France UAVs Market Report: Trends, Growth and Forecast (2026-2032)

By Class (Short UAV, Medium UAV, Large UAV), By Technology (AI-enabled, Remote Piloted, Swarming Technology, Stealth Technology), By Type (Combat UAVs, Reconnaissance UAVs, Tactical UAVs, Strategic UAVs), By Platform (Fixed-Wing, Rotatory-Wing, Hybrid), By Payload (Electro-Optical/Infrared, Synthetic Aperture Radar, Electronic Warfare, Communication Relay, Weapons Payloads, Others), By End User (Military Forces, Intelligence Agencies, Homeland Security, Defence Contractors)

- Aerospace & Defense

- Nov 2025

- VI0414

- 130

-

France UAVs Market Statistics and Insights, 2026

- Market Size Statistics

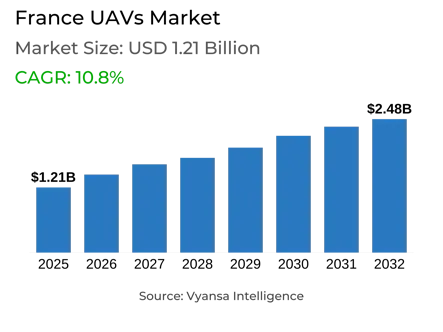

- UAVs in France is estimated at $ 1.21 Billion.

- The market size is expected to grow to $ 2.48 Billion by 2032.

- Market to register a CAGR of around 10.8% during 2026-32.

- Type Shares

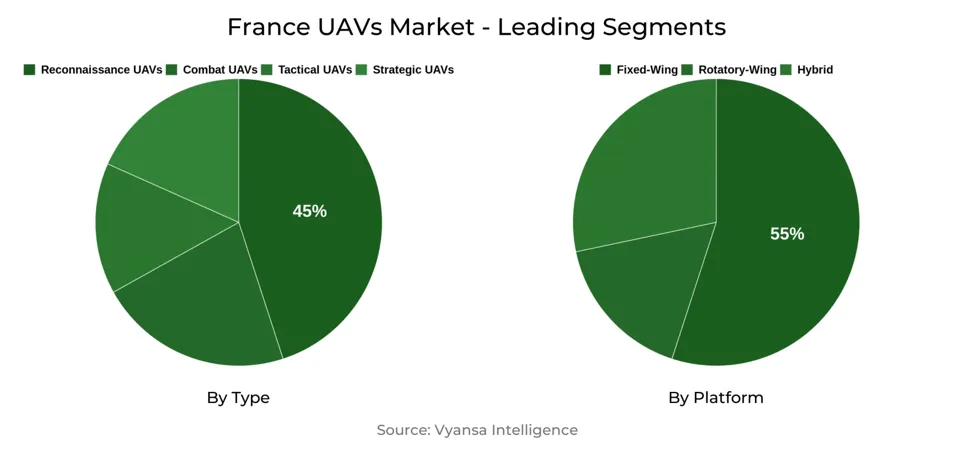

- Reconnaissance grabbed market share of 45%.

- Competition

- More than 10 companies are actively engaged in producing UAVs in France.

- Top 5 companies acquired 60% of the market share.

- Delair SAS, Parrot Drone SAS, Elistair SAS, Thales S.A., Airbus SE etc., are few of the top companies.

- Platform

- Fixed-Wing grabbed 55% of the market.

France UAVs Market Outlook

The French UAVs market is currently estimated at $1.21 billion and is projected to have strong growth, with an estimate of reaching $2.48 billion by 2032. The demand comes primarily from the increased application of UAVs in the French military and local security organizations. UAVs play a central role in surveillance and reconnaissance, along with tactical operations, by collecting real-time information to enhance operational effectiveness in a wide range of applications.

In the platform category, Fixed-Wing UAVs are the market leaders with a 55% market share. They are preferred for long-range missions due to their high speed and durability, along with advanced sensor integration. Their ability to cover large areas of operation effectively makes them indispensable for border monitoring, along with coastal surveillance and extended intelligence-collection missions.

The market is also highly concentrated, as the top five companies hold a market share of 60%. This indicates that UAV manufacturers have a firm competitive advantage by leveraging leading technologies and strategic collaborations to dominate France's UAV market.

Overall, the France UAV market will register sound growth over the forecasting period with the help of rising demand for high-endurance reconnaissance capabilities, continuing defense modernization, and operational efficiency concerns. Fixed-wing UAVs will be the major contributor, with leading industry players well positioned to capitalize on expanding opportunities in defense as well as internal security applications.

France UAVs Market Growth Driver

Growing ISR Needs from Armed Forces and Internal Security Boosting UAV Demand

The increasing demand for Intelligence, Surveillance, and Reconnaissance (ISR) capabilities from the French military and domestic security forces is largely driving France's Unmanned Aerial Vehicle (UAV) market. The French military is taking an aggressive approach towards the adoption of UAVs like Aarok drones and platforms like the Spy'Ranger to enhance battlefield situational awareness and operational effectiveness. These drones are designed to provide real-time intelligence, allowing for rapid decision-making and greater mission success. For instance, the French military employed drones for reconnaissance and high-precision strikes in Operation Barkhane, demonstrating their crucial role in modern military operations. The rising demand for (ISR) capabilities in the defence forces of France is driving investments in advanced UAV systems. This is supported by the defense modernization budget of USD 60.4 billion in 2024, enabling procurement and development of cutting-edge UAV platforms.

Internal security agencies in France are increasingly using UAVs to strengthen intelligence, surveillance, and reconnaissance (ISR) capabilities. Drones help monitor borders, patrol cities, and oversee large public events, improving safety and situational awareness. During the 2024 Paris Olympics, authorities deployed UAVs to track crowds and detect potential threats in real time. This shows how drones provide practical support for law enforcement and public security operations. The growing use of UAVs for domestic security highlights their importance in France’s national defense and internal security framework, driving demand for advanced UAV systems across the country. This heightened reliance on UAVs for domestic security activities is also evidenced by the presence of over 150 French firms involved in drone technologies, whose market generated over USD 118 million as of 2022. This growth indicates the pivotal role of UAVs in enhancing national defense as well as domestic security capabilities.

France UAVs Market Challenge

High Supply Chain Dependency Affecting Production

The French UAV market is highly vulnerable to challenges because of its significant dependence on global supply chains for critical elements such as printed circuit boards and semiconductors. Companies like Thales have reported that supply problems with crucial components have affected production schedules and delivery timelines. Even with a record-high order book, market players have anticipated that these supply chain challenges will impede growth in the forthcoming years as well.

Additionally, several companies providing UAVs to domestic and international clients have experienced delays due to a lack of specialized components. For instance, the manufacturing of Delair's UX11 "Colibri" suicide drones has been impacted by the lack of essential components, leading to postponed deliveries and a huge loss of revenue. These events underscore the pressing need for a more varied and robust supply chain to satisfy the increasing demand for UAVs in the security and defense sectors of France.

France UAVs Market Trend

Hybrid UAVs are Shaping the Market Dynamics

Hybrid UAVs are emerging as a key trend in France's UAV market due to their unique combination of capabilities and growing operational demand. These drones merge the vertical takeoff and landing abilities of multicopters with the speed and endurance of fixed-wing platforms. This allows them to perform a wider range of missions, from long-duration ISR operations to logistics support, making them highly versatile compared to traditional UAVs. The adoption of hybrid-electric propulsion systems like Ascendance’s Sterna further improves flight efficiency by reducing fuel consumption and extending airborne time, which is critical for sustained surveillance or transport tasks.

The market trend is reinforced by the collaboration between French companies like Ascendance and Delair to develop hybrid UAVs for the Ministry of Armed Forces. This demonstrates the increasing preference for multi-role UAVs that can adapt to diverse operational environments. As defense and commercial sectors seek drones capable of both endurance and maneuverability, hybrid UAVs are positioned to capture a larger share of the market. Their rising adoption reflects a shift in France’s UAV landscape toward more flexible and high-performance platforms, making hybrids a clear growth trend.

France UAVs Market Opportunity

Growth of Tactical Swarm & Loitering Munitions Offering Lucrative Opportunity

The emergence of tactical drone swarms and loitering munitions is changing France's UAV market, presents a substantial opportunity for market players. These technologies enhance battlefield effectiveness by delivering synchronized, automated assaults that overwhelm enemy defenses and offer precision strike capabilities. France plans to invest USD 5.9 billion by 2030 to develop domestic loitering munition capabilities and swarm-flight technologies, aiming to deploy 3,000 tactical drones by the end of 2025. The strategic investment indicates a growing emphasis on advanced, cost-effective unmanned systems in modern combat.

French defense companies are fully capitalizing on this trend. KNDS has unveiled the MATARIS series, a range of loitering munitions tailored for various operational needs. The French Army is testing autonomous "hives" that can deploy and manage numerous drones simultaneously, demonstrating the potential of swarm strategies in battle situations. These developments position France as a leader in the growing UAV market, with its defense industry ready to meet both local and international needs for advanced unmanned systems.

France UAVs Market Segmentation Analysis

By Type

- Combat UAVs

- Reconnaissance UAVs

- Tactical UAVs

- Strategic UAVs

The biggest market share under the Type segment belongs to Reconnaissance, dominating 45% of the France UAVs market. French Armed Forces and internal security forces use Reconnaissance UAVs widely for situational awareness, intelligence gathering, and surveillance. Their high-resolution imaging capabilities, advanced sensors, and long endurance capabilities qualify them as indispensable instruments for border surveillance, urban areas, and operational theaters. These drones enable real-time decision-making and enhance operational efficiency, cementing their leadership in the market.

The Tactical/Combat UAV segment is next in terms of a smaller market percentage. Tactical UAVs are principally designed to carry out targeted operations, strike missions, and support in hostile areas. Loaded with precision-guided loads and rugged communication systems, tactical UAVs expand reconnaissance activities with offensive and defensive capabilities. The majority of reconnaissance UAVs is a result of France's UAV market bias towards intelligence and surveillance.

By Platform

- Fixed-Wing

- Rotatory-Wing

- Hybrid

The Fixed-Wing portion, holding the biggest market share within the Platform category, constitutes 55% of the UAV market in France. The French military and internal security agencies extensively deploy fixed-wing UAVs for extended ISR operations. Fixed-wing UAVs possess an aerodynamic design that offers enhanced endurance and speed compared to other platforms, making them ideal for border security, coastal monitoring, and extensive operational areas. These drones are equipped with advanced sensors, high-definition cameras, and communication systems that enhance real-time situational understanding and operational efficiency.

The Rotary-Wing platform follows, offering the vertical takeoff and landing capability ideal for urban monitoring, short-range reconnaissance, and tactical operations. While rotary-wing UAVs provide agility in confined areas, the dominance of fixed-wing UAVs highlights France's focus on extended-range, high-endurance missions. The strong need for fixed-wing platforms reflects the strategic focus on operational efficiency and ongoing air support in the French UAV deployments.

Top Companies in France UAVs Market

The top companies operating in the market include Delair SAS, Parrot Drone SAS, Elistair SAS, Thales S.A., Airbus SE, Northrop Grumman Corp., Safran S.A., Azur Drones SAS, General Atomics, Drone Vault, S.A., etc., are the top players operating in the France UAVs Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France UAVs Market Policies, Regulations, and Standards

4. France UAVs Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France UAVs Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Class

5.2.1.1. Short UAV- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Medium UAV- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Large UAV- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Technology

5.2.2.1. AI-enabled- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Remote Piloted- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Swarming Technology- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Stealth Technology- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Type

5.2.3.1. Combat UAVs- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Reconnaissance UAVs- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Tactical UAVs- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Strategic UAVs- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Platform

5.2.4.1. Fixed-Wing- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Rotatory-Wing- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Hybrid- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Payload

5.2.5.1. Electro-Optical/Infrared- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Synthetic Aperture Radar- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Electronic Warfare- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Communication Relay- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Weapons Payloads- Market Insights and Forecast 2022-2032, USD Million

5.2.5.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By End User

5.2.6.1. Military Forces- Market Insights and Forecast 2022-2032, USD Million

5.2.6.2. Intelligence Agencies- Market Insights and Forecast 2022-2032, USD Million

5.2.6.3. Homeland Security- Market Insights and Forecast 2022-2032, USD Million

5.2.6.4. Defence Contractors- Market Insights and Forecast 2022-2032, USD Million

5.2.7.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. France Short UAVs Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Type- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Platform- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Payload- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

7. France Medium UAVs Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Type- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Platform- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Payload- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

8. France Long UAVs Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Technology- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Type- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Platform- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By Payload- Market Insights and Forecast 2022-2032, USD Million

8.2.5.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.Thales S.A.

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Airbus SE

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Northrop Grumman Corp.

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Safran S.A.

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Azur Drones SAS

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Delair SAS

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Parrot Drone SAS

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Elistair SAS

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.General Atomics

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Drone Vault, S.A.

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Class |

|

| By Technology |

|

| By Type |

|

| By Platform |

|

| By Payload |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.