France Space-based Surveillance and Satellite Communication Market Report: Trends, Growth and Forecast (2026-2032)

By Orbit (Low Earth Orbit, Medium Earth Orbit, Geostationary Orbit, Highly Elliptical Orbit), By Component (Hardware, Software, Services), By Technology (Optical, Radar/SAR, Radio, Infrared, Multispectral, Telecom/Broadcast), By Frequency Band (Ku Band, Ka Band, X Band, S Band, L Band, Others), By End User (Defence and Intelligence, Government and Public Sector, Commercial and Enterprises, Others)

- Aerospace & Defense

- Nov 2025

- VI0413

- 125

-

France Space-based Surveillance and Satellite Communication Market Statistics and Insights, 2026

- Market Size Statistics

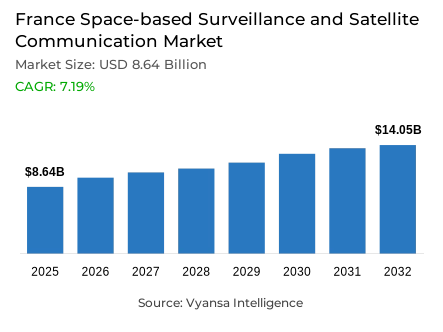

- Space-based Surveillance and Satellite Communication in France is estimated at $ 8.64 Billion.

- The market size is expected to grow to $ 14.05 Billion by 2032.

- Market to register a CAGR of around 7.19% during 2026-32.

- Component Shares

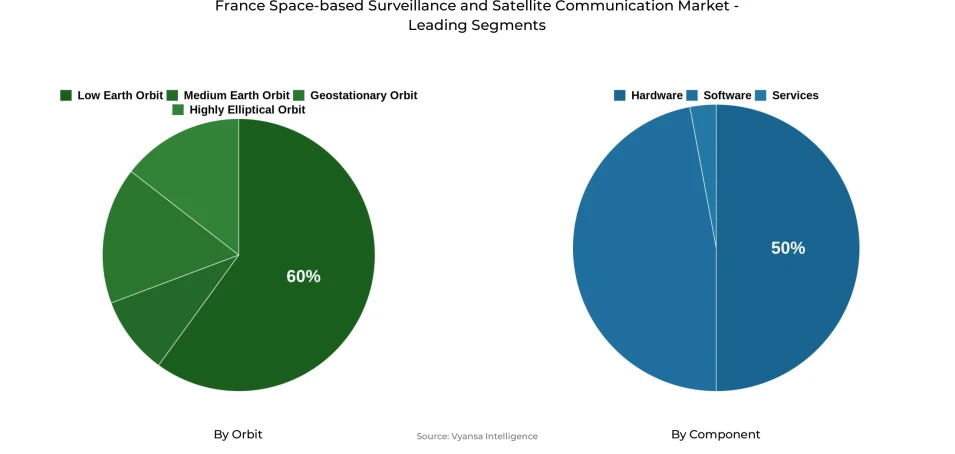

- Hardware grabbed market share of 60%.

- Competition

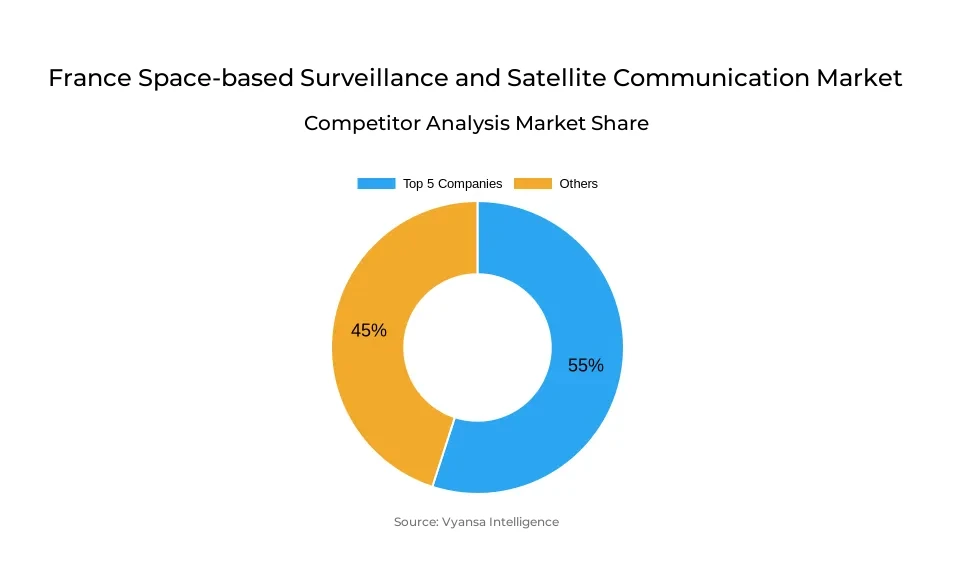

- More than 10 companies are actively engaged in producing Space-based Surveillance and Satellite Communication in France.

- Top 5 companies acquired 55% of the market share.

- CLS Group, Exotrail, HEMERIA, Thales Alenia Space, Airbus Defence and Space etc., are few of the top companies.

- Orbit

- Low Earth Orbit grabbed 50% of the market.

France Space-based Surveillance and Satellite Communication Market Outlook

The French space-based surveillance and satellite communication industry is valued at $8.64 billion in 2025. It is set to experience high growth, with market size growing to $14.05 billion by 2032. Its growth is driven by increasing demand for cutting-edge surveillance and communication systems in defense, government, and commercial applications.

LEO satellites are the most popular in the market, taking over half of the orbit segment with 50% because of their ability to offer low-latency, real-time observation and communication. This segment is significant for uses like intelligence, disaster relief, and broadband connectivity.

The market is extremely concentrated, with the top five players commanding a combined market share of 55%. These industry leaders lead innovation and adoption of new satellite technology and analytics services that benefit France's strategic interests.

Overall, the outlook for the market between 2026 and 2032 is favorable. Ongoing investments in satellite infrastructure and increasing uptake of space-based services place France's space surveillance and satellite communication market on a solid growth trajectory with several opportunities for growth.

France Space-based Surveillance and Satellite Communication Market Growth Driver

Rising Geopolitical Tensions and Growing Focus on National Security Driving Demand

Heightened geopolitical tensions and an increased focus on national security have emerged as major drivers for the France Space-based Surveillance and Satellite Communications market. France is facing increasing space threats, particularly from nations such as Russia, which have demonstrated the ability to jam satellites, conduct cyber-attacks, and disrupt lasers. In turn, the French military has demanded increasing strong space-based observation and shielded communication strength to maintain strategic familiarity of the situation and operational ascendancy. For example, the French Ministry of Armed Forces made significant investments in defense satellite programs and signed long-term agreements with operators like OneWeb in order to have dedicated defense communication channels for exclusive use. These steps highlight the way in which geopolitical forces are directly compelling demand for cutting-edge surveillance and satellite technology in France.

In addition, the war in Ukraine has only placed more emphasis on the importance of space as a vital area of national defense. France is pushing hard to develop its space assets to monitor potential threats, ensure early warning systems, and ensure secure communications for military applications. State-sponsored investments, including the USD 844.08 million stake in Eutelsat to support European satellite networks, reflect how national security requirements are being given direct expression through market growth. Such strategic initiatives create a solid pipeline of demand for satellite manufacturing, ground facilities, and operating services, driving on-going growth in the French Space-based Surveillance and SATCOM sector.

France Space-based Surveillance and Satellite Communication Market Challenge

Space Debris and Orbital Congestion Increasing Operational Risks

France's satellite communications and space-based surveillance industries are increasingly at risk from operations as space debris and orbital traffic continue to increase. A total of 40,000 objects are being monitored in orbit around Earth as of 2025, with roughly 11,000 active payloads. This junk is a huge threat to satellites, particularly those in low Earth orbit (LEO), where collision threats are greatest. Even small pieces, between 1 and 10 cm, are capable of causing disastrous loss to operational satellites. For example, in February 2023, the French SMOS satellite was forced to carry out an avoidance maneuver after noticing a possible collision with a small piece of debris, illustrating the unpredictable nature of space debris threats. This rising density of debris makes space situational awareness (SSA) efforts challenging, critical for monitoring and safeguarding satellite assets.

The French Space Operations Act requires satellites to deorbit within 25 years and provide debris mitigation plans. Yet, the pace of accumulation outruns mitigation, calling for increased surveillance. France is answering by investing in sophisticated radar systems and building demonstrator satellites to augment its space defense posture. In addition, the spread of satellite constellations, like SpaceX's Starlink, worsens congestion in space, heightening collision hazards and making it harder to manage space traffic. These aspects highlight the importance of taking earnest measures to make the French space activity sustainable and secure.

France Space-based Surveillance and Satellite Communication Market Trend

Integration with 5G and IoT Shaping Market Dynamics

The synergy of 5G and Internet of Things (IoT) technologies is fundamentally revolutionizing France's space-based observation and satellite communications markets. Satellite-enabled 5G provides high-quality connectivity in remote areas and allows real-time data transfer for military, climate monitoring, and industrial application scenarios. For example, France has been applying satellites to enhance situational awareness in national security operations so that communication is not interrupted even in areas beyond terrestrial network coverage. The capacity to network an increasingly large number of IoT devices over satellite is fortifying business efficiency, allowing for accurate tracking of infrastructure, transport, and agricultural assets.

France has been aggressively rolling out its 5G satellite network to capitalize on these opportunities. CNES in September 2025 contracted UNIVITY for USD 36.49 million to develop a 5G Non-Terrestrial Network satellite-based service together with TDF. Eutelsat has also successfully conducted the first-ever 5G NTN test with OneWeb's low Earth orbit satellites. These efforts are a testament to the momentum toward the convergence of terrestrial and satellite networks to provide IoT-driven applications with better connectivity and operational intelligence across verticals.

France Space-based Surveillance and Satellite Communication Market Opportunity

Specialized Military and Dual-Use Payloads Offering Lucrative Opportunities

The addition of advanced military and dual-purpose payloads to France's satellite communications and space-based observation infrastructure provides a genuine strategic opportunity. Such payloads enhance space situational awareness, secure communications, and reconnaissance capabilities critical to national defense and security missions. For instance, France's military CSO constellation of high-resolution optical satellites is to be used for military reconnaissance and is utilized for civilian applications too, reflecting the dual-use character of such a system. The dual-use approach facilitates efficient utilization of resources and increased utilization of space assets.

French defense industry players are actively capitalizing on this potential by designing and implementing high-end dual-use payloads. For instance, Thales Alenia Space has been in the vanguard of producing dual communications payloads for many countries, including Turkey, Brazil, and South Korea, which proves France's world leadership in this field. Moreover, the French Ministry of Armed Forces has been investing in fourth-generation satellite systems with both military and civilian uses to ensure a robust and adaptable space infrastructure. These investments not only strengthen France's military forces but also render its space sector one of the drivers of the global market for dual-use space technologies.

France Space-based Surveillance and Satellite Communication Market Segmentation Analysis

By Component

- Hardware

- Software

- Services

The most representative market segment in the Component category is Hardware, representing 60% market share of France Space-based Surveillance and Satellite Communications. Hardware involves satellites, ground stations, antennas, and other equipment required for surveillance as well as communication operations. The dominance of this segment originates from France's steady investment in high-performance optical, radar, and communication satellites, which are the bases of its space infrastructure. Advanced satellite platforms like the CSO constellation of watch and dual-use missions contribute significantly to hardware demand, assuring secure and dependable operations both in military use and in civilian applications.

The remaining market share is provided under Software and Services, which supports satellite operations, data analysis, and network management. However, the most significant and capital-intensive element goes to hardware, showcasing France's focus on developing its space capabilities with robust and technologically grounded equipment. The high level of focus assures functional efficiency and long-term sustainability of France's space-based systems.

By Orbit

- Low Earth Orbit

- Medium Earth Orbit

- Geostationary Orbit

- Highly Elliptical Orbit

The most prevalent market-leading segment within the Orbit category is Low Earth Orbit (LEO), taking 50% of the French Space-based Surveillance and Satellite Communications market. The altitude range of LEO satellites is between 500 and 2,000 kilometers and is preferred because of low latency, high-resolution imaging, and efficient communication capabilities. This orbit is widely used throughout surveillance, Earth observation, and broadband satellite communications, making it a market-leading force for growth. The focus on LEO also helps align with France's goal to expand its military and dual-use satellite constellations, enabling quick data transfer and better coverage.

Other orbit types, such as Medium Earth Orbit (MEO) and Geostationary Orbit (GEO), are specialized use but collectively form a percentage of the market. The dominance of LEO is a reflection of the expanding demand for agile, responsive, and cost-effective space-based services, solidifying the leadership position of the frontrunner for national security, environmental monitoring, and commercial satellite communications in France.

Top Companies in France Space-based Surveillance and Satellite Communication Market

The top companies operating in the market include CLS Group, Exotrail, HEMERIA, Thales Alenia Space, Airbus Defence and Space, Eutelsat, ArianeGroup, Safran, Bertin Technologies, Arianespace, etc., are the top players operating in the France Space-based Surveillance and Satellite Communication Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Space-based Surveillance and Satellite Communications Market Policies, Regulations, and Standards

4. France Space-based Surveillance and Satellite Communications Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Space-based Surveillance and Satellite Communications Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Orbit

5.2.1.1. Low Earth Orbit- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Medium Earth Orbit- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Geostationary Orbit- Market Insights and Forecast 2022-2032, USD Million

5.2.1.4. Highly Elliptical Orbit- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Component

5.2.2.1. Hardware- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Software- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Services- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Technology

5.2.3.1. Optical- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Radar/SAR- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Radio- Market Insights and Forecast 2022-2032, USD Million

5.2.3.4. Infrared- Market Insights and Forecast 2022-2032, USD Million

5.2.3.5. Multispectral- Market Insights and Forecast 2022-2032, USD Million

5.2.3.6. Telecom/Broadcast- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Frequency Band

5.2.4.1. Ku Band- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Ka Band- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. X Band- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. S Band- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. L Band- Market Insights and Forecast 2022-2032, USD Million

5.2.4.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By End User

5.2.5.1. Defence and Intelligence- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Government and Public Sector- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Commercial and Enterprises- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. France Low Earth Orbit Space-based Surveillance and Satellite Communications Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Technology- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Frequency Band- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

7. France Medium Earth Orbit Space-based Surveillance and Satellite Communications Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Technology- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Frequency Band- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

8. France Geostationary Orbit Space-based Surveillance and Satellite Communications Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Technology- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Frequency Band- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

9. France Highly Elliptical Orbit Space-based Surveillance and Satellite Communications Market Statistics, 2022-2032F

9.1. Market Size & Growth Outlook

9.1.1.By Revenues in US$ Million

9.2. Market Segmentation & Growth Outlook

9.2.1.By Component- Market Insights and Forecast 2022-2032, USD Million

9.2.2.By Technology- Market Insights and Forecast 2022-2032, USD Million

9.2.3.By Frequency Band- Market Insights and Forecast 2022-2032, USD Million

9.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

10. Competitive Outlook

10.1.Company Profiles

10.1.1. Thales Alenia Space

10.1.1.1. Business Description

10.1.1.2. Product Portfolio

10.1.1.3. Collaborations & Alliances

10.1.1.4. Recent Developments

10.1.1.5. Financial Details

10.1.1.6. Others

10.1.2. Airbus Defence and Space

10.1.2.1. Business Description

10.1.2.2. Product Portfolio

10.1.2.3. Collaborations & Alliances

10.1.2.4. Recent Developments

10.1.2.5. Financial Details

10.1.2.6. Others

10.1.3. Eutelsat

10.1.3.1. Business Description

10.1.3.2. Product Portfolio

10.1.3.3. Collaborations & Alliances

10.1.3.4. Recent Developments

10.1.3.5. Financial Details

10.1.3.6. Others

10.1.4. ArianeGroup

10.1.4.1. Business Description

10.1.4.2. Product Portfolio

10.1.4.3. Collaborations & Alliances

10.1.4.4. Recent Developments

10.1.4.5. Financial Details

10.1.4.6. Others

10.1.5. Safran

10.1.5.1. Business Description

10.1.5.2. Product Portfolio

10.1.5.3. Collaborations & Alliances

10.1.5.4. Recent Developments

10.1.5.5. Financial Details

10.1.5.6. Others

10.1.6. CLS Group

10.1.6.1. Business Description

10.1.6.2. Product Portfolio

10.1.6.3. Collaborations & Alliances

10.1.6.4. Recent Developments

10.1.6.5. Financial Details

10.1.6.6. Others

10.1.7. Exotrail

10.1.7.1. Business Description

10.1.7.2. Product Portfolio

10.1.7.3. Collaborations & Alliances

10.1.7.4. Recent Developments

10.1.7.5. Financial Details

10.1.7.6. Others

10.1.8. HEMERIA

10.1.8.1. Business Description

10.1.8.2. Product Portfolio

10.1.8.3. Collaborations & Alliances

10.1.8.4. Recent Developments

10.1.8.5. Financial Details

10.1.8.6. Others

10.1.9. Bertin Technologies

10.1.9.1. Business Description

10.1.9.2. Product Portfolio

10.1.9.3. Collaborations & Alliances

10.1.9.4. Recent Developments

10.1.9.5. Financial Details

10.1.9.6. Others

10.1.10. Arianespace

10.1.10.1. Business Description

10.1.10.2. Product Portfolio

10.1.10.3. Collaborations & Alliances

10.1.10.4. Recent Developments

10.1.10.5. Financial Details

10.1.10.6. Others

11. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Orbit |

|

| By Component |

|

| By Technology |

|

| By Frequency Band |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.