France Anti-Ship Missile Market Report: Trends, Growth and Forecast (2026-2032)

By Range (Short Range (Up to 100 km), Medium Range (101-500 km), Long Range (Above 500 km)), By Launch Platform (Surface Ship-Launched, Unmanned Aerial Vehicle-Launched, Aircraft-Launched, Submarine-Launched, Coastal Defence System-Launched), By Speed (Subsonic, Supersonic, Hypersonic), By Guided System (GPS-guided Systems, Inertial Navigation Systems, Radar-guided Systems, Laser-guided Systems, Electro-Optical Systems), By End User (Naval Forces, Coast Guard, Commercial Shipping Companies, Private Security Contractors, Defense Research Organizations)

- Aerospace & Defense

- Nov 2025

- VI0412

- 125

-

France Anti-Ship Missile Market Statistics and Insights, 2026

- Market Size Statistics

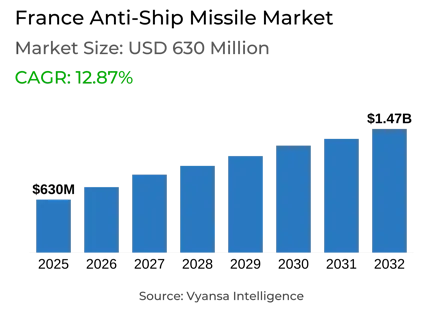

- Anti-Ship Missile in France is estimated at $ 630 Million.

- The market size is expected to grow to $ 1.47 Billion by 2032.

- Market to register a CAGR of around 12.87% during 2026-32.

- Launch Platform Shares

- Surface Ships grabbed market share of 70%.

- Competition

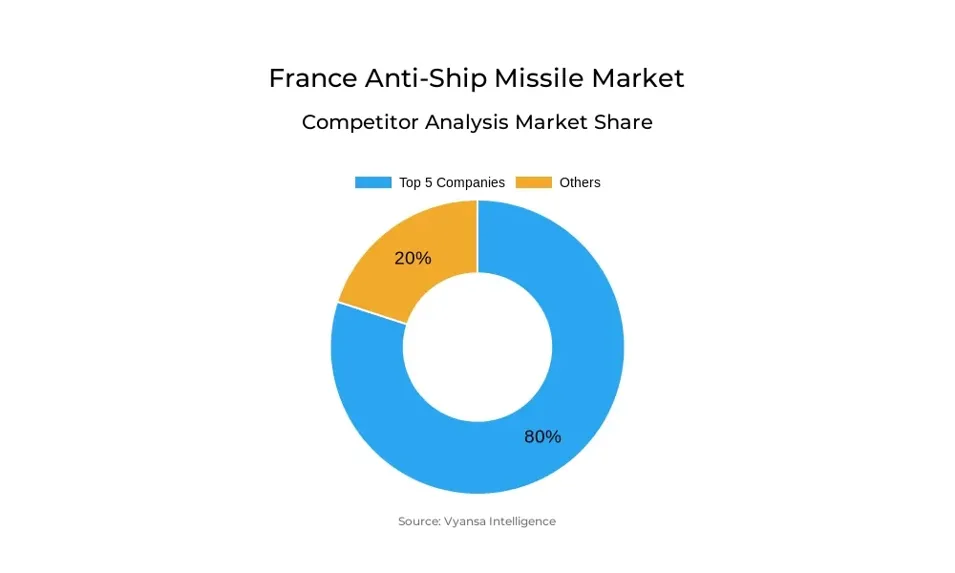

- More than 10 companies are actively engaged in producing Anti-Ship Missile in France.

- Top 5 companies acquired 80% of the market share.

- Nexter Systems, Raytheon Technologies (RTX), Lockheed Martin, MBDA, Naval Group etc., are few of the top companies.

- Speed

- Subsonic grabbed 85% of the market.

France Anti-Ship Missile Market Outlook

The France Anti-Ship Missile Market is USD 630 Million in 2026 and is expected to grow steadily to USD 1.47 Billion by 2032. It is fueled by consistent naval modernization programmes and the need for sophisticated missile systems to fit new and upgraded surface ships, submarines, and aircraft. The French Navy still depends largely on the Exocet missile family, which serves as the core of its anti-ship capabilities, providing consistent procurement and integration activity over the forecast period.

The industry is extremely concentrated with the leading five competitors holding 80% market share. These market leaders are spearheading the advancement, manufacture, and sale of anti-ship missiles backed by sophisticated industrial capacity and expertise in long-term program implementation. The monopoly of these players guarantees incessant technology improvements and sustainability contracts, which make a contribution to both home-based and export-based income streams.

Aaccording to Speed, Subsonic missiles dominate 85% of the market, a testament to the ongoing use of the Exocet MM40, AM39, and SM39 models. Supersonic and hypersonic efforts are still constrained in operational deployment, maintaining subsonic missiles as the top option for operational readiness across platforms.

In general, France's anti-ship missile market outlook is optimistic from 2026 through 2032. Expansion, modernization of current platforms, and continued emphasis by leading suppliers on enhancing missile performance sustain growth. Subsonic missiles remain the best sellers in both demand and output, and focused industrial control guarantees consistent procurement cycles and technology development.

France Anti-Ship Missile Market Growth Driver

Naval Fleet Expansion Creating Demand for ASMs

France's strategy to enlarge and upgrade its naval fleet is a primary motivator for the increased demand for anti-ship missiles (ASMs). Each new vessel assigned to the French Navy, including the FDI-class frigates, will need to be equipped with upgraded ASMs such as the Exocet MM40 Block 3c. This does not end with initial delivery as spare missiles, training units, and future upgrades are also required by the Navy. France's 2024-2030 Military Programming Law allots the naval procurement more budget, thereby maintaining steady orders for missiles during the decade.

This growth propels the ASM market as greater numbers of ships translate to more sets of missiles, and current ships demand mid-life refits like new seekers and software upgrades. Greater naval patrolling and preparedness translate to increased stockpiling and replacement demands. For instance, MBDA has already manufactured more than 4,000 Exocet missiles, demonstrating both the high demand from the French Navy and the priority of the industry to fill this fleet-based need.

France Anti-Ship Missile Market Challenge

Budgetary Constraints Impeding Growth

Budgetary limitations are a primary challenge for the France anti-ship missile market since defence funds are distributed among various priorities and not merely naval strike capability. France's defence budget for 2025 is approximately USD 55.67 billion, with funds allocated to land systems, air defence, nuclear deterrence, space, and cyber, apart from naval assets. With increasing prices of fighter aircraft, drones, and combined air and missile defence, it is becoming ever harder for France to provide adequate funds to anti-ship missiles.

This competition limits room for large-scale missile buys or upgrades, retarding take-up of advanced versions such as the Exocet Block 3c. For instance, MBDA is experiencing record demand throughout Europe, but production capacity is already strained, and budget compromises may run down French orders behind more pressing systems such as air defence interceptors. This directly limits the growth prospects of the French ASM segment.

France Anti-Ship Missile Market Trend

Next-Generation Multi-Role Missiles Shaping Market Dynamics

Next-generation multi-mission missiles are influencing the France anti-ship missile (ASM) market because they integrate anti-ship, land-attack, and even restricted anti-submarine capability into one vessel. This thinking enables the French Navy to achieve maximum operational versatility with reduced procurement budget optimization since a single missile can support multiple mission profiles. Programs such as MBDA's STRATUS and FC-ASW concepts demonstrate this thinking, providing modular guidance systems, advanced seekers, and increased range. Such flexibility guarantees that new-build frigates and upgraded ships can react to varied threats without requiring several specialized missile inventories.

Industry players are seizing this trend by concentrating R&D and output on flexible platforms, capturing domestic as well as export orders. MBDA, for instance, takes advantage of multi-role capability to provide export bundles that couple missiles with sensor and target systems, raising the value proposition. Through the combination of advanced seekers, networked targeting, and software-defined guidance, vendors can charge premium margins as they align with France's overall naval modernization plan. This will be a driver of mid-to-long-term ASM sector revenue growth.

France Anti-Ship Missile Market Opportunity

Growing Focus on Submarine-Compatible ASMs

The increasing emphasis on submarine-compatible anti-ship missiles (ASMs) is an important opportunity for the France ASM market because undersea platforms offer strategic stealth and longer reach in naval operations. France's SM39 Exocet is the present submarine-launched ASM, and next-generation SM40 plans show a renewed focus on placing modern, long-range, and networked missiles onboard submarines. This development enables the French Navy to improve deterrence and strike and maintain flexibility in contested littoral and open ocean, and hence enhances demand for submarine-compatible missile variants.

Market participants, especially MBDA, are tapping into this potential by investing in R&D, integration, and manufacturing submarine-launched systems. Through providing turnkey solutions such as missile, launch capsule, and fire-control integration, suppliers are able to win domestic orders and also possible export orders. For instance, continuing development programs emphasize modular guidance, low-signature propulsion, and miniaturized design to accommodate several submarine classes so that firms can achieve a high-margin portion of the ASM market fueled by France's strategic undersea modernization initiatives

France Anti-Ship Missile Market Segmentation Analysis

By Launch Platform

- Surface Ship-Launched

- Unmanned Aerial Vehicle-Launched

- Aircraft-Launched

- Submarine-Launched

- Coastal Defence System-Launched

The most dominant market segment in the France Anti-Ship Missile Market under the Launch Platform is Surface Ships, with a commanding 70% share. This is due to the deployment of Exocet MM40 Block 3c missiles on new and upgraded frigates, as well as ship-based missile requirements for operational preparedness and fleet modernization. Surface ships need complete missile complements, spares, and upgrades, so this platform is the biggest contributor to the market. Aircraft, submarines, and coastal defense installations come in second, but none have the level of volume and recurring demand as that of surface vessels.

Other launch platforms are Aircraft, Submarines, Coastal Defense Installations, and UAVs, each representing the balance of the remaining market. Aircraft-launched SM39 Exocet missiles sustain naval strike missions, with the submarine-launched SM39 and coastal/mobile Exocet versions playing niche functions. UAV-launched ASMs are just developing and play a negligible share. They collectively fill out the France ASM market segmentation 2026–32, where surface ships resoundingly dominate both procurement and sustainment demand.

By Speed

- Subsonic

- Supersonic

- Hypersonic

The segment with the highest market share under Speed in the France Anti-Ship Missile Market is Subsonic, which holds a dominant 85% share. This is mainly driven by the widespread deployment of Exocet missiles, including MM40, AM39, and SM39 variants, all of which operate at high-subsonic speeds. Subsonic missiles remain the backbone of the French Navy’s strike capability due to their proven reliability, sea-skimming design, and compatibility with multiple launch platforms, including surface ships, aircraft, and submarines.

Other speed segments include Supersonic and Hypersonic, which together account for the remaining 15% of the market. Supersonic and hypersonic missile programs are still at development or experimental stages, with limited operational deployment. The dominance of subsonic missiles is expected to continue through 2026–32, driven by fleet modernization, recurring procurement, and integration across new and upgraded platforms, making it the key speed category in the French ASM market.

Top Companies in France Anti-Ship Missile Market

The top companies operating in the market include Nexter Systems, Raytheon Technologies (RTX), Lockheed Martin, MBDA, Naval Group, Thales Group, Safran Electronics & Defense, Airbus Defence and Space, BAE Systems, Leonardo S.p.A., etc., are the top players operating in the France Anti-Ship Missile Market.

Frequently Asked Questions

Related Report

1. Market Segmentation

1.1. Research Scope

1.2. Research Methodology

1.3. Definitions and Assumptions

2. Executive Summary

3. France Anti-Ship Missile Market Policies, Regulations, and Standards

4. France Anti-Ship Missile Market Dynamics

4.1. Growth Factors

4.2. Challenges

4.3. Trends

4.4. Opportunities

5. France Anti-Ship Missile Market Statistics, 2022-2032F

5.1. Market Size & Growth Outlook

5.1.1.By Revenues in US$ Million

5.2. Market Segmentation & Growth Outlook

5.2.1.By Range

5.2.1.1. Short Range (Up to 100 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.2. Medium Range (101-500 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.1.3. Long Range (Above 500 km)- Market Insights and Forecast 2022-2032, USD Million

5.2.2.By Launch Platform

5.2.2.1. Surface Ship-Launched- Market Insights and Forecast 2022-2032, USD Million

5.2.2.2. Unmanned Aerial Vehicle-Launched- Market Insights and Forecast 2022-2032, USD Million

5.2.2.3. Aircraft-Launched- Market Insights and Forecast 2022-2032, USD Million

5.2.2.4. Submarine-Launched- Market Insights and Forecast 2022-2032, USD Million

5.2.2.5. Coastal Defence System-Launched- Market Insights and Forecast 2022-2032, USD Million

5.2.3.By Speed

5.2.3.1. Subsonic- Market Insights and Forecast 2022-2032, USD Million

5.2.3.2. Supersonic- Market Insights and Forecast 2022-2032, USD Million

5.2.3.3. Hypersonic- Market Insights and Forecast 2022-2032, USD Million

5.2.4.By Guided System

5.2.4.1. GPS-guided Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.4.2. Inertial Navigation Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.4.3. Radar-guided Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.4.4. Laser-guided Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.4.5. Electro-Optical Systems- Market Insights and Forecast 2022-2032, USD Million

5.2.5.By End User

5.2.5.1. Naval Forces- Market Insights and Forecast 2022-2032, USD Million

5.2.5.2. Coast Guard- Market Insights and Forecast 2022-2032, USD Million

5.2.5.3. Commercial Shipping Companies- Market Insights and Forecast 2022-2032, USD Million

5.2.5.4. Private Security Contractors- Market Insights and Forecast 2022-2032, USD Million

5.2.5.5. Defense Research Organizations- Market Insights and Forecast 2022-2032, USD Million

5.2.6.By Competitors

1.1.1.1. Competition Characteristics

1.1.1.2. Market Share & Analysis

6. France Short Range (Up to 100 km) Anti-Ship Missile Market Statistics, 2022-2032F

6.1. Market Size & Growth Outlook

6.1.1.By Revenues in US$ Million

6.2. Market Segmentation & Growth Outlook

6.2.1.By Launch Platform- Market Insights and Forecast 2022-2032, USD Million

6.2.2.By Speed- Market Insights and Forecast 2022-2032, USD Million

6.2.3.By Guided System- Market Insights and Forecast 2022-2032, USD Million

6.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

7. France Medium Range (101-500 km) Anti-Ship Missile Market Statistics, 2022-2032F

7.1. Market Size & Growth Outlook

7.1.1.By Revenues in US$ Million

7.2. Market Segmentation & Growth Outlook

7.2.1.By Launch Platform- Market Insights and Forecast 2022-2032, USD Million

7.2.2.By Speed- Market Insights and Forecast 2022-2032, USD Million

7.2.3.By Guided System- Market Insights and Forecast 2022-2032, USD Million

7.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

8. France Long Range (Above 500 km) Anti-Ship Missile Market Statistics, 2022-2032F

8.1. Market Size & Growth Outlook

8.1.1.By Revenues in US$ Million

8.2. Market Segmentation & Growth Outlook

8.2.1.By Launch Platform- Market Insights and Forecast 2022-2032, USD Million

8.2.2.By Speed- Market Insights and Forecast 2022-2032, USD Million

8.2.3.By Guided System- Market Insights and Forecast 2022-2032, USD Million

8.2.4.By End User- Market Insights and Forecast 2022-2032, USD Million

9. Competitive Outlook

9.1. Company Profiles

9.1.1.MBDA

9.1.1.1. Business Description

9.1.1.2. Product Portfolio

9.1.1.3. Collaborations & Alliances

9.1.1.4. Recent Developments

9.1.1.5. Financial Details

9.1.1.6. Others

9.1.2.Naval Group

9.1.2.1. Business Description

9.1.2.2. Product Portfolio

9.1.2.3. Collaborations & Alliances

9.1.2.4. Recent Developments

9.1.2.5. Financial Details

9.1.2.6. Others

9.1.3.Thales Group

9.1.3.1. Business Description

9.1.3.2. Product Portfolio

9.1.3.3. Collaborations & Alliances

9.1.3.4. Recent Developments

9.1.3.5. Financial Details

9.1.3.6. Others

9.1.4.Safran Electronics & Defense

9.1.4.1. Business Description

9.1.4.2. Product Portfolio

9.1.4.3. Collaborations & Alliances

9.1.4.4. Recent Developments

9.1.4.5. Financial Details

9.1.4.6. Others

9.1.5.Airbus Defence and Space

9.1.5.1. Business Description

9.1.5.2. Product Portfolio

9.1.5.3. Collaborations & Alliances

9.1.5.4. Recent Developments

9.1.5.5. Financial Details

9.1.5.6. Others

9.1.6.Nexter Systems

9.1.6.1. Business Description

9.1.6.2. Product Portfolio

9.1.6.3. Collaborations & Alliances

9.1.6.4. Recent Developments

9.1.6.5. Financial Details

9.1.6.6. Others

9.1.7.Raytheon Technologies (RTX)

9.1.7.1. Business Description

9.1.7.2. Product Portfolio

9.1.7.3. Collaborations & Alliances

9.1.7.4. Recent Developments

9.1.7.5. Financial Details

9.1.7.6. Others

9.1.8.Lockheed Martin

9.1.8.1. Business Description

9.1.8.2. Product Portfolio

9.1.8.3. Collaborations & Alliances

9.1.8.4. Recent Developments

9.1.8.5. Financial Details

9.1.8.6. Others

9.1.9.BAE Systems

9.1.9.1. Business Description

9.1.9.2. Product Portfolio

9.1.9.3. Collaborations & Alliances

9.1.9.4. Recent Developments

9.1.9.5. Financial Details

9.1.9.6. Others

9.1.10. Leonardo S.p.A.

9.1.10.1. Business Description

9.1.10.2. Product Portfolio

9.1.10.3. Collaborations & Alliances

9.1.10.4. Recent Developments

9.1.10.5. Financial Details

9.1.10.6. Others

10. Disclaimer

| Segment | Sub-Segment |

|---|---|

| By Range |

|

| By Launch Platform |

|

| By Speed |

|

| By Guided System |

|

| By End User |

|

Research Methodology

This study followed a structured approach comprising four key phases to assess the size and scope of the electro-oxidation market. The process began with thorough secondary research to collect data on the target market, related markets, and broader industry context. These findings, along with preliminary assumptions and estimates, were then validated through extensive primary research involving industry experts from across the value chain. To calculate the overall market size, both top-down and bottom-up methodologies were employed. Finally, market segmentation and data triangulation techniques were applied to refine and validate segment-level estimations.

Secondary Research

The secondary research phase involved gathering data from a wide range of credible and published sources. This step helped in identifying industry trends, defining market segmentation, and understanding the market landscape and value chain.

Sources consulted during this phase included:

- Company annual reports, investor presentations, and press releases

- Industry white papers and certified publications

- Trade directories and market-recognized databases

- Articles from authoritative authors and reputable journals

- Gold and silver standard websites

Secondary research was critical in mapping out the industry's value chain and monetary flow, identifying key market segments, understanding regional variations, and tracking significant industry developments.

Other key sources:

- Financial disclosures

- Industry associations and trade bodies

- News outlets and business magazines

- Academic journals and research studies

- Paid industry databases

Primary Research

To validate secondary data and gain deeper market insights, primary research was conducted with key stakeholders across both the supply and demand sides of the market.

On the demand side, participants included decision-makers and influencers from end-user industries—such as CIOs, CTOs, and CSOs—who provided first-hand perspectives on market needs, product usage, and future expectations.

On the supply side, interviews were conducted with manufacturers, industry associations, and institutional participants to gather insights into current offerings, product pipelines, and market challenges.

Primary interviews provided critical inputs such as:

- Market size and revenue data

- Product and service breakdowns

- Market forecasts

- Regional and application-specific trends

Stakeholders consulted included:

- Leading OEM and solution providers

- Channel and distribution partners

- End users across various applications

- Independent consultants and industry specialists

Market Size Estimation and Data Triangulation

- Identifying Key Market Participants (Secondary Research)

- Goal: To identify the major players or companies in the target market. This typically involves using publicly available data sources such as industry reports, market research publications, and financial statements of companies.

- Tools: Reports from firms like Gartner, Forrester, Euromonitor, Statista, IBISWorld, and others. Public financial statements, news articles, and press releases from top market players.

- Extracting Earnings of Key Market Participants

- Goal: To estimate the earnings generated from the product or service being analyzed. This step helps in understanding the revenue potential of each market player in a specific geography.

- Methods: Earnings data can be gathered from:

- Publicly available financial reports (for listed companies).

- Interviews and primary data sources from professionals, such as Directors, VPs, SVPs, etc. This is especially useful for understanding more nuanced, internal data that isn't publicly disclosed.

- Annual reports and investor presentations of key players.

- Data Collation and Development of a Relevant Data Model

- Goal: To collate inputs from both primary and secondary sources into a structured, data-driven model for market estimation. This model will incorporate key market KPIs and any independent variables relevant to the market.

- Key KPIs: These could include:

- Market size, growth rate, and demand drivers.

- Industry-specific metrics like market share, average revenue per customer (ARPC), or average deal size.

- External variables, such as economic growth rates, inflation rates, or commodity prices, that could affect the market.

- Data Modeling: Based on this data, the market forecasts are developed for the next 5 years. A combination of trend analysis, scenario modeling, and statistical regression might be used to generate projections.

- Scenario Analysis

- Goal: To test different assumptions and validate how sensitive the market is to changes in key variables (e.g., market demand, regulatory changes, technological disruptions).

- Types of Scenarios:

- Base Case: Based on current assumptions and historical data.

- Best-Case Scenario: Assuming favorable market conditions, regulatory environments, and technological advancements.

- Worst-Case Scenario: Accounting for adverse factors, such as economic downturns, stricter regulations, or unexpected disruptions.

Partnering With Industry Leaders to Drive Growth

Our mission is to deliver intelligence that matters. By combining data, analysis, and industry expertise, we enable organizations to make smarter, faster, and more impactful decisions. Whether it’s a Fortune 500 company or a high-growth startup, businesses trust us to provide clarity in an ever-evolving marketplace.