR of around 8.8% during 2026-32.

- Product Type Shares

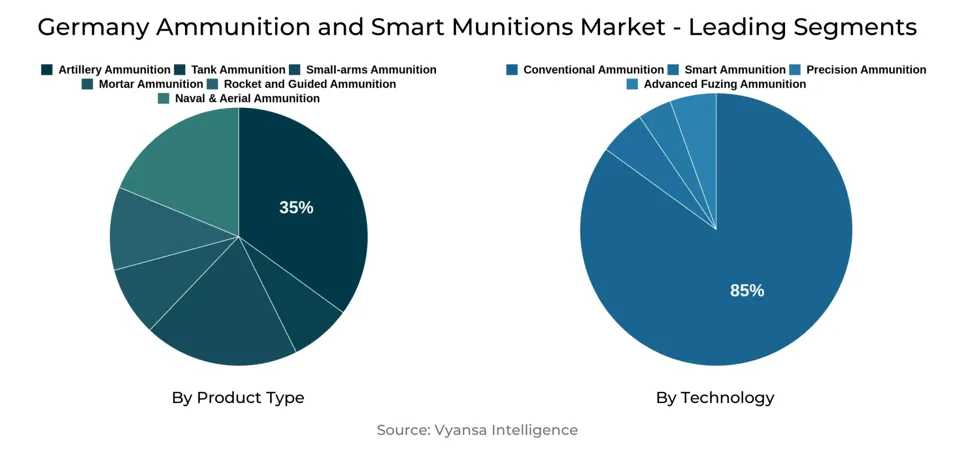

- Artillery Ammunition grabbed market share of 35%.

- Competition

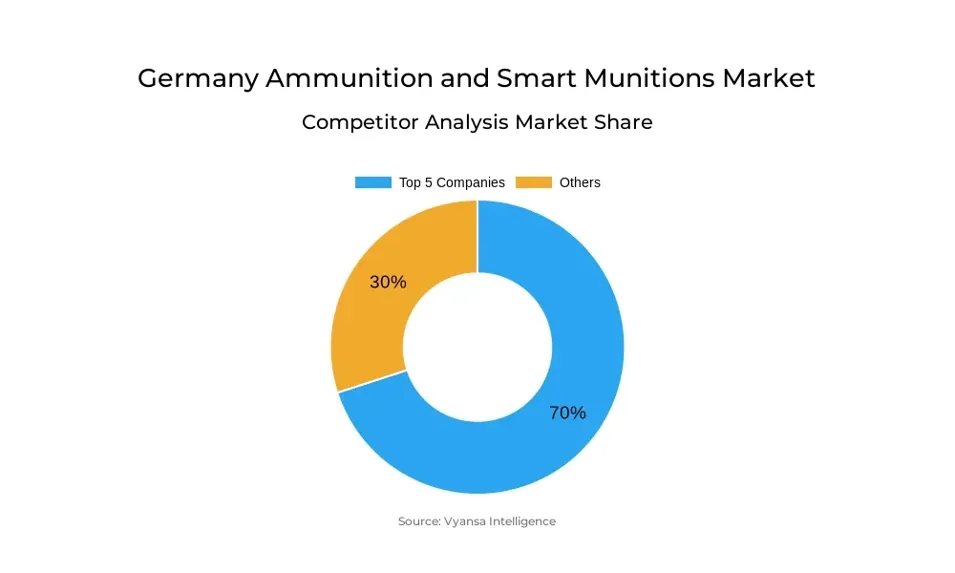

- More than 10 companies are actively engaged in producing Ammunition and Smart Munitions in Germany.

- Top 5 companies acquired 70% of the market share.

- Renk AG, Thales Group, Saab AB, Rheinmetall AG, Diehl Defence GmbH & Co. KG etc., are few of the top companies.

- Technology

- Conventional Ammunition grabbed 85% of the market.

Germany Ammunition and Smart Munitions Market Outlook

The Germany Ammunition and Smart Munitions Market is now valued at $4.62 billion. The market is fueled by the nation's priority of upgrading its defense capacity, specifically in reaction to NATO obligations and regional security requirements. Germany's military still heavily utilizes conventional ammunition for artillery, small arms, and armored vehicles, so conventional ammunition, which accounts for 85% of the market, is the leading technology category.

The market will expand steadily and touch $8.34 billion by 2032, representing growth in defense infrastructure investments and procurement programs. Although traditional ammunition dominates, smart and precision-guided munitions are slowly coming under the limelight for specialized operations, marking a gradual transition toward advanced technologies without affecting the conventional core segment.

Competition in the market is focused, with the first five players controlling 70% of the market. They sustain leadership through established manufacturing processes, government contracts with term durations, and ongoing technology improvements. Their presence guarantees stability in supply while pushing incremental penetration of smart munitions across targeted platforms.

Overall, the Germany Ammunition and Smart Munitions Market during 2026-2032 is marked by a steady growth, strong dependence on conventional technology, and dense market leadership. The industry continues to balance between traditional defense requirements and gradual incorporation of cutting-edge munitions, making Germany a central figure in Europe's defense setup.

Germany Ammunition and Smart Munitions Market Growth Driver

Geopolitical Instability and NATO Commitments Driving Demand

The rise in Eastern European geopolitical tensions, especially Russia's invasion of Ukraine, has made Germany more concerned about enhancing its defense capabilities. NATO obligations call for member nations to be on high alert and ready to have advanced ammunition and munitions systems at hand. As a prominent European nation, Germany has augmented military drills and warehousing of conventional and smart munitions, where it stands ready for quick response capabilities. For instance, Germany has considerably increased its purchase of 155mm artillery ammunition and guided munitions from Rheinmetall to NATO operational specifications in response to the close correlation between geopolitical threats and growing demand in the defense value chain.

NATO's strategic guidelines also call for interoperability and standardization between member nations, compelling Germany to upgrade legacy platforms and embrace advanced munitions technology. The Bundeswehr has incorporated smart fuzes and programable munitions to improve accuracy and minimize collateral damage during training, providing tangible implementation of NATO guidelines. In addition, cross-border maneuvers with allies like the "Defender Europe" exercises point to the operational imperative of being able to draw on a ready supply of ammunition, rendering geopolitical turbulence and alliance obligations a main driver for Germany's ammunition and smart munitions market.

Germany Ammunition and Smart Munitions Market Challenge

Supply Chain Disruptions Impeding Growth

Supply chain disruptions pose a growing threat to Germany's ammunition and smart munitions industry. Relying on rare raw materials like high-grade explosives, tungsten, and electronic components for the smart fuzes leaves manufacturers vulnerable to delays created by geopolitical instability, global trade embargoes, and restricted supplier bases. For instance, Rheinmetall and Diehl Defence both reported bottlenecks in the sourcing of electronic guidance components because of shortages in semiconductors and tighter export controls by key supplier nations. Such disruptions can postpone production schedules and make inventory management more complex, which goes directly against Germany's capability to stay ready for NATO missions and homeland defense obligations.

The challenge is compounded by the intricacy of munitions production, involving the exact coordination of various levels of suppliers and rigorous adherence to military specifications. A disruption in transport supply chains, customs formalities, or raw materials supply can initiate cascading delays. One high-profile example in 2023 involved disruptions to specialized propellants that impacted the timely supply of 155mm artillery shells for Bundeswehr training exercises. Such vulnerabilities highlight the importance of supply chain reliability, such that disruptions remain an ongoing market challenge.

Germany Ammunition and Smart Munitions Market Trend

Shift Toward Precision- Guided Munitions Shaping Market Dynamics

Germany's defense industry is increasingly focusing on precision-guided munitions (PGMs) with the escalating demand for accuracy, operational effectiveness, and minimal collateral damage in today's warfare. Unlike traditional munitions, PGMs employ sophisticated guidance systems, including GPS, laser, or inertial navigation, enabling forces to hit targets accurately even in challenging environments. This trend is backed by NATO interoperability standards, which mandate member nations to employ munitions that ensure precision engagement. The Bundeswehr has adopted PGMs in its missile and artillery projects, such as Rheinmetall's guided 155mm shells, to improve effectiveness in joint exercises with its allies.

Market actors are taking advantage of this trend by investing in R&D and increasing manufacturing lines for intelligent ammunition. Diehl Defence has, for example, created programmable fuzes and guided projectiles adaptable to current artillery platforms, allowing Germany to modernize its military without complete platform overhaul. Rheinmetall also works with EU partners to coproduce PGMs to ensure access to advanced technology while satisfying alliance demands. These efforts demonstrate how producers are linking product plans to changing battlefield requirements, upholding PGMs as a key tendency in Germany's defense sector.

Germany Ammunition and Smart Munitions Market Opportunity

Development of Dual-Use Technologies Offering Lucrative Opportunity

The development of dual-use technologies offers a major opportunity for Germany's smart munitions and ammunition industry. Dual-use systems are intended for both military and civilian use, including precision guidance systems, sensors, and high-performance propellants. Such technologies enable industry to diversify revenue streams and build on existing R&D investments. For instance, Diehl Defence's programmable fuzes designed for military ammunition can be implemented in industrial applications such as controlled demolition or emergency response training. Such cross-applicability de-risks instability from defense budget fluctuations while broadening market appeal to a wider customer base beyond purely military customers, making dual-use innovation a growth path.

Market participants are aggressively taking advantage of the opportunity in the form of strategic alliances and technology evolution. Rheinmetall has adapted some sensor and guidance technologies initially developed for intelligent munitions into aerospace and civilian protection applications. Diehl Defence, in a similar context, partners with European research centers to develop technologies meeting military and industrial requirements, opening up more export opportunities while keeping in line with regulatory structures. These efforts highlight how dual-use innovation not only propels technological progress but also enhances Germany's competitive standing in international defense and industrial markets.

Germany Ammunition and Smart Munitions Market Segmentation Analysis

By Product Type

- Artillery Ammunition

- Tank Ammunition

- Small-arms Ammunition

- Mortar Ammunition

- Rocket and Guided Ammunition

- Naval & Aerial Ammunition

The most prominent market segment under Product Type is Artillery Ammunition, covering 35% of the Germany Ammunition and Smart Munitions Market. This is followed by the country's emphasis on upgrading its artillery equipment and maintaining preparedness for homeland defense and NATO operations. The rest of the share falls to other product types like small arms ammunition, tank ammunition, and smart munitions, representing the multifaceted operational needs of the Bundeswehr.

Of the other product categories, tank ammunition and small arms ammunition trail Artillery Ammunition in share, collectively accounting for a substantial proportion of the market. Smart munitions account for a smaller but expanding share driven by rising use of programmable and guided projectiles. The Product Type segmentation overall identifies artillery ammunition as the leading contributor with other categories collectively enabling operational diversity and supply requirements.

By Technology

- Conventional Ammunition

- Smart Ammunition

- Precision Ammunition

- Advanced Fuzing Ammunition

The most prominent segment in the Technology category is Conventional Ammunition, with 85% market share in the Germany Ammunition and Smart Munitions Market. The reason for such dominance lies in the Bundeswehr's dependence on conventional munitions in artillery, small arms, and tank warfare. Most operational needs are still serviced by conventional ammunition because of its tried and trusted nature, simplicity in manufacture, and compatibility with established military platforms.

Advanced-fuzing, Smart, and precision-guided ammunition constitute the last 15% of the market, which represents the slow rollout of sophisticated technologies for targeted action. Although smaller in share, these rounds are being increasingly incorporated into niche artillery and missile platforms to tighten the accuracy and cut collateral damage. The Technology breakdown shows conventional ammunition leading the way as the main driver, with smart and guided ammunition slowly growing to complement Germany's modernization push in accordance with NATO standards.

Top Companies in Germany Ammunition and Smart Munitions Market

The top companies operating in the market include Renk AG, Thales Group, Saab AB, Rheinmetall AG, Diehl Defence GmbH & Co. KG, MBDA Deutschland GmbH, Krauss-Maffei Wegmann GmbH & Co. KG, Hensoldt AG, General Dynamics European Land Systems (GDELS), Leonardo S.p.A., etc., are the top players operating in the Germany Ammunition and Smart Munitions Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. Germany Ammunition and Smart Munitions Market Policies, Regulations, and Standards

4. Germany Ammunition and Smart Munitions Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. Germany Ammunition and Smart Munitions Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Caliber

5.2.1.1. Small Caliber (up to 12.7mm)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Medium Caliber (12.7mm- 40mm)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Large Caliber (Above 40 mm- 155 mm)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Extra Large Caliber (Artillery and Tanks Main Gun Rounds)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Product Type

5.2.2.1. Artillery Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Tank Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Small-arms Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Mortar Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Rocket and Guided Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.2.6. Naval & Aerial Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Technology

5.2.3.1. Conventional Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Smart Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Precision Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Advanced Fuzing Ammunition- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By End User

5.2.4.1. Military- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Homeland Security- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Sporting- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Hunting- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Self-Defense- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. Germany Small Caliber Ammunition and Smart Munitions Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

7. Germany Medium Caliber Ammunition and Smart Munitions Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Technology- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

8. Germany Large Caliber Ammunition and Smart Munitions Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Technology- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Germany Extra Large Caliber Ammunition and Smart Munitions Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Product Type- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Technology- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By End User- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1.Company Profiles

10.1.1. Rheinmetall AG

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Diehl Defence GmbH & Co. KG

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. MBDA Deutschland GmbH

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. Krauss-Maffei Wegmann GmbH & Co. KG

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Hensoldt AG

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. Renk AG

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Thales Group

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

| Segment | Sub-Segment |

|---|---|

| By Caliber |

|

| By Product Type |

|

| By Technology |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.