France Bags and Luggage Market Report: Trends, Growth and Forecast (2026-2032)

By Category (Bags (Cross Body Bags, Bags and Backpacks, Business Bags, Duffle Bags, Clutches, Others), Luggage (Soft Luggage, Hard Luggage, Wheeled Luggage, Non-Wheeled Luggage)), By Sales Channel (Retail Offline, Retail Online), By Material Type (Soft Case (Nylon, Polyester, Ballistic Nylon), Hard Case (Polycarbonate, ABS (Acrylonitrile Butadiene Styrene), Polypropylene)), By Price Category (Luxury, Mass/Economy, Premium), By Application (Travel, Business)

|

Major Players

|

France Bags and Luggage Market Statistics and Insights, 2026

- Market Size Statistics

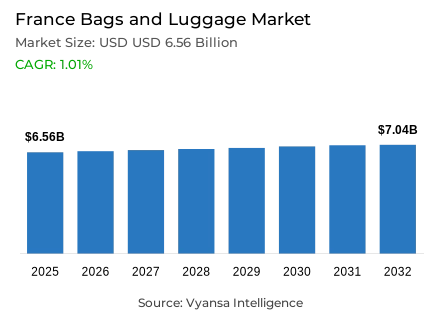

- Bags and luggage in France is estimated at USD 6.56 billion in 2025.

- The market size is expected to grow to USD 7.04 billion by 2032.

- Market to register a cagr of around 1.01% during 2026-32.

- Category Shares

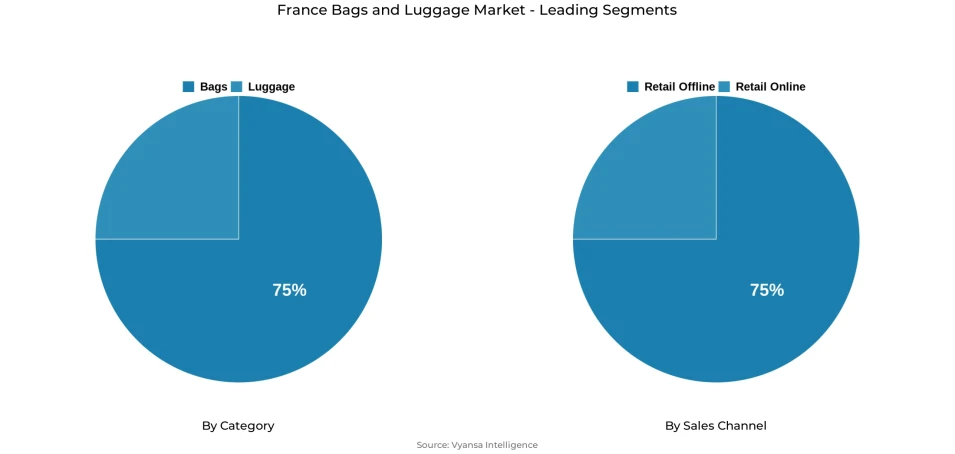

- Bags grabbed market share of 75%.

- Competition

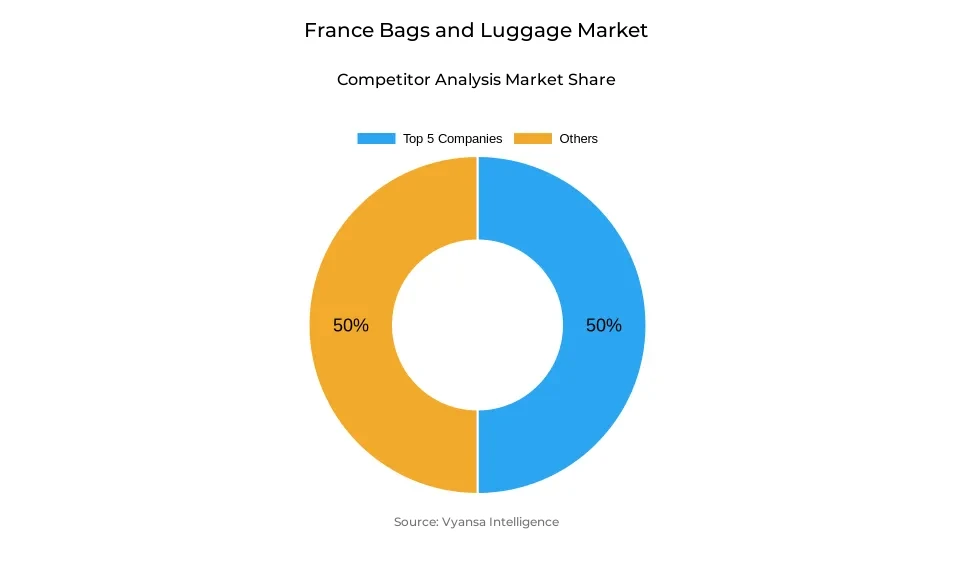

- More than 20 companies are actively engaged in producing bags and luggage in France.

- Top 5 companies acquired around 50% of the market share.

- Yves Saint Laurent SAS; Céline SA; Chanel SA; Louis Vuitton Malletier SA; Hermès International SCA etc., are few of the top companies.

- Sales Channel

- Retail offline grabbed 75% of the market.

France Bags and Luggage Market Outlook

France bags and luggage market will experience consistent growth in the period 2026 to 2032, as it is a mature market influenced by the conservative end users behaviour and changing travel trends. In France, the bags and luggage are estimated at USD 6.56 billion in 2025 and projected to be USD 7.04 billion in 2032 with a CAGR of about 1.01%. The market is likely to stabilise more than pick up pace after a weaker performance in 2024, due to reduced outbound travel and disrupted summer flows associated with the Paris Olympics.

Bags will remain in the category, which will contribute about 75% of the total market value. Handbags are still a vital fashion item and still enjoy the power of luxury brands especially in Paris and other major tourist spots. Designer handbags are becoming more of an investment product, as shown by the upward unit prices and the high resale value. Simultaneously, luxury leather products that are produced sustainably and responsibly are likely to gain increased demand, as individuals will become more concerned with transparency and sustainability.

Growth in luggage will also be moderate. Although medium and a long distance travel is expected to come back slowly, outbound travel volumes may still be restricted by high airfares, environmental issues, and uncertainty in government policies. However, the need to have smart, durable and high-end travel bags is likely to continue, particularly when traveling to cities, business trips, and MICE-related movements.

In terms of channel, the retail offline will continue to have approximately 75% share with the support of the luxury boutiques, brand stores, and multi-brand retailers. retail online will be still a part of research and comparison, but in-store experience is essential in the process of high-value purchases. In general, the market perspective in France is that of stable, value-based development based on luxury, sustainability, and product development.

France Bags and Luggage Market Growth DriverIntegration of Bags into Fashion and Lifestyle Preferences

Bags remain integral as both fashion expressions and functional mobility accessories, supported by sustained inbound tourism and steady household spending on personal items. The projection of international arrivals in France is estimated to be 100 million in 2024, and international tourism receipts is estimated to be EUR 71 billion, which supports demand of travel-related luggage and city shopping purchases that prefer premium and designer products.

Concurrently, the household buying behaviour of personal goods proves to be strong against the backdrop of the macroeconomic stressors INSEE shows that household confidence varies in the course of 2024 household confidence index is about 92 in August 2024, and 89 in December 2024, which signals that the household is cautious but still interested in discretionary fashion spending like handbags and everyday carry. These two signals of tourism and household spending keep the bag as a lifestyle product not only a travel necessity.

France Bags and Luggage Market ChallengeHousehold Spending Volatility and Second-hand Substitution

Heightened household spending caution is constraining volume growth, as a notable share of end users defer bag purchases or opt for lower-priced alternatives. The end users confidence indicator of INSEE is still below the average of the long-term, at the end of 2024 the index is around 89–95 in mid-to-late 2024, which is the evidence of the continued anxieties about purchasing power that decreases the number of discretionary purchases of the goods like schoolbags or trendy handbags.

Meanwhile, the circular-economy project and reuse development in France promote second-hand replacement. Active policy measures and reuse targets that enlarge the supply and societal admissibility of second-hand goods, which directly redirect the demand toward new, cheaper products in particular, schoolbags and entry-level backpacks are detailed in the European Environment Agency / ETC country profile of France 2024 and the OECD circular-economy working document.

Unlock Market Intelligence

Explore the market potential with our data-driven report

France Bags and Luggage Market TrendIncreasing demand on Transparency and Sustainable Luxury

End users are becoming more demanding of transparent environmental reporting and traceable leather and high-end supply chains. The May 2024 Eurobarometer shows high levels of EU wide environmental concern, with nearly six out of ten people ready to prefer sustainable choices, which is especially high in France among younger and fashion related end users. These feelings force high-end brands to reveal origin, materials, and production.

The expectations are reinforced by the public efforts of France the national environmental-labelling programme Ecobalyse / affichage environnemental of ADEME promotes textile product scoring and disclosure work until 2024, which preconditions the emergence of transparent environmental information that must be covered by the luxury leather-goods manufacturers in their sourcing and communication. This policy-regulatory trend brings transparency as a fundamental trend that defines buyer preference.

France Bags and Luggage Market OpportunityPolicy-Supported Sustainability Enabling Premium Value Creation

The brands which are sustainable, durable, and customisable attract high-quality demand and command a premium price. The trends in policies and end users preferences provide a context that supports value-based premiumisation The good 2024 tourism performance of Atout France 100 million arrivals, EUR 71 billion receipts opens up the market to inbound buyers who are willing to pay a premium and differentiated products and ADEME labelling work justifies the use of eco-premium claims. These forces prefer companies that provide repairable, modular or customisable bags.

Tangibly, the barriers to brands using repair, resale, and eco-materials programmes are minimized by public policy and circular-economy support EEA/ETC and OECD work in 2024. Companies integrating maintainability, open eco-scores, and customization, and thus reducing overall effective cost of life and reinforcing resale value, stand in the best situation to maintain high premium margins even when aggregate volumes are held down.

Unlock Market Intelligence

Explore the market potential with our data-driven report

France Bags and Luggage Market Segmentation Analysis

By Category

- Bags

- Cross Body Bags

- Bags and Backpacks

- Business Bags

- Duffle Bags

- Clutches

- Others

- Luggage

- Soft Luggage

- Hard Luggage

- Wheeled Luggage

- Non-Wheeled Luggage

The largest segment in the France bags and luggage market is bags which has a share of about 75% of the total market share. This supremacy is indicative of the high position of handbags as utility items and fashion products especially in the luxury-focused retail environment of France. The handbags are still seen as a necessity that complements outfits and the demand remains stable despite wider discretionary expenditure being strained.

The bags will continue their domination position over the forecast period with the luxury leather goods and increasing attention to sustainable and innovative styles. The rising prices and high resale value are making designer handbags to be considered as long term investments. At the same time, materials, customisation and environmentally-friendly production innovations make bags remain relevant even among the older generation. Consequently, the bags segment will be placed to continue as the leading value addition to the France bags and luggage market

By Sales Channel

- Retail Offline

- Retail Online

The segment with the highest share under the sales channel category is retail offline, holding around 75% of the France bags and luggage market. Physical retail remains critical, particularly for luxury and premium products, as end users value the ability to assess craftsmanship, materials, and brand authenticity in person. Flagship stores, boutiques, and shopping districts continue to benefit from domestic and inbound tourism.

Over the forecast period, retail offline is expected to retain its dominant position, despite the steady presence of retail online. Online channels mainly support product discovery, price comparison, and brand engagement, while final purchases—especially for high-value bags—often take place in-store. As brands invest in transparency, service quality, and experiential retail, offline channels are likely to remain the cornerstone of bags and luggage sales in France.

List of Companies Covered in France Bags and Luggage Market

The companies listed below are highly influential in the France bags and luggage market, with a significant market share and a strong impact on industry developments.

- Yves Saint Laurent SAS

- Céline SA

- Chanel SA

- Louis Vuitton Malletier SA

- Hermès International SCA

- Gucci France SASU

- LVMH Moët Hennessy Louis Vuitton SA

- Prada SpA

- Samsonite France SA

- Longchamp SAS

Competitive Landscape

France bags and luggage market remains strongly shaped by luxury dominance, despite softer overall category momentum. Louis Vuitton continues to lead, supported by exceptional brand equity, extensive retail presence, and strong inbound and domestic tourism, particularly in Paris. Hermès follows closely, benefiting from its ultra-premium positioning, controlled supply, and pricing power, while Gucci, Chanel, Dior, Céline, and Prada remain influential players in value terms. High unit prices have helped luxury brands preserve value sales even amid fluctuating travel demand and cautious spending. In luggage, Samsonite and Delsey compete through product innovation, warranties, and sustainability-led propositions rather than price. Alongside incumbents, innovative local brands such as Cabaïa are gaining visibility through customisation, durability, and eco-conscious positioning, signalling gradual competitive diversification.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Bags and Luggage Market Policies, Regulations, and Standards

4. France Bags and Luggage Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Bags and Luggage Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in USD Million

5.1.2.By Units Sold in Thousand Units

5.2. Market Segmentation & Growth Outlook

5.2.1.By Category

5.2.1.1. Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.1. Cross Body Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.2. Bags and Backpacks- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.3. Business Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.4. Duffle Bags- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.5. Clutches- Market Insights and Forecast 2022-2032, USD Million

5.2.1.1.6. Others- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.1. Soft Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.2. Hard Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.3. Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2.4. Non-Wheeled Luggage- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Sales Channel

5.2.2.1. Retail Offline- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Retail Online- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Material Type

5.2.3.1. Soft Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.1. Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.2. Polyester- Market Insights and Forecast 2022-2032, USD Million

5.2.3.1.3. Ballistic Nylon- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Hard Case- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.1. Polycarbonate- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.2. ABS (Acrylonitrile Butadiene Styrene)- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2.3. Polypropylene- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Price Category

5.2.4.1. Luxury- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Mass/Economy- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Premium- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By Application

5.2.5.1. Travel- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Business- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

5.2.6.1. Competition Characteristics

5.2.6.2. Market Share & Analysis

6. France Bags Market Statistics, 2022-2032

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in USD Million

6.1.2.By Units Sold in Thousand Units

6.2. Market Segmentation & Growth Outlook

6.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

6.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

7. France Luggage Market Statistics, 2022-2032

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in USD Million

7.1.2.By Units Sold in Thousand Units

7.2. Market Segmentation & Growth Outlook

7.2.1.By Category- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Sales Channel- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Material Type- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By Price Category- Market Insights and Forecast 2022-2032, USD Million

7.2.5.By Application- Market Insights and Forecast 2022-2032, USD Million

8. Competitive Outlook

8.1. Company Profiles

8.1.1.Louis Vuitton Malletier SA

8.1.1.1. Business Description

8.1.1.2. Product Portfolio

8.1.1.3. Collaborations & Alliances

8.1.1.4. Recent Developments

8.1.1.5. Financial Details

8.1.1.6. Others

8.1.2.Hermès International SCA

8.1.2.1. Business Description

8.1.2.2. Product Portfolio

8.1.2.3. Collaborations & Alliances

8.1.2.4. Recent Developments

8.1.2.5. Financial Details

8.1.2.6. Others

8.1.3.Gucci France SASU

8.1.3.1. Business Description

8.1.3.2. Product Portfolio

8.1.3.3. Collaborations & Alliances

8.1.3.4. Recent Developments

8.1.3.5. Financial Details

8.1.3.6. Others

8.1.4.LVMH Moët Hennessy Louis Vuitton SA

8.1.4.1. Business Description

8.1.4.2. Product Portfolio

8.1.4.3. Collaborations & Alliances

8.1.4.4. Recent Developments

8.1.4.5. Financial Details

8.1.4.6. Others

8.1.5.Prada SpA

8.1.5.1. Business Description

8.1.5.2. Product Portfolio

8.1.5.3. Collaborations & Alliances

8.1.5.4. Recent Developments

8.1.5.5. Financial Details

8.1.5.6. Others

8.1.6.Yves Saint Laurent SAS

8.1.6.1. Business Description

8.1.6.2. Product Portfolio

8.1.6.3. Collaborations & Alliances

8.1.6.4. Recent Developments

8.1.6.5. Financial Details

8.1.6.6. Others

8.1.7.Céline SA

8.1.7.1. Business Description

8.1.7.2. Product Portfolio

8.1.7.3. Collaborations & Alliances

8.1.7.4. Recent Developments

8.1.7.5. Financial Details

8.1.7.6. Others

8.1.8.Chanel SA

8.1.8.1. Business Description

8.1.8.2. Product Portfolio

8.1.8.3. Collaborations & Alliances

8.1.8.4. Recent Developments

8.1.8.5. Financial Details

8.1.8.6. Others

8.1.9.Samsonite France SA

8.1.9.1. Business Description

8.1.9.2. Product Portfolio

8.1.9.3. Collaborations & Alliances

8.1.9.4. Recent Developments

8.1.9.5. Financial Details

8.1.9.6. Others

8.1.10. Longchamp SAS

8.1.10.1. Business Description

8.1.10.2. Product Portfolio

8.1.10.3. Collaborations & Alliances

8.1.10.4. Recent Developments

8.1.10.5. Financial Details

8.1.10.6. Others

9. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Category |

|

| By Sales Channel |

|

| By Material Type |

|

| By Price Category |

|

| By Application |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.